Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Between US$500 – US$600 billion in new capital investment is required for mining between 2024-2040 to meet global energy transition targets, as demand for critical minerals is expected to increase rapidly.

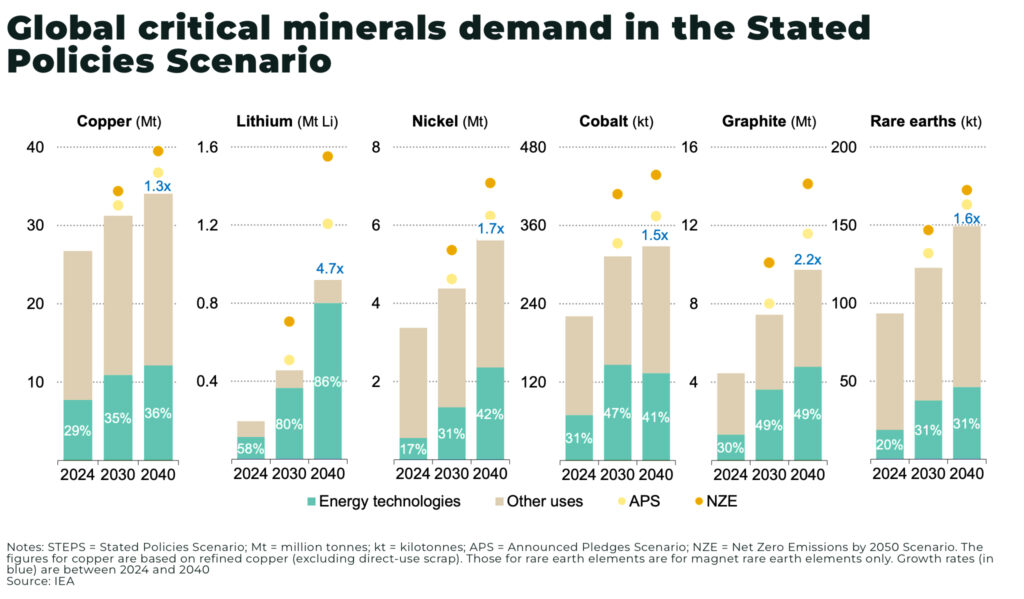

The International Energy Agency’s (IEA) latest Global Critical Minerals Outlook 2025 highlights a growing imbalance between surging demand for critical minerals and the sluggish pace of supply diversification. In the Stated Policies Scenario (STEPS):

- lithium demand increases x5 from 2024-2040

- graphite and nickel demand doubles

- cobalt and rare earth elements demand increases 50-60% by 2040

- copper demand is projected to grow by 30% over the same period

The new demand is coming online just as investment momentum in the critical mineral sector slowed in 2024, with spending rising by just 5%, down from 14% in 2023. Adjusted for cost inflation, real investment growth was just 2%. Exploration activity plateaued in 2024.

Recent investment over the past few years has helped narrow previously projected supply gaps over the next decade.

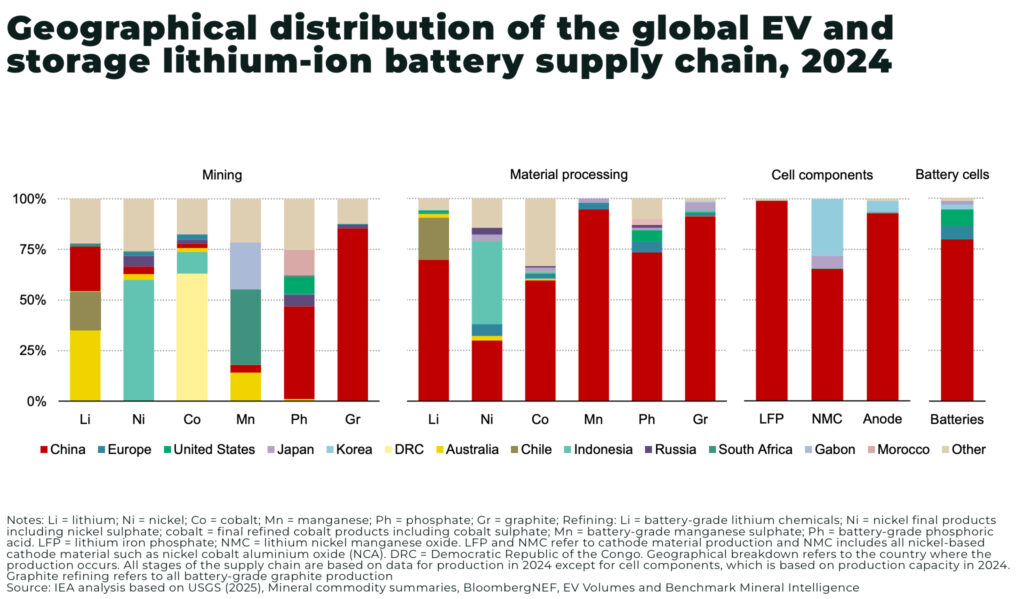

But, despite Western policies aimed at diversifying supply chains due supply shock vulnerability and geopolitical risk, the opposite trend is playing out with:

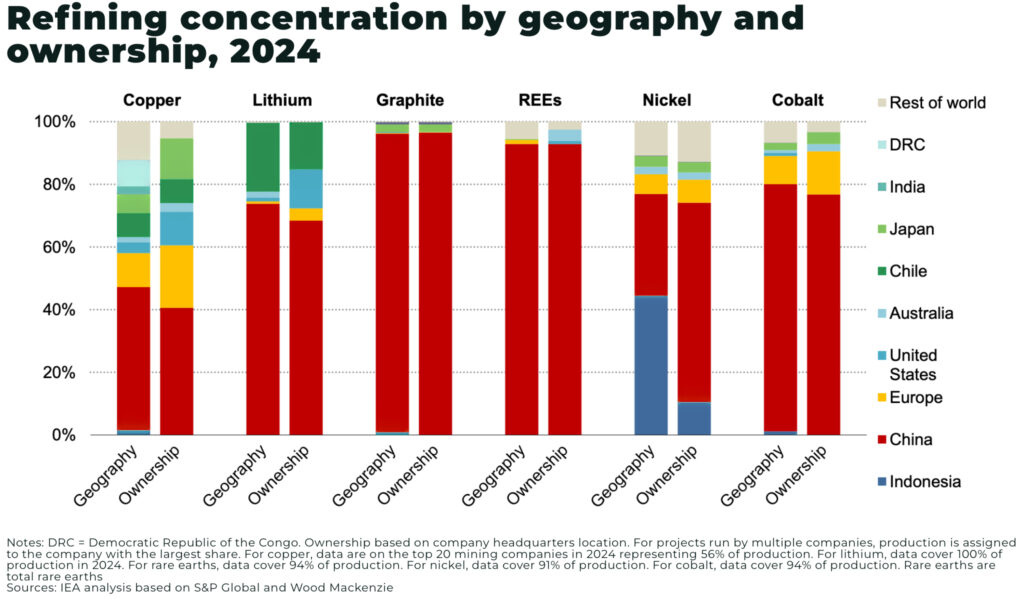

- the average market share of the top three refining nations of key energy minerals rose from around 82% in 2020 to 86% in 2024. 90% of supply growth came from the top single supplier alone: Indonesia for nickel and China for cobalt, graphite and rare earths

- by 2035, the average share of the top three refined material suppliers is projected to decline only marginally to 82%, effectively returning to the concentration levels seen in 2020

- the average market share of the top three mining countries for key energy minerals (Democratic Republic of the Congo (DRC) for cobalt, Indonesia for nickel, and China for graphite and rare earths) rose from 73% in 2020 to 77% in 2024

- geographical concentration is expected to intensify for copper, nickel and cobalt

China is the dominant refiner for 19 of the 20 minerals analysed, holding an average market share of around 70%.

Lithium is one notable exception, with a major portion of supply growth coming from emerging producers like Argentina and Zimbabwe.

The report warns, A sustained supply shock for battery metals could increase global average battery pack prices by as much as 40-50%.

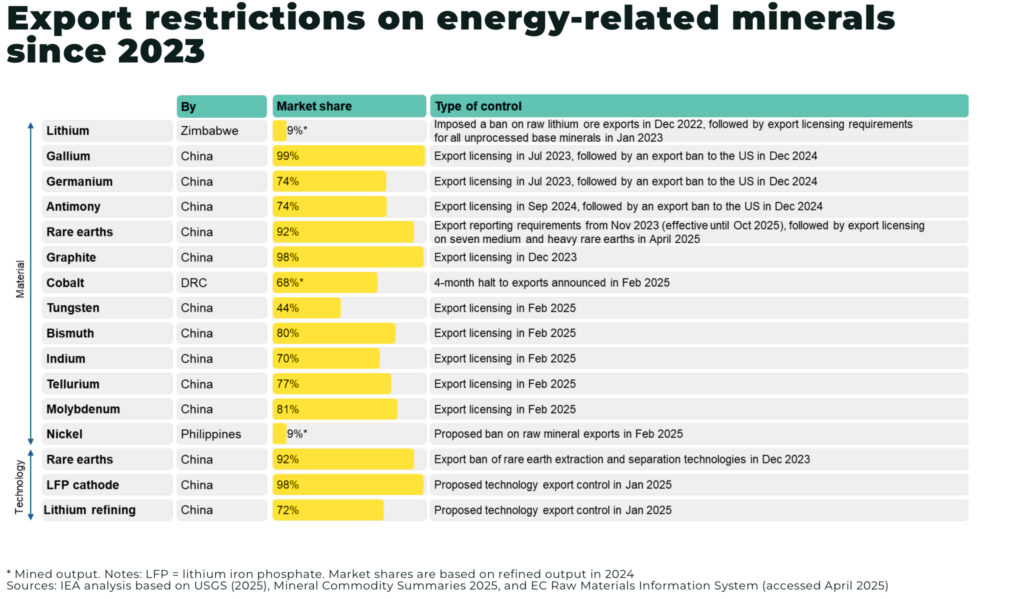

Supply restrictions are compounding the risk. Export bans, resource nationalization, and permitting delays are tightening access to key materials. In 2024 alone, over 30 policy measures were enacted worldwide restricting mineral exports—double the number in 2020. The report flags that more than 75% of global lithium production is now subject to some form of trade or investment control, with similar risks looming for rare earths and graphite.

In a notable shift, the IEA explicitly endorses public intervention in critical mineral markets, urging governments to take a more active role in shaping supply and demand. The agency calls for “well-designed” policies that may include price-distorting mechanisms such as offtake agreements, floor prices, and direct financial support to de-risk investment. The report argues that relying solely on market forces will not deliver the scale or speed of investment needed to align with net zero targets.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.