- investment in energy transition forecast to reach $1.7 trillion in 2023, just over a third of what’s needed to reach net-zero targets

- signs political momentum behind energy transition in US, China, Europe is slowing

- UK has admitted it won’t hit it’s own legally enforceable targets

- “Peak Green” may mean deadlines are pushed back — not necessarily a bad thing

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

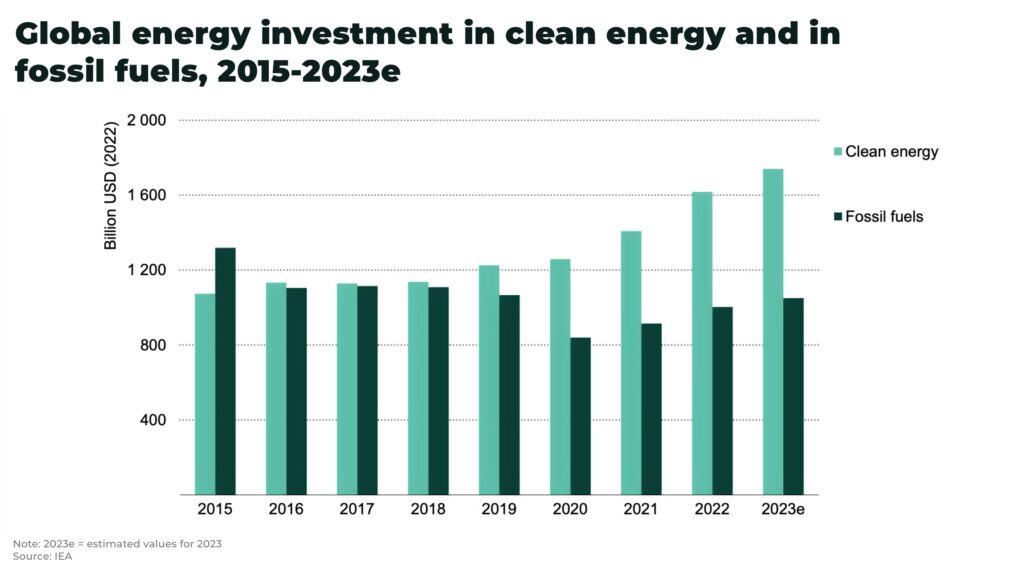

Investment in the energy transition is forecast to reach a record $1.7 trillion in 2023, 60% of an estimated US$2.8 trillion set to be invested globally in energy — but it’s not enough.

To reach global global net-zero targets, BloombergNEF estimates investment must average $4.55 trillion until 2030. McKinsey suggests it could cost even more, at US$275 trillion or US$9.2 trillion per year on average, to reach global net-zero targets by 2050.

These are eye-watering numbers and the impact of this scale of investment on mining and commodities needed to build out the energy transition would obviously be enormous.

But there are signs that momentum is slowing, something we argue may, in fact, be a good thing for both investors and the campaign for net-zero.

Pushing back against Net-Zero

The last few decades has seen an accelerated push to reduce global carbon emissions to limit the impact of climate change. Almost every economy in the world has set net-zero targets. For example:

- USA, net-zero by 2050

- China, net-zero by 2060

- India, net-zero by 2070

- Canada, net-zero by 2050

- UK, net-zero by 2050

Some of the most major pieces of legislation to support this transition include America’s Inflation Reduction Act, Europe’s trillion-dollar Green Deal Investment Plan, and China’s massive clean energy investments that totalled US$546 billion in 2022.

But this is increasingly having other costs.

Across the world there are signs off push back against the net-zero agenda. Some of the most recent examples include:

- a proposal from US Republican Speaker Kevin McCarthy that would repeal the Inflation Reduction Act’s green energy incentives, including the law’s new solar and wind manufacturing production tax credits. South Korea’s trade minister has gone so far as to suggest that clean energy tax credits may be reduced if Republicans come to power

- China plans to expand its coal fleet by 45% to 250 gigawatts, leaving China accounting for 72% of the world’s future coal projects

- in the EU, a new law containing a binding goal for the EU to get 42.5% of its energy from renewable sources by 2030 has been delayed (with no specified date for a vote set) after France and other countries lodged last-minute opposition due to the lack of recognition over nuclear power as a clean energy

- in Germany, a government bill that in effect bans new gas boilers in Germany from January 1 next year, has been thrown into turmoil after a popular backlash

- eight EU countries, including France and Italy, have called new pollution limits on car tailpipes to be scrapped as they distract from the goal of effectively banning new combustion engine vehicles after 2035

- the Dutch Agriculture Minister resigned in March after failing to get farmers on board with tough nitrogen reduction targets

- the latest 2023 report from the Intergovernmental Panel on Climate Change (IPCC) warns that, without immediate and massive carbon emissions reductions, the world will exceed its agreed 1.5°C limit

These political setbacks are against a backdrop of high energy costs, especially in Europe due to sanctions against Russia; fears of a recession; high inflation and rising interest rates.

For example, the UK has admitted in it’s revised net-zero strategy that it will fail to meet it’s legally enforceable targets, hitting only 92% of it’s pledged carbon emission reductions by 2030.

Other political and economic priorities are rising for voters and governments, who are increasingly concerned about the disruptive nature of such a fast and vast energy transition.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Rising cost of renewables

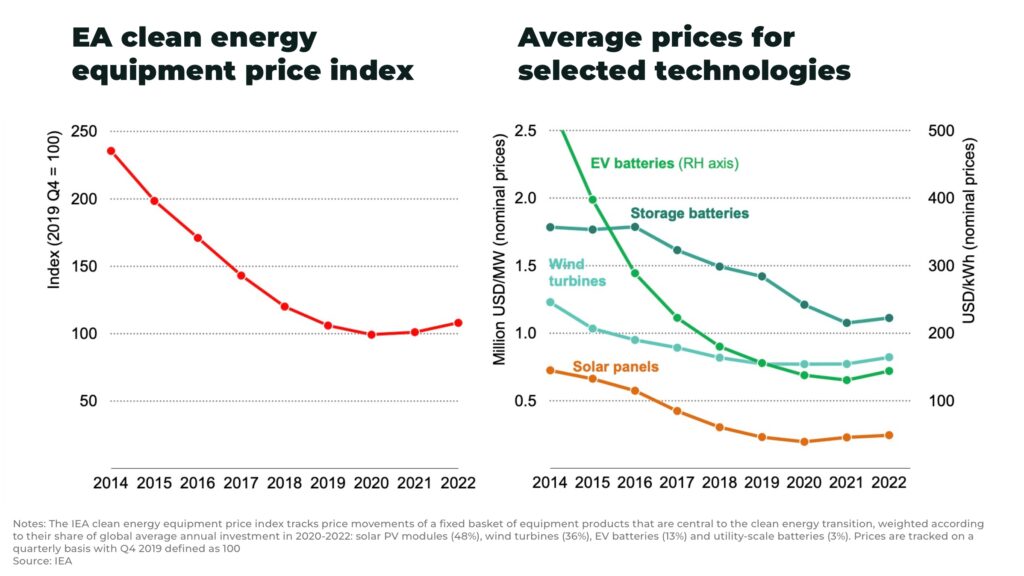

This pushback comes as, after 10 years of decreasing costs for renewable energy, prices of wind and solar have begun to level off and even begin to increase. Reasons include rising prices of critical minerals and semiconductors, supply chain issues, interest rates and inflation, as well as permitting issues.

Consequences of Pushback Against Net-Zero

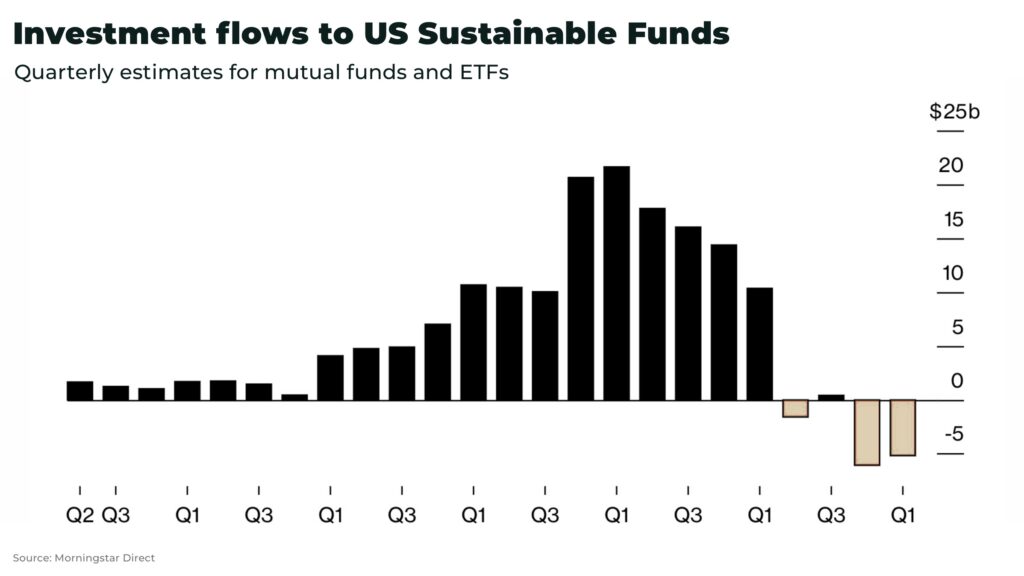

Investment in US sustainable funds is falling.

In March 2023, net withdrawals from US sustainable mutual funds and ETFs totalled US$5 billion and another US$300 million in April.

To be clear, much of the big outflow in March was due to reallocation within BlackRocks’s model portfolio, shifting from an ESG-focused ETF to a non-ESG ETF (a move that comes as Bloomberg reports, many companies are reluctant revising their public marketing on environmental, social and governance investing (ESG))

But, the short-term trend is clear.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Is this the end of net-zero?

This is not the end of net-zero. The political and economic capital invested is too big.

However, we may have reached a peak in the momentum driving the energy transition as countries face a variety of economic and political challenges. Even the net-zero agenda is not immune to external shocks.

But a slower pace, in our opinion, may be — excuse the pun — more sustainable.

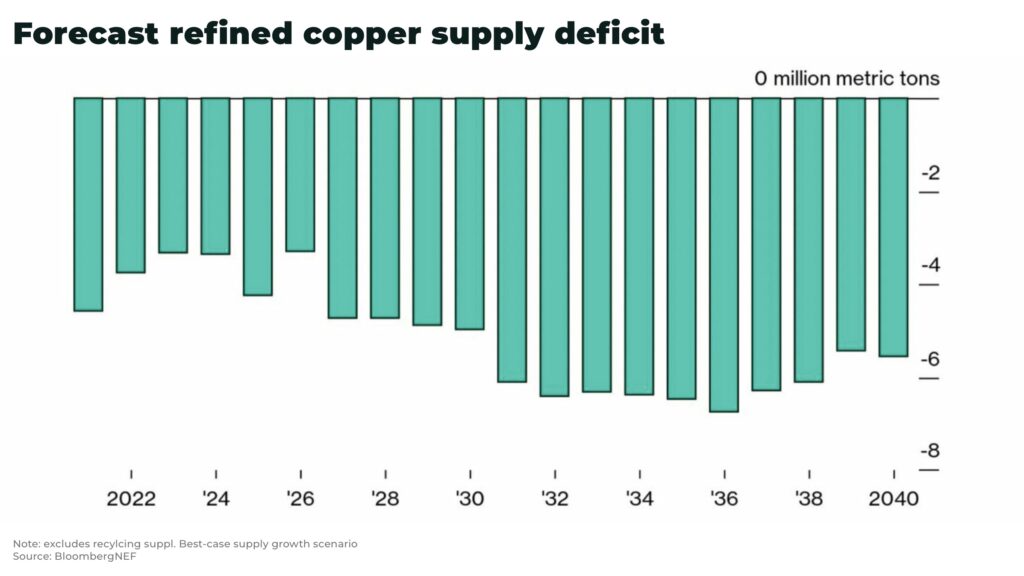

As we have repeatedly warned on The Oregon Group, the current net-zero targets risk driving up the price of critical minerals extremely sharply and, in turn, the cost of the energy transition.

For example, copper is essential for the energy transition, estimates suggest copper demand is set to rise 50% by 2040, with supply increasing only 16%.

This sounds good for investors in the short term, but risks the long-term viability of the entire project. If there is not enough critical mineral supply, either prices rises sharply or demand falls dramatically.

“As soon as you announce [net-zero] targets, you want to deliver on them and, if you fall short of meeting them, you may start looking for shortcuts. I would personally drop the targets and go for a strategy of investing in firms with credible and ambitious transition plans.”

— Paolo Angelini, deputy governor at the Bank of Italy

The new mines needed for the scale of the energy transition can take over 10 years to build — and need steadily rising prices, not sharp volatility up and down, to source the required investment.

“Peak Green” may mean deadlines are pushed back and allow sensible investments to be made with the long-term support of both governments and voters.

But more flexible targets will not mean the pressure on the mining industry and commodity prices will ease.

The net-zero challenge remains enormous and the demand coming online, just from investment this year across electric vehicles and batteries, renewables, nuclear, and grid electrification, has created it’s own momentum.

For investors in the energy transition: momentum may slow in the short-term, but stay focused on the long-term potential and opportunities.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.