Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

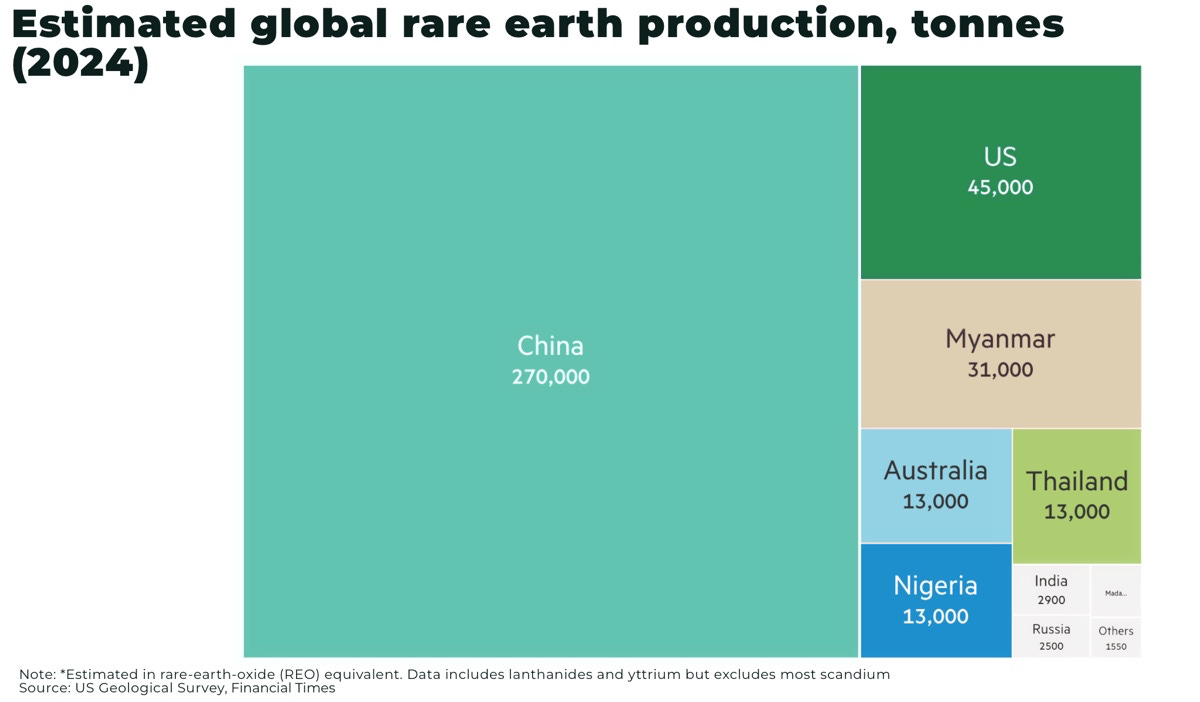

- China’s leverage: China provided 70% of global rare-earth mine output in 2024 and nearly 90% of processing capacity; US net import reliance was 80% in 2024

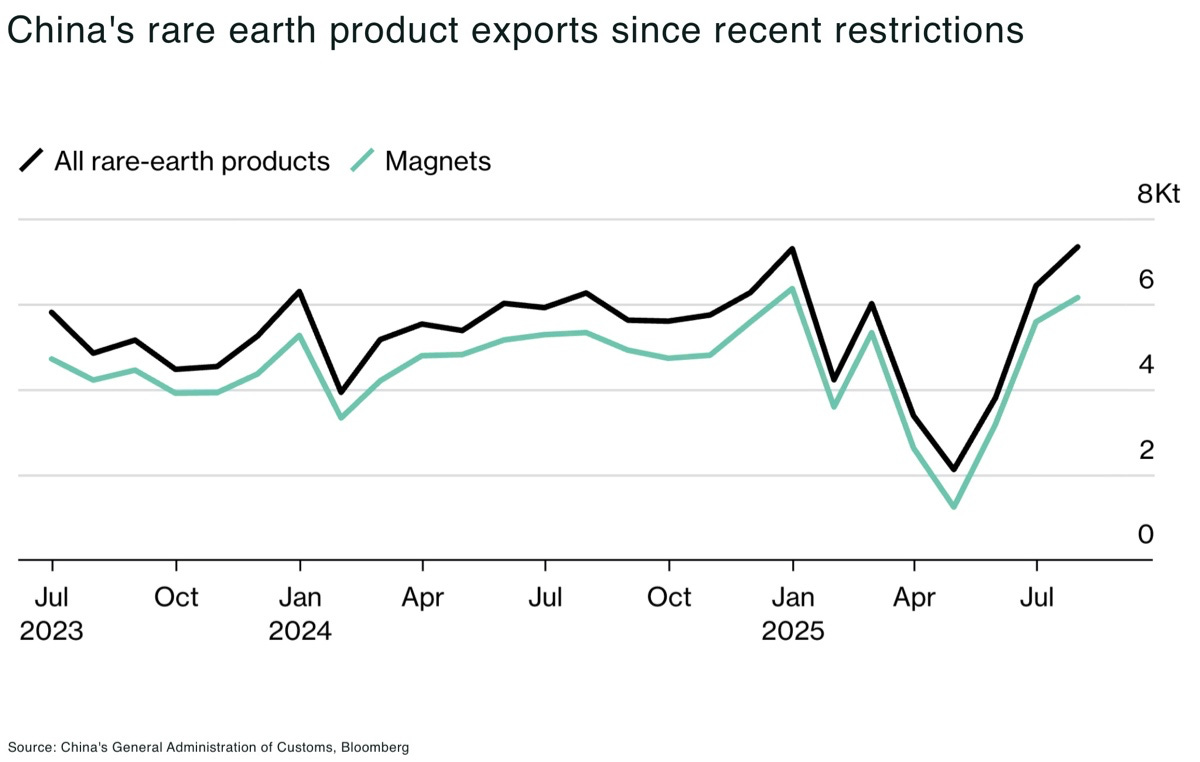

- Export controls: after Beijing tightened controls in 2025, China’s overseas magnet shipments fell 74% YoY in May; monthly exports hit the lowest since 2020

- Warp Speed 2.0: Washington has introduced price floors, equity stakes, and strategic stockpiles, to secure supply

US Treasury Scott Bessent has pledged to break China’s stranglehold over global rare earth supply with the equivalent of an “Operation Warp Speed.”

“We are going to go at warp speed over the next 1-2 years, and we are going to get out from under this [rare earth] sword the Chinese have over us, and they have it over the whole world” — US Treasury Scott Bessent told CNN.

Why the urgency?

- China controls an estimated 70% of global rare earth production and 90% of processing capacity

- then, in April 2025, China tightened export controls over rare earths and magnet exports — and exports of Chinese rare earth magnets dropped by roughly 75%

- the restrictions forced some automakers in the US and EU to shutdown production, with similar impact across aerospace, semiconductor and military industries.

“It’s day to day,” Jim Farley, Ford Motors CEO, told Bloomberg News in June. “We have had to shut down factories. It’s hand-to-mouth right now”

The “light is turning from yellow to red” a senior defense industry source told The Telegraph, concerning American companies’ ability to source rare earths

As part of the latest US-China trade deal, the White House has announced that China will suspend “current and proposed” export controls on rare earth metals for at least a year, giving the America some breathing space to try and secure rare earth supply chains.

“China has alerted everyone to the danger. They’ve made a real mistake,” US Treasury Scott Bessent told the Financial Times. “It’s one thing to put the gun on the table. It’s another thing to fire shots in the air.”

But, it took China decades to secure and scale rare earth mining and processing — can the US do it in only a few years?

Why rare earths are so important?

Rare earth elements are made up of seventeen metals, including neodymium, praseodymium, terbium, and dysprosium. They are essential in manufacturing permanent magnets essential to, for example, electric vehicle motors, cancer diagnosis, wind turbines, guided missile systems, and military fighter jets.

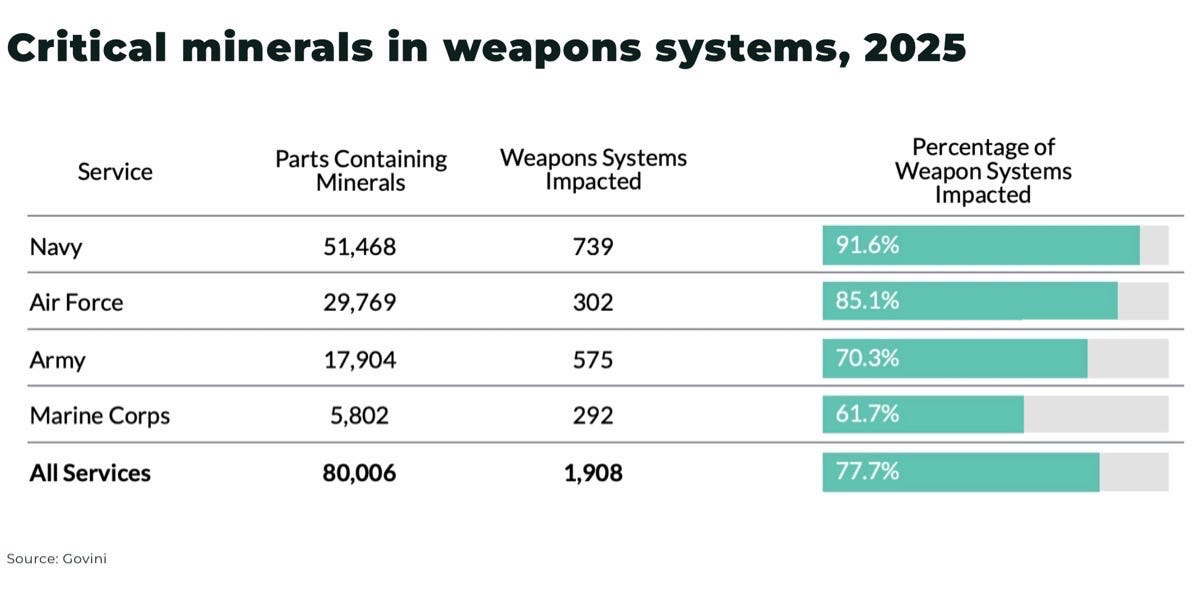

For example, the US Department of Defense relies on Chinese supply chains for components used in 1,900 weapon systems, encompassing over 80,000 individual parts — threatening 78% of US military weapon systems, according to a recent report from Govini.

The cost (both financially and environmentally) to mine and process rare earths has meant the West has largely ceded a supply chain monopoly to China. With over 90% of global processing capacity, Beijing controls the chokepoint of the supply chain, and with it, major geopolitical leverage as trade tensions escalate.

For the West, rare earths as just tradable commodities, they are national security assets.

Demand outlook: the wall of magnets

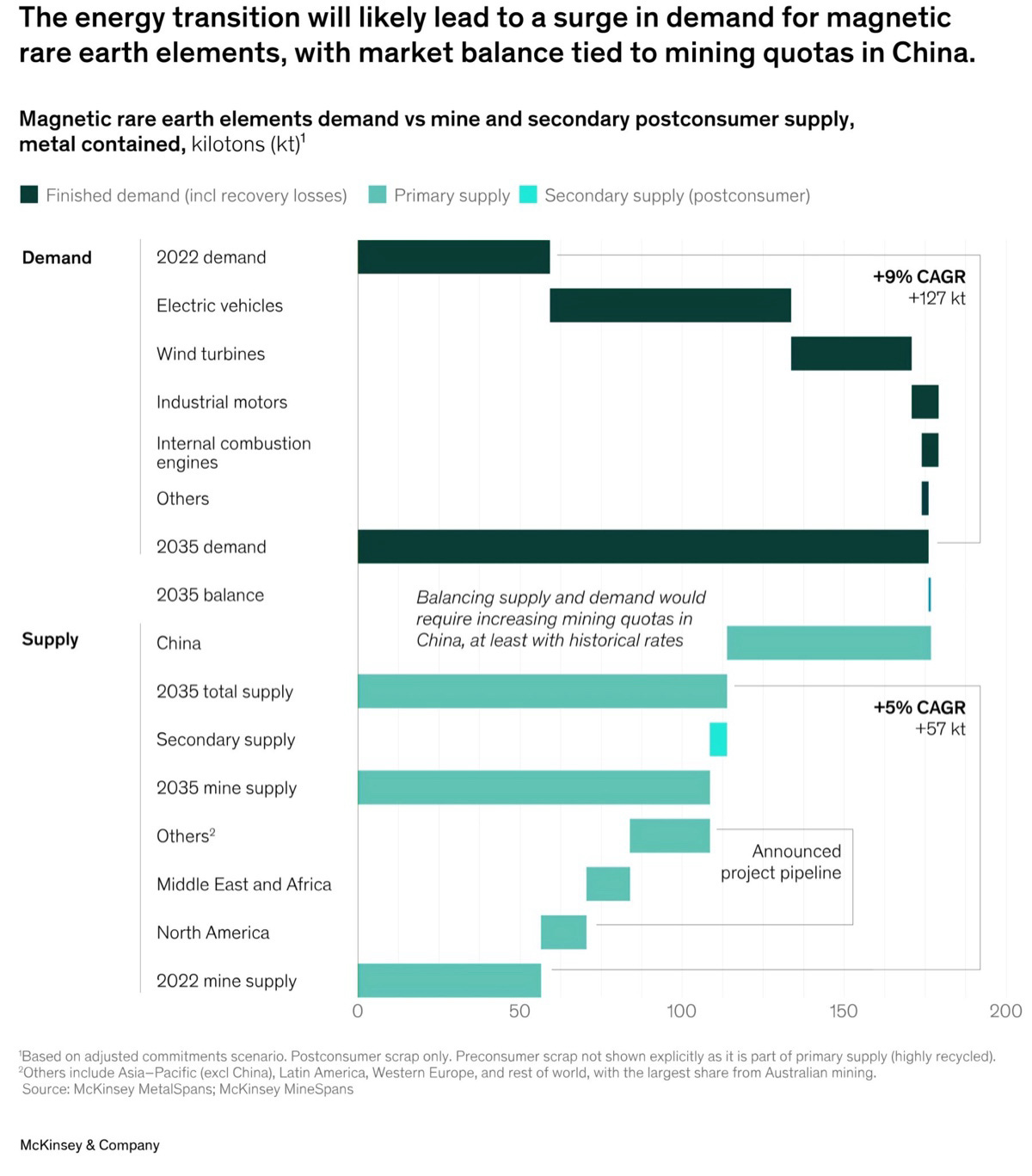

Multiple independent forecasters see magnet rare earth demand rising steeply into the 2030s:

- Adamas’ Intelligence forecasts that global demand for NdFeB magnets will increase five-fold by 2040, from US$7.8 billion in 2024 to US$44.1 billion by 2040 growth, driven by robotics, advanced air mobility and electric vehicle sectors

- a new report by McKinsey, expects demand for rare earth elements to triple from 59 kilotons (kt) in 2022 to 176 kt in 2035, driven by strong growth in electric vehicle adoption

The challenge for the US isn’t just breaking China’s monopoly today, it’s scaling fast enough to meet the surge in demand coming through the next decades.

Trump’s “Warp Speed 2.0” playbook

The Trump administraction’s strategy to break China’s rare earth leverage rests on five core pillars:

- public-private partnerships: the US government became the largest shareholder in MP Materials (investing US $400 million in convertible preferred stock in MP Materials, acquiring a roughly 15% diluted stake) in 2025, with more deals expected

- price floors / new pricing system: the US (and allies, such as Australia) are planning price floors and “forward-buying” to counter China’s use of below-cost exports to control global supply chains.

For example, the equity stake agreement with MP Materials, backs an independent pricing mechanism and guaranteed a minimum price of US$110/kg for NdPr to support domestic projects, explicitly to counter Chinese undercutting - strategic stockpiles: the US is preparing to purchase US$1 billion worth of critical minerals to build a national stockpile, prioritizing NdPr oxide, NdFeB magnet block, and Sm-Co alloy to potential FY2024–25 acquisitions

- permitting: Trump’s executive order to “Increase American Mineral Production“ is part of a trend across America at federal and state level to accelerate permitting processes forseparation and magnet plants, pairing grants/loans with equity to de-risk timelines.

So, for example, Ramaco Resources announced in July 2025, that its Brook Mine has secured a second five-year mining permit from Wyoming regulators, completing all required approvals — making it the first rare earth mine to open in the US in 70 years - international deals: the Trump administration has agreed a series of partnerships across Japan, Malaysia and Australia to co-fund and build out mining, separation, metals, and magnet capacity in a pivot from China to other partners in Asia.

For example, in Malaysia, Lynas — the largest non-Chinese supplier — will build a new US$142 heavy rare earth plant in the country, in partnership with South Korea. Processing will include samarium, gadolinium, dysprosium, terbium, yttrium, and lutetium, will follow within two years, while the production of additional HREs such as europium, holmium, ytterbium, and erbium will be considered subject to commercial returns

This is no longer a laissez-faire approach by the US state to support rare earth production, similar to what we’ve seen over the past decade despite repeated warnings, and instead it’s a wide-spread intervention to bridge the scale and cost challenges in taking on China.

Global coordination: from communiqués to term sheets

And it’s not just the US.

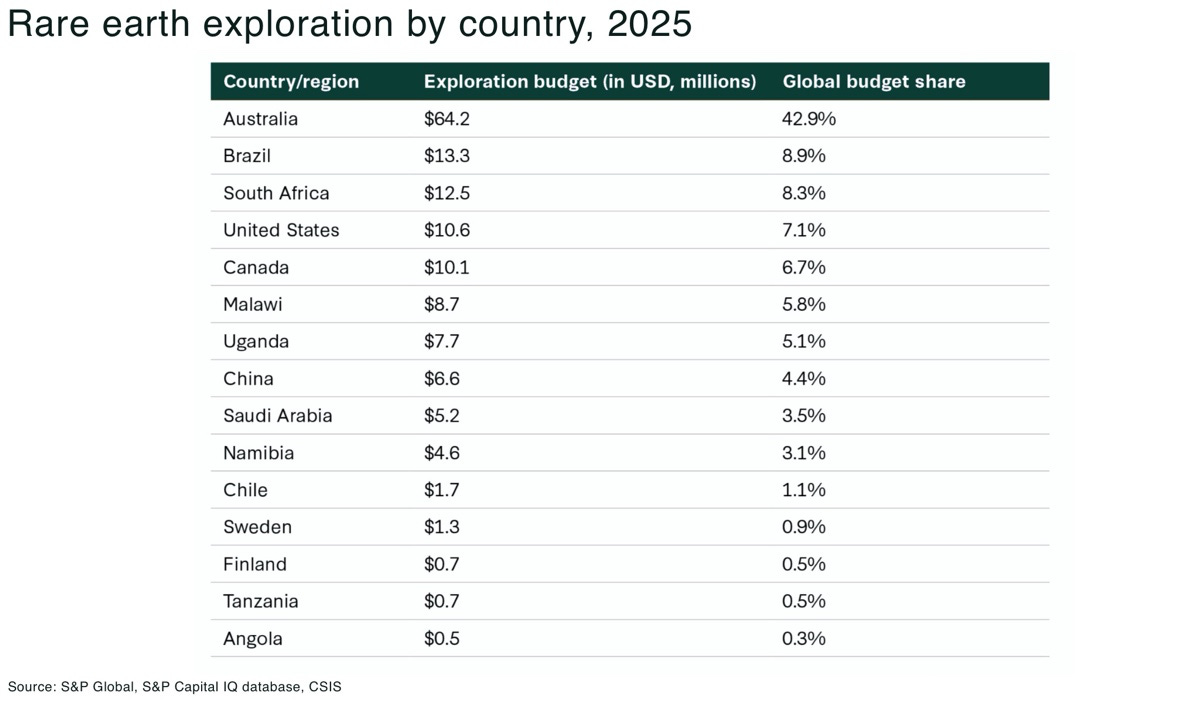

A G7 meeting of energy and environment ministers in Canada, will focus on financing tools, offtake contracts with floor pricing, and stockpiling to underwrite non-Chinese supply; Canada has pledged US$4.6 billion to accelerate critical mineral projects, including rare earths; Australia is considering price floors and offering financial lifelines to processing companies; in Brazil, the US-led Minerals Security Partnership backed Brazil’s Serra Verde rare earths project as the only mine outside Asia currently producing both light and heavy rare earths in 2024; the EU Critical Raw Materials Act set 2030 benchmarks to extract 10%, process 40%, and recycle 25% of EU needs.

Africa, in particular Namibia, is also emerging as one of the most strategically important regions for new supply. Namibia hosts high-grade monazite-type rare earth deposits, including the key magnet elements NdPr, and offers a stable democracy, mining-friendly policies, and growing Western investment interest.

Several rare earth assets are already moving through development with an eye on supplying US, EU and Japan processing hubs including:

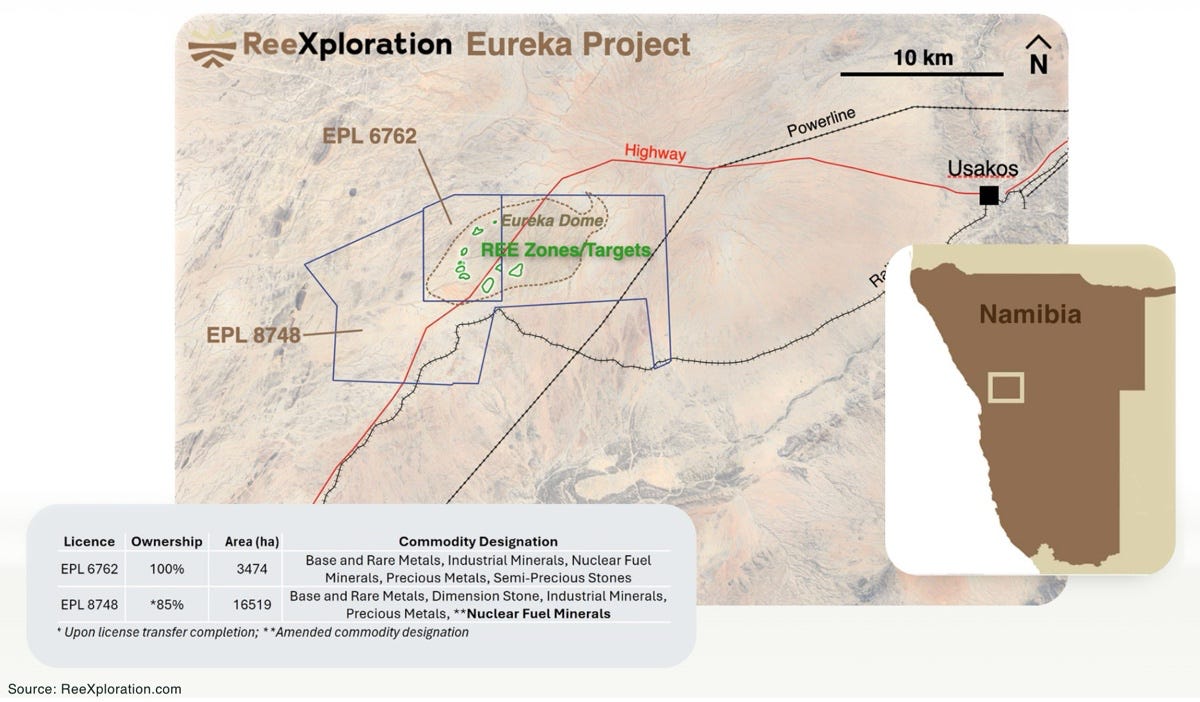

ReeXploration Inc — emerging rare earth and uranium supply from Namibia

ReeXploration Inc (TSX-V: REE | FSE: K2i)is owner of the Eureka Rare Earths Project in Namibia, one of the most advanced opportunities in the region. Eureka is a monazite-dominant, NdPr-rich deposit targeting magnet-grade material for Western demand growth in one of Africa’s most established and mining-friendly jurisdictions.

Project highlights:

- stablished resource base: A maiden NI 43-101 mineral resource of 310,000 tonnes at 4.8% TREO including 0.7% Nd+Pr oxides from 19 drill holes and 613 m of drilling across Zones 1–3

- favourable mineralogy & low impurities: Mineralization is monazite-hosted in carbonatite – recognised as a favorable feedstock for Western processing due to low impurities and lower radioactivity burdens. Initial metallurgical test-work produced ~59% TREO concentrate at ~65% recovery and very low Th/U (~0.45% Th, ~0.01% U) – aiding permitting and cost

- district-scale upside: The Eureka Dome covers ~13 × 6 km. Exploration to date (soil sampling, trenching, geophysics, drilling) shows shallow, high-quality REE mineralisation and multiple step-out targets

And it’s not just a rare earth play. The company has announced it’s also identified a large-scale uranium target at its Eureka Project. Airborne data defines a 6.5 x 3.5 km zone characterized by high uranium and low thorium responses. The trend lies in the same structural corridor — Namibia’s “Alaskite Alley” — that hosts major uranium deposits, including Rössing, Husab, Etango, Omaholo, and Norasa, which collectively contain more than 1 billion pounds of U₃O₈.

ReeXploration Inc stands out as a leveraged play on both the global rare-earth supply-chain re-orientation and rising uranium demand for the record nuclear energy build out. While major players focus on North America, Australia and Europe, Eureka offers emerging supply from Africa, which adds diversification and jurisdictional balance to the Western strategy.

Can “Warp Speed 2.0” work?

A rare earth supply chain outside China faces a series of obstacles:

- high capex

- technical expertise

- environmental regulations

- price volatility

And it has been done before — in Japan. In 2010, after China implemented an export ban on rare earths against Japan following a territorial dispute, the country worked to diversify and secure its supply chains. The strategy included investing in mines and processing in Australia — notably Lynas — as well as stockpiling, recycling and promoting alternative technologies. As a result, Japan’s dependence on Chinese rare earths fell to 60% from 2023 from more than 90% in 2010.

The latest US and allied measures — on paper — take the major challenges head on, from direct public investment in mining and processing companies, price floors and offtake certainty, permitting acceleration and policy architecture in place.

Speed and scale remain critical; the one-year China pause is tight and risks remain, including execution lag on permits, development fragmentation, and China will not be standing still.

Conclusion

“Warp Speed 2.0” is the first coherent Western plan to break China’s rare-earth mining and processing grip where it matters — investment and pricing support — which changes the financing math for non-Chinese projects.

Time is now the real enemy.

The one-year export restriction pause from Beijing buys the US room to manoeuvre and, critically, it also keeps the pressure on the US to maintain urgency in the development of the secure rare earth supply chains.

To break the global scale of China’s rare earth stranglehold will take longer than 12 months, but the US has finally hit the “panic” button and at warp speed, there’s no turning back.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.