- average age of miner is 46, nearly 50% of skilled engineers reach retirement in next 10 years

- 71% of mining leaders experiencing talent shortage, 86% say it’s harder to recruit and retain talent

- apprenticeships, artificial intelligence, and new working practices offer way forward

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Demand is rising sharply, but supply is tightening at an unprecedented scale. We’re not talking about minerals, but miners.

The mining industry is close to a workforce crisis, with a significant impact on investors.

Let’s run through some headline statistics:

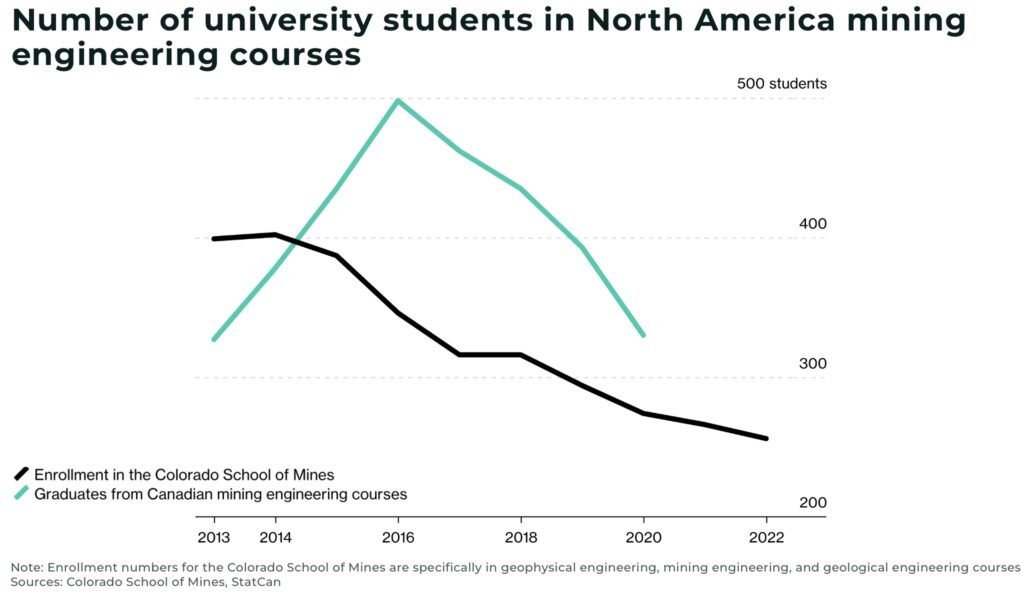

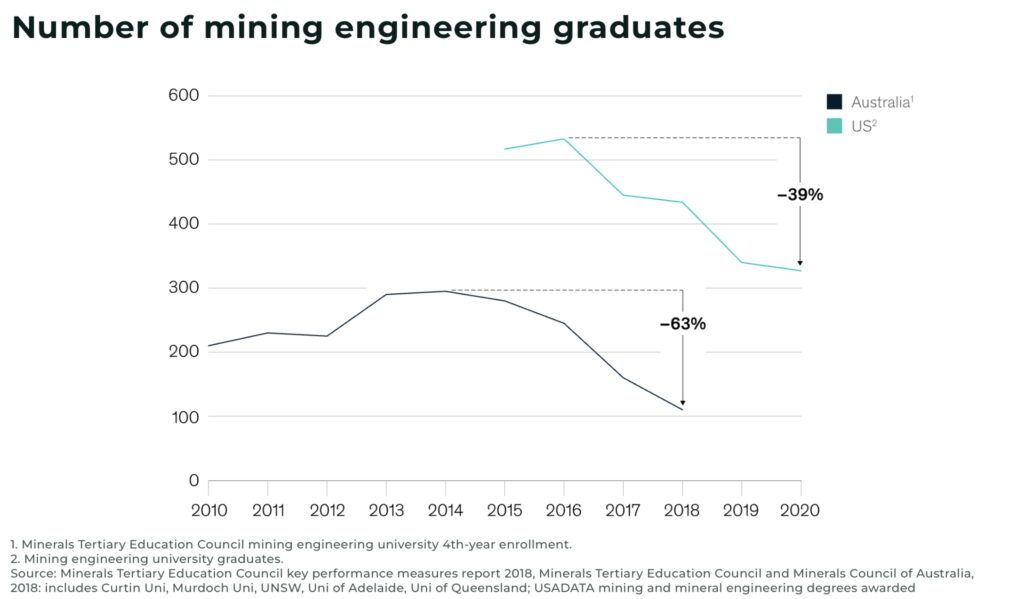

- 314 mining & mineral engineering degrees were awarded the US in 2021, a decrease of 3.98% on 2020 — the workforce, however grew at 3.65%

- the average age of a miner in the US is 46, and nearly 50% of skilled engineers in the industry will reach retirement age in the next 10 years

- recruitment and retirement problems are the 7th biggest risks facing the mining industry in 2023, up from 8th last year, according to EY’s latest report

There are a decreasing number of mining and engineering graduates, just as half the workforce — from engineers to miners to truck drivers — is expected to retire by 2033.

In comparison, in China, 1.4 million engineering students graduated in 2021. Although, it must be noted, China also faces the challenge of an aging workforce in it’s industrial heartlands.

The mining workforce represents less than 0.4% of US labor but, as anyone who works in mining knows, any delay or rise in costs has significant impact across the economy.

But in this crisis, we argue, there is an opportunity.

“Mining, mineral processing and then the downstream production of the materials that we rely upon for all aspects of the energy sector are at risk because of these shortages, and I find the statistic staggering that we are anticipating a retirement of more than half of the US mining workforce over the next six years, that’s 221,000 workers that are expected to retire by 2029”

— Walter Copan, VP, Research and Technology Transfer at Colorado School of Mines

Mining labor reserves are running low

71% of mining leaders are experiencing a talent shortage, with 86% of mining executives saying it’s harder to recruit and retain talent, compared to two years ago, according to a McKinsey survey.

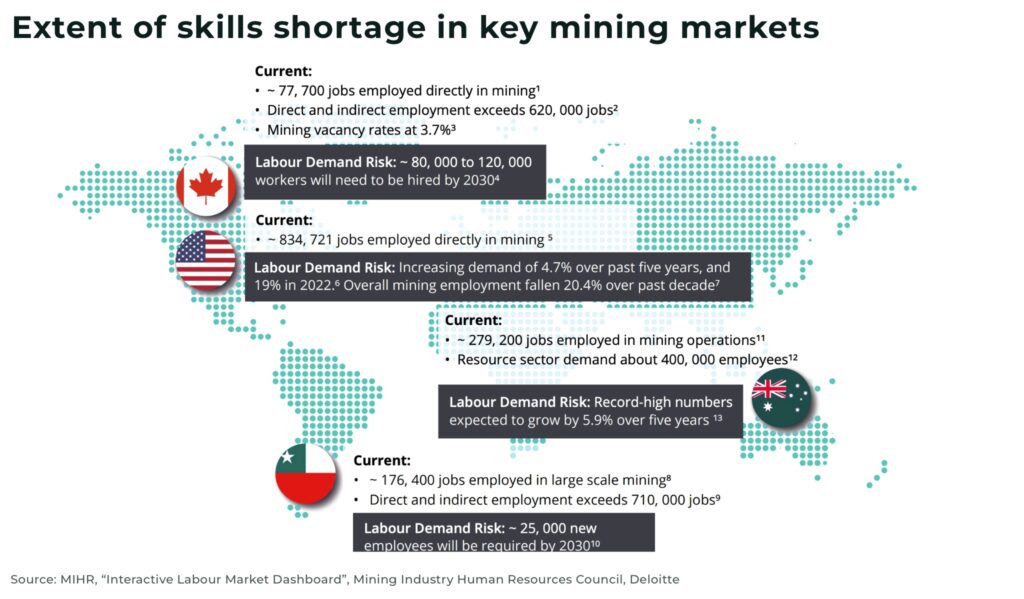

The job vacancy rates give an insight into a global problem:

- in the US, the job vacancy rate for mining and logging up was 5.1% in March 2023, an increase from 3.6% in 2018

- in Canada, 4.6% (June, 2023) vs 2.4% (June, 2018)

- in Australia, vacancies rose to 11,700 mining jobs in May 2023, up from 2,500 in May 2016

The mining industry is expected to add jobs at a rate of 11,000-13,000 per year over the next 20 years. For example, in April 2023, the US mining sector had 36,000 job vacancies, up from 27,000 the previous year.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Less workers, less profit

The recruitment shortage and retirement of experienced miners, comes as the mining industry is undergoing big changes, with dramatic demand forecast for the energy transition, as well as significant technological and geopolitical challenges.

Almost 66% of mining CEOs believe skill shortages will have a “large” or “very large” impact on profitability over the next 10 years, according to a recent PwC survey. 57% of CEO respondents see recruitment as the biggest barrier to adopting new technology.

What went wrong?

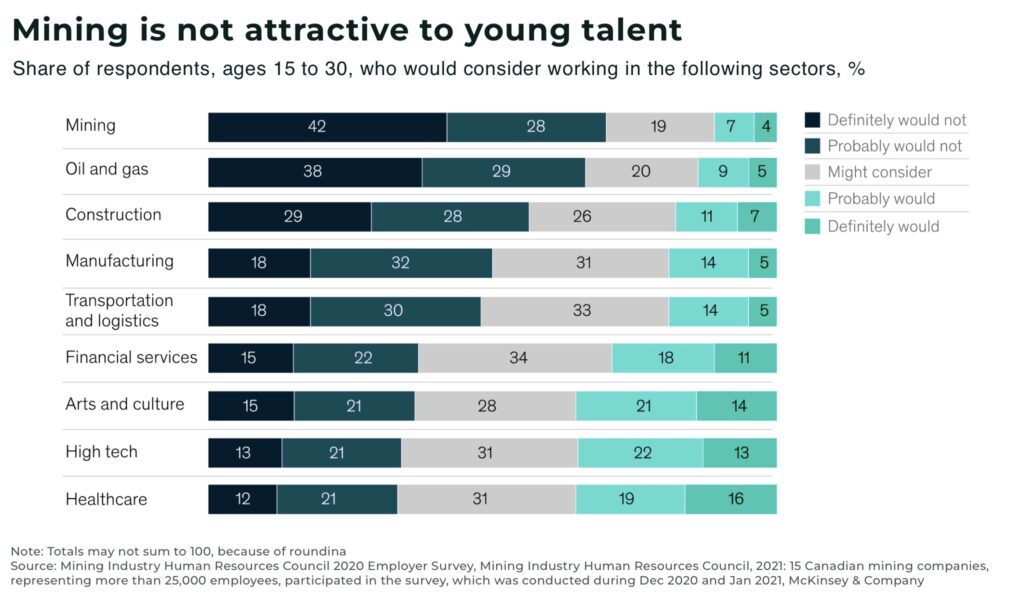

Mining is no longer an aspirational industry for many young people.

70% of 15-30 year-old respondents to a global McKinsey survey said they definitely wouldn’t or probably wouldn’t work in mining. Only 4% said they “definitely would”.

This is a charge all the more serious for an industry that, in the US, offers an average salary of US$115,761, against a national average salary of US$59,428. The highest paid mining company CEO earned US$35 million in 2021.

“They tell us: ‘You can try and throw as much money as you want at me, but that’s not going to attract me”

— anonymous mining executive, EY report

So, why do many young students not want to enter the mining industry?

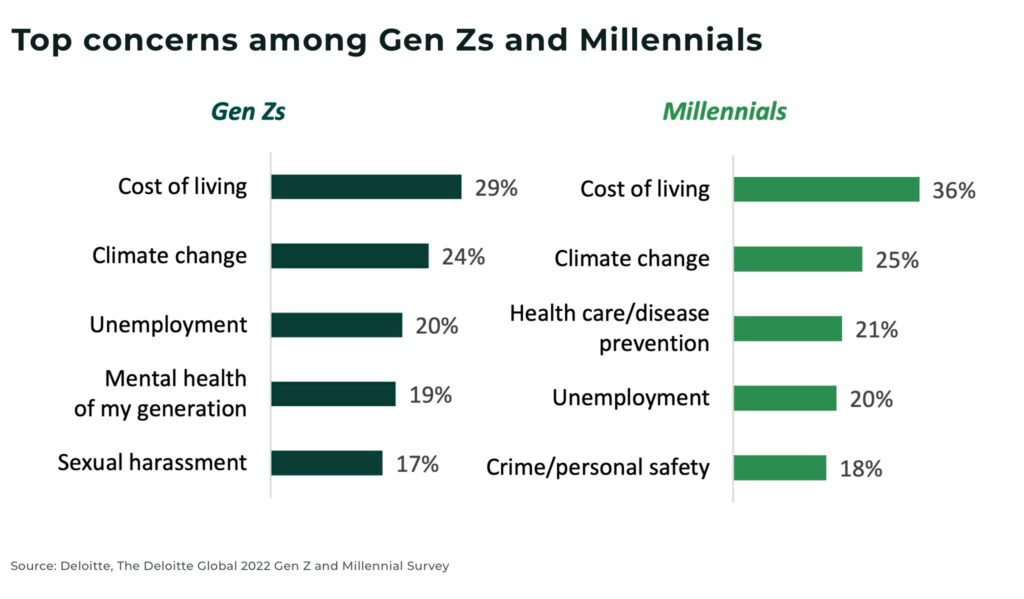

Employment expectations among the new generation, Gen Z and Millennials, have shifted significantly, with greater emphasis on meaningful work, work-life balance, remote working, job security, a sense of belonging and feeling valued.

In a BDO survey among Gen Z, 66% said having a career that positively impacts local communities is important to them, and 59% said positively impacting the environment is important.

The younger generation prioritizes the environment and social concerns, but are concerned about the environmental and social legacy of the mining industry.

And this has a direct impact on recruitment: four universities in the UK have now banned oil, gas and mining companies from recruiting events on campus, and 15 student unions reportedly boycotting oil, gas and mining recruitment.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

We are well aware of the changes within the mining industry to improve its environmental impact and relationships with local communities, not to mention that without the mining industry, there would be no energy transition.

However, we argue, the mining industry still shares a considerable portion of the blame for the reputation problems in recruiting new graduates:

- the mining workforce, particular with new recruits, is too often seen as an enabler, not a driver of value

- a lack of transparency over environmental, social and governance improvements

- and, a failure to get across the message about the importance of mining to the global energy transition to meet net-zero targets

“As societal expectations are changing, and higher standards are placed on organisations, we must ensure that we are consistently displaying and living our values. Without change or action, our ability to attract and retain partners and talented people will be negatively impacted. The trust from host communities and countries may also be weakened, limiting our operating licence and growth opportunities”

— Rio Tinto Annual Report 2022, Strategic Report

School of Mining

In the US, federal funding for mining schools has been drastically reduced after the dissolution of the Federal Bureau of Mines in 1996, with a corresponding decline in mining and mineral engineering programs at US colleges and universities from a high of 25 in 1982 to 15 in 2023.

Now, US Senators Joe Manchin and John Barrasso have introduced the Mining Schools Act of 2023 to establish a US$10 million grant program for mining schools to fund recruitment, as well as mineral research and development projects.

This would help provide much needed funds to support institutions, which are also looking into closer partnerships to share ideas. For example, the Colarado School of Mines and Canada’s University of Regina have recently signed an agreement to establish “a framework for collaboration on multiple fronts, including research, student and faculty learning and professional experiences”.

Apprenticeships

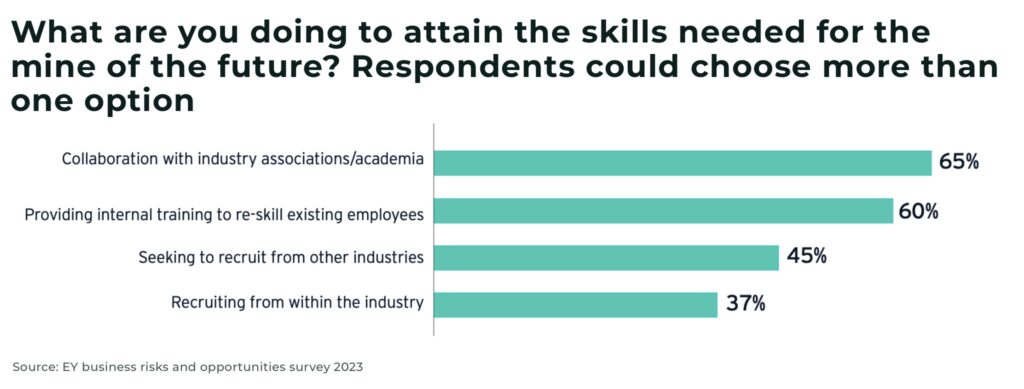

Mining companies are starting to increasingly recruit outside of universities.

In the US, registered apprenticeships in mining, quarrying, and oil and gas extraction doubled in the last year.

- 1,065, in 2021

- 411, in 2020

- 520, in 2019

- 425 in 2018

And it’s a trend that seems to be global. For example, in Australia, 7,689 apprentices and trainees joined the mining workforce in 2022, an increase of 19% on 2021.

BHP has announced a plan to hire 3,500 new apprenticeships and trainees, as part of a US$800 million plan to “create a pipeline of future talent in highly skilled roles”.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Artificial Intelligence

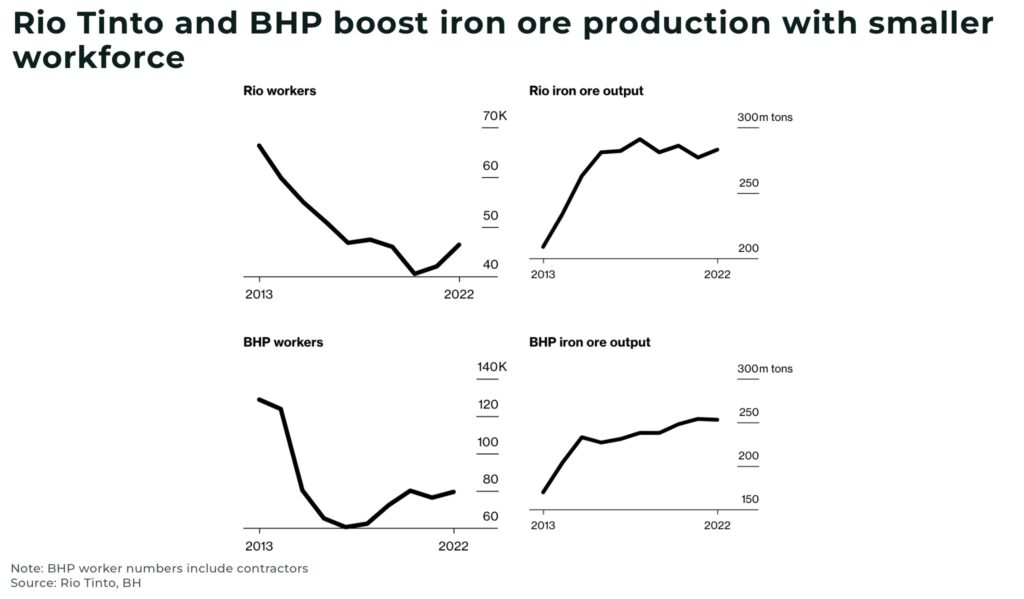

AI offers the mining industry an opportunity for significant productivity savings, and potentially reduce the mining industry’s dependence on manual labor through automation.

Estimates suggest, for producers of copper, natural gas, iron ore, coal and crude oil, artificial intelligence will be worth up to US$390 billion by 2035.

However, as we warn in our analysis on The AI Revolution in Mining: Opportunities and Risks, new technology means new skills. To quote in full:

Training the human workforce is critical to understand and apply the new technology in the most effective and productive manner. This often means significant change in the short-term for what is still largely a blue-collar workforce.

Hiring new talent with the necessary skills, eg coding and robotics engineering, to to install, maintain and enhance the new technology.

There is also a philosophical shift that many “legacy” companies across all industries struggle with when disruptive technology arrives. For example, unlike finite mined metals, data is almost infinite as more data creates more data.

57% of mining CEOs see recruitment as the biggest barrier to adopting new technology that is essential to the future of the industry.

Anglo American has told Bloomberg that it plans to shift focus to include graduates with degrees in social and environmental sciences and data analytics.

The challenge, is that recruiting graduates with technology and data analytics puts the mining industry in direct competition with the technology companies, financial services and healthcare.

Conclusion

“If you can’t grow it, you have to mine it,” is the common refrain to highlight the mining industry’s importance. The trouble is, a workforce is grown, not mined.

Just like a mine, it takes years, if not decades, to train new recruits.

Tight supply will likely lead to delays and higher costs, just as increased demand is urgently expected.

The temptation will be to fast-track low-quality labor to meet the short-term deficits, but, we argue, this will only exacerbate the problems in the long-term.

The mining industry needs a significant overhaul — technologically, economically, politically and culturally — to meet the coming challenges.

Meeting this recruitment challenge will be the first step in meeting that future, the next generation’s future.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.