The US Department of Energy launched its Pathways to Commercial Liftoff to accelerate the commercialization and deployment of key clean energy technologies — with a particular focus on nuclear — through engagement between the public and private sectors.

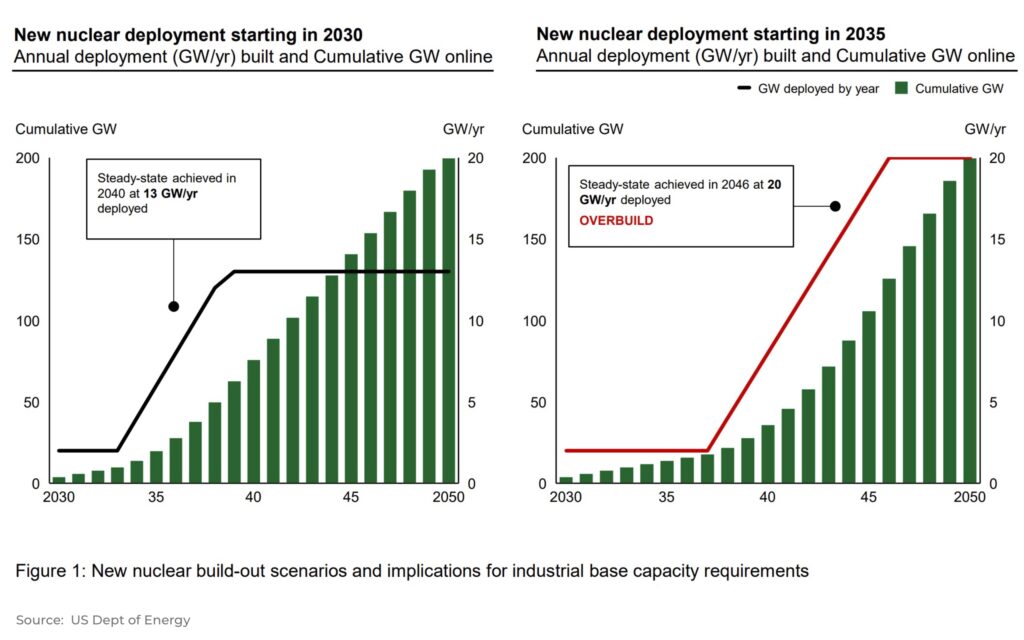

The proposed build out of 13GW added annually would require the fuel supply chain capacity to increase by 200–300%.

According to the report, the US had a recent peak of 2,263 MT U3O8 mined in 2014. However, an additional 22,000 MT were procured by the U.S. globally in support of ~100 GW of existing nuclear power capacity. To support an additional 200 GW, the U.S. would need to expand mining/milling operations by an additional ~50,000 MT per year (i.e., grow by 22x the most recent peak). Mining/milling of uranium will need to be increased from the U.S., allies, and partners to ensure a secure supply for the expected growth in nuclear capacity.

This supply would potentially need to be split between developing a domestic supply and working with other OECD countries to ensure a sufficient uranium supply (e.g., Australia, Canada).

Possible actions by the public sector to ensure such supply increases would include:

- Classify uranium as a critical material

- Ensure any non-domestic U3O8 supply comes from allies and partners

For investors, our report on the uranium bull market and coming of the second atomic age: