Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

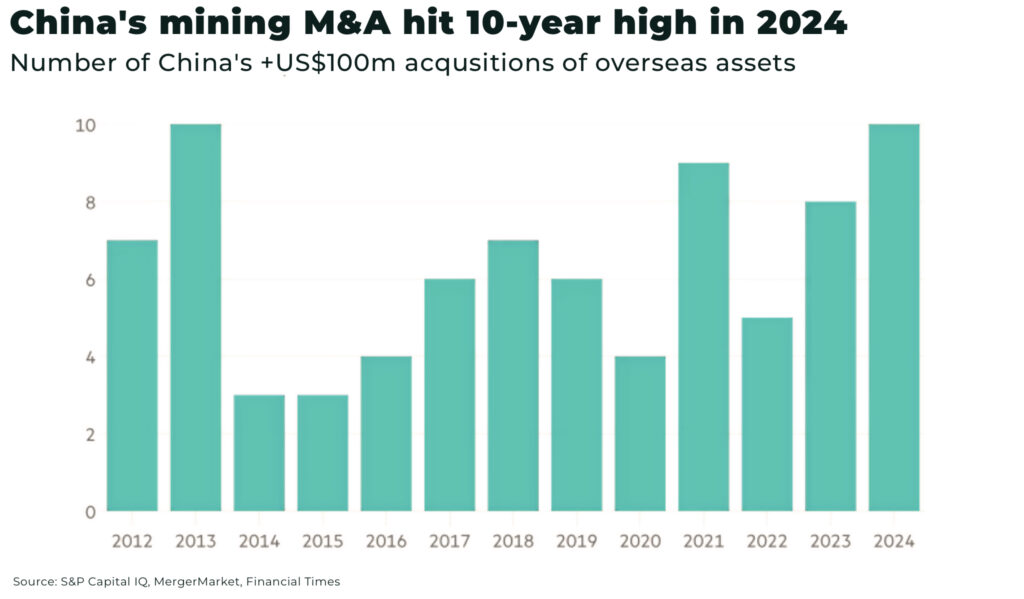

In 2024, Chinese mining firms completed ten major overseas acquisitions, each valued at more than US $100 million, marking their busiest year since 2013, according to analysis by S&P and Mergermarket data.

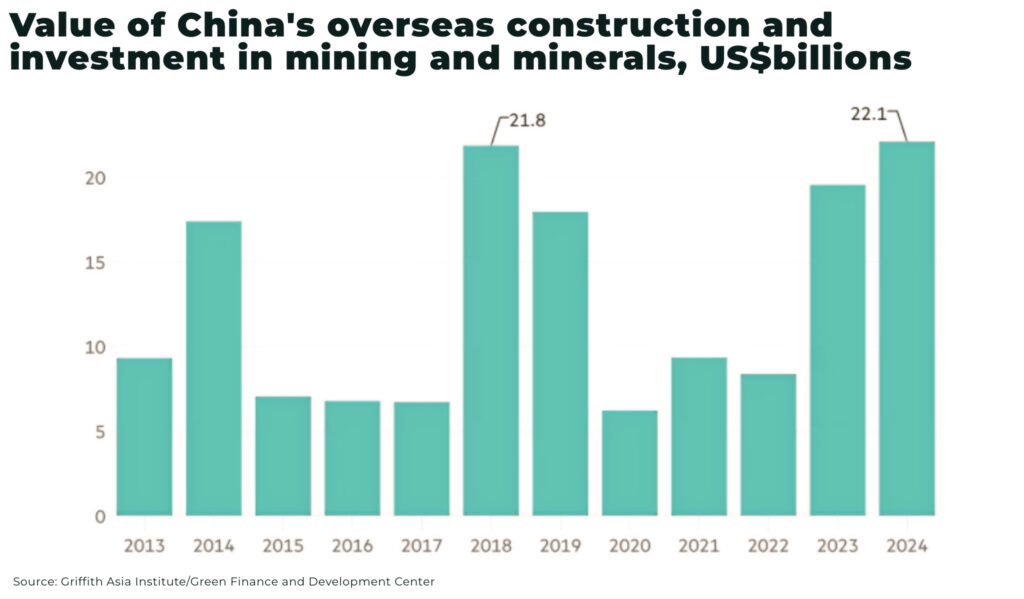

China’s overseas mining investment also hit highs in 2024, valued at US$22.1 billion, compared to the previous high of US$21.8 billion in 2018, according to research by the Griffith Asia Institute.

Michael Scherb, founder of private equity group Appian Capital Advisory, told the Financial Times there had been “more activity in the past 12 months because Chinese groups believe they have this near-term window . . . They’re trying to get a lot of M&A done before geopolitics get difficult.”

This surge reflects China’s strategy to secure critical mineral access for high‑tech and renewable energy industries, driving demand for lithium, cobalt, and rare earths, with firms like Zijin Mining and Baiyin Nonferrous Group closing significant deals in Kazakhstan and Brazil.

Despite mounting scrutiny and tighter restrictions in countries like Canada and Australia, Chinese companies are adopting riskier M&A strategies and tapping cheaper assets in the developing world. They’re also leveraging billions in Chinese-backed loans to support these moves. And in riskier regions, like Africa, some military governments (especially across the Sahel) are working to seize control of western mining assets and are demanding higher royalty payments from Chinese companies willing to pay.

The West is working to make moves to secure critical mineral supply chains, dominated across mining and refining by China, but efforts are struggling to keep up with China.