Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Mitchell Smith is a seasoned finance professional with over 15 years of entrepreneurship, executive leadership, and capital markets experience. In addition to his command in accessing capital markets he has extensive hands-on experience as a key stakeholder, management, and board member for private and public resource companies. Mitchell’s considerable board and executive leadership experience together with his extensive sectoral expertise in battery and energy technology has positioned him as a recognized global voice on critical mineral supply chain security.

Hidden in Plain Sight

Hidden in plain sight are countless abandoned legacy mine waste heaps — so called, tailings — left behind after mining companies ceased operations at open pit or underground sites. Pulverized waste rock, a by-product of previous mineral extraction and ore processing, abandoned in giant ponds or in massive heaps.

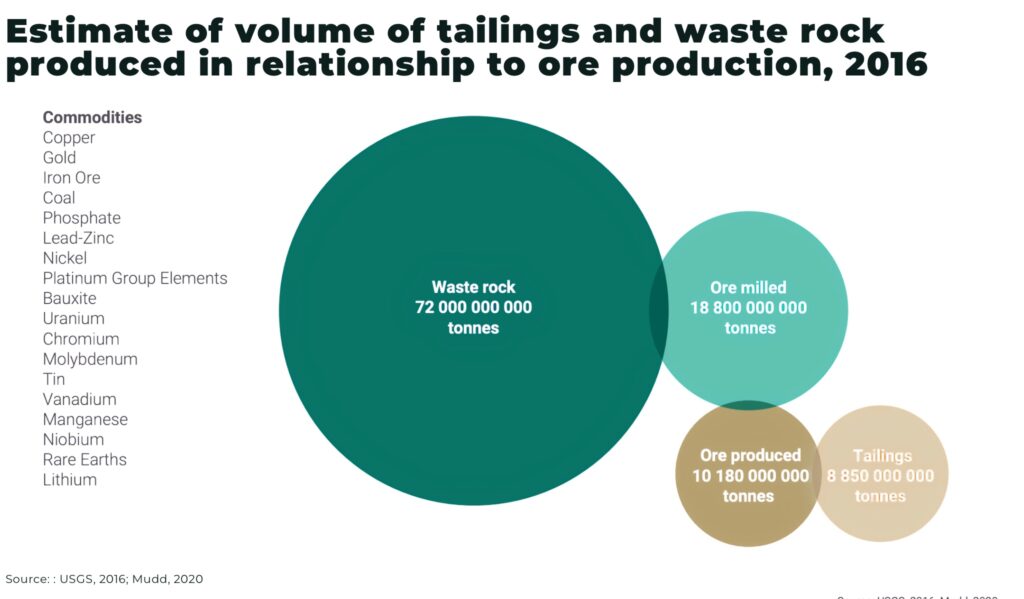

According to a Global Tailings Review in 2021, 72 billion tonnes of mined material produced just over 10 billion tonnes of ore — meaning only 14% mined material made it to processing for metals.

This mine waste holds significant untapped mineral wealth, such as gold, copper, nickel, silver, and zinc, mostly in the form of previously unrecoverable primary metals that previous operators were producing, but also for critical and strategic minerals vital in the shift to a more sustainable, low carbon energy supply.

This widespread and rapid increase in the adoption of these low-carbon technologies, required for the energy transition away from fossil fuels, will not be possible without a ramp-up of critical minerals supply at a pace never before seen in history.

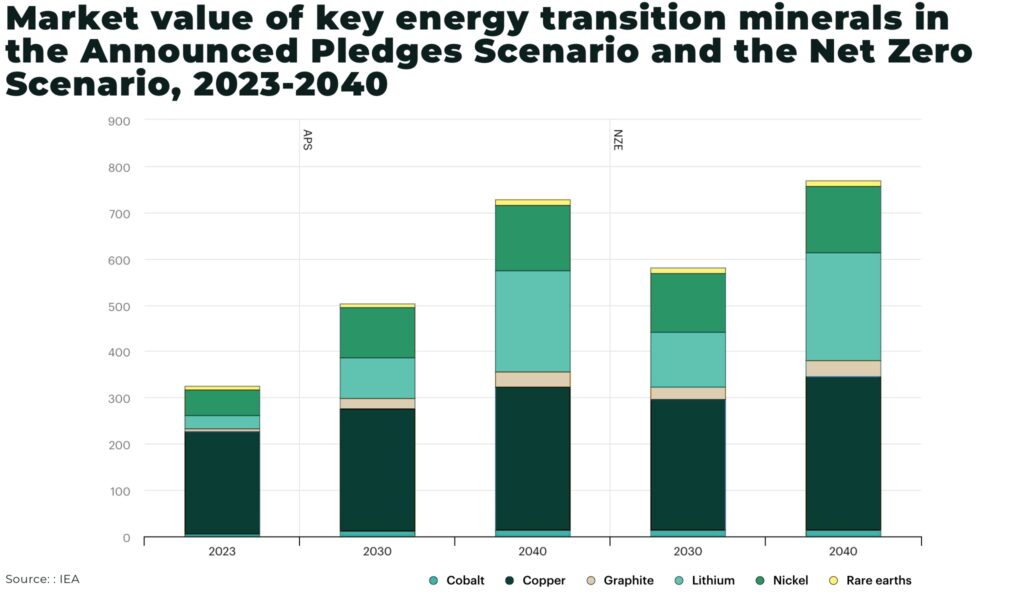

Mineral demand for these clean energy technologies almost triples by 2030 and quadruples by 2040 in some scenarios to reach nearly 40 Mt, according to the International Energy Agency (IEA). This demand is primarily driven by electric vehicles, battery storage, expansion of data centres, and low-emission power generation.

The challenge is that the mining and processing of many of these minerals is concentrated in a handful of countries.

As governments across the world scramble to secure supply, the result is a looming supply-demand gap.

Prioritizing secure access to precious, critical, and strategic metals by building capability and resilience into supply chains is on every government’s agenda, including setting directives to take immediate action to facilitate domestic mineral production to significantly reduce reliance on foreign nations.

But these quantities won’t be met by traditional mining alone.

In the decades ahead, as global demand for critical and strategic minerals surges to unprecedented levels, every potential source will need to be tapped — and unconventional methods put to work. This includes exploring the opportunities that legacy tailings and abandoned mine sites hold as renewed sources for these essential minerals, vital for economic stability, technological innovation, and defence capabilities.

Re-Mining

Re-mining of these tailings offers a unique, overlooked opportunity to boost supply chains, reduce environmental liabilities, and drive economic growth.

Re-mining, like re-cycling, isn’t a stand-alone solution and cannot meet the world’s growing demand for new energy minerals by itself, but it could act as a compelling mechanism to help secure critical and strategic mineral supply chains, complementing traditional mining efforts while reducing some of the need for new mining operations and meet sustainability and environmental goals.

Canada’s history as a global mining leader of more than sixty minerals and metals, means it is home to an estimated 10,000 abandoned mine sites (as well as 200 active mines) — many of which still hold economic value from unrecovered minerals or minerals, many of which are now considered strategic or critical, but weren’t considered valuable at the time of processing. This translates to an untapped multi-billion dollar resource sitting at surface that could be converted from long-standing liabilities into strategic assets.

A small group of industry players already recognize the potential of re-mining—and are building business strategies around it. Several have identified Canada as a key opportunity and are positioning themselves at the forefront of a sector still in its early stages. By forming partnerships with technology firms that offer proven recovery processes, these emerging companies are showing that re-mining tailings isn’t just viable — it has the potential to evolve into a full-scale industry.

Re-mining is gaining momentum not just for its economic upside, but because it tackles a pressing environmental challenge: legacy tailings. Many of these tailings contain harmful elements that contribute to acid mine drainage and pose serious environmental risks that can persist for decades.

By recovering valuable metals from these waste materials, re-mining offers a dual benefit: it helps meet the surging demand for critical and precious metals while also delivering meaningful environmental and social impact. The process supports land remediation, removes hazardous contaminants from soil and water, creates jobs, and restores lands for future use — turning environmental liabilities into long-term community assets.

Unlocking abandoned legacy tailings is a “now” opportunity — one that’s increasingly hard to ignore. Securing a sustainable, affordable supply of critical minerals for the energy transition demands more than ambition; it requires decisive action.

As the race to scale up the critical mineral supply chain intensifies, the stakes are rising. The global energy transition is accelerating, just as cross-border cooperation shrinks and trade becomes more fractured.

Re-mining represents one of those rare moments where strategy and necessity align. If these emerging players can stay focused, scale fast, and prove commercial viability, they won’t just clean up the past — they’ll help define this new next industrial age.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.