Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

America’s MEMA, the Vehicle Suppliers Association, and CLEPA, the European Association of Automotive Suppliers, have issued calls for urgent action to be taken to limit disruption from export restrictions on rare earths by China.

In a statement to Reuters, MEMA, warned parts companies are facing “serious, real-time risks” to their supply chains:

“The situation remains unresolved and the level of concern remains very high,” the group said. “Immediate and decisive action is needed to prevent widespread disruption and economic fallout across the vehicle supplier sector.”

And CLEPA, representing over 3,000 companies across the industry in Europe, warn:

“These restrictions have led to the shutdown of several production lines and plants across Europe, with further impacts expected in the coming weeks as inventories deplete… They also threaten automotive production and thousands of jobs in the European Union.”

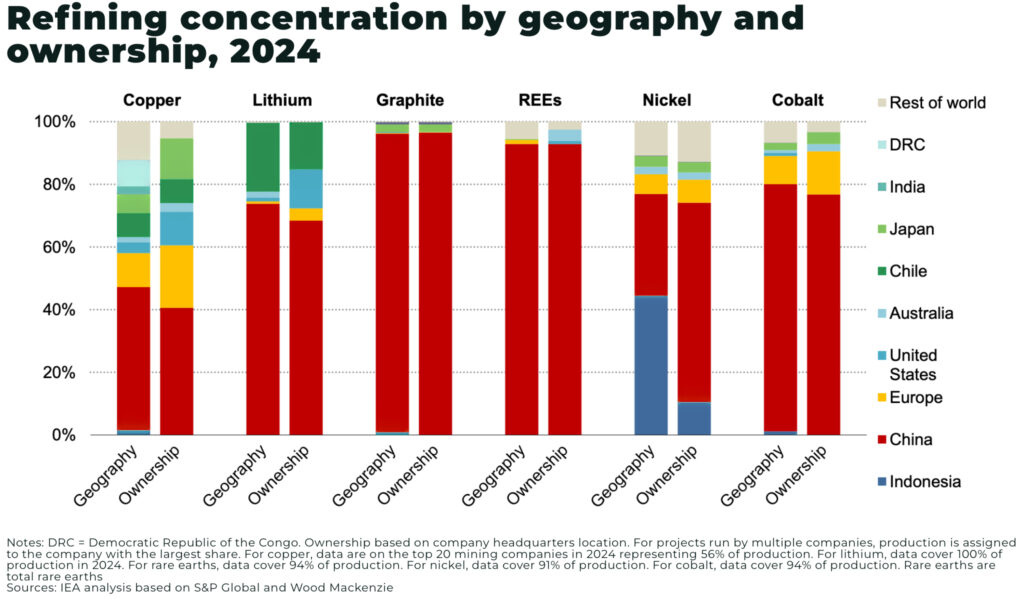

China produces approx 90% of global rare earth minerals, just as demand is expected to increase 50-60% by 2040.

Exports of rare earths were placed under export restrictions from China on April 4 and reportedly “ground to a halt” almost immediately as exporters have been forced to wait for government licence approval. China has reportedly now introduced a tracking system for its rare earth magnet sector to further tighten and monitor the restrictions.

Ford Motor Company has temporarily halted production of its Explorer SUV at the Chicago plant in May due to a shortage of rare earth materials. Rare earths are essential for critical components across the automotive value chain, from magnets, electric batteries, motor sensors, lights, steering and much more.

UPDATE: after the latest phone call between the leaders of the US and China, President Trump posted: “I just concluded a very good phone call with President Xi… There should no longer be any questions respecting the complexity of Rare Earth products.”

The White House has yet to respond to these concerns. President Donald Trump has accused China of violating a prior agreement to reduce tariffs, further escalating trade tensions.

As we warned in 2024, US miners vs US automakers is key point of tension with US miners and US automakers on a collision course over supply of critical minerals for electric batteries.

“US automakers, facing an urgent existential threat, need the minerals now, and at competitive prices.

If the US government backs down on enforcing its FEOC guidelines to accommodate the US automakers urgent need for access to critical minerals, wherever they are sourced, then, as one mining CEO told us: “It’s over.”

The problem is that US miners and their FTA partners are also facing an urgent, existential threat of their own, from cheap Chinese supply. To secure supply, mines need the government to support legislation that drives financial investment in the face of such competition. But, because of the time it takes to develop new mines, every year such incentives are delayed, the harder it is to make a transition away from cheap supply from elsewhere.

And, without a secure source of critical minerals, American automakers and the government will also be at the mercy of Chinese supply.”

Read the full article:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.