Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Fluorspar may not have the name recognition (yet) of copper, lithium, nickel or cobalt, but a lithium-ion electric battery needs up to x5-10 more fluorspar than lithium. And, last year, prices hit record highs due to a supply shortage.

The US Department of Energy forecasts that demand for fluorspar will exceed current supply by 1-4% by 2025, but that by 2035 demand will exceed current supply by 40-70%.

And, this time, the supply crunch for the critical mineral is coming, not just in the West, but also in China.

“While cobalt, nickel, and lithium hog the headlines, another critical mineral is quietly gaining prominence in the lithium-ion battery revolution: fluorspar”

— Benchmark Mineral Intelligence’s Fluorspar Market Outlook Report

What is fluorspar?

Fluorspar is the commercial name of mineral fluorites, in particular: acidspar, metaspar and ceramic (there are others as well, such as optical).

It is used across chemical production, particularly refrigerants and fluoropolymers, cement, glass, iron, steel and aluminium casting, as well as for processing uranium.

The most widely used fluorspar, expected to dominate the market over the next few decades, is acidspar, used in steel and aluminium production, as well as the production of hydrofluoric acid, essential across the automotive, construction, electronics and healthcare industries.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Fluorspar in electric batteries

The main reason fluorspar is listed as a critical mineral in the US, EU, Australia and others, is the projected demand for electric vehicles (EVs), as well as to process silicon essential for solar panels.

Fluorspar is used in all three main parts of an electric battery: cathode, electrolyte, anode.

Although there is significant variety in lithium-ion battery chemistry, on average, each battery needs approx 100kg of fluorspar to per 100KWh lithium battery, so 1kg pr 1KWh. In comparision, a typical EV battery contains an estimated 8kg of lithium, 14kg of cobalt, and 20kg of manganese.

For example, every battery in a Volkswagen ID.4 requires about 10kg of fluorspar.

Demand for Fluorspar from the lithium-ion battery sector is expected to be more than 1.6 million tonnes by 2030, according to Benchmark’s Fluorspar Market Outlook.

The US Department of Energy forecasts demand for fluorspar for energy applications will increase from 5% in 2025 to 22% in 2035 — electric vehicles will make up 19% of this demand.

Fluorspar supply and demand

Both the world’s biggest consumers of fluorspar are struggling to secure supply:

China

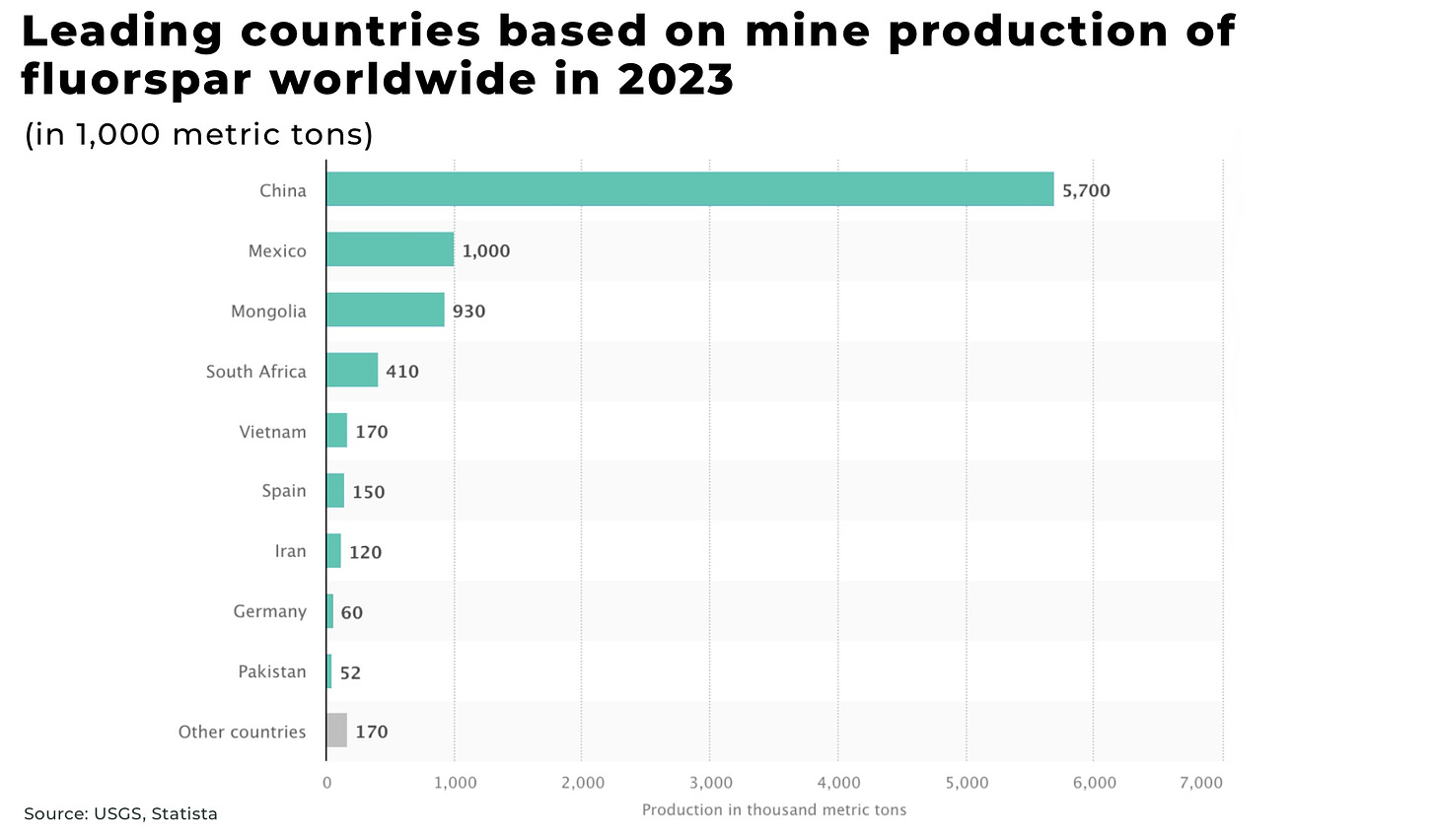

In 2023, China was both the largest producer and consumer of fluorspar, accounting for over 60% of global production.

However, exports have been steadily decreasing and imports rising as China’s fluorspar production and reserves decline.

The US Department of Energy projects China’s market dominance of fluorspar will continue, but some estimates suggest, at current production rates, the country has only 10 years of reserves left.

Authorities are working to consolidate many of the country’s smaller mines to make the industry more efficient in the face of falling reserves.

In particular, after a major mining accident in Xingan country last year, mining licenses are reportedly more difficult to obtain, and safety inspections across the industry have been increased, with a nation-wide fluorspar mining inspection announced in March 2024 that has already sent prices rising again.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The notice warned the inspection will involved “shutting down, restructuring, and renovating enterprises based on different situations… This nationwide safety production special rectification may lead to a decrease in fluorite output, but it will also stimulate fluorite prices to some extent at the same time.”

The fluorspar price in China at end of Q4 2023 was US$500/MT, ex Shanghai, a 19% increase on same Q4 2022.

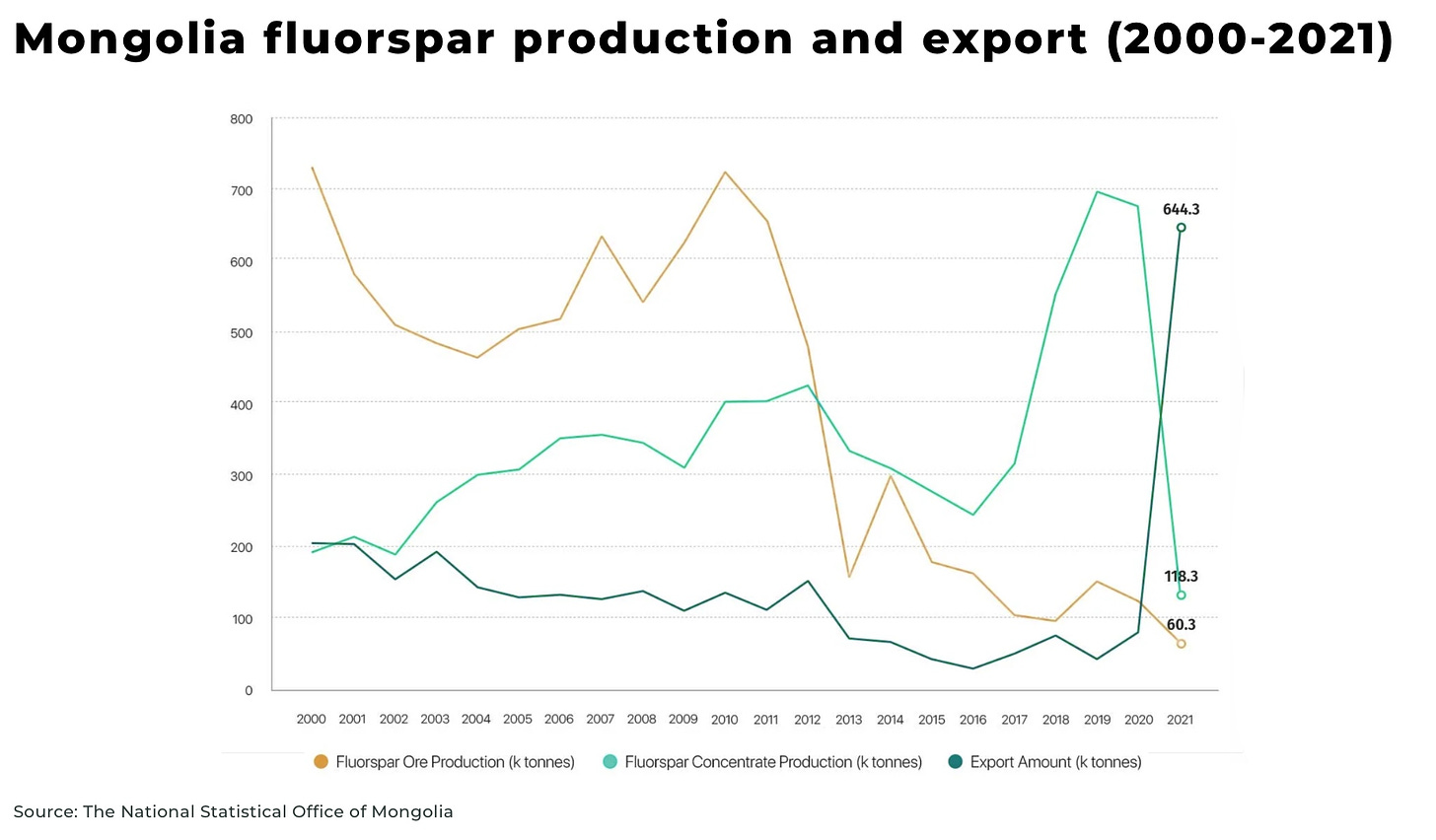

Instead, China is increasingly dependent on imports, in particular, Mongolia, the world’s third largest fluorspar producer with the world’s fourth largest reserves.

Mongolia is now the largest supplier of fluorspar to China, exporting 912,732 tonnes of metspar (fluorspar raw ore) to China in 2023, a year-on-year increase of 348% from 203,527 tonnes in 2022, latest data shows.

China’s Ministry of Finance has published plans to cut import taxes on fluorspar starting this January, with the aim of encouraging imports of fluorspar-related products to increase the country’s stockpile.

USA

North America and Europe account for approximately 25% of consumption. However, the US is 100% dependent on imports, which totalled 340,000 metric tons in 2023 (Europe’s domestic production covers only about 33% of domestic consumption)

With new legislation restricting access to US EV tax credits through the Inflation Reduction Act from foreign entities of concern, the source of fluorspar to US electric battery manufacturers (who have an estimated US$92 billion of announced investments in the US) is increasingly critical.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US imported 390,000 tonnes of fluorspar in 2023, with 58% of acid-grade imports from Mexico, 20% from Vietnam and 15% from South Africa.

Authorities hope to offset 100,00 tonnes per year with the new ARES Strategic Mining, Lost Sheep mining project that has just started construction, as well as their recent announcement to start fabrication of their US$19 million fluorspar processing facility in Utah.

The challenge for both the US and China, is that supply risk from Mongolia, Mexico, South Africa, and Vietnam remains high due to a variety of concerns over infrastructure, environmental standards, community protests, and political insecurity. For example, South Africa is struggling to stop electricity blackouts due to crumbling power stations.

Mines in Canada, Australia, Germany, Italy and Spain, some of which have been idle for decades, are working to (re)start operations, but without support they will struggle against the same problems that miners across the West are facing with stricter domestic regulation vs cheaper supply from China in the immediate-term (for example, the trade wars over nickel and rare earths)

Kenya is also note-worthy, with the government signing an agreement with UK-based Soy-Fujax Mining to restart the fluorspar operations based at Kimwarer in Elgeyo Marakwet County with a US$33 million investment.

“Addressing supply chain challenges, reducing price volatility, and prioritizing sustainability will be crucial to unlocking the full potential of this mineral in the burgeoning lithium-ion battery revolution”

— Benchmark Mineral Intelligence’s Fluorspar Market Outlook Report

“There is a strong supply-demand imbalance forecast to emerge, particularly from about 2025 in … acid-grade fluorspar, the material that’s going into these next generation EV batteries. China… is deficient in reserves and if they continue to consume fluorspar at the rate that they are, they will run out in about 10 years, which is remarkable”

— Tivan chief executive Grant Wilson told ABC

Research (fluorspar replacements)

Projects to develop fluorspar alternatives, including work to recover fluorine from aluminium smelting to produce aluminium fluoride (AIF3), building a plant to produce hydrogen fluoride from FSA, and research to develop alternative fluorine sources, such as fluosilicic acid, are still all untested at any commercial scale and are unlikely to impact the sector for at least a decade.

Instead, research into the development of a fluorine-containing electrolyte that performs as well in sub-zero temperatures as room temperatures (the current electrolytes freeze in sub-zero temperatures impacting charging), may in fact increase demand.

Conclusion

In the short-term, especially with the expected slowdown in electric vehicle sales and global economic headwinds, it’s expected that current fluorspar production capacity will meet demand.

But this is expected to be only temporary as governments across the West continue to push for the energy transition and electric vehicles; for example, the strict, new regulations by the US Environmental Protection Agency on vehicle emissions are projected to mean EVs make up make up 35-56% of sales in vehicles by 2032.

And, in the fluorspar market, the major moves that will impact future supply are already underway. In particular: China is focusing on Mongolia, and the US looking to ramp up domestic production to offset its 100% dependency on the volatility of international supply.

The EV slowdown and financial volatility should, in theory, buy the industry time to invest in new supply. The truth is that any temporary fall in demand and prices, as well as inflation and interest rates, will only likely stall some projects.

The price — and name recognition — of fluorspar is on a trend upwards.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.