Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

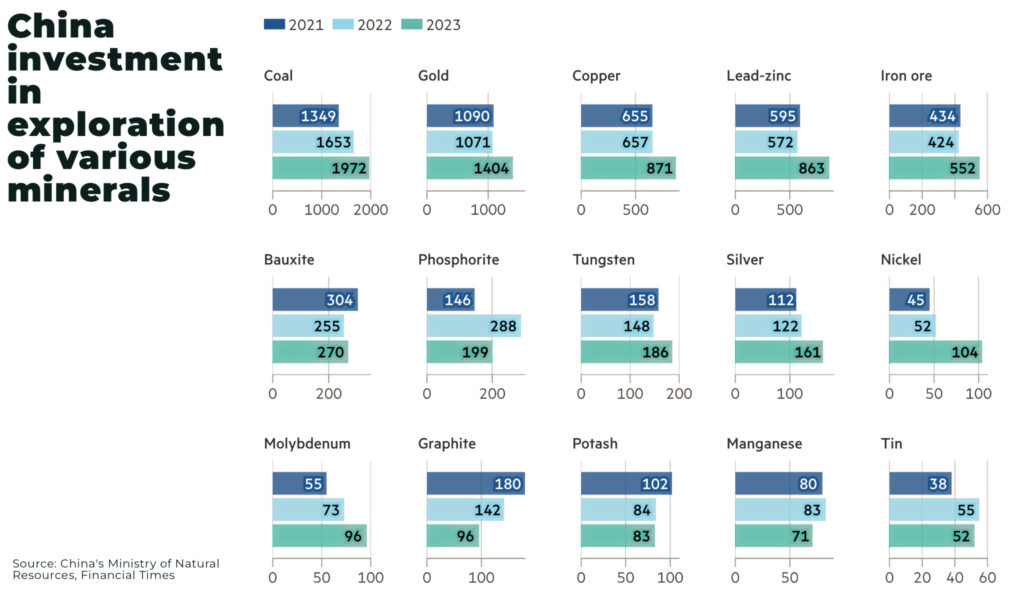

The Chinese government has raised more than US$13.8bn (Rmb100bn) investment across geological exploration annually since 2022, the highest three-year period in a decade.

According to a new report by the Financial Times, over the past year, at least half of China’s 34 provincial-level governments have announced increased subsidies or expanded access for mineral exploration. This include key resource-producing regions such as Xinjiang, which has increased support for geological exploration from 150 million yuan in 2023 to 650 million yuan in 2025.

The boost in state funding and subsidies for mineral exploration and mining comes as part of President Xi Jinping’s strategy for China achieve self-sufficiency, as well as provide further leverage in the escalating trade war with the United States.

Beijing recently tightened control over exports of strategic minerals crucial for modern tech and chip manufacturing, including gallium, germanium, antimony, graphite, and tungsten. This move came in response to US restrictions on tech exports to China.

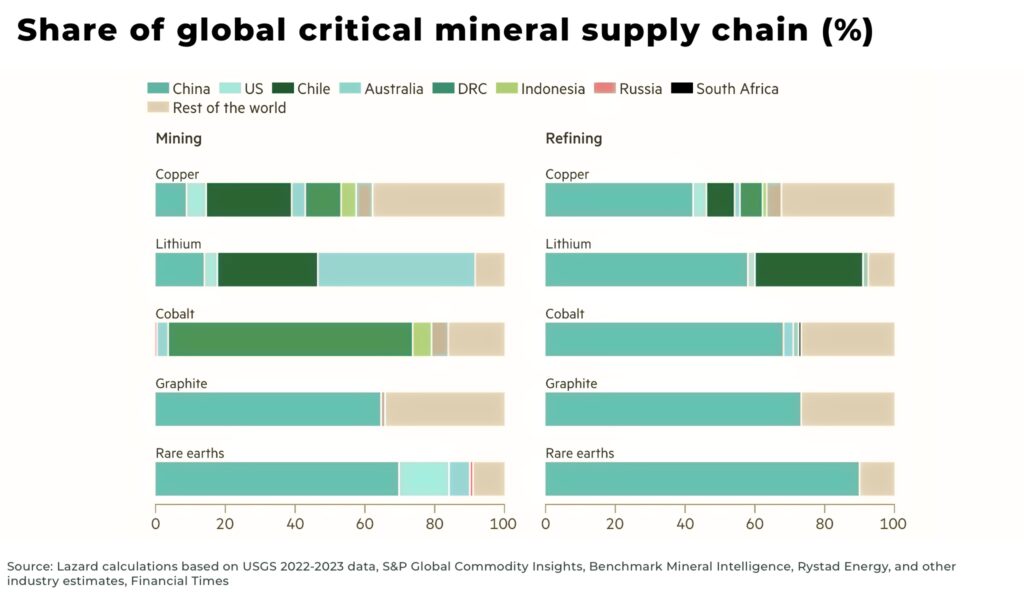

China dominates mining and processing across the majority of critical minerals — with the country being the world’s largest producer of 30 out of 44 critical minerals tracked by the US Geological Survey. This includes a 95% share in rare earths production, 83% in gallium, and 81% in tungsten.

Other measures taken by China include:

- the Chinese government has allocated over US$13.8 billion (100 billion yuan) annually to geological exploration since 2022, marking the highest three-year investment period in a decade

- Xinjiang, a resource-rich western region, has significantly increased the issuance of mining exploration rights to record levels

- China has issued US$57 billion in loans over two decades via at least 26 state-backed financial institutions

- under Xi’s leadership, Beijing has implemented policies to protect its strategic resources. In 2021, China blocked foreign companies from investing, even indirectly, in mining tungsten, rare earths, and uranium

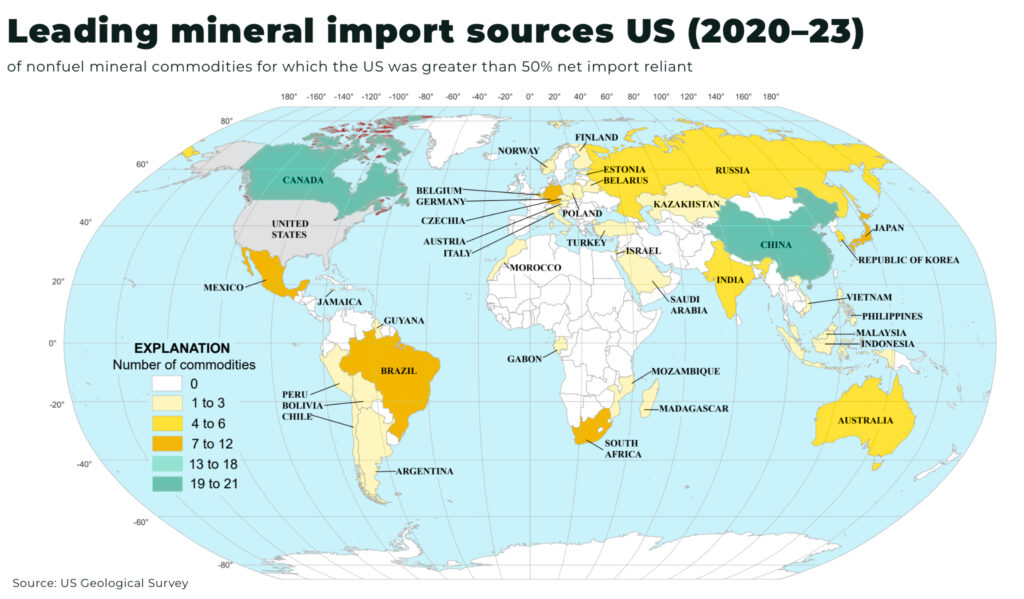

Of the 50 mineral commodities identified in the US Geological Society’s “2022 Final List of Critical Minerals,” the US was 100% net import reliant for 12, unchanged from 2023, and an additional 28 (down from 29 in 2023) had a net import reliance of greater than 50%.

In response to China’s supply chain dominance, US President Donald Trump, since his return to the White House in January, has prioritized domestic mining. In March 2025, he signed a new Executive Order invoking cold war era powers to ramp up critical mineral production across the US.

Our analysis on the challenges for American’s current critical mineral strategy:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.