Critical Minerals and Energy Intelligence

Gallium and Germanium

Gallium and germanium have both experienced dramatic price volatility and supply disruptions since mid-2023, driven by sweeping Chinese export controls and intensifying global demand across advanced technologies.

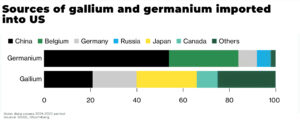

China, which produces roughly 98% of the world’s gallium and 60% of germanium, imposed strict export licensing requirements in July 2023, followed by outright bans and further restrictions in late 2024, effectively choking off Western access to these critical minerals.

Both elements are indispensable for semiconductors, 5G infrastructure, defense, and high-efficiency solar cells, making supply security a major concern for the US, EU, and allied economies.

Gallium and Germanium Insights

Latest News

What are Gallium and Germanium?

Gallium and germanium are rare, metallic elements critical to the modern technology ecosystem. Gallium, with atomic number 31, is a soft, silvery metal primarily obtained as a by-product of bauxite (aluminum ore) processing, while germanium, atomic number 32, is mainly recovered as a by-product of zinc refining and from coal fly ash. Both metals are solid at room temperature and possess unique semiconductor properties that make them essential for advanced electronics, defense, and renewable energy applications.

Gallium’s name derives from “Gallia,” the Latin for France, where it was discovered, and it is notable for melting just above room temperature (29.76°C). Germanium, discovered in 1886, is named after Germany and is a lustrous, grayish-white metalloid.

Today, gallium and germanium are indispensable for high-performance semiconductors, fiber optics, infrared optics, solar cells, and military technologies, securing their status as critical minerals.

Why Gallium and Germanium matter: strategic applications

Semiconductors and electronics

gallium arsenide (GaAs) and gallium nitride (GaN) are foundational for high-speed, high-frequency chips used in smartphones, satellites, radar, and 5G networks

germanium is vital for silicon-germanium (SiGe) chips, fiber optic systems, infrared night vision, and solar panels

Defense and aerospace

both metals are used in military communications, advanced radar, missile guidance, and satellite systems, where their unique electronic and optical properties are irreplaceable for performance and reliability

Renewable energy and telecommunications

gallium and germanium are crucial for high-efficiency photovoltaic (solar) cells and the expanding global fiber optic network, supporting the energy transition and digital infrastructure

Supply and demand dynamics

Production concentration

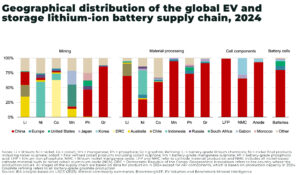

China dominates global production: 94% of gallium and 83% of germanium originate from Chinese refineries, giving the country near-monopoly power over both supply and pricing

the US, EU, and Japan are heavily reliant on imports, with the U.S. importing $225 million in gallium and $60 million in germanium in 2022 alone

Market Drivers

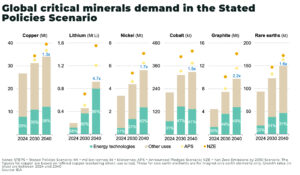

demand is driven by growth in semiconductors, electric vehicles, defense modernization, and green technologies

the relatively small market size for both metals belies their strategic leverage, as substitutes like silicon cannot match their performance in critical applications

Supply landscape and mining characteristics

Mining and processing

gallium is extracted as a by-product during the refining of bauxite and, to a lesser extent, zinc

germanium is mainly recovered from zinc concentrates and coal fly ash

because both are by-products, their supply is tightly linked to the production rates of other base metals, making rapid scaling difficult

Major producers and projects

China is the leading global refiner and exporter, with Japan, Canada (notably Teck Resources for germanium), and a handful of European countries as secondary players

Western nations are seeking to ramp up domestic production and recycling, but new supply projects face long lead times and economic hurdles due to China’s historic undercutting of prices

Market trends shaping gallium and germanium’s future

Supply chain security

China’s export restrictions, introduced in August 2023, slashed global exports by over 80%, causing prices to spike and highlighting the vulnerability of Western supply chains

governments are responding with strategic stockpiling (notably for germanium in the U.S.), recycling initiatives, and incentives for domestic production, but progress is slow and costly

Technological evolution

the rise of AI, data centers, and the energy transition is expected to drive exponential demand for both metals, increasing their strategic importance

Regulatory and geopolitical environment

export controls are widely viewed as a response to Western restrictions on semiconductor technology, and further critical mineral “wars” are anticipated as nations compete to secure supply

the West is exploring “bifurcation” of mineral markets, potentially paying a premium for domestically or sustainably produced gallium and germanium to reduce reliance on China

Gallium and germanium are linchpins of the modern digital and defense economy, with supply chain security now a top priority for governments and industry. As China tightens its grip on exports, the race is on to diversify sources, invest in recycling, and develop domestic capacity. The outcome will shape the future of critical technologies and the global balance of power in the years ahead

US launches $12 billion strategic minerals stockpile

The US will establish a US$12 billion strategic minerals stockpile, marking its most direct intervention yet in critical mineral markets as competition with China intensifies.

US-backed $7.4bn smelter escalates critical minerals decoupling from China

The US has thrown its weight behind a US$7.4bn critical minerals processing plant to be built by Korea Zinc, underscoring how refining and smelting —

China lifts export ban gallium, germanium, antimony

China has suspended the export ban on gallium, germanium and antimony to US until November 27, 2026. Exports will now be managed under licensing until

Gallium’s 2025 Breakout: The Small Metal Behind Big Power Plays (Guest Post by Louis O Connor)

Louis O Connor , founder of Strategic Metals Invest. The world’s first marketplace for private investors to physically own rare earths. Our private clients also

US and Australia sign $8.5 billion rare earths deal

On 20 October 2025, Donald Trump and Anthony Albanese signed the United States–Australia Framework for Securing of Supply in the Mining and Processing of Critical

Why the US fails to secure critical mineral supply — and how it can be fixed

An inside look into what’s gone wrong in Washington — and how to fix it In December 2024, China banned exports of gallium, germanium, and antimony