Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

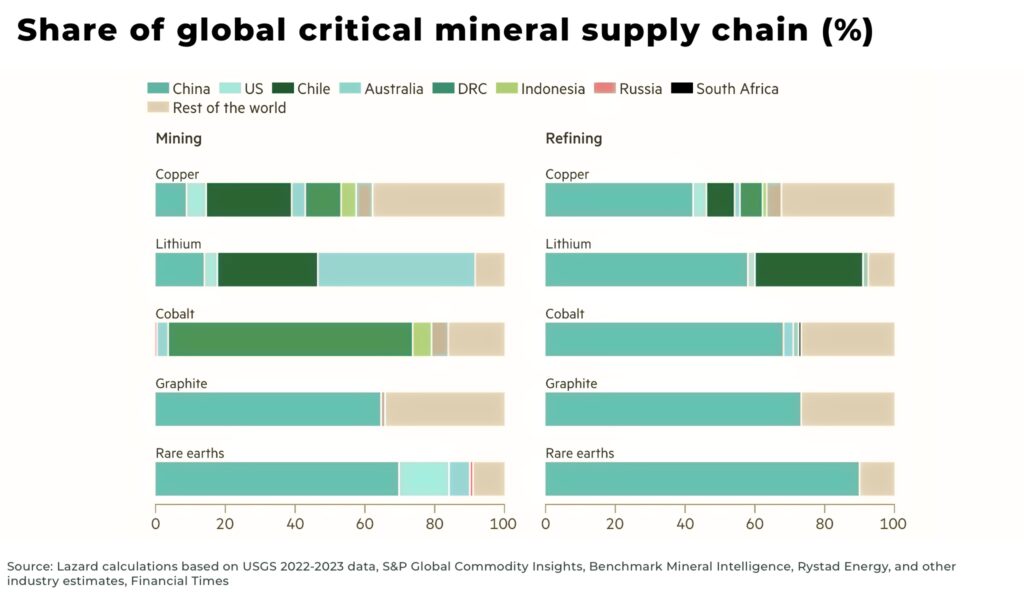

President Donald Trump has signed an executive order invoking cold war era powers to ramp up critical mineral production across the US. It marks one of the most aggressive moves in decades to secure domestic supply and reduce reliance on China.

Donald Trump stated the order would “dramatically increase production of critical minerals and rare earths.”

The US was 100% net import reliant for 12 of the 50 critical minerals on the 2022 critical minerals list and more than 50% net import reliant for an additional 29, according to a review in the USGS Mineral Commodity Summaries 2024.

The order “Immediate Measures to Increase American Mineral Production” invokes the Defense Production Act, passed in 1950 after the outbreak of the Korean war, aims to expedite the development of domestic mineral resources through several key policy shifts:

- expedited permitting: within 10 days, government agencies must identify and prioritize mineral production projects for immediate approval . These projects will be fast-tracked on the Permitting Dashboard

- industry input: the National Energy Dominance Council (NEDC) will seek feedback from the mining industry to identify and address regulatory bottlenecks

- Mining Act clarification: recommendations will be prepared for Congress within 30 days to clarify regulations regarding mine waste disposal under the Mining Act of 1872

- Federal Land prioritization: the Secretary of the Interior has 10 days to identify federal lands with mineral deposits, prioritizing mineral production as the primary land use

- private sector engagement: duitable federal land sites will be identified within 30 days for private commercial mineral production, with extended use leases to be granted

- financial incentives: the administration will ensure private parties in these leases can access favorable terms under existing public assistance programs

- Capital Forum: the Secretary of Defense will utilize the National Security Capital Forum to connect private investors with domestic mineral projects

- Defense Production Act (DPA): the President’s authority under the DPA is delegated to the Secretary of Defense to promote domestic mineral production, which will be designated a priority industrial capability

- DFC fund: the US International Development Finance Corporation (DFC) will establish a dedicated fund for domestic mineral investments within 30 days

- Export-Import Bank guidance: the Export-Import Bank will issue guidance within 30 days for utilizing financing tools for mineral production

- mineral buyer convening: mineral buyers will be convened within 30 days to work towards a request for bids to supply minerals domestically

- small business support: the Small Business Administration (SBA) will prepare legislative recommendations within 45 days to enhance financing for small businesses in mineral production

The announcement has been widely welcomed across the industry.

“Ramping up American mining is a national security imperative, and President Trump’s strong action recognizes that. By encouraging streamlined and transparent permitting processes, combined with financing support to counter foreign market manipulation, we can finally challenge China’s mineral extortion. We applaud this strong action that confronts our mineral crisis head on and we look forward to working with the administration to ensure made in America increasingly means mined in America.”

— Rich Nolan, president and CEO, National Mining Association

There are also reports that the Trump admin plans to build critical mineral refining facilities on Pentagon military bases as part of the plan to boost domestic production and reduce dependence on China’s control of the sector, two senior administration officials told Reuters.

The strategy is a departure from the critical mineral strategy deployed by previous president Joe Biden who supported mining agreements in countries with US free trade agreements.

Our analysis on the challenges and opportunities as Trump wants to make American mining great again:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.