Critical Minerals and Energy Intelligence

Fluorspar

Fluorspar is the electric battery metal no one is heard of, but a lithium-ion electric battery needs up to x5-10 more fluorspar than lithium. And, in the last few year, prices hit record highs due to supply shortages.

The US Department of Energy forecasts demand for fluorspar will exceed current supply by 40-70% by 2035.

And, this time, the supply crunch for the critical mineral is coming, not just in the West, but also in China.

Fluorspar Insights

Latest News

What is Fluorspar?

Fluorspar, scientifically known as fluorite (CaF₂), is a versatile mineral valued for its unique physical and chemical properties. It is often recognized by its vibrant colors, ranging from purple and green to blue and yellow, and its perfect cleavage, making it easily identifiable. With a Mohs hardness of 4 and specific gravity of 3.2, fluorspar is widely used across chemical, metallurgical, and ceramic industries.

The term “fluorspar” originates from the Latin word “fluere,” meaning “to flow,” reflecting its historical use as a flux in metal smelting to lower melting temperatures and remove impurities.

Today, fluorspar is a critical mineral due to its applications in hydrofluoric acid production, aluminum manufacturing, and steelmaking.

Why Fluorspar Matters: Strategic Applications

Chemical industry

- hydrofluoric acid production: Acid-grade fluorspar (≥97% CaF₂) is the primary raw material for hydrofluoric acid (HF), which is essential for producing refrigerants, pharmaceuticals, plastics like Teflon, and fluorine-based chemicals

- refrigerants and propellants: HF derived from fluorspar is used to manufacture Freon for refrigeration systems and as a propellant in sprays

Metallurgical industry

- steelmaking: metallurgical-grade fluorspar (60–85% CaF₂) acts as a flux to remove impurities like sulfur and phosphorus from molten steel, improving quality and efficiency

- aluminum production: fluorspar is used to produce aluminum fluoride (AlF₃), which lowers the melting point of alumina during smelting, reducing energy consumption

Ceramic and glass manufacturing

- ceramics: ceramic-grade fluorspar enhances porcelain glaze brightness and durability. It also serves as a dyeing assistant and fluxing agent in ceramic production

- glass production: fluorspar lowers the melting temperature of glass raw materials, improving workability while reducing energy consumption

Supply and Demand Dynamics

Demand Drivers

- industrial growth: increasing demand for hydrofluoric acid in refrigerants and polymers drives fluorspar consumption

- energy transition: fluorspar’s role in aluminum production supports renewable energy technologies like solar panels

- electric batteries: fluorspar is essential in all three main parts of a lithium-ion battery, cathodes, electrolytes, anodes. Approximately 100kg of fluorspar is needed per 100 kWh lithium battery, making it a crucial component for electric vehicle production, with a lithium-ion electric battery needs up to 5-10 times more fluorspar than lithium. For example, every battery in a Volkswagen ID.4 requires about 10kg of fluorspar.

Demand for fluorspar from the lithium-ion battery sector is expected to exceed 1.6 million tonnes by 2030. The US Department of Energy forecasts that fluorspar demand for energy applications will increase significantly, with EVs making up 19% of this demand by 2035

Supply Landscape

- production concentration: China dominates global fluorspar production and consumption, followed by Mexico and South Africa. This concentration creates supply chain vulnerabilities, especially with declining domestic reserves in China.

The USA is 100% import-dependent, with 58% of acid-grade imports from Mexico, 20% from Vietnam, and 15% from South Africa. Efforts are underway to ramp up domestic production through projects like ARES Strategic Mining’s Lost Sheep project. - mining characteristics: fluorspar is mined both as a primary product and as a by-product of other minerals like lead. Supply risks from Mongolia, Mexico, South Africa, and Vietnam remain high due to infrastructure, environmental, and political concerns. Mines in Canada, Australia, Germany, Italy, and Spain are working to restart operations

Market Trends Shaping Fluorspar’s Future

- supply chain security

- Diversification efforts are underway to reduce reliance on single-source countries like China.

- Strategic stockpiling by governments ensures stable supplies for critical industries

- technological advancements

- Research into fluorine-based advanced materials could expand fluorspar’s applications.

- Recycling processes for fluorine-containing products are being developed to enhance supply sustainability

- regulatory environment

- Fluorspar’s designation as a critical mineral incentivizes domestic production and supply chain improvements globally

Fluorspar’s indispensable role in chemical manufacturing, metallurgy, and ceramics underscores its importance as a strategic resource. As industries prioritize sustainability and supply security, fluorspar’s relevance will continue to grow in modern industrial society.

Why the US fails to secure critical mineral supply — and how it can be fixed

An inside look into what’s gone wrong in Washington — and how to fix it In December 2024, China banned exports of gallium, germanium, and antimony

Is this the “shale moment” for critical mineral mining in the US?

A quiet revolution is underway in the bedrock of the global economy. The mining and processing of critical minerals — from lithium to rare earths,

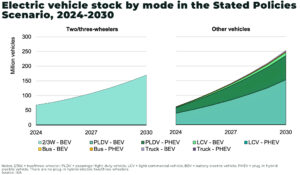

Global electric vehicle fleet to quadruple by 2030

The global electric vehicle (EV) fleet is projected to hit 250 million vehicles by 2030 — excluding two- and three-wheelers (2/3Ws) — marking a x4

Where will fluorspar for US-made EVs come from?

Fluorspar is vital for the energy transition yet, despite its growing importance, it is one of the most under-reported critical minerals we’ve found in all

Fluorspar: the EV critical mineral no one has heard of

Fluorspar may not have the name recognition (yet) of copper, lithium, nickel or cobalt, but a lithium-ion electric battery needs up to x5-10 more fluorspar

Germany struggles to avoid another geopolitical disaster, this time over critical minerals

Russia’s invasion of Ukraine is estimated to have cost Germany’s economy — particularly due to it’s dependence on Russian energy exports — more than US$100billion,