Critical Minerals and Energy Intelligence

Rare Earths

Rare earth demand is expected to surge over the next decade, driven by the global race to electrify transport, expand renewable energy, and power next-generation technologies. Permanent magnets made from rare earths like neodymium and dysprosium are essential for electric vehicles, wind turbines, robotics, and advanced electronics.

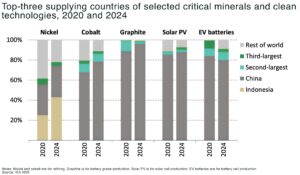

Yet, supply remains highly concentrated: China controls roughly 90% of refined rare earths and dominates both mining and processing, creating persistent geopolitical and supply chain risks. While global rare earth output has jumped from 240,000 to 350,000 metric tons since 2020, new supply outside China has lagged, and heavy rare earths face looming deficits as demand outpaces new project development.

Expect rare earth prices to remain volatile, whipsawed by Chinese policy, inventory swings, and shifting EV and renewable demand. But the long-term fundamentals are clear: the energy transition and technology boom are set to drive rare earth demand, and supply security, to the top of the global critical minerals agenda

Rare earth Insights

Rare Earth Elements (REEs)

Rare earth elements, often called the “Group of 17,” are a set of metals critical to the technologies powering the global clean energy transition, advanced electronics, and defense systems. These elements-including neodymium, praseodymium, dysprosium, and terbium-are prized for their unique magnetic, luminescent, and electrochemical properties. Despite their name, rare earths are relatively abundant in the Earth’s crust, but are rarely found in economically viable concentrations, making mining and refining both challenging and costly.

Why rare earths matter: strategic applications

Clean energy and electrification

-

permanent magnets: Neodymium-iron-boron (NdFeB) magnets, which use neodymium, praseodymium, dysprosium, and terbium, are essential for high-efficiency motors in electric vehicles (EVs), wind turbines, and robotics. These magnets provide unmatched strength and energy efficiency, enabling smaller, lighter, and more powerful devices

-

renewable energy: Rare earths are vital for wind turbine generators and other renewable energy infrastructure, supporting the decarbonization of global power grids

Defense and advanced technology

-

military and aerospace: Rare earth compounds are used in missile guidance systems, radar, night vision, fiber optics, and solid-state lasers-making them irreplaceable for modern defense and aerospace applications

-

electronics and communications: REEs are found in smartphones, computers, medical imaging, and advanced semiconductors, underpinning the digital economy

Supply and demand dynamics

Demand drivers

-

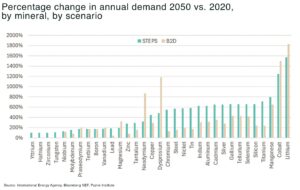

surging global demand: Rare earth magnet demand is expected to keep rising in 2025 and beyond, driven by growth in EVs, hybrids, renewable energy, and emerging technologies like humanoid robotics and passenger drones

-

price outlook: While prices have been volatile and are currently subdued due to high inventories and macroeconomic uncertainty, experts forecast a sharp rebound-especially for heavy rare earths like dysprosium. By 2034, dysprosium prices could surge by up to 450% if supply remains constrained

Supply challenges

-

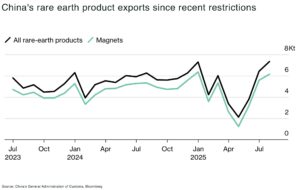

China’s dominance: China accounts for 58% of global rare earth mine production and dominates refining, controlling prices and supply for the rest of the world. Recent export controls and a strategic shift toward domestic use have heightened concerns about supply security

-

geopolitical risk: The rare earths supply chain is exposed to policy risks, such as export restrictions and regional conflicts. Disruptions in Myanmar, a major supplier of heavy rare earths, have already caused price spikes and supply shortages

-

environmental and social impact: Traditional rare earth extraction is energy- and water-intensive, with significant environmental footprints. New projects in South America and technological advances are aiming to address these challenges with more sustainable practices

Major producers and emerging projects

-

Lynas Rare Earths (Australia/Malaysia): the largest non-Chinese REE producer, supplying key markets in Asia, Europe, and North America

-

China Northern Rare Earth Group: the world’s largest rare earth miner and processor

-

Aclara Resources (Chile/Brazil): developing innovative, low-impact extraction methods to diversify global supply

Market trends shaping rare earths’ future

-

decoupling from China: For the first time, rare earth prices are beginning to decouple from Chinese benchmarks, signalling a structural shift as new supply chains emerge in the Americas, Australia, and Africa

-

investment in recycling and alternatives: companies and governments are ramping up investment in recycling rare earths from end-of-life products and developing alternative materials to reduce dependence on primary supply

-

technological innovation: advances in extraction, processing, and magnet manufacturing are improving efficiency and reducing environmental impact, supporting sustainable market growth

Rare earth elements are the backbone of the clean energy revolution, advanced manufacturing, and modern defense. As demand accelerates and supply risks intensify, the race is on to build resilient, diversified, and sustainable rare earth supply chains-cementing their role as a linchpin of the 21st-century global economy.

US launches $12 billion strategic minerals stockpile

The US will establish a US$12 billion strategic minerals stockpile, marking its most direct intervention yet in critical mineral markets as competition with China intensifies.

Can America’s “Warp Speed 2.0″ break China’s grip on Rare Earths?

US Treasury Scott Bessent has pledged to break China’s stranglehold over global rare earth supply with the equivalent of an “Operation Warp Speed.” “We are

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

Key takeaways The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are

US and Australia sign $8.5 billion rare earths deal

On 20 October 2025, Donald Trump and Anthony Albanese signed the United States–Australia Framework for Securing of Supply in the Mining and Processing of Critical

US weighs price floors for critical minerals to counter China

The United States is weighing price floors and “forward-buying” for critical minerals such as rare earths and graphite to counter China’s use of below-cost exports

US to build $1 billion critical mineral stockpile as supply risk deepens

The US Department of Defense is preparing to purchase $1 billion worth of critical minerals to build a national stockpile and shield military supply chains