Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Fluorspar is vital for the energy transition yet, despite its growing importance, it is one of the most under-reported critical minerals we’ve found in all our analysis.

To take just a few examples:

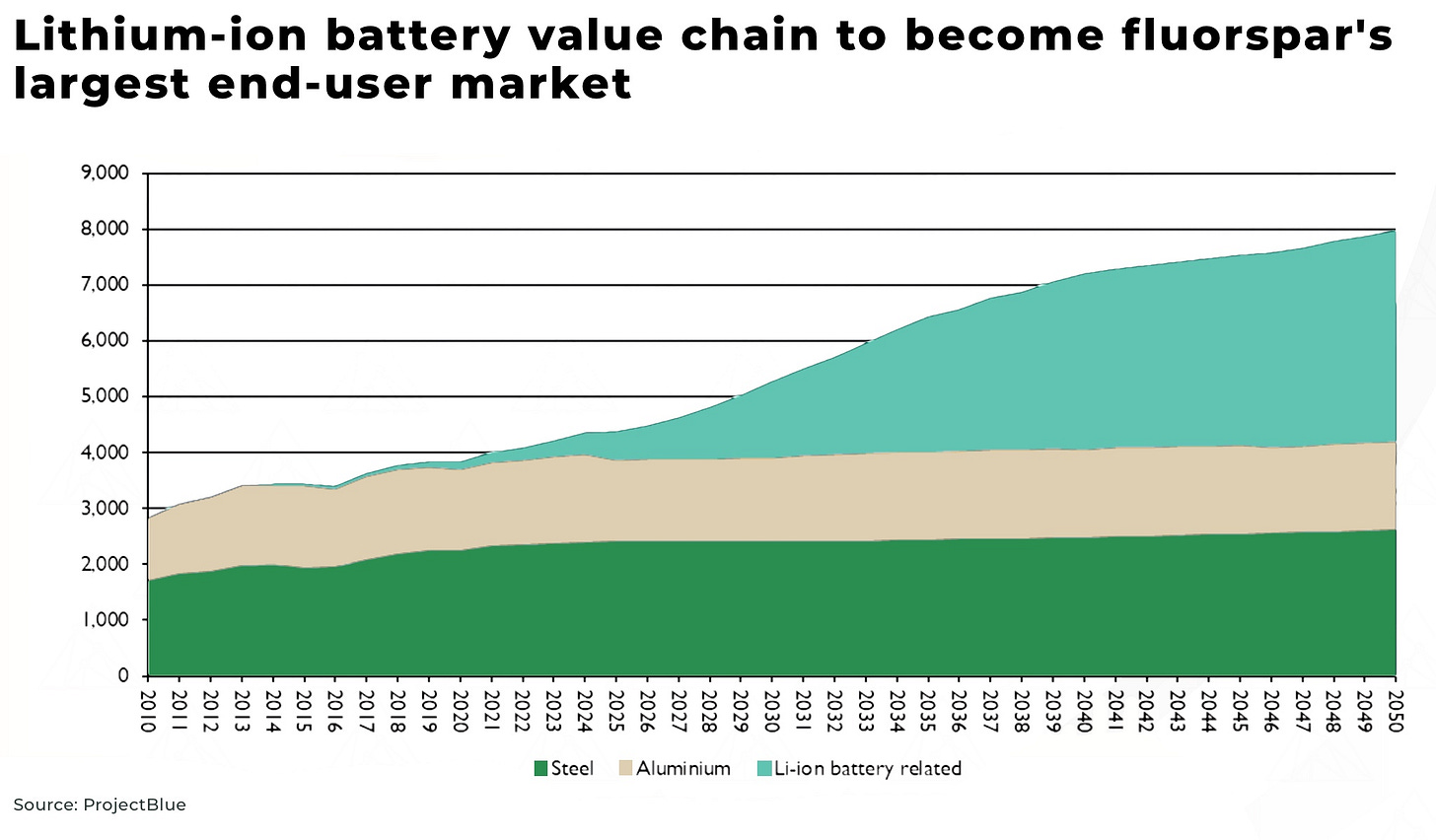

- a lithium-ion electric battery needs up to x5-10 more fluorspar than lithium

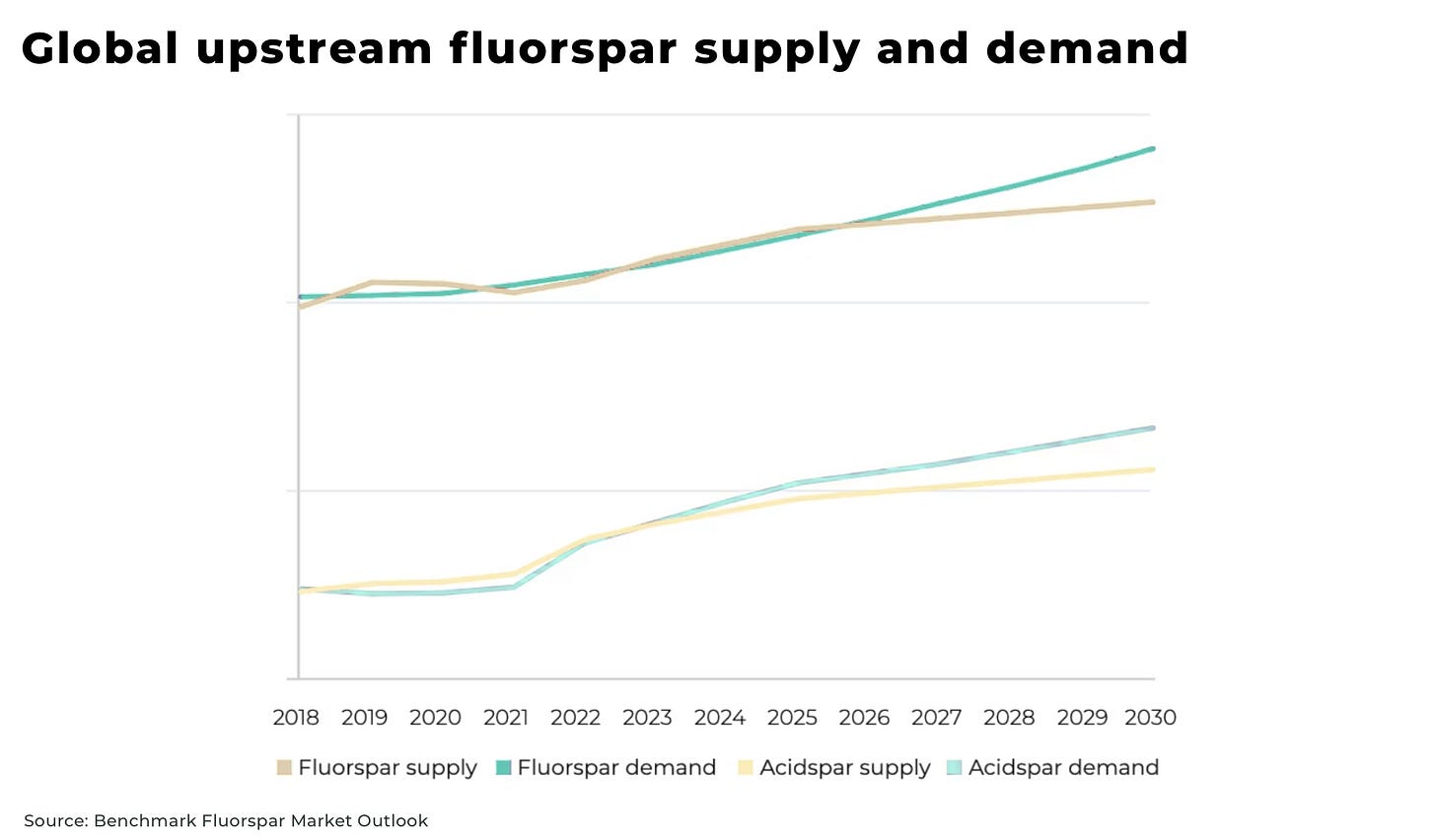

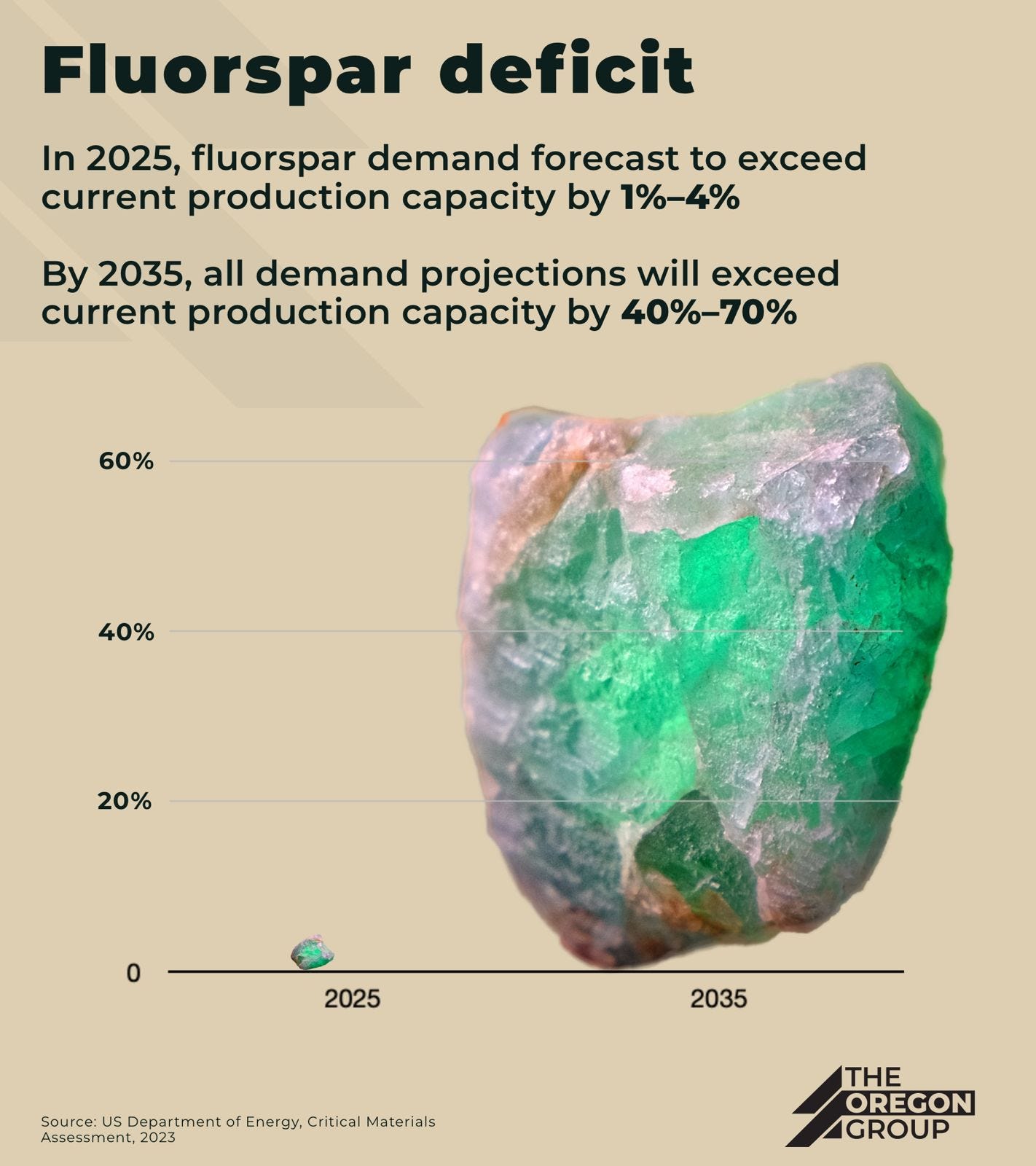

- demand for fluorspar forecast to exceed current supply by 40-70% by 2035

But, it’s as though the mineral almost does not exist:

- there is not one mention of fluorspar in the recent IEA report, eg Global Critical Mineral Outlook 2024 and Batteries and Secure Energy Transitions

- there are no relevant stories at all when searching on Bloomberg or Reuters

The challenge is that global fluorspar supply is tightening, just as demand is forecast to increase significantly.

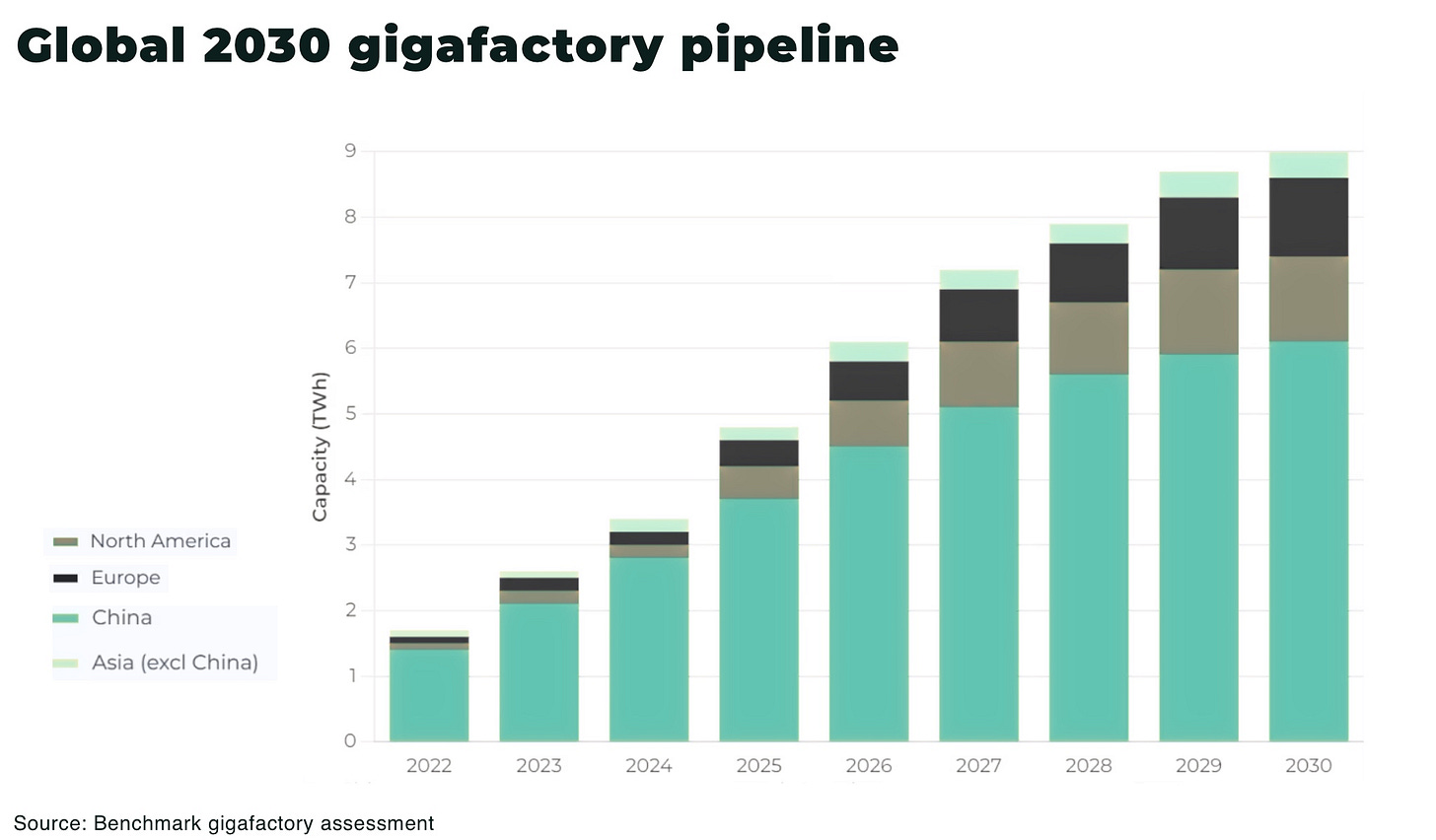

The IEA estimates EV battery demand could increase x12 by 2035, compared to 2023, in a net-zero emissions scenario. To meet this demand there are more than 400 gigafactories planned across the world by 2030, up 60% from 240 gigafactories in 2023. This growth is driven by China, Europe and the US — and will need a secure supply of fluorspar.

But, Benchmark Minerals estimates that increased mining rates will increase pressure on global reserves which could decrease 30% by 2030.

We recently analyzed the macro situation in the fluorspar market. Now we want to explore where new, secure supply can potentially be found.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

What is fluorspar

Fluorspar is the commercial name of mineral fluorites, in particular: acidspar, metaspar and ceramic (there are others as well, such as optical). It is a mineral with a variety of uses

- across chemical production (especially hydrofluoric acid), refrigerants and fluoropolymers, cement, glass, iron, steel and aluminium casting, as well as for processing uranium

- in lithium-ion electric batteries, Fluorspar is one of the few minerals to be used across all major components: the cathode, anode, and separator bindings

- in the rapid expansion of data centers to support the growth of artificial intelligence, fluorspar and fluorine compounds are used in the fabrication of semiconductors (including Reactive Ion Etching to Deposition Precursors)

Fluorspar is listed as a critical mineral by China, the US, EU, Canada, Japan and Australia.

Fluorspar demand

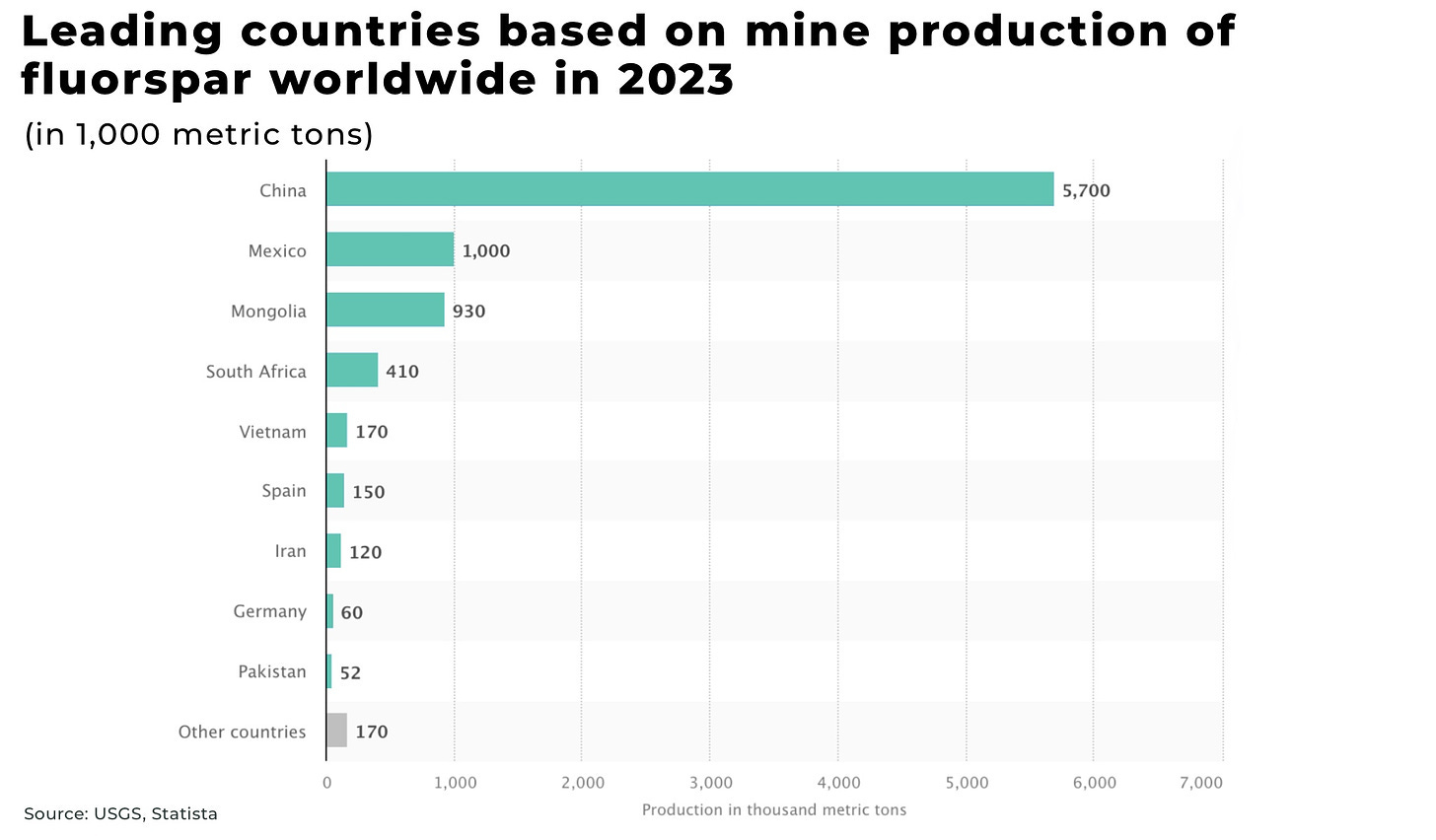

Global fluorspar production in 2023 is approximately 6MMT a year, with some estimates suggest fluorspar demand will increase 4-5% over the next 5 years.

North America and Europe are the largest importers, accounting for approximately 25% of consumption. However, the US is 100% dependent on imports, which totalled 340,000 metric tons in 2023; Europe’s domestic production covers only about 33% of domestic consumption.

Recent legislation, such as the Inflation Reduction Act, restricts access to US EV tax credits for foreign entities of concern. This makes the source of fluorspar supply to US electric battery manufacturers (who have an estimated US$92 billion of announced investments in the US) is increasingly critical.

The 97% CaF2 Fluorspar market industry (acidspar) is expected to grow significantly in the coming years. Some estimates project that it will grow from US$110.86 billion in 2024 to US$126 billion by 2032.

China

In 2023, China was both the largest producer and consumer of fluorspar, accounting for over 60% of global production.

However, China is shifting from a net exporter to net importer as it exhausts domestic supply of fluorspar. Instead imports are rising and exports falling.

The fluorspar mining industry in China is also hindered by frequent safety inspections and increased difficulties in obtaining mining rights as the government works to amalgamate smaller miners into the bigger players across the sector.

In a recent official statement, the Ministry of Finance of China has announced its intention to implement a reduction in the import tariff applied to fluorspar. This policy change, set to take effect in 2024, is designed to stimulate the import of products associated with fluorspar and to bolster the country’s reserves of this critical mineral.

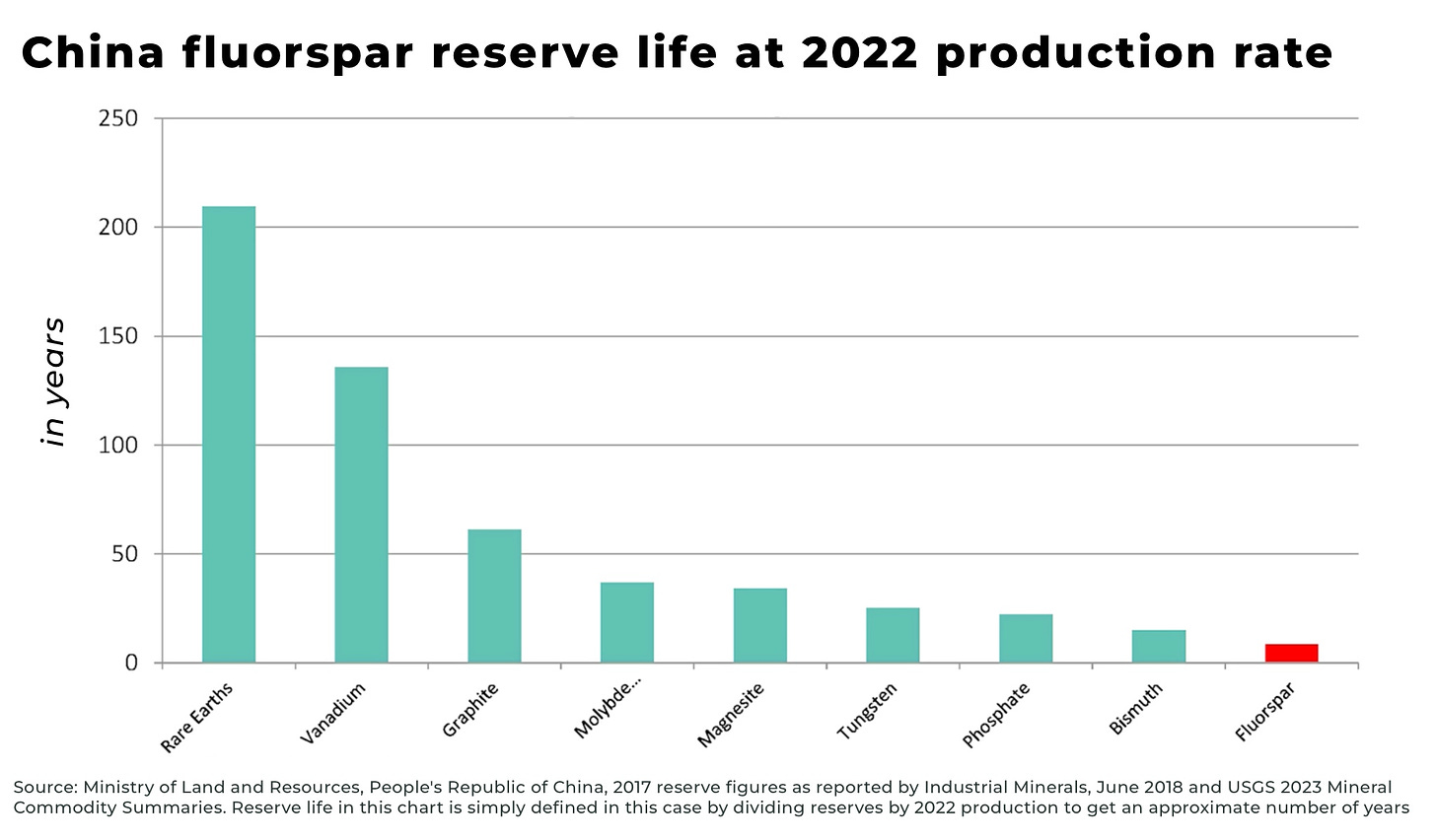

The US Department of Energy projects China’s market dominance of fluorspar will continue but some estimates suggest, at current production rates, the country has only 10 years of reserves left. The fluorspar price in China at end of Q4 2023 was US$500/MT, ex Shanghai, which is a 19% increase on Q4 2022.

This fall in Chinese production, just as demand rises, is ratcheting up pressure on global supply.

So where else can new supply come from?

Mongolia

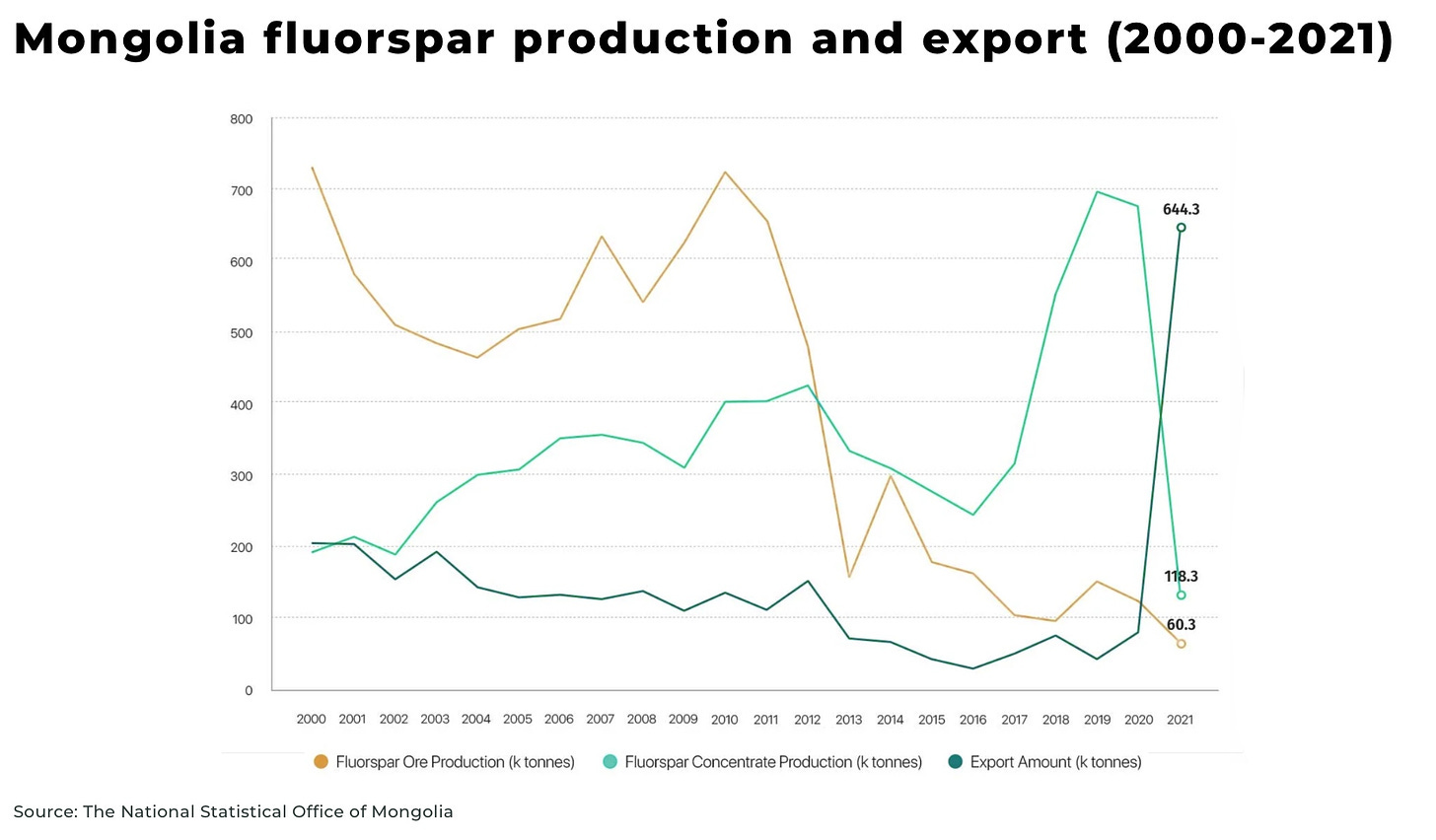

In 2023, imports of metspar from Mongolia to China surged, with a total of 912,732 tonnes of metspar from Mongolia, a year-on-year increase of 348% from the 203,527 tonnes in 2022, as per the customs data.

Overall production in Mongolia, the world’s third largest producer, increased nearly 120% from 2022-2023, up to 930,000 tonnes from 425,000 tonnes.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

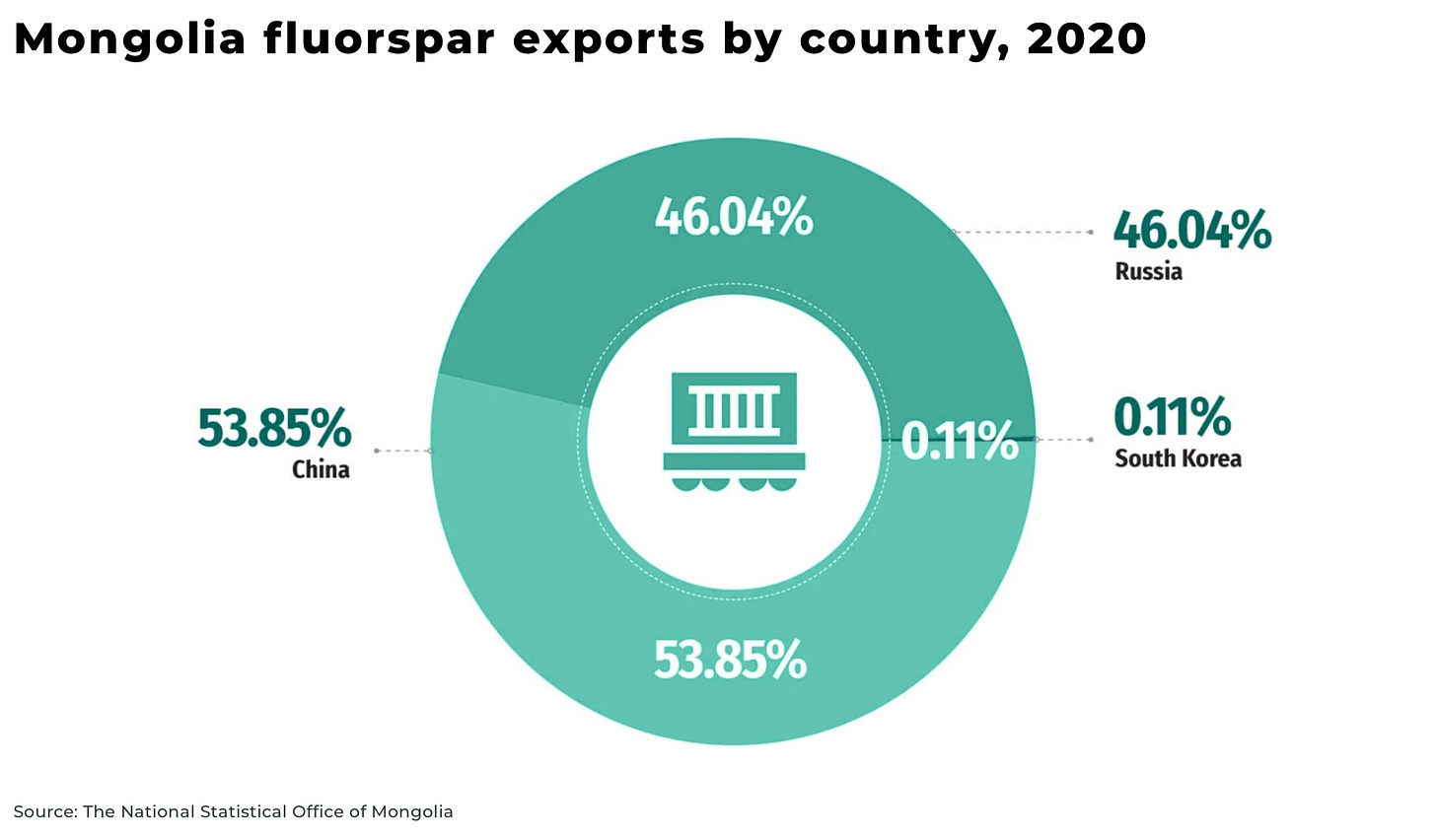

In 2022, more than 90% of fluorspar from Mongolia was exported to China and Russia. It’s unlikely this share of exports has moved significantly since then, as China’s booming electric car industry continues to drive demand for the mineral.

This growing dependence on fluorspar from Mongolia raises concerns for the West over the security of supply.

Mexico

Mexico is both the world’s second largest exporter of fluorspar and geographically located on the doorstep of North America. So, in theory, the country should be perfectly suited to meet fluorspar demands by American gigafactories for electric battery orders.

The world’s largest fluorspar mine is located in San Luis Potosi, Mexico with an annual volume which represents about 18% of global production. It has one of the largest reserves of certified global fluorspar.

However, there are challenges to be addressed. Some mines, including Las Cuevas, have been found to contain arsenic, which is deemed a penalty and not tolerated for some end products.

Despite this, Mexico currently accounts for 64% of US fluorspar imports.

However, there are warning signs over the supply-sustainability of Mexico’s fluorspar reserves:

- between 1980-1990, the country lost approximately 50% of fluorspar production capacity with eight mining operations shutting down

- in 2023, fluorite (fluorspar) mine production in Mexico totaled 989,000 metric tonnes, representing a decrease of 1% compared to 2022. While this decline is small, it occurred despite rising prices and could signal a trend

Africa

South Africa is the world’s fourth largest producer of fluorspar, producing an estimated 410,000 tonnes in 2023, and accounting for 6% of US imports.

Despite its prominent position in the fluorspar market, South Africa faces numerous challenges, including political instability and infrastructure issues. For instance, the recent electricity blackouts have had a significant impact on the mining sector, disrupting operations and affecting production.

Kenya is another country of interest in the fluorspar market. The Kenyan government recently signed an agreement with UK-based Soy-Fujax Mining to restart fluorspar operations at the Kimwarer mine in Elgeyo Marakwet County. This agreement involves a US$33 million investment and aims to revive the mine, which closed 10 years ago after reaching peak production of 120,000 tonnes.

However, even if the Kimwarer mine restart is successful, it is unlikely to make up for the anticipated shortfall in global fluorspar supply.

Europe

Europe is expected to be one of the regions most severely impacted by volatility in global fluorspar supply. Unlike China, which has access to large reserves in Mongolia, or the US, which can secure reserves from Mexico, the European Union has limited options for easily securing reserves in its vicinity.

The only significant reserves in the region are the mines located in northern Spain operated, operated by MINERSA Group for over a century. However, from our understanding, these mines are increasingly depleted with few new mineral reserves being added to the inventory.

As a result,Europe’s domestic production meets only a third of its demand for this critical mineral.

As we outlined in our recent analysis, Germany is struggling to avoid another geopolitical disaster, this time over critical minerals. The region is facing challenges in securing a stable supply of these essential resources.

There are, however, some new fluorspar mine deals being made across the EU. These include:

the opening of the Käfersteige mine on the fringes of the Black Forest. This mine is reported to contain about 2 million tonnes of raw fluorspar and could produce 100,000 tonnes per year after 2029. This would meet 40% of Germany’s and 13% of the EU’s demand.

But new fluorspar mine deals across the EU include:

- opening the Käfersteige mine, near the Black Forest, which is reported to contain about 2mn tonnes of raw fluorspar and could produce 100,000 tonnes a year after 2029. This would meet 40% of German demand and 13% of EU demand

- additionally, the privately owned Mineraria Gerrei is plannig to restart the Silius fluorspar mine on Sardinia, Italy with an investment of over US$47 million

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Europe

Europe is expected to be one of the regions most severely impacted by volatility in global fluorspar supply. Unlike China, which has access to large reserves in Mongolia, or the US, which can secure reserves from Mexico, the European Union has limited options for easily securing reserves in its vicinity.

The only significant reserves in the region are the mines located in northern Spain operated, operated by MINERSA Group for over a century. However, from our understanding, these mines are increasingly depleted with few new mineral reserves being added to the inventory.

As a result,Europe’s domestic production meets only a third of its demand for this critical mineral.

As we outlined in our recent analysis, Germany is struggling to avoid another geopolitical disaster, this time over critical minerals. The region is facing challenges in securing a stable supply of these essential resources.

There are, however, some new fluorspar mine deals being made across the EU. These include:

the opening of the Käfersteige mine on the fringes of the Black Forest. This mine is reported to contain about 2 million tonnes of raw fluorspar and could produce 100,000 tonnes per year after 2029. This would meet 40% of Germany’s and 13% of the EU’s demand.

But new fluorspar mine deals across the EU include:

- opening the Käfersteige mine, near the Black Forest, which is reported to contain about 2mn tonnes of raw fluorspar and could produce 100,000 tonnes a year after 2029. This would meet 40% of German demand and 13% of EU demand

- additionally, the privately owned Mineraria Gerrei is plannig to restart the Silius fluorspar mine on Sardinia, Italy with an investment of over US$47 million

Australia

In Western Australia, the Tivan company has recently made significant strides in the fluorspar market. The Company has successfully upgraded the mineral resource at its Speewah Fluorite project by an impressive 37%. This upgrade has resulted in an inferred resource of 37.3 million tonnes at 9.1% calcium fluoride (CaF2), containing a total of 3.39 million tonnes CaF2. This development represents a substantial increase in the available resources at their Speewah project and demonstrates Tivan’s commitment to expanding its operation in the fluorspar market.

North America

At present, the US imports 100% of its fluorspar, with an estimated total of 390,000 tonnes in 2023. The majority of these imports come from Mexico, accounting for 58% of acid-grade imports, followed by Vietnam and South Africa, with 20% and 15% respectively.

This import dependency is expected to tighten further as the US invests heavily in its electric vehicle (EV) supply chains. Between August 2022 and March 2023, cumulative investment of US$52 billion was announced in North American EV supply chains.

The US authorities are working to become less dependent on insecure supply sources, such as China and Russia, and are hoping to offset some of their imports through support for domestic production.

However, the prospects for domestic production are limited.

Instead, as we’ve highlighted in our analysis, Plugging Canada into America’s battery belt, Canada’s mining friendly jurisdiction offers opportunities to meet the critical mineral demands of America’s new “battery belt”. Canada has the potential to provide a secure and stable supply of fluorspar to the US market, reducing the country’s reliance on imports.

“Significant demand for fluorspar is already coming online as America works to secure its electric battery investments, but new supply is not prepared. As with so many other critical minerals like lithium and rare earths, the need to have a secure supply of new fluorspar means investors are turning to Canada, a big mining-friendly jurisdiction with big fluorspar reserves on America’s doorstep”

— Ronald Woo, CEO & Director, Liard Strategic Minerals

Liard Strategic Minerals — a “crush and grind” district play with more than 3 million tonnes of fluorspar indicated in our historic resource estimates and grades exceeding 30% — is one of just a handful of new global projects based in North America hoping to put a dent in the expected fluorspar deficit.

Conclusion

The challenge for both the US and China, is that the majority of global fluorspar supply is concentrated in a handful of countries — each presenting a variety of risk, from political insecurity to dilapidated infrastructure, community protests to delayed mine permitting.

In particular, the fluorspar supply crunch represents a critical challenge to America’s push for a domestic battery production industry, with the Inflation Reduction Act’s emphasis on local sourcing.

So, where will fluorspar for the new US-made EVs come from?

In a country that is 100% dependent on imports, we expect a significant push to bring supply much closer to home — which means Canada will play a critical role.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.