Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

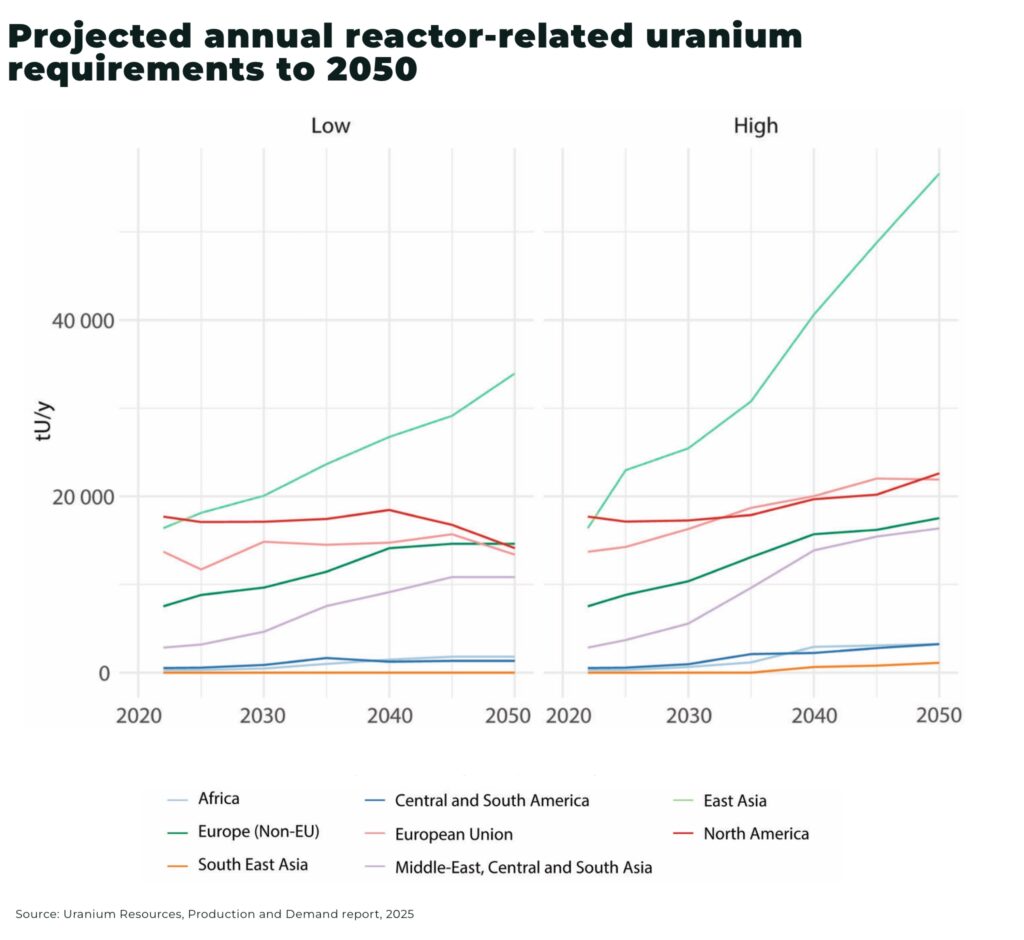

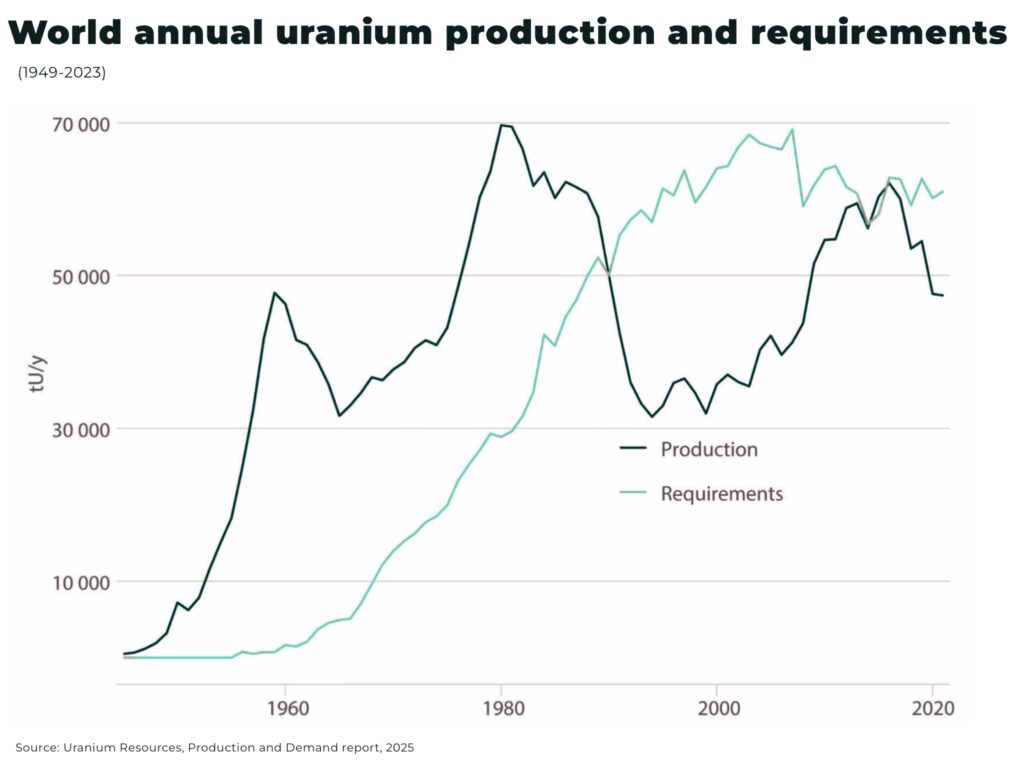

World annual reactor-related uranium requirements are projected to rise to between around 90,000 tU/y and 142,000 tU/y by 2050, from 59,000 tU in 2023 — an increase of 53% and 140% respectively.

According to the latest “Red Book” report by the Nuclear Energy Agency and International Atomic Energy Agency, world nuclear capacity by 2050 is projected to increase from 394 GWe in 2023, to 574 GWe in the low demand case and 900 GWe in the high demand case.

These projections are a significant upward revision of demand projections compared to the 2022 edition of the Red Book.

Asia is projected to have the largest increase, maybe as high as 354 GWe by 2050; however, in the US, in the low case nuclear capacity could decrease 18% or rise 31% in the high demand case.

The report warns that uranium supply will struggle to meet the high-demand growth requirements by the 2080s:

“Meeting high-demand growth requirements by 2050 would use approximately 50% of the currently identified recoverable resource base at costs below USD 130/kgU and about 35% at costs below USD 260/kgU. Beyond 2050, however, even if nuclear capacity remains at 2050 levels, cumulative uranium requirements would surpass 100% of the current total identified resource base in the highest cost category by the 2080s under high demand or by the 2110s under low demand”

— Uranium Resources, Production and Demand, report 2025

Our report on where new uranium supply will come from: