Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

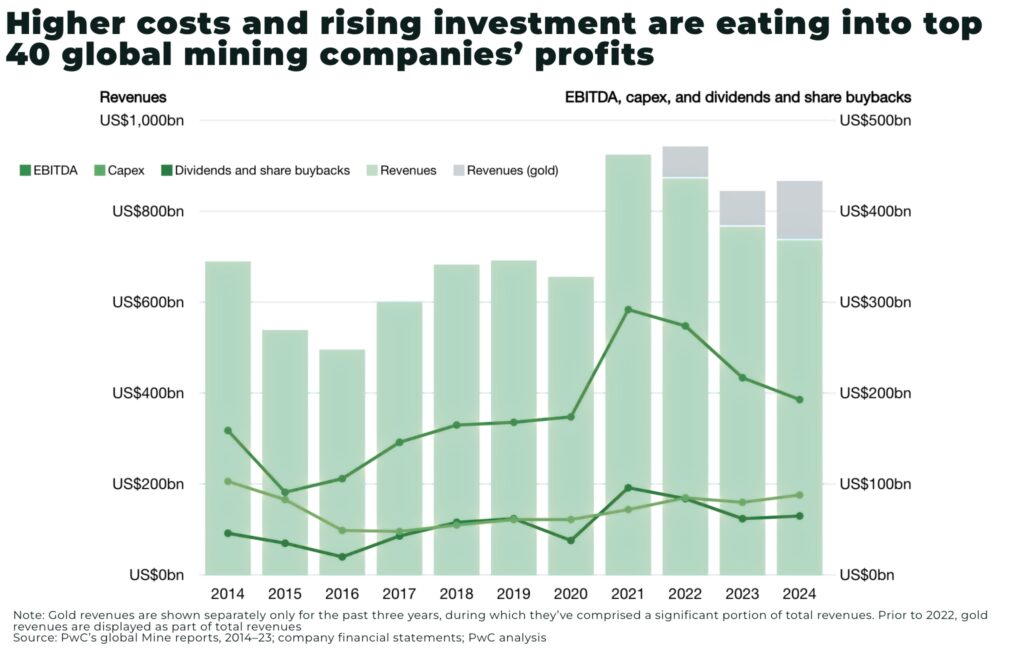

The top 40 companies in the global mining industry brought in US$689 billion in revenue in 2024, excluding trading (+1% from 2023), with US$92 billion in net profit — but US$193bn EBITDA (–5% from 2023), according to the latest PwC Mining 2025 report.

PwC’s report frames mining’s importance across six “domains” of human activity:

- Fuel and Power

- Move

- Feed

- Care

- Build

- Make

Each domain relies on a mix of commodities, from uranium powering nuclear energy (10% of global electricity) and coal (still 35% of generation), to lithium, cobalt, nickel, and manganese fueling the battery revolution in mobility. Fertiliser minerals like phosphate and potassium remain vital for global food security, while metals such as titanium and cobalt are essential for both medical devices and advanced manufacturing.

A central theme this year is concentration risk—the growing dominance of a few countries in the production and processing of critical minerals. China is the standout, accounting for over 50% of global production for 18 minerals and dominating processing for many more, including 92% of rare earth element refining. The Democratic Republic of Congo supplies 76% of global cobalt, while Indonesia commands 53% of nickel production. Uranium supply is equally concentrated, with Kazakhstan responsible for 38% of global output, often involving Russian ownership and enrichment.

Countries and companies are responding to these risks with a range of strategies: investing in domestic production and processing, securing supplies through long-term contracts, diversifying sources, and accelerating recycling and innovation. Indonesia’s nickel industry is a case in point: policy-driven bans on ore exports have spurred a boom in domestic smelting and processing, attracting billions in foreign investment and transforming the country into a key player in the EV battery supply chain.

As the industry looks to 2035, PwC identifies several forces that will shape mining’s trajectory: urbanisation, the energy transition, climate risks, technology and automation, evolving workforce needs, shifting investor profiles, and intensifying government intervention. The report urges mining leaders to embrace collaboration across the value chain—partnering with governments, communities, technology providers, and end users—to unlock new value pools and navigate systemic risks.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.