- value of Grade-A helium sold during 2022 in the US by private industry was US$820 million

- prices range from $500 mcf to $1200 mcf

- market has been in supply deficit for 8 years — nearly half — between 2006-2022

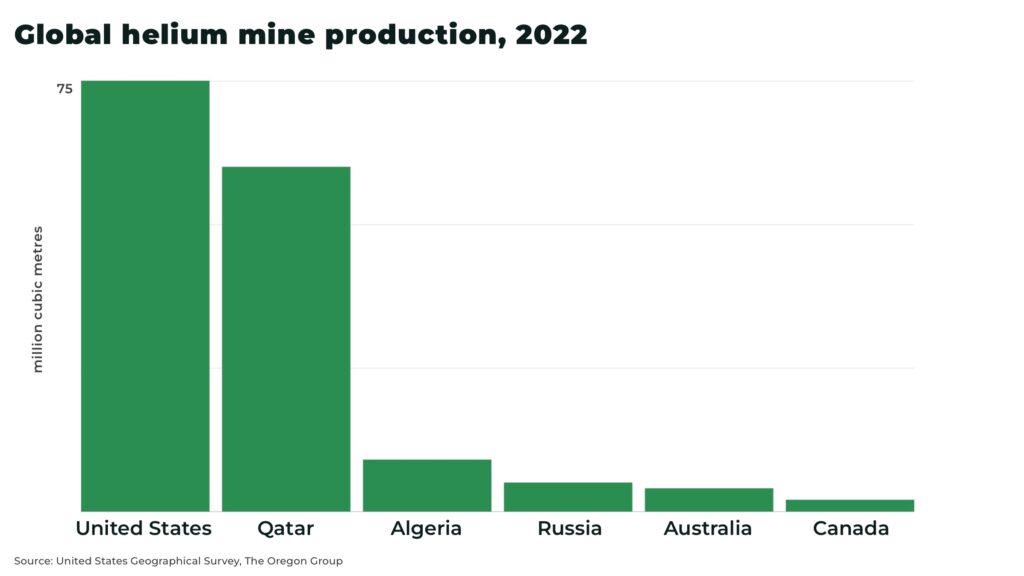

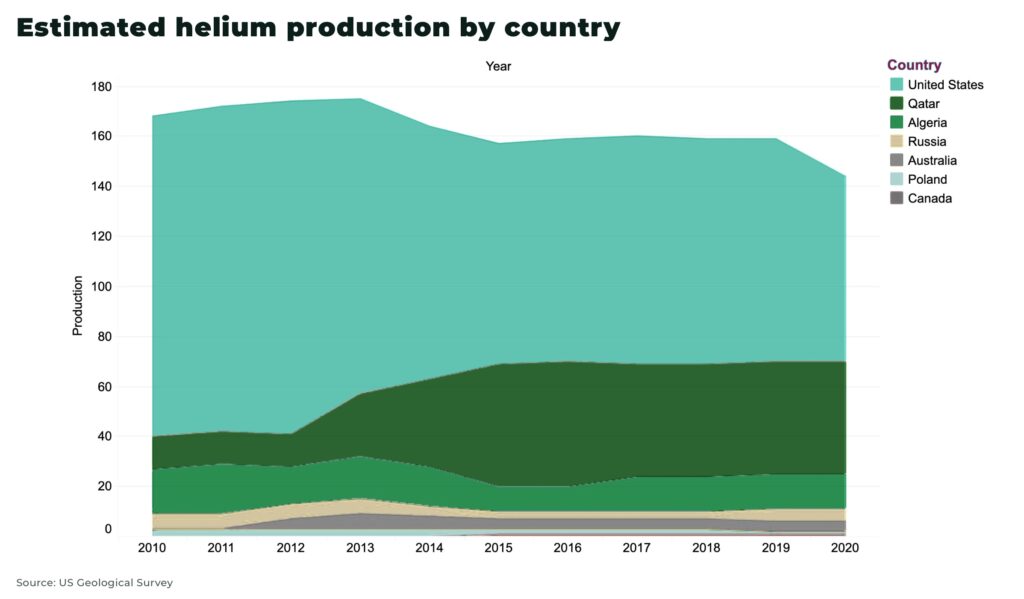

- US and Qatar produce 85% of supply, but US reserves and production falling

If I say helium, you say “balloons” — yet party balloons make up less than 10% of helium’s use across rocket launches, semiconductors and medical equipment.

The scale and importance of the global helium market is often overlooked.

The estimated value of Grade-A helium (99.997% helium or greater) sold during 2022 in the US by private industry was US$820 million.

Helium is not publicly traded, with agreements negotiated privately between buyers and sellers, so pricing is often difficult to establish.

But it is clear that demand is growing and supply is extremely volatile.

One of the industry’s leading consulting firms, Akap Energy, values the global helium production market to be worth US$1.5billion on a price assumption of US$250 thousand cubic feet (mcf) — but, end user pricing could have been up to x4 times higher in 2022.

And this is not due to a one-off supply chain problem: we are currently in the fourth helium supply shortage since 2006, with prices doubling since January 2002.

“Helium prices are at all-time highs with a number of commentators reporting helium spot sales at between US$2,000 and US$3,000 per mcf. Naturally, we are keen to sell helium into this market as soon as possible”

Trent Spry, Blue Star Managing Director and CEO

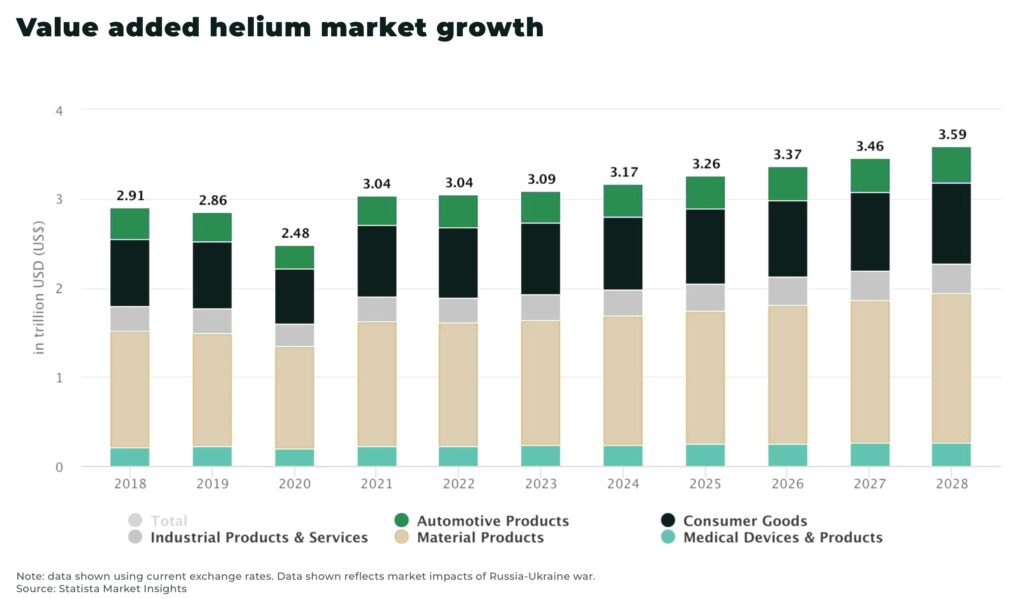

And the market is expected to grow by 5-6% CAGR over the next 5 years.

“It will keep growing” — Cliff Cain, CEO of rare gas consultancy Edelgas Group

So, how should interested investors position themselves?

What is helium

Helium gas is the second most abundant element in the universe, after hydrogen, but considered the only non-renewable element on earth — it’s so light that it can easily escape the Earth’s gravitational pull, and then disappears from the planet.

Naturally occurring helium on Earth takes thousands of years to produce, as elements, such as uranium and thorium, decay deep in the Earth. The helium rises up and is then trapped in pockets of natural gas, which is drilled and processed.

Helium production and reserves

The vast majority of the world’s helium production comes from natural gas wells in the United States, with 2.6 billion cubic feet in 2022, and QatarGas, with 2.1 billion cubic feet. Much of the rest comes from Sonatrach in Algeria, Russia, Australia and Canada.

The first-ever estimate on recoverable helium reserves by the US Geological Survey found that the US has an estimated 306 billion cubic feet of helium, or about 150 years of supply at 2020 US production levels. Reserves outside of the US are estimated at 1.13 trillion cubic feet.

However, significant new discoveries are very rare and any problems in supply from one of the few producers can cause a significant spike in prices.

Helium demand

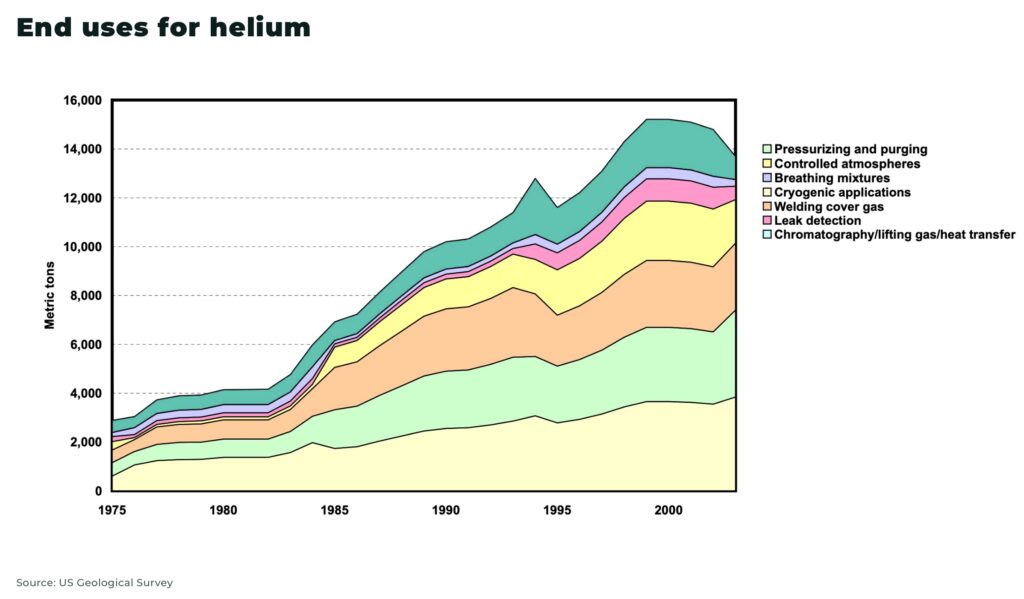

Most popularly known for filling party balloons, helium is essential across significant growth industries, particularly as it’s use as a super coolant, including:

- medical, eg to cool the superconducting magnets in MRI scanners

- military equipment, eg air-to-air missile guidance systems

- high-tech manufacturing, eg fibre optic cables

- space rockets, eg liquid fuel rockets to separate hot gases and ultra-cold liquid fuel during lift-off

- semiconductors and scientific research, eg as a “superfluid” in quantum computing

For example, NASA is the biggest consumer of helium in the world, buying roughly 75 million cubic feet a year. Their latest contract with Air Products and Chemicals is to supply 33 million litres of liquid helium with approximately $1.07 billion.

Helium Prices

In 2021, the official US estimated price of Grade-A helium was US$210 per thousand cubic feet. In 2022, this has risen to US$310 per thousand cubic feet.

However, prices can vary sharply in the private market, with our sources calling the average contract price for 2022 at approx US$500 mcf, with some sales for rocket launches at Space X and the US Dept of defence at around $1200 mcf.

Retail chain Party City filed for Chapter 11 bankruptcy in January 2023. There are, of course, a variety of factors, but a significant one is that the cost of a full tank of helium rose from $195 in 2021 to $350 in 2023.

Helium supply chains

The main reason for volatility in helium prices is the vulnerability of the supply chain: two countries produce over 85% of the world’s supply.

Concerns over supply has meant helium is listed as a critical mineral in Canada and Australia, the EU is proposing adding it. The US removed helium from its critical mineral list in 2021, but this may change as the US Geological Survey is seeking public comment on helium supply risk.

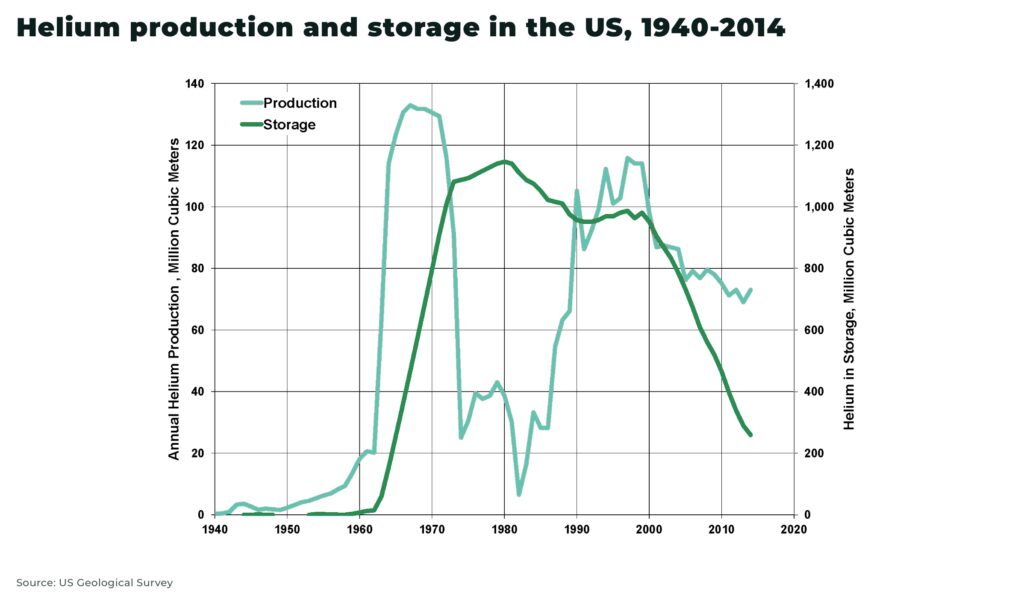

One of the reasons is that US reserves and production have fallen sharply.

US Federal Helium Program Reserve

America’s Federal Helium Program Reserve, administered by the US Bureau of Land Management (BLM), is held at the underground Cliffside Storage Facility in Texas, with helium piped in from across the country.

In 1995, the Helium Privatization Act mandated the reserve be sold to pay debts of US$1.4 billion, often at below market price meaning there was no incentive to invest in private facilities.

The process has seen a variety of delays but privatization is now entering its final stages with almost all the site’s assets now up for sale.

And the reserve is now almost empty.

The latest statistics, as of September 30, 2022, show about 2.06 billion cubic feet of privately owned helium remained in storage at Cliffside Field.

Supply chain problems

The reason price spikes is volatility in supply.

The market is still struggling to recover from a series of problems after the disruption of Covid lockdowns, including a 6-month long, unscheduled outage at BLM’s Crude Helium Enrichment Unit last year; a fire at a natural gas processing plant in Kansas; maintenance of two of Qatar’s three helium plants; and fires at Russian facilities.

This may seem like bad luck, but helium is an industry beset by problems with unsettling consistency.

Every year brings some new challenge, so much so that the market has been in supply deficit for 8 years — nearly half — between 2006-2022.

And 2023 seems to be no different with ExxonMobil’s LaBarge facility in Wyoming, which provides 20% of the world’s supply, is reportedly set to close for 29 days this summer for maintenance.

Russian helium

The huge, planned increase of helium production at Amur Gas Processing Plant, run by Russia’s state-owned energy company, is seen as a solution to rising demand and problems with the helium supply chain.

Expected to reach full capacity in 2025, the plant can produce up to 2.1 billion cubic feet of helium a year — almost as much as the US today.

However, the project has been hit by numerous delays.

Most recently, a fire at the plant in January 2022 has meant that helium production could be delayed again by as much as 6 months.

Western sanctions on Russia, due to the war in Ukraine, have also hampered both repairs to the plant, as well as helium exports.

There are no direct sanctions on helium from Russia, but sanctions have meant Western ships are not permitted to call at Russian ports — in particular, Vladivostok, Russia’s main helium export port.

Helium expert Phil Kornbluth, in his latest analysis, warns the lack of access “greatly diminishes the number of slots available on cargo ships” and “times to acquire new containers that are required to eliminate the bottleneck have recently been 18-24 months.”

This is no easy fix, even if exports are rerouted through China, due to the logistical difficulties in securely transporting what is the second lightest element (after hydrogen).

Conclusion

When Russia’s Amur plant is brought online — scheduled for the end of 2023 — it is hoped the global shortages will be alleviated.

However, this does not resolve the underlying issue of a supply chain concentrated in a small number of volatile regions.

And it will take time to resolve the supply shocks of the past 5 years — especially as US production continues to decline.

More importantly, in our view, the fall in price from any new (Russian) supply will likely be met by a corresponding increase in demand if volatility in supply can be reduced.

High prices have meant demand destruction across science, medicine and industry, but these industries are forecast for significant growth, despite fears of a recession.

For example, SpaceX is planning a 40% increase in rocket launches, aiming to have 100 this year, up from 61 in 2022.

We may see some stabilization in supply and prices, but the risk of volatility and rising demand means the helium market is unlikely to pop anytime soon.

Exposure

For investors interested in exposure to the helium market, the easiest way to gain exposure is through one of the majors (who also offer a more diversified portfolio of other commodities):

- Air Liquide

- Air Products and Chemicals

- Linde, Matheson-Trigas

- Praxair

The difference in wholesale and retail price from US$1000 to US$250-500 respectively, is what largely currently accrues to these large companies.

The recent changes in market structure mean the potential investment opportunity has moved increasingly to developers as incentives move to primary, not by-product helium producers.

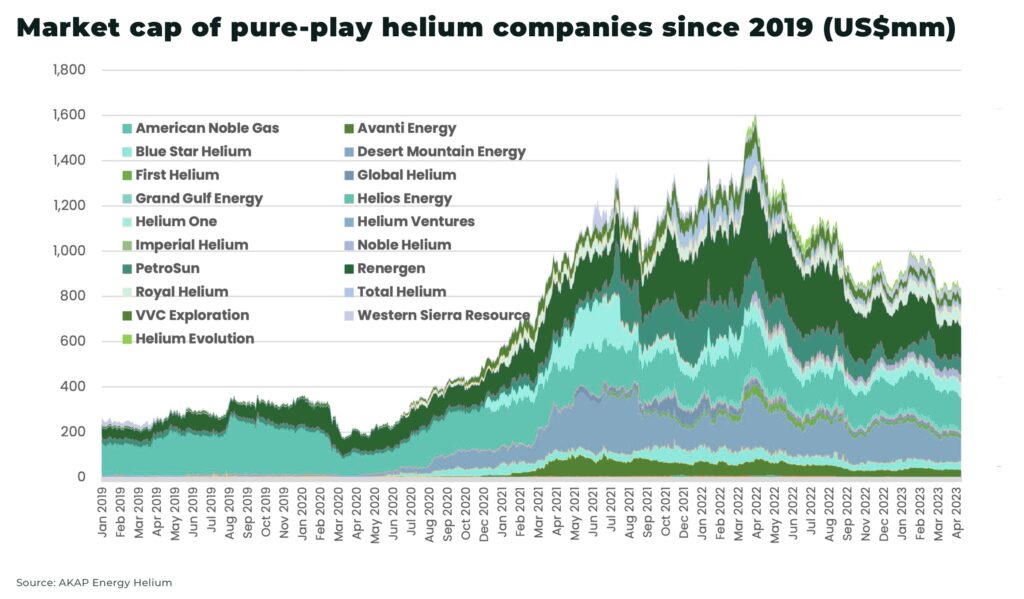

There has also been a recent “boom” in micro cap companies, encouraged by the recent price rises, focused on helium exploration and production. Most of the old, big discoveries were made during oil and gas exploration, and the new companies are deliberately seeking new reserves.

Smaller companies carry more risk, so this is where you will need to do your due diligence, and we would recommend focusing on companies based in North America, where they will be closer to growing demand and secure from trade restrictions.

For example, Canada’s Saskatchewan province released their Helium Action Plan: From Exploration to Exports (HAP) in 2021 to encourage investment and increase the value of exports by 50%, annual exports worth more than $500 million.

The same year, Canada opened the country’s largest helium purification facility, worth CA$32million, with capacity to produce more than 50 million cubic feet per year of purified helium for commercial sale.

Saskatchewan produces only 1% of the world’s helium, but hopes to increase output to 10% of world supply by 2030. The province holds the world’s 5th largest helium reserves.

In America, global gas giant, Linde, has signed a long-term helium off-take agreement with Freeport LNG, to provide nearly 200 million cubic feet of helium into Linde’s supply portfolio.

Stay Subscribed.