(First published in The Northern Miner, PDAC 2022 edition)

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

New ETFs in Europe, $billions raised and spent on physical uranium by Sprott, aggressive reactor construction programs, mine restarts, rising contract pricing, positive turns in public sentiment. Driven by powerful geopolitical and climate related trends, nuclear energy has finally moved out from the shadow cast by Fukushima and is bringing fundamental change to the uranium sector.

The steady flow of positive news for the uranium sector also highlights its greatest peculiarity: uranium equities typically rise and fall based on the spot price, despite most uranium being bought and sold via term contracts that pay little attention to spot pricing. To compound matters, the spot price can be volatile because the sector is small and also opaque in many respects, since the main consumers are utility companies that are loathe to share details on stockpiles and purchasing plans.

So, while the term price has trended upwards, the spot price has at times surged to levels not seen in over a decade, only to be hit by significant dips with no relation to the overall sentiment or fundamentals. Share prices across the board have followed suit in both directions.

At what point are equities going to reflect the underlying growth trends, either by decoupling from the spot price or experienced stronger, less erratic spot pricing? It’s a difficult question to answer but to begin with, it’s worth examining the increase in spot volatility.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Firstly, this an issue that was predicted by leading nuclear market research and analysis firm, UxC. The main catalyst has been the Sprott Physical Uranium Trust (SPUT) which took over Uranium Trading Corp. in 2021 and put in an At-The-Market (ATM) funding mechanism. The ATM allows SPUT to sell stock into the market every single day from the Treasury, receive the funds and immediately purchase uranium. They have been highly active, raising and spending over $1.1 billion to date. Such action, in the famously thin spot market, has meant the Trust has sucked up much of the loose supply and, as Sprott AM chief executive, John Ciampaglia, said: “We don’t sell any of it. It is a stockpiling fund.”

However, SPUT can only use its ATM facility when its stock price is trading its net asset value (NAV) and when that price is below – as it has been for several weeks now – it cannot purchase. This has left the spot market particularly sensitive to traders, including one financial player that unloaded its 1.3 million pound uranium inventory over a two-day period in May, pushing down prices aggressively.

In contrast, term pricing has risen slowly but steadily. In February of 2020, just before the $24.80/lb spot price began to leap forwards, the term price sat at $32.50/lb. As of the end of April this year, the term price was sitting at $50/lb and experienced almost no negative price movement on the way to that level.

Such is the confidence that this trend will continue, one of the world’s largest uranium miners, Cameco, will be restarting production at its McArthur River mine and Key Lake processing plant later this year. This is both more technically complex and more costly than many investors will realize, so is not a decision the company will have undertaken lightly. More tellingly, Cameco and Orano Mining have recently partnered in order to increase their ownership of Cigar Lake, the world’s largest high-grade uranium mine, with a C$187 million purchase of Idemitsu’s stake.

On the financial side, money has also poured into two uranium ETFs launched this year in Europe. Research, conducted and published by the Financial Times in May of this year, shows global nuclear and uranium focused funds are now sitting on more than US$3 Billion of assets, six times more than in 2020.

Looking at the underlying drivers

All this growth is being driven by powerful trends. Climate change has given rise to rapidly growing decarbonization efforts by governments and corporations around the world. These are not idle promises. Several countries, including the United Kingdom, France, New Zealand, and Sweden, have already gone as far as to enshrine decarbonization targets in law. These nations, together with many others, have reviewed their options for weaning off fossil fuels and the conclusion is clear: decarbonization is not possible in the required timeframe without expanding nuclear energy.

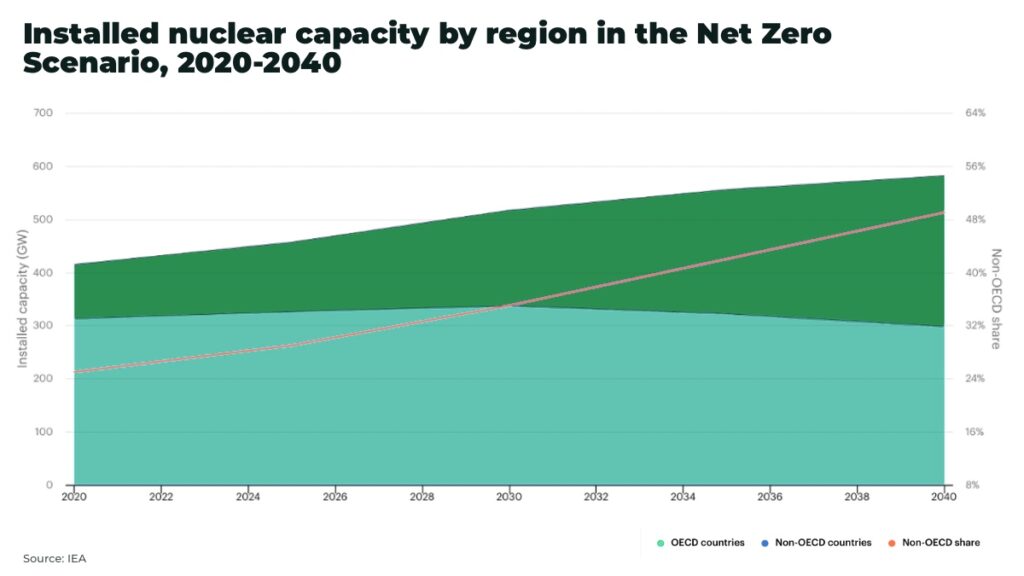

Thus we have the EU including nuclear in its green energy taxonomy despite opposition from Germany – the only anti-nuclear European nation; we have France announcing the overhaul and growth of its huge nuclear reactor fleet after years of political paralysis; the U.K. recently announced nuclear will be the backbone of its new energy policy; even countries like Poland are planning to commence a multi-reactor program that will directly replace coal power; and in the U.S., the government has provided a USD $6 billion fund to assist its reactor fleet. And let’s not forget that China’s nuclear program is so big that it will soon overtake the U.S. as the number generator of nuclear energy, and consumer of nuclear fuel.

“In today’s context of the global energy crisis, skyrocketing fossil fuel prices, energy security challenges and ambitious climate commitments, I believe nuclear power has a unique opportunity to stage a comeback”

— IEA Executive Director, Fatih Birol

Of course, it’s important to acknowledge that nuclear power stations do not get built overnight. These are high-capex, multi-year endeavors – factors that have long been a roadblock to wide-scale rollouts. This is why the recent milestones in small modular reactors (SMR) are so important.

As the name suggests, SMRs are small reactors that are produced by factories as modular components for delivery and assembly on site. They have remarkable, built-in safety features, can be mass produced and are ideal for powering remote and small to midsized communities or large industrial installations. Most importantly for uranium investors, SMRs have the potential to send the nuclear energy sector into a realm of growth that is not yet fully appreciated.

Granted, we do not yet have any mass rollout programs in place, nor indeed are there any completed factories capable of supplying such rollouts. However, several facts suggest this changing fast. Billions have been poured into SMR development over the last two years alone across countries including the US, China, U.K., and Canada. In January of this year China connected its first commercial SMR to the grid to “lay the foundation for the construction of industrialisation and mass production”. More recently, another SMR front runner, U.S.-based NuScale, announced a partnership with South Korea’s Doosan Enerbility to begin manufacturing equipment this year for full-scale production of SMRs. And it looks like there won’t be a shortage of early customers, including the UK, where the Prime Minister Boris Johnson, has boasted that the UK intends to build one nuclear plant every year. This would be inconceivable without SMR technology.

Geopolitics and the Danger of Low Stockpiles

The knowledge that nuclear is critical for the success of clean energy programs is now combined with a similarly powerful revelation: security of supply can no longer be ignored by nuclear utilities. The entire world knows that Russia is a major supplier of oil and gas, but it is also a big player when it comes to nuclear fuel. In addition, the world’s largest uranium producer is Kazakhstan, which sits firmly within the Russian sphere of influence.

Russia and its opponents have already shown their willingness and ability to weaponize energy supplies. The focus may currently be on oil and gas, but an extended uranium and processed nuclear fuel embargo is by no means off the table. In fact, a number of U.S. lawmakers are pushing the administration to implement just such an embargo. If that embargo, or a similar one initiated by Moscow, included Kazakhstan’s uranium, it would send a shockwave throughout the sector, particularly considering the current state of known utility stockpiles. Indeed, the International Atomic Energy Agency (IAEA), warned inventories held by US and EU nuclear utilities were averaging at 16 and 24 months respectively, an incredibly vulnerable position to be in considering the rise of geopolitics.

Utilities at risk after years of low uranium prices

The sector is exiting over ten years of underinvestment in uranium exploration and development which means any disruption to production is going to have a major effect on available supplies. What many newcomers don’t realize is that uranium mining is amongst the most heavily regulated resource sectors in the world. From discovery to production can tell well over a decade. Although there are advanced, well-funded projects in development with impressive economics – notably those owned by NexGen Energy and Fission Uranium in Saskatchewan, Canada – they have not yet commenced construction and will not be delivering material anytime soon. Additionally, although Cameco’s McArthur River is coming back online, analysts at UxC have stated that established mines around the world are facing dwindling reserves and falling grades – so much so that the cost of production for most existing uranium miners will rise within the next three years.

Nuclear energy looks set for robust, long-term growth, and it will take the uranium sector with it.

— Anthony Milewski, The Oregon Group

Nuclear energy looks set for robust, long-term growth, and it will take the uranium sector with it. For the near term, with the global economy and political landscape in such flux, there is increased potential for major supply disruption and extra volatility in the spot price. Past that, it is likely to be heavily influenced by new reactor build programs that could be greatly accelerated as SMR factories commence production, and new, primary supply – most like from mines located in stable jurisdictions. A bumpy ride for utilities but a potentially exciting one for investors.

— Anthony Milewski is the co-founder of The Oregon Group research house and a director of International Consolidated Uranium (TSX-V:CUR), which has entered option agreements to acquire five uranium projects in Australia, Canada and Argentina.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.