- AI forecast to contribute US$15.7 trillion to world economy by 2030

- AI industry to create an estimated 97 million new jobs by 2025

- AI global revenues will pass US$500 billion in 2023

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Artificial Intelligence — with an estimated contribution to the global economy of US$15.7 trillion by 2030— has the potential to turbo-charge the productivity and efficiency of almost all industries while also presenting a compelling area for investment.

As the name artificial intelligence, or AI, suggests, the goal is to create intelligent machines which can operate faster and more accurately than human labour. This is disruption on a global scale, driven by big data and designed to learn so it becomes smarter, more efficient, more productive.

So, how can investors stay one step ahead? We’ll address the key areas of investment in a new series of reports, cutting through the hype, to find both risks and the upside.

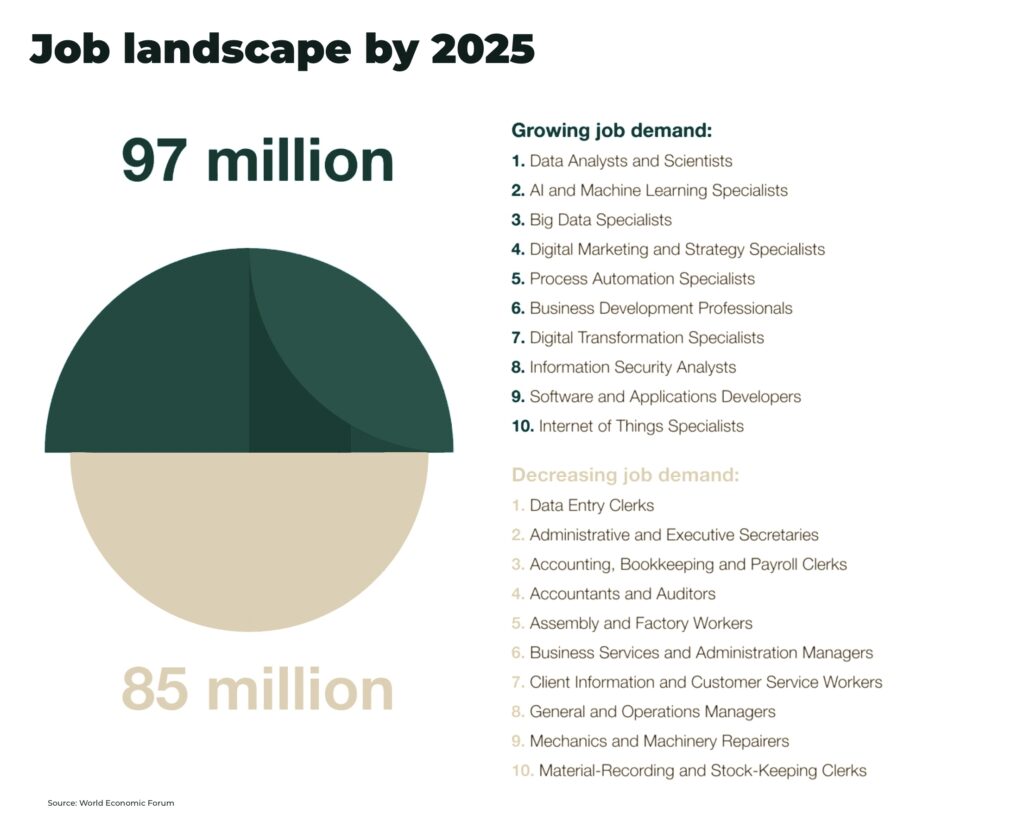

85 million jobs will be displaced by Artificial Intelligence across 26 countries by 2025, but that 97 million new jobs will be created.

— Future of Jobs Report 2020, World Economic Forum

The tech behind AI is part of the so-called fourth industrial revolution that is going to leave few businesses untouched, including those that are fundamental to modern life.

Robots that pick fruit faster than humans are already being tested in farms; accelerated mine prospecting with drill data; automated healthcare assistants to support with nursing and even surgery; self-driving cars have driven millions of miles across America; police are using advanced facial recognition software to catch criminals; and, in finance, banks are using AI to fast-track trading to the point at which portfolio advisors are being turned into algorithms.

The Covid pandemic has accelerated the demand for AI, as companies learn to adapt to new pressures and ways of working online, yet 85% of respondents to one KPMG survey still want to push for faster integration before their competitors gain an AI edge first.

It may sound exciting but there are some significant challenges for the widespread growth of AI, including concerns about bias of algorithms, the cost of computing power, as well as data privacy and security.

The biggest challenge of all is job losses and redistribution of wealth. But, we at The Oregon Group, do not believe in the dystopian vision of Artificial Intelligence and robots putting everyone out of work. Humans always find some way of keeping themselves productive, as the “Great Resignation” and retraining showed during the pandemic.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

A report by the World Economic Forum estimates 85 million jobs will be displaced by Artificial Intelligence across 26 countries by 2025 — but that 97 million new jobs will be created.

In particular, 30% of jobs and 44% of workers with lower levels of education are at risk. The OECD estimates over 1 billion jobs, almost one-third of all jobs worldwide, will likely be disrupted by technology in the next ten years. Governments and businesses that prioritize re-skilling their workers in high value jobs will have the advantage.

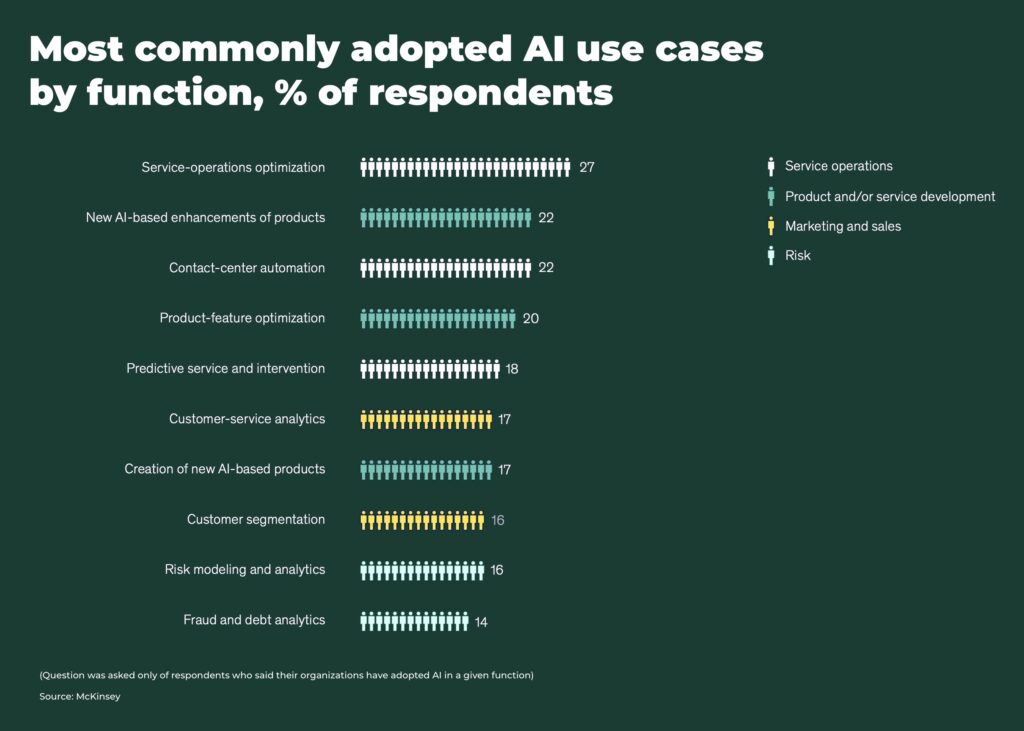

Entire economies are about to be overhauled, but it’s still early days. The majority of businesses are still experimenting with artificial intelligence technology. One study suggests only 12% of firms are using AI in a way that achieves a significant competitive advantage.

That leaves a lot of potential for growth for investors who back the right AI developers.

You are likely already to have indirect exposure as many of the major US public companies are already working with AI to improve their productivity. And those organizations seeing the highest returns from AI are more likely to follow best practices set out in the recently developed Machine Learning Operations (MLOps).

For direct exposure, broadly speaking, there are three categories: hardware, software and services.

Hardware is made up of the sensors (visual, haptic, audio, infrared, and so on) that deliver digital information via semi/superconductors to microchips and data centres where the information can be processed for the desired output via robotics and software.

The software — algorithms and APIs — is then applied via the hardware and digital apps to manufacturing, mining, healthcare, retail, finance, public sector, science, etc.

Services are the businesses that provide the platforms, such as the data centres for cloud computing, to allow the software to function.

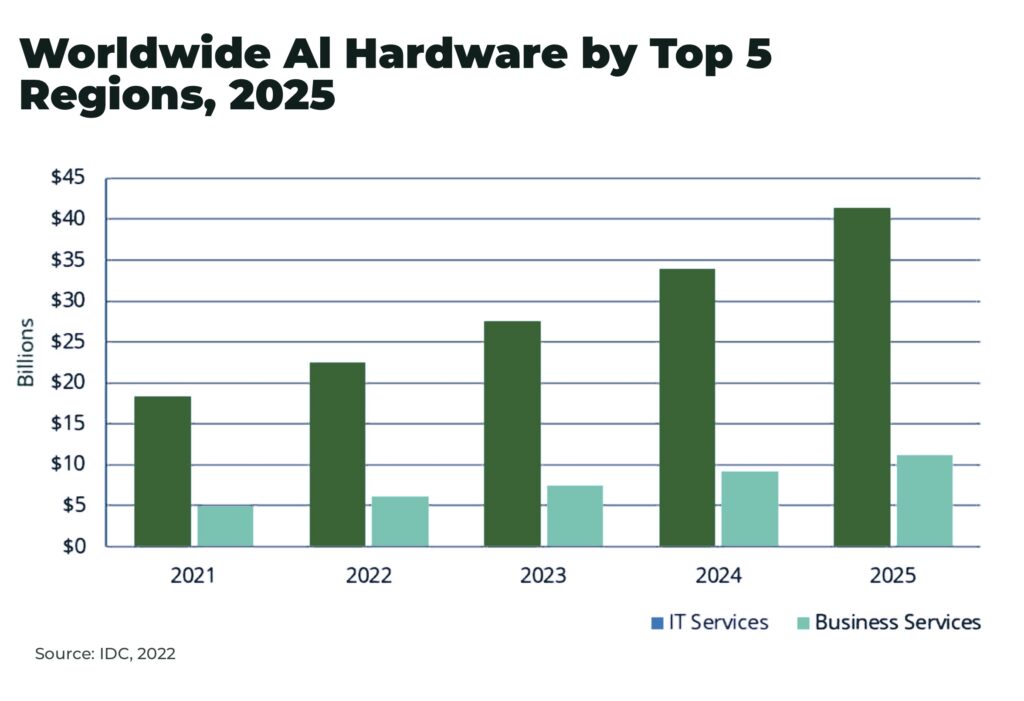

The IDC forecasts global revenues for AI will increase 19.6% year over year in 2022 to US$432.8 billion, and pass US$500 billion in 2023. Services will see the fastest compound annual growth rate of 22% over the next five years, hardware will be 20.5%, and software will see its share decline slightly.

The countries set to gain the most from AI are forecast to be China, an increase of up to 26% GDP by 2030, and North America, a boost of up to 14% GDP by 2030.

Alphabet Inc (aka Google) is arguably the largest AI software company in the world, with its search and assistant algorithms, self-driving car programme, as well as healthcare investments, including a protein-folding simulation run by Deepmind that could discover new drugs faster.

In hardware, the global semiconductor chip industry is expected to reach about a value of US$600 billion in 2022, with US companies Intel and Nvidia among the largest companies in the world.

Amazon still dominates the cloud market infrastructure with 33% share of the US$180 billion market last year, but Microsoft and Google are also significant players with 21% and 10% respectively.

ETFs are available that offer portfolio exposure to a variety of these AI stocks. Some of the largest include: ROBO Global Robotics & Automation Index ETF (ROBO) and Global X Robotics & Artificial Intelligence ETF.

Or, for investors who understand the opportunity/risk ratio, micro cap stocks and private companies, are researching and testing technology that has the potential to transform all of the above.

Artificial Intelligence will most likely impact your investments whether you have direct exposure or not. Stay tuned as we delve deeper into this area in coming commentary.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.