Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

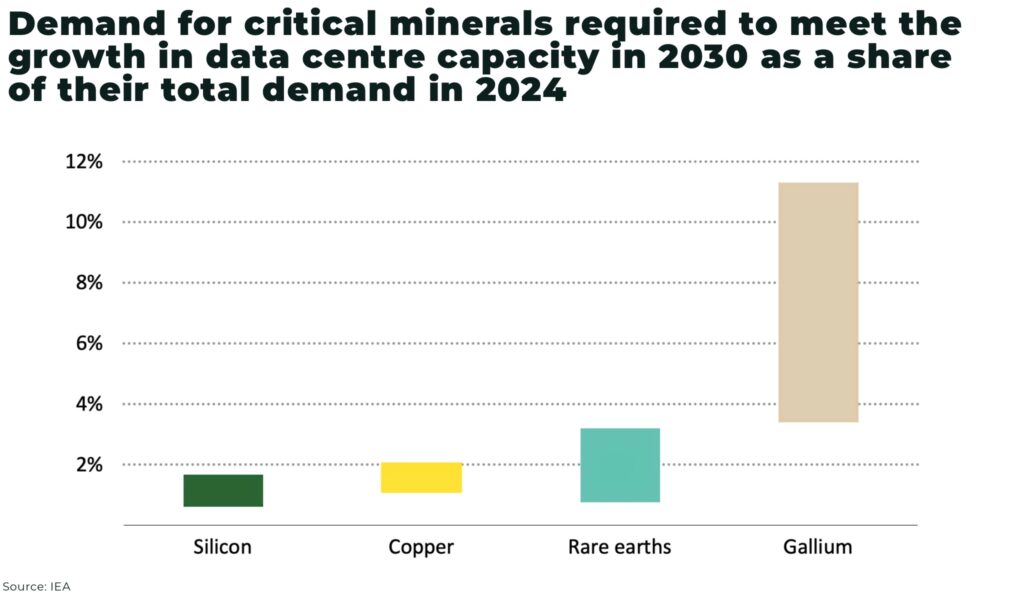

Global demand for critical minerals from data center development is set to rise significantly by 2030, compared to 2024 levels:

- 2% for copper

- 2% for silicon

- 3% for rare earths

- 11% for gallium

According to a new Energy and AI report by the IEA, forecasts “the absolute volumes in 2030 still reach 512 kilotonnes (kt) of copper and 75 kt of silicon, so project developers have good reason to pay attention to supply security.”

Critical minerals in data centers

Transformers and updated electricity girds are two of the most critical mineral hungry aspects of AI. For example,

- copper and aluminium, as insulation, represents approx 50% of total expense of a transformer

- 20% of cost of a power transformer is grain-orientated electrical steel

Data centers, the backbone of Artificial Intelligence infrastructure, rely on a variety of critical minerals for their construction and operation, including:

- copper: Essential for power distribution systems, networking cables, and cooling infrastructure due to its superior conductivity and durability

- silicon: Used in processors and memory storage components, with ultrapure silicon being a key material for semiconductors

- gallium: Increasingly important for high-efficiency power converters and radio frequency components.

- aluminium: Valued for its lightweight properties and thermal conductivity, it is used in server racks, casings, and cooling systems

- rare earth elements (REEs): Neodymium, praseodymium, dysprosium, and terbium are critical for high-performance magnets in motors, cooling fans, hard drives, and optical components

- battery minerals: lithium-ion batteries in uninterruptible power supplies (UPS) rely on lithium and other battery materials

Supply chain vulnerabilities

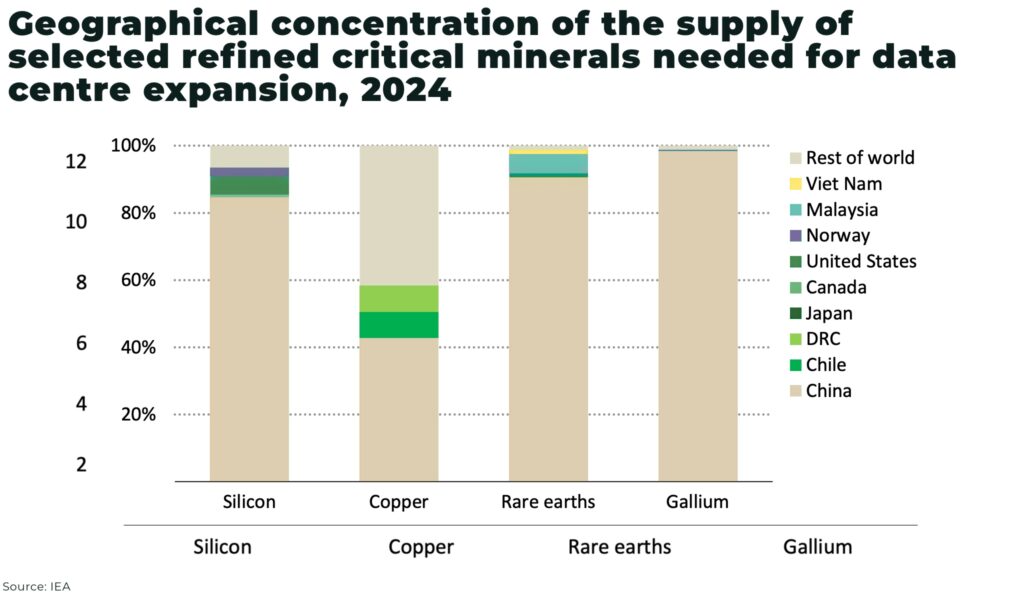

The IEA warns geographical concentration of critical mineral production poses significant risks, for example:

- nearly 60% of refined copper comes from just three countries

- over 90% of aluminium, silicon, magnet rare earths, and gallium are sourced from three dominant producers, primarily China

This concentration creates vulnerabilities to supply shocks caused by trade restrictions, extreme weather events, or geopolitical tensions. Recent developments have exacerbated these risks:

Our recent report on how the explosion of Artificial Intelligence it expected to spark a 10-year critical mineral supercycle as the massive energy needs of new AI data centers will increase pressure on global supply chains already under strain to meet global net-zero targets:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.