Mark Selby and Steve Balch stood over a laptop, watching as their in-house algorithm applied to stitched together geophysical maps from Ontario and Quebec lit up twenty plus targets around their Crawford Project north of Timmins.

What they saw changed everything.

In 2019, Selby — now CEO of Canada Nickel (TSXV: CNC, OTCQX: CNIKF) — had almost dismissed the Crawford deposit north of Timmins, assuming it was another small, high-grade target hyped during prior nickel booms. But this was different.

Balch, Canada Nickel’s VP of Exploration and a seasoned geophysicist, had learned the “secret sauce” from other ultramafic nickel deposits, to interpret geophysical data and predict the scale and quality of these types of nickel deposits with 70–80% accuracy.

They blended datasets held by the Quebec and Ontario governments and their knowledge of the Crawford and Dumont projects. Nickel often forms in clusters, and they believed the key lay in connecting the data.

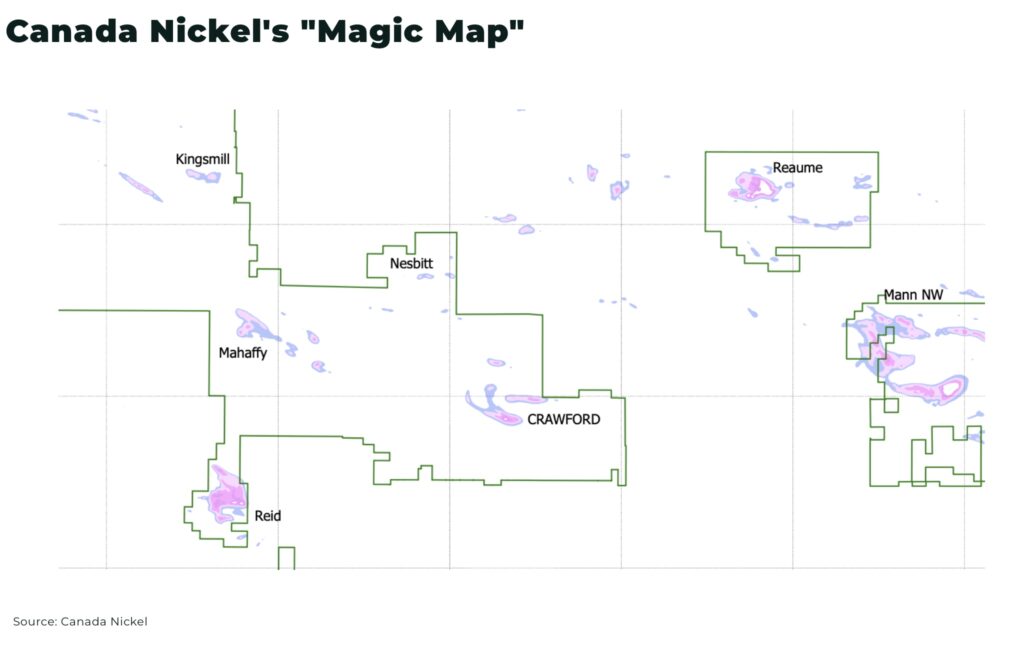

“We knit the geophysics maps together, tuning them to highlight magnetic anomalies that matched our existing projects—to create the ‘magic map’,” Mark Selby says.

Canada Nickel’s Timmins Nickel District now hosts six deposits containing 9.2 million tonnes of Measured & Indicated nickel and 9.5 million tonnes of Inferred nickel — almost 19 million tonnes of contained nickel — with three more projects expected by year-end. This puts the development on track to rival the scale of Sudbury.

This wasn’t guesswork. They meticulously cross-referenced these “magic map” findings with historical drilling records available through Ontario and Quebec’s public claim maintenance system. Some of these targets had been drilled in the 1940s–60s by companies like Inco putting in one or two holes looking for high grade nickel or other firms who drilled but never assayed for nickel.

The “magic map” was first successfully tested with nearby MacDiarmid and Nesbitt targets and then hit it out of the park with the Reid discovery — now one of Canada Nickel’s most promising assets with larger potential than the Company’s flagship project —hitting nickel in all of the first 16 drill holes using only the “magic map” as a guide.

The entire, sprawling acquisition of these 20-plus targets — spanning 42 square kilometres, 25 times the size of Crawford’s original geophysical footprint — unfolded discreetly during the COVID-19 pandemic. For 18 months, Canada Nickel worked behind the scenes, consolidating land through 35 to 40 deals with prospectors, estates, and other mining companies before publicly announcing their ambition.

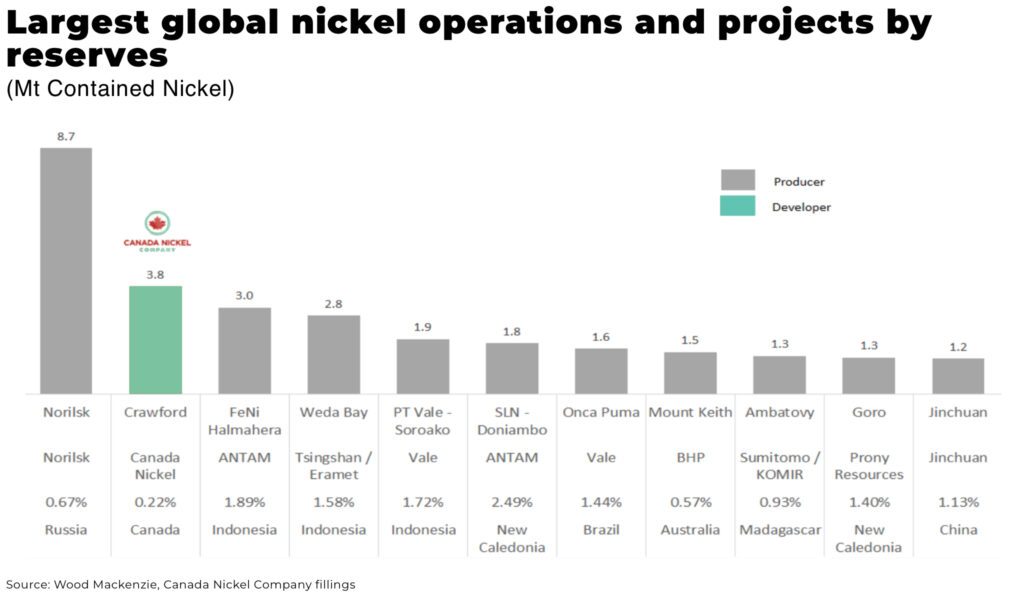

This strategic discovery positions Canada Nickel as a formidable player, boasting the largest nickel resource in North America and on track to make the Timmins Nickel District the world’s largest nickel sulphide district

And just in time.

Since the Voisey’s Bay discovery in 1993, there hasn’t been another major high-grade nickel sulphide discovery of comparable scaleanywhere globally. This absence has created a significant gap in the development pipeline for nickel supply.

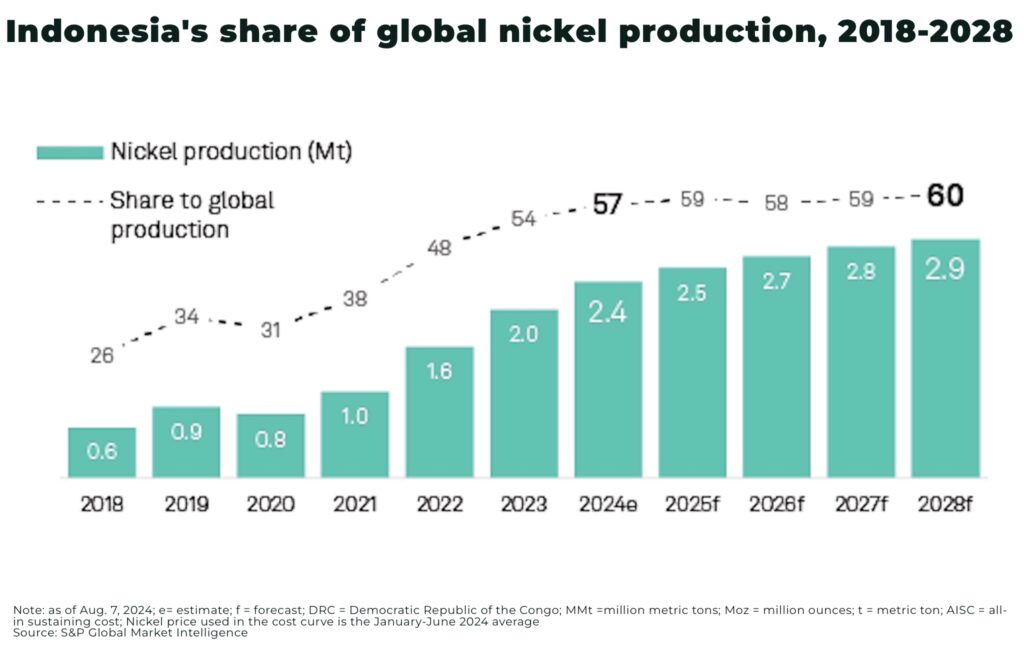

This has been offset by the massive ramp up of supply from Indonesia — approx 60% of global supply in 2024 — but continued strong demand from historic uses in stainless steel, and alloys for aerospace, defense, etc.) with new demand from electric batteries (50% of batteries produced in 2023 using high-nickel chemistries) and has meant significant volatility in the market.

Despite a two-year correction from a sharp spike in 2022 after Russia invaded Ukraine and a major short squeeze occurred, prices are still trading approximately double their 2016 levels.

And there are signs the market is tightening again with electric battery demand rising and ore grades falling in Indonesia and the country looking to maximise value by limiting supply and raising prices with domestic ore prices close to two-year highs.

Geopolitics is also intruding urgently as governments across the West look to diversify and secure supply from Indonesia (where Chinese companies control approx 75% of Indonesia’s nickel refining capacity).

Canada, with its established mining infrastructure and skilled workforce is emerging as a strategic supplier of choice as governments across the West urgently look to diversify and secure supply away from Chinese-controlled supply in China & Indonesia.

The Crawford Project is located in north of Timmins, Ontario, with good infrastructure links — and it also recognised as one of Ontario’s five critical minerals priority and nation-building projects. This recognition is expected to help leverage further funding from the government, particularly from the new CAD$500 million Critical Minerals Processing Fund created by the province.

Canada Nickel has recently raised CAD$19.4 million in aggregate gross proceeds from private placements in 2025, as well as securing investments from prominent players, including Agnico Eagle (10.4% stake), Samsung SDI (7.5% stake), Anglo American (6.5% stake), and the Taykwa Tagamou Nation (7.4% on conversion). Notably, the CAD$20 million investment from Ontario’s Taykwa Tagamou Nation is believed to be the largest ever by a First Nations group into a critical minerals mining company, signifying strong local support.

The Crawford Poject is advancing at a “near modern-day record pace” according to Mark Selby, with expectations the company will receive its key federal permit by the end of 2025.

Selby and Balch’s “magic map” showed where X marks the spot. Now it’s time to dig up the treasure.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.