Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The US Department of Defense is investing US $400 million in convertible preferred stock in MP Materials, acquiring a roughly 15% diluted stake — placing the Pentagon at the center of the nation’s rare earth magnet supply chain strategy.

This investment is part of a broader, multibillion-dollar public-private partnership aimed at creating a fully integrated rare earth magnet supply chain in the US.

MP Materials currently runs the Mountain Pass mine in California and has begun producing NdPr metal at its Independence facility in Fort Worth, Texas. The new 10X Facility, expected to be online by 2028, will expand annual magnet output to around 10,000 t, covering production from extraction to finished magnets on domestic soil.

The Pentagon will also provide a US $150 million loan for heavy rare earth separation enhancements at Mountain Pass; additional construction financing is supported by a US $1 billion line of credit from JPMorgan and Goldman Sachs .

The agreement includes:

- a fixed price of US $110/kg for neodymium-praseodymium (NdPr) oxide and a 10-year offtake commitment ensuring that 100% of the output from MP’s proposed second magnet facility—the “10X Facility”—is purchased by defense and commercial users

- a warrant for additional common stock and grants Pentagon board observation rights—providing direct insight into MP’s strategic planning

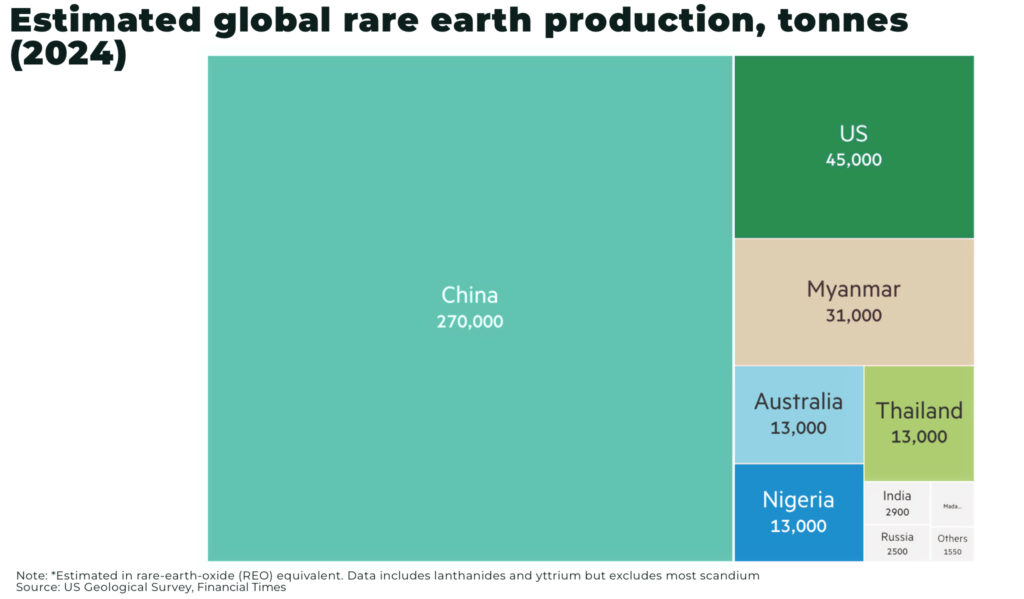

China currently dominates over 90% of NdFeB magnet production and 85% of rare earth oxide refining. In April 2025, China cut rare earth magnet exports by roughly 75%, citing “domestic industrial needs”.

In April 2025, China announced a series of rare earth export restrictions in response to the tariff war waged by Donald Trump’s administration — the move cames the day after US President Trump announced a combined total of 54% of imports from China. By June, exports of Chinese rare earth magnets dropped by roughly 75%, triggering supply shortfalls for automakers and defence suppliers.

This DoD-backed deal directly offsets that strategic vulnerability, ensuring price stability and supply security.

MP’s stock surged more than 50% following the announcement, reaching multi-year highs around US $45.50, reflecting investor recognition of the significance of this long-term support .

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.