- global copper demand set to double by 2035

- copper supply will be 20% less than what’s needed to meet global net-zero goals

- report suggests future demand could be met if three tier-one copper mines are fast-tracked every year per year for the next 29 years

- prices forecast to rise from 2025, but surplus be realized only from 2040

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

If you plan to trade copper in the next few years, get ready for plenty of volatility. But, if you can wait it out, the pay-off should be sizeable as demand is set to rise exponentially.

Short-term the headwinds against copper will be significant: record inflation, a strong dollar, a severe contraction of manufacturing in the Eurozone, a possible economic downturn in the US, as well as China’s zero-Covid policy.

But, from 2025, as national governments ramp up their efforts to transition to clean energy to meet their net-zero targets, we expect an unprecedented demand which supply will struggle to keep up with.

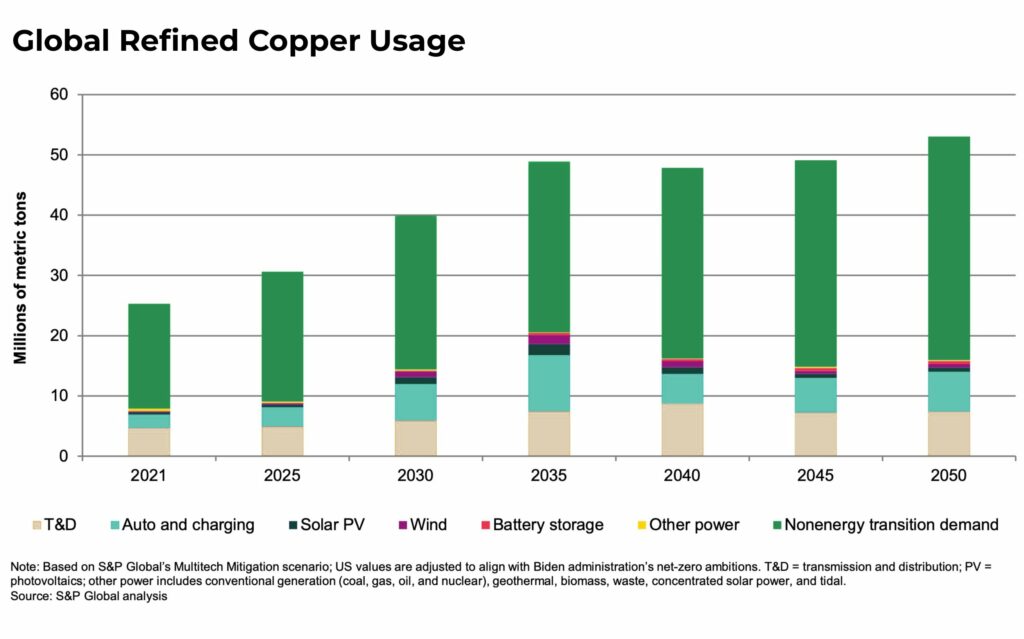

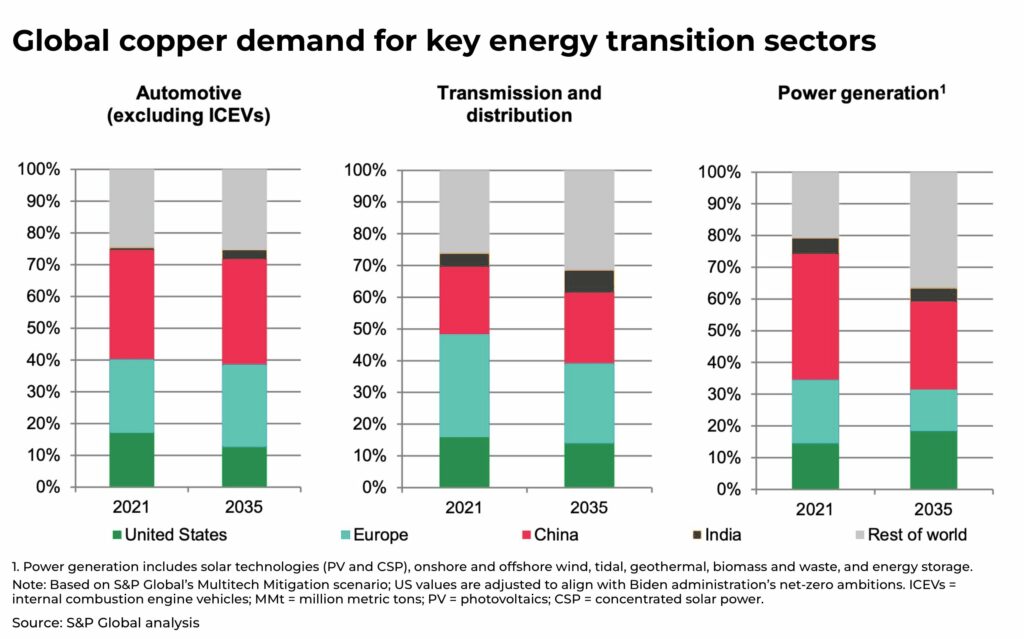

Copper demand is forecast to increase by more than 100% by 2035, from current production of 25 million metric tons (MMt) to 50MMt. This will continue to grow to 53MMT by 2050.

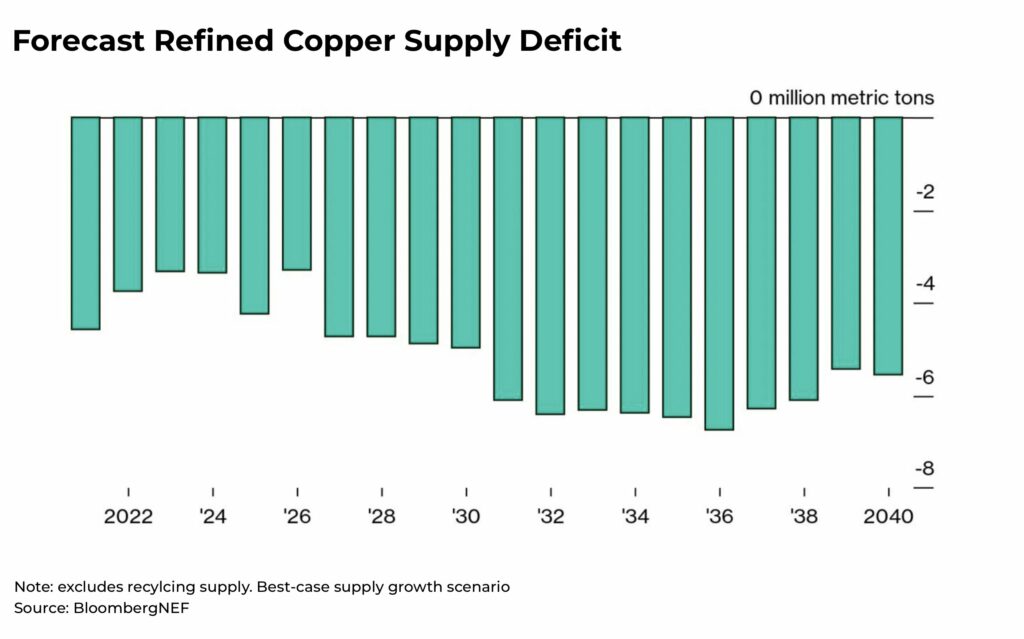

In 2035, S&P Global projects in their worst-case scenario, the copper shortfall to be 9.9MMt, 20% less than what is needed to meet global 2050 net-zero goals. To put this figure in context, the biggest shortfall between 1994-2020 was 2.5%.

In a similar report, BloombergNEF estimates copper demand to rise 50% by 2040, with supply increasing only 16%.

The reason is that copper is a critical metal for the energy transition.

Copper is the second most conductive metal (surpassed only by silver, which is far more costly), and therefore essential for the electrification of national grids, cars, wind and solar panels, that will allow a move away from fossil fuels.

“The shift to a clean energy system is set to drive a huge increase in the requirements for these minerals…. A rapid rise in demand for critical minerals – in most cases well above anything seen previously – poses huge questions about the availability and reliability of supply”

— IEA, The Role of Critical Minerals in Clean Energy Transitions

The role copper plays in the energy transition is best illustrated by the chart below, for example an electric car needs four times the amount of copper than a combustion engine, and the expansion of national grids is expected to need double the amount of copper between now and 2040.

So, to answer the obvious question, why can’t we just mine more copper?

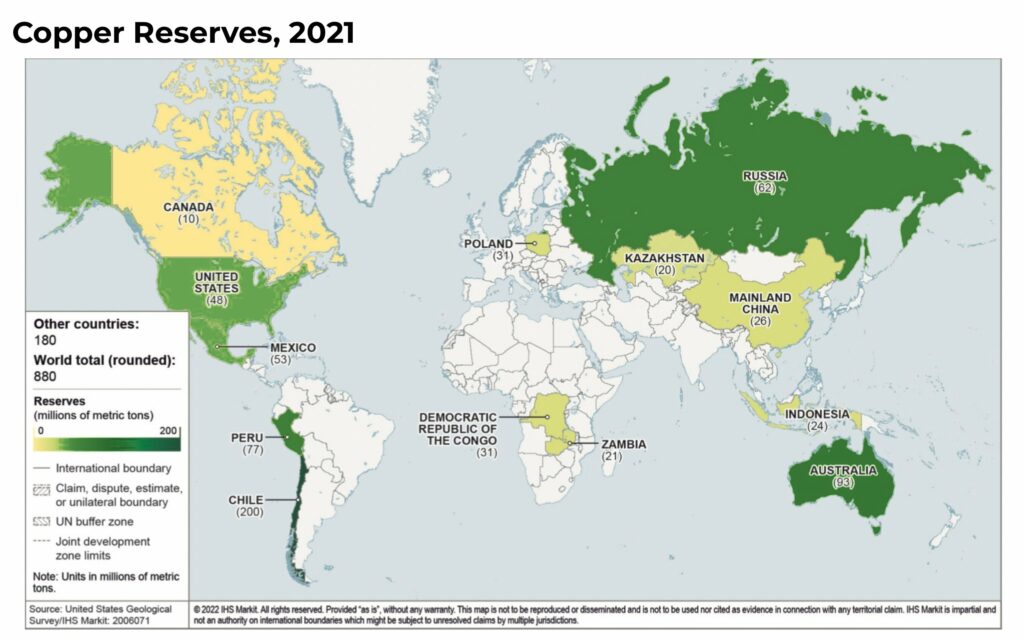

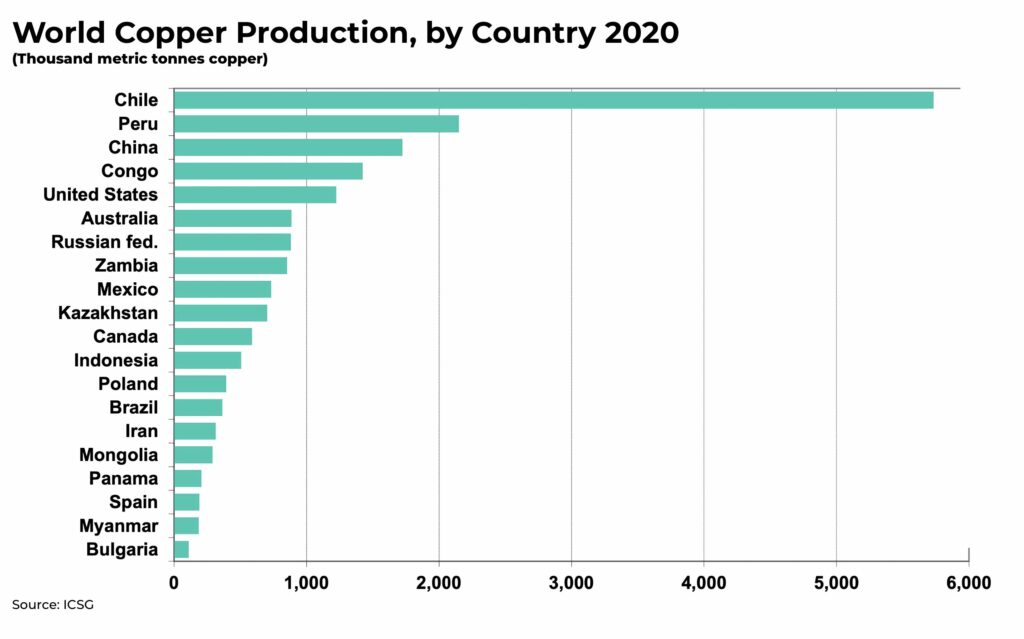

Chile is the world’s largest copper producer, as well as holding the world’s largest reserves, yet production has been steadily falling and is down 10.2% year-on-year in August to only 415,500 tons.

Due to lower quality grade of ore from old mines, a scarcity of water for extraction, as well as redesigns and handling issues flagged by Codelco, the world’s largest copper producer, ouput from the country has stagnated.

In Peru, the world’s second largest copper producer, protests by local communities has shutdown output and forced the government to declare a national emergency.

Mining company, Newmont Corp, has now put on hold plans to invest US$2 billion into a new copper and gold mine in the country, citing “unprecedented and evolving market conditions.”

Businesses were already wary of importing Russian copper after the invasion of Ukraine and now the London Metal Exchange (LME) has sanctioned imports from Russia’s Ural Mining and Metallurgical Company.

And, in America, one of Rio Tinto’s latest ventures is in a legal dispute over an estimated 18MMT of copper that Native Americans are claiming is sacred land.

These are just a few of the examples of permitting issues, environmental concerns, labor relations, as well as government regulations and taxes, that are roadblocks to any meaningful expansion of copper mining across the world.

Development of a new copper mine can take more than 15 years and can cost tens of billions of dollars to build.

The S&P Global report suggests all future demand could “theoretically” be met if three tier-one copper mines were fast-tracked, each with a capacity to produce 300,000 metric tons a year, every year per year for the next 29 years. The estimated cost for this would be more than US$500 billion. Such a feat, however, would be unprecedented in history.

For investors, the returns have been too expensive and distant — until now.

Even under the best case scenario of having the approval waived and construction accelerated for all copper projects currently in development, it would still not be enough to meet the upcoming demand.

Higher prices driven by the deficit in supply will change this supply-demand dynamic significantly. Goldman Sachs forecasts that the price will rise to US$15,000 per ton by 2035. Today, it traded at US$7,607 on the LME.

A long-term copper price of US$10,000 per ton, suggest Goldman Sachs, is needed for supply to catch up with demand after 2030.

Such a price hike would effect not just mining, but also recycling which accounts for approximately 16% of copper supply and this is also set to grow to 22% by 2035, driven by high prices.

It would also affect demand which would most like be lower with such costs.

But, once high prices kick in, after 2025, so too will investment but it will take until at least 2040, maybe later, before a surplus emerges.

“From 2025, as national governments ramp up their efforts to transition to clean energy to meet their net-zero targets, we expect an unprecedented demand which supply will struggle to keep up with”

— Anthony Milewski, The Oregon Group

So, how to get exposure to this unprecedented bull run?

With copper, you could head down to the scrapyard and buy some copper direclty yourself. However, we would suggest some more efficient ways:

ETFs such as Copper ETF (LSE: COPA) allow you to invest in a spread of businesses, without the concentration risk of individual mines or companies. Global X copper miners ETF (NYSE: COPX) is arguably the most liquid copper ETF listed on the New York Stock Exchange.

Some of the largest mining companies with meaningful exposure to copper include Freeport-McMoran (NYSE: FCX), BHP Group (NYSE:BHP), Rio Tinto (NYSE:RIO), Glencore (LSE:GLEN), and Anglo American (LSE:AAL).

Alternatively, there are plenty of micro-cap stocks.

The Oregon Group will be watching this market closely, stay subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.