Despite commodity prices moving against their forecasts, Goldman Sachs warns one of the main drivers will have significant impact on prices in the medium-turn.

“It is likely the largest physical and financial de-stocking the complex has ever witnessed; hence, the ‘great de-stocking.’ The bottom line is markets have cashed in on their insurance policies in the form of physical and financial hedges”

— Goldman Sachs, Commodity Views: The ‘great de-stocking’

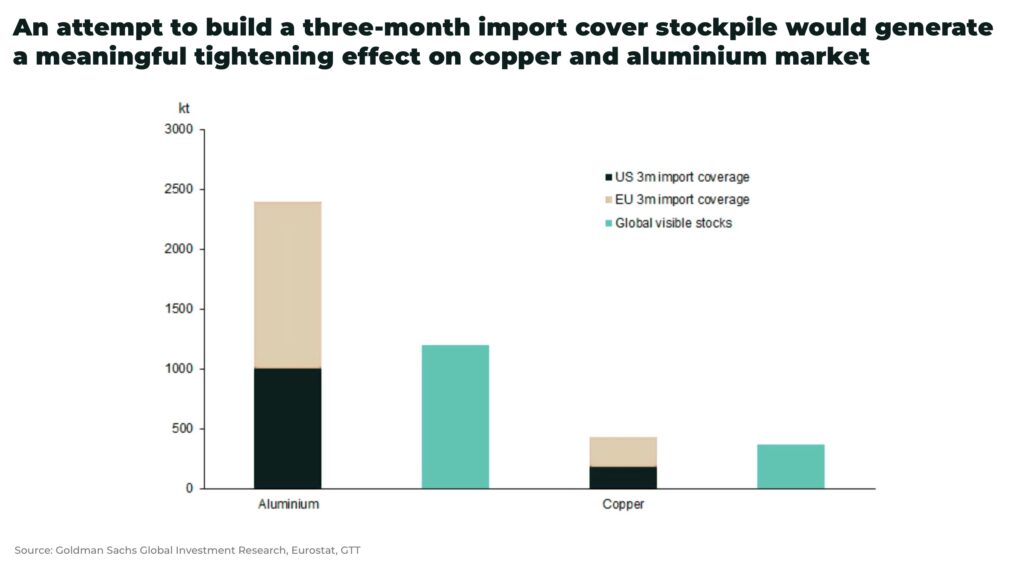

But the market is still exposed to the upside as Western governments are proposing new insurance policies with the build up of green mineral strategic reserves to meet an expected surge in green demand. For example, France has set aside a €2billion fund to finance a secure supply of green critical minerals.

Goldman Sachs now forecasts the S&P GSCI to return 30.3% on a 12-month horizon.

And, for copper, they are forecasting a full year metal deficit (GSe 167kt vs. 248kt prior deficit) and expect a resurgence in upside after this trough phase (current price targets on a 3/6/12M basis of $7,750/9,200/10,000/t).

“Despite China’s copper demand growing by 5% y/y year-to-date, in line with our full-year expectation, over the same period net refined imports have fallen 15% y/y. With Western metals demand deteriorating over the same timeframe, this has left ex-China markets skewed toward surplus in the short term”

— Goldman Sachs, Commodity Views: The ‘great de-stocking’

Our analysis on the long-term trend for copper demand and supply: