Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

By 2033, vanadium redox flow batteries (VRFBs) are projected to account for 17% of global vanadium use — a x6 increase from just 3% in 2021.

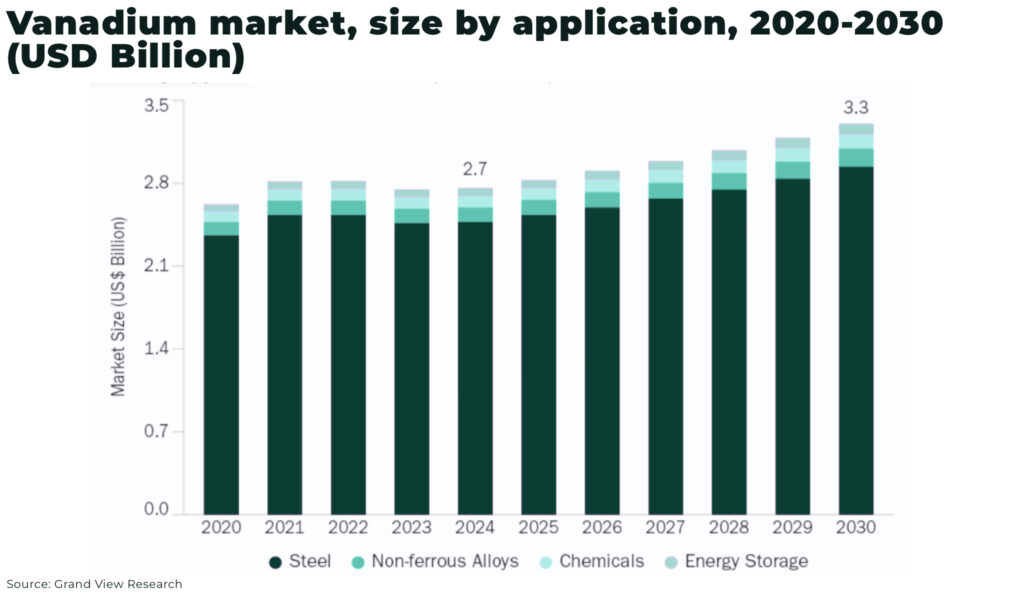

With steel still dominating vanadium demand (accounting for 94% of US consumption in 2023), this surge in battery use is expected to put significant pressure on supply.

To meet this growing demand, global vanadium supply will need to increase by 6.9% annually between 2022-2030.

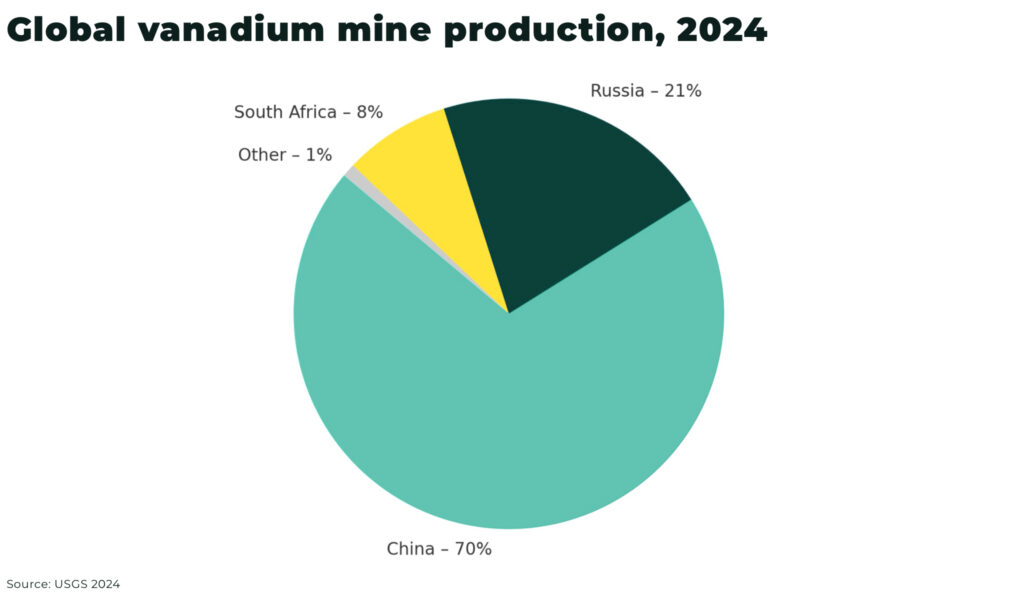

However, 99% of global supply is concentrated in high risk regions: China (70%) and Russia (21%) and South Africa (8%). And most potential new sources of vanadium remain either un-financed or in early-stage exploration.

What is vanadium and why it matters

Vanadium is a silvery-blue transition metal named after the Norse goddess Vanadis. Its primary use is as an alloying agent to strengthen steel, where even small additions (typically <0.2%) significantly increase tensile strength and durability. This makes it essential for applications in construction, pipelines, tools, jet engines, and rebar, especially in earthquake-prone regions.

But vanadium’s relevance is expanding, in particular, as the active element in vanadium redox flow batteries (VRFBs), a leading non-lithium energy storage technology. Unlike lithium-ion, VRFBs don’t degrade with time, making them ideal for grid use with longer life cycles, improved safety, and scalability, especially for large-scale grid storage solutions. The batteries rely on vanadium’s almost unique ability to exist in four stable oxidation states, which enables energy to be stored and discharged repeatedly without degradation.

Market fundamentals: steel still dominates, but batteries rising

Historically, vanadium demand has tracked closely with industrial output and infrastructure spending, particularly in emerging markets. The main drivers:

- global steel production, led by China

- chemical catalysts, particularly sulfuric acid and maleic anhydride

- and, increasingly, vanadium flow batteries

Historically, vanadium price has tracked closely to industrial output and infrastructure spending.

And global steel demand is not slowing down. Demand is expected to increase from 1.8 billion tons in 2020 to approx 2 billion tons in 2030, an average annual growth rate of around 1.06% or 11% in absolute terms compared with 2020 — driven by industrialization in developing countries such as India and regions in Africa.

In 2023, 94% of vanadium consumption in the US was still tied to steel alloying applications, with demand jumping 27% year-on-year. Between 2019 and 2023, total apparent consumption in the US grew by more than 40%, from under 10,000 metric tons to over 14,000.

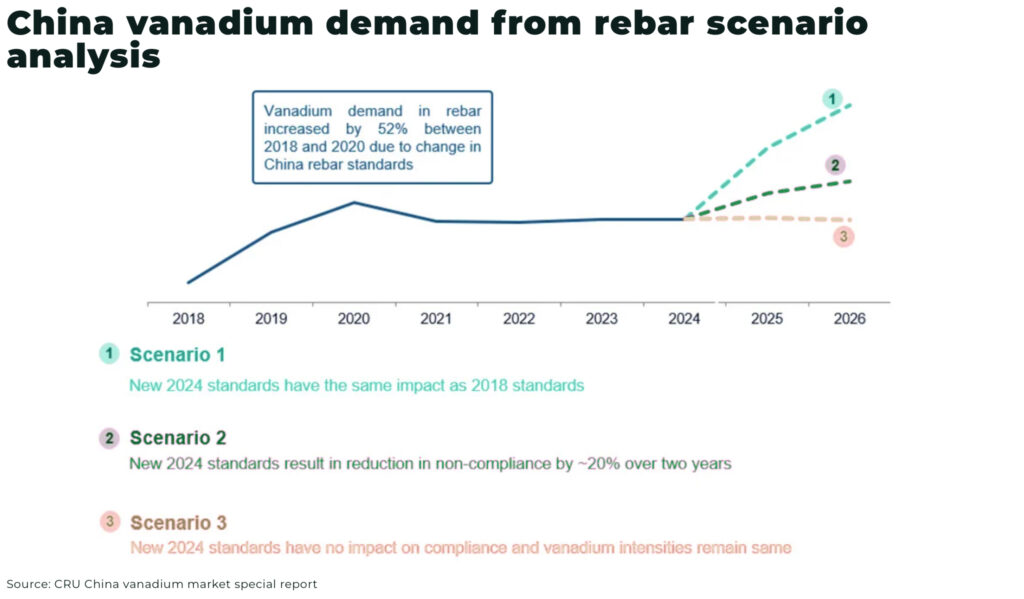

In September 2024, China introduced new rebar standards that are expected to boost demand high-quality vanadium, potentially increasing vanadium nitrogen consumption by an estimated 15%. However, with a weak construction market and fragile economy in China, this may only offset industry wide falls.

Instead, it is new demand from the vanadium flow battery market that is expected to squeeze the underlying supply fundamentals.

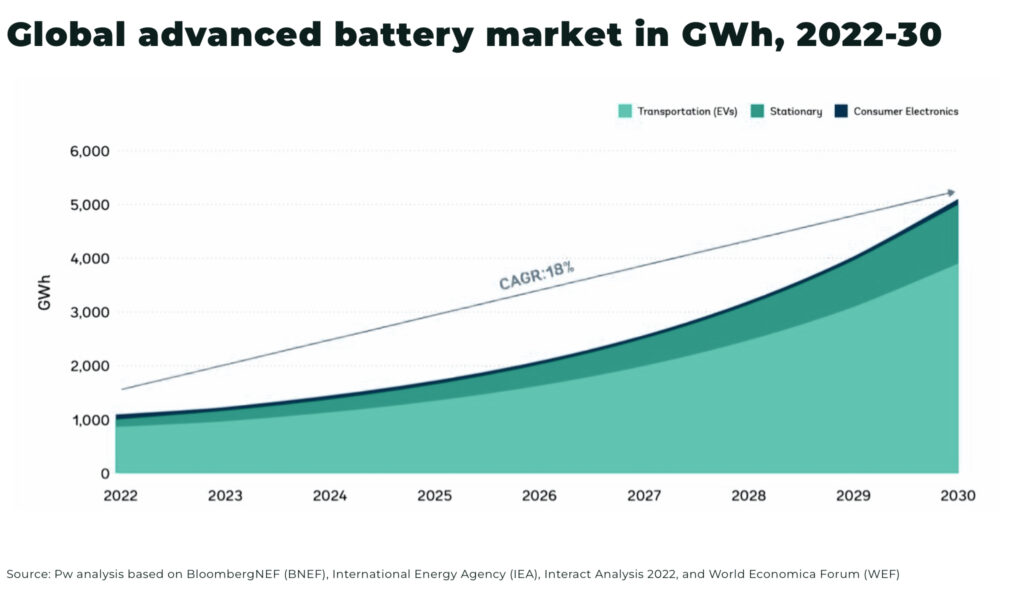

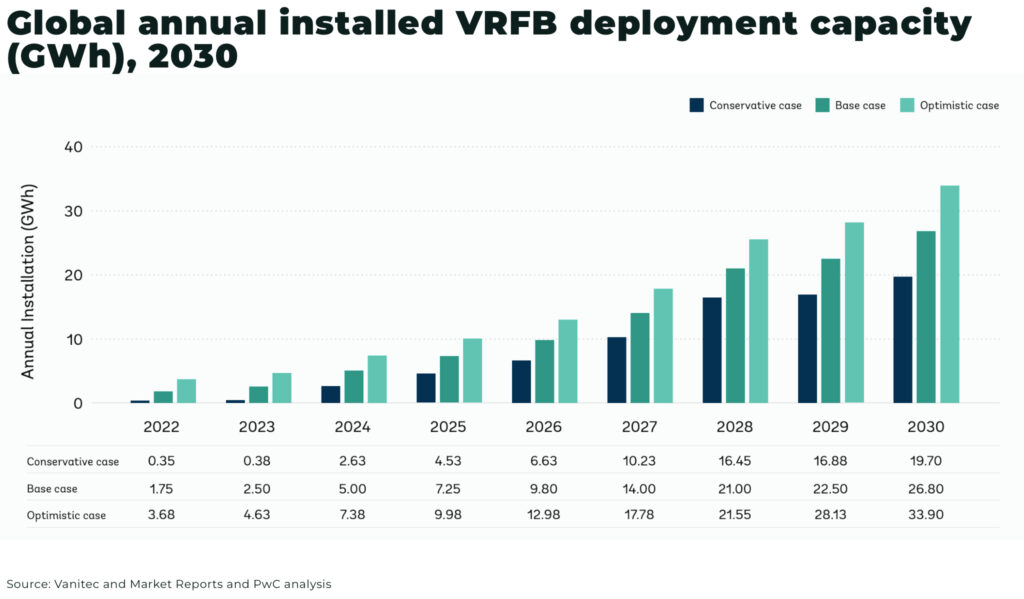

The cumulative global demand of VRFB by 2030 is around 111 GWh, with annual demand of about 27 GWh, or 2.4% of the total required stationary storage capacity for that year — a CAGR of 41% from 2022 to 2030 — according a a World Bank Group report.

China is expected to drive the sector and recently announced a new production target for VRFBs, aiming to reach a 12 GWh annual capacity by 2027, but the move is global:

- in China, Rongke Power completed a 175MW/700MWh VRFB project, the largest of its kind globally, in 2024

- in Japan, Sumitomo Electric deployed a 51MWh VRFB system in Hokkaido to support wind energy integration, in 2022

- in Canada, Invinity Energy Systems is supplying an 8.4MWh VRFB for a solar-plus-storage project in Alberta

BloombergNEF predicts that, if all the redox flow batteries were grouped, the annual demand could compete with lithium-ion for up to 69 GWh capacity in 2030.

According to the World Bank report “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition” vanadium demand could increase by 200% by 2050.

Without any significant new supply coming online CRU analysis expects the vanadium market to be in deficit after 2025.

“We are estimating a global supply deficit in 2025 due to change in rebar standards and rise in vanadium battery demand, causing vanadium prices to rise. As more supply comes online in 2026 and 2027, by 2027 vanadium prices will come down when compared to 2025 prices, but crucially remain higher than the pricing in the last 12 months”

— Piyush Goel, commodities consultant at CRU Group, Top trends for vanadium in 2025

However, a significant challenge to such growth expectations for VRFB, is the scaling up of production from the current low levels of mining and refining, as well the high cost and limited manufacturing facilities for redox flow batteries.

Vanadium supply gaps

Vanadium is primarily extracted as a byproduct from mining titaniferous magnetite ores, where it is recovered during steel production. There are three main pathways for production:

- co-/by-product recovery from steelmaking slag (common in China and Russia)

- secondary recovery from petroleum residues, fly ash, and spent catalysts (e.g., in the U.S. and Europe)

- primary mining, which remains rare and geographically limited

As of 2024, 97% of global vanadium production is sourced from just four countries — China, Russia, South Africa, and Brazil — with China alone producing more than two-thirds.

The US currently lacks any active primary vanadium mines. Production from domestic ore ended in 2020. However, in 2025, Anfield Energy’s Velvet-Wood uranium-vanadium mine in Utah became the first mine approved under the Trump administration’s new 14-day expedited permitting process, reflecting renewed urgency over mineral security.

China dominates, not just mining, but also processing — more than 50% of all processed vanadium — highly energy-intensive and requiring complex extraction methods, especially to convert ore or slags into battery-grade vanadium pentoxide (V2O5) or electrolyte solutions used in VRFBs.

Secondary sources are unable to make up the shortfall. Reprocessing petroleum residues, fly ash, and spent catalysts contributed an estimated 5,700 metric tons to US supply in 2023. These materials contain vanadium as a trace element, typically ranging from 2–5% by weight in spent catalysts and even lower in fly ash or heavy oil residues. Recovery involves chemical leaching, roasting, or solvent extraction to isolate vanadium pentoxide.

However, feedstock composition varies widely, and the environmental cost of processing — especially handling toxic byproducts — limits capacity expansion with a lack of dedicated collection systems or centralized recycling infrastructure.

This high concentration in global supply creates significant vulnerability to supply shocks, trade restrictions, or political instability — especially as the IEA warns that diversification in critical minerals is stalling, where China retains over 70% of global control.

Between January 2014 – March 2025, vanadium prices have shown greater price volatility than oil and natural gas.

The Ukraine conflict and sanctions against Russian exports have added further instability, while China’s clampdown on critical mineral exports in 2024-2025 has raised alarm over the vulnerability of downstream industries.

In response the US has managed to increase secondary supply of vanadium, but still imported 40% of its vanadium consumption in 2024, with key suppliers including Canada, Brazil, Austria and South Africa.

Conclusion: a strategic metal caught between two markets

Vanadium’s dual-role in steel and stationary storage means it is simultaneously a mature industrial metal and an emerging technology metal. This makes it volatile, but also strategic. For investors seeking asymmetric exposure to energy security and grid transformation, vanadium offers a rare, under-explored angle — but investors must navigate a thin supply pipeline and geopolitical chokepoints.

While speculative demand may ebb with steel cycles, the structural demand growth from VRFBs, and the inability to quickly scale primary supply, points to sustained long-term tightness in the market. Projects with vertically integrated vanadium extraction and refining, particularly outside China and Russia, stand to gain premium valuations.

The supply-demand crunch is already in motion.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.