A record rally fueled by supply squeeze and safe-haven demand

- silver’s record surge: the price of silver more than doubled in 2025, rallying 120%

- supply deficit: silver demand reached 1.17 billion ounces in 2024, outpacing mine supply by a staggering 500 million ounces; 2025 marks the fifth straight year of shortage, with another shortfall expected in 2026

- energy transition tailwind: silver’s role in tech is soaring, from data centers to solar panels; the IEA sees solar capacity quadrupling by 2030

The price of silver broke all records in 2025, and by December surged above US$65 an ounce — up more than 120% in January, beating even gold’s meteoric rise of 64% over the same period.

There’s significant upward momentum across nearly all metals and commodities—a trend we’ve been forecasting for years. While we typically avoid prediction pieces, silver currently sits at the intersection of several highly favorable market conditions.

To put it simply, like so many of the critical minerals we cover, it is in a supply deficit, with soaring demand, fragile supply chains and impacted by the debasement trade. But, what really sets silver apart, unlike so many other critical minerals we cover: silver is both an industrial and precious metal.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Industrial demand

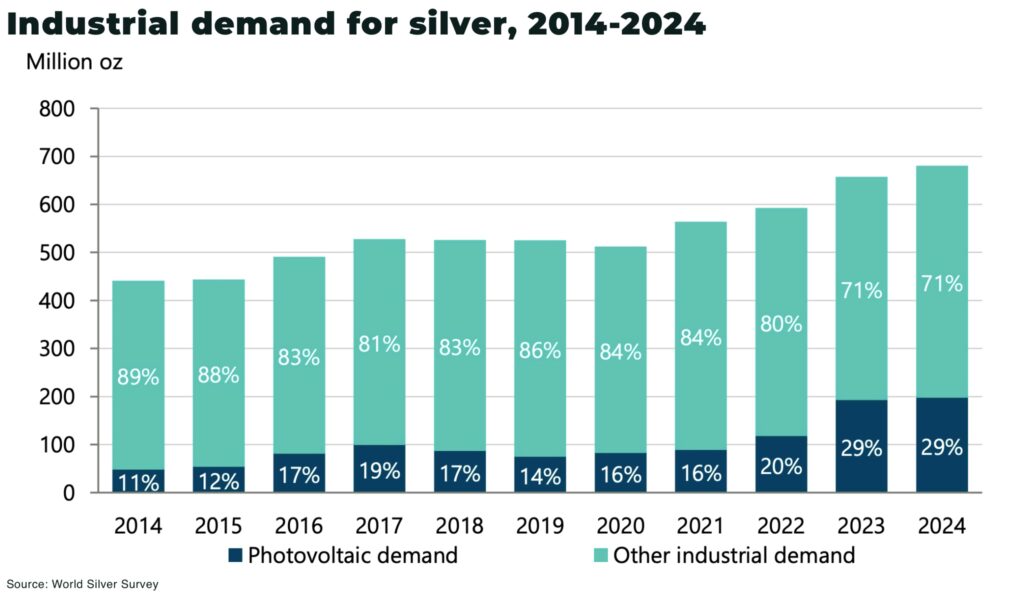

Industrial demand accounts for more than half of all silver demand, and it has been relentless despite recent economic headwinds. In 2024, global industrial silver consumption jumped to 689.1 million ounces – a record high. The three big drivers include:

- photovoltaic demand (solar panels)

- electric vehicles

- data centers and AI

The reason: silver has the highest electrical conductivity of any metal.

In 2025, the US added silver to its critical minerals list, a clear acknowledgment that the metal is no longer just monetary or industrial, but strategically essential to clean energy systems and high-tech manufacturing, on par with rare earths and other battery metals.

Solar photovoltaics

Installed photovoltaic (PV) capacity has increased more than x10 since 2013, led by China (51% of growth), Europe (15%), and the USA (9%) — and silver demand in PVs has risen nearly x4.

And the IEA forecasts solar PV capacity will expand by 3,200–4,400 GW by 2030.

Electric Vehicles

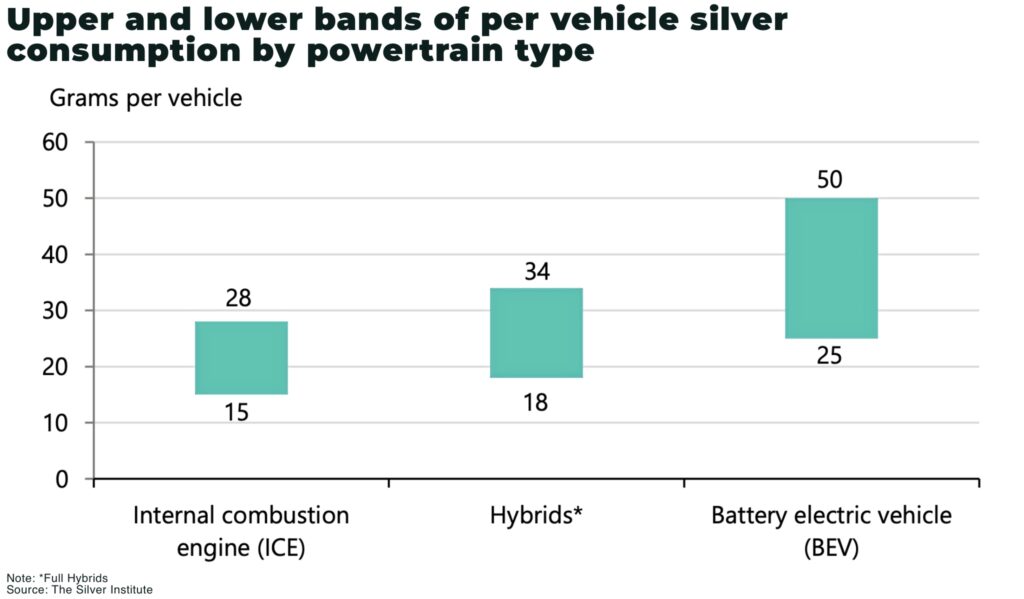

EVs, especially battery electric vehicles (BEVs), consume on average 67-79% more silver than internal combustion engines (ICE).

The Silver Institute estimates silver demand by the automotive industry will increase at 3.4% CAGR between 2025-2031, with demand from EVs overtaking ICE by 2027 — and the growing technological sophistication of EVs set to boost demand further.

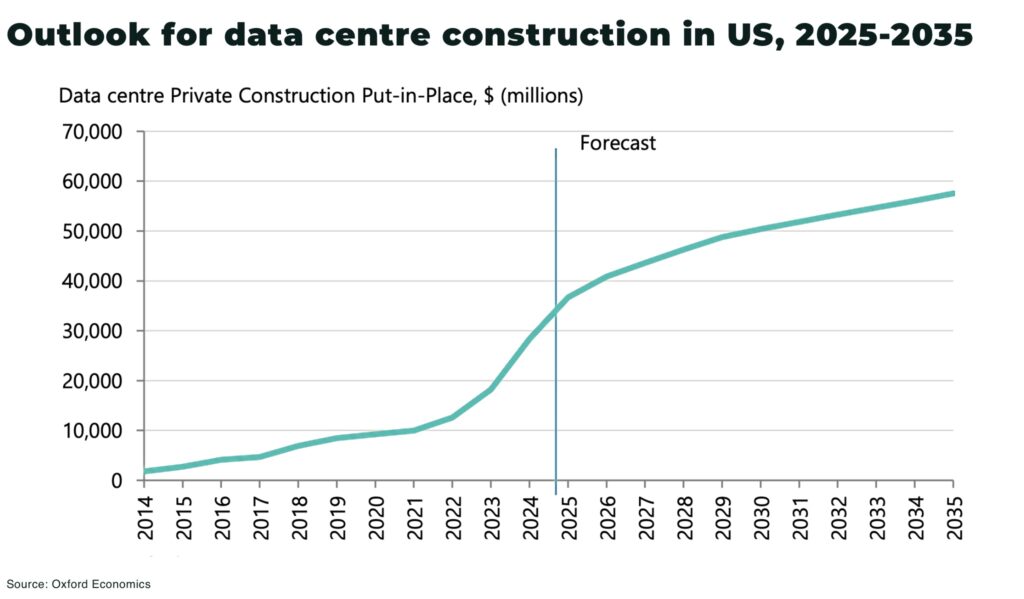

Data Centers

Due to its conductivity properties, silver is essential for a range of technologies across the Artificial Intelligence boom (see our report, Artificial Intelligence and the next Critical Mineral Supercycle), including:

- AI servers and switches: for example, silver is used in multi-layer ceramic capacitors (MLCCs) that are essential for high-power components in advanced servers and switches

- electronic components: for example, silver is used in silver-palladium (Ag-Pd) MLCCs, which are crucial for high-frequency and high-speed data transmission in AI devices

- circuit boards and bonding wires: for example, silver is also used in printed circuit boards (PCBs) and as bonding wire in chip and memory packages; these applications are vital for the efficient functioning of AI hardware

Supply crisis

Just as demand is rising, so supply is tightening. Heading into 2026, the silver market is grappling with one of its longest-running shortages in modern history.

Silver mine output peaked in 2016 with total global mine production approx 900 Moz, and falling to an estimated 835 Moz in 2025.

2025 will see the fifth successive silver deficit, estimated at 95Moz. For 2021-25, this results in a cumulative deficit of almost 820Moz.

The decline in supply is due to a variety of issues, including, short-term, operation disruptions to regulatory challenges in key producing countries; but, long-term, ore grades have fallen at many mature operations with closures across major producers in Mexico, India, Russia, Bolivia, Kazakhstan, and Peru.

There are two principal ways silver is mined, each putting their own specific constraints on supply:

- approximately 71% of mined silver supply comes as a byproduct from polymetallic gold, lead, zinc and copper mines. This means higher silver prices do not necessarily translate to higher production, though they may incentivize more scrap generation and liquidation of investment positions

- approximately 29% comes from primary producers, but all-in sustaining costs(AISC) increased by 25% year-on-year as costs rose with interest rates and inflation

There has been a long stretch of under-investment in exploration and new projects, and new mines can take an estimated 18 years to build.

Silver and the debasement trade

The return of inflation and the US Federal Reserve’s pivot from tightening to rate cuts have supported a rush into precious metals — the so-called debasement trade.

Gold’s rise above US$4,300/oz in 2025 has grabbed the headlines, signaling deepening investor anxiety over currency debasement and geopolitical strife, but it’s silver — traditionally the high-beta “poor man’s gold” — that caught gold’s slipstream, but then outpaced it.

A weaker dollar and lowering of interest rates by the Federal Reserve turbocharged the rally, attracting a wave of speculative and safe-haven money into precious metals. So much so, that precious metals (and other hard commodities) are competing with crypto and bitcoin in a great rotation and flight to safety.

Geopolitics

Investors seek safety in time of crisis and we have war in Ukraine, an armarda threatening war off the coast of Venezuela, a deepening US-China trade war (with export restrictions on semiconductors and rare earths), the collapse of governments across the Sahel, and much more.

Monetary policy

Investors are also faced with the prospect of central banks loosening monetary policy even as government debts balloon, driving the debasement trade as investors seen safety in hard assets.

In particular, as we’ve flagged with gold, this is not just a dollar trade. China’s currency depreciation is also supporting a higher price of many precious metals — as we’ve flagged in our previous analysis, especially so with gold, but also with silver. The renminbi’s real effective exchange rate has fallen by nearly 20% since early 2022, increasing the appeal of precious metals as a store of value and contributing to upward pressure on prices.

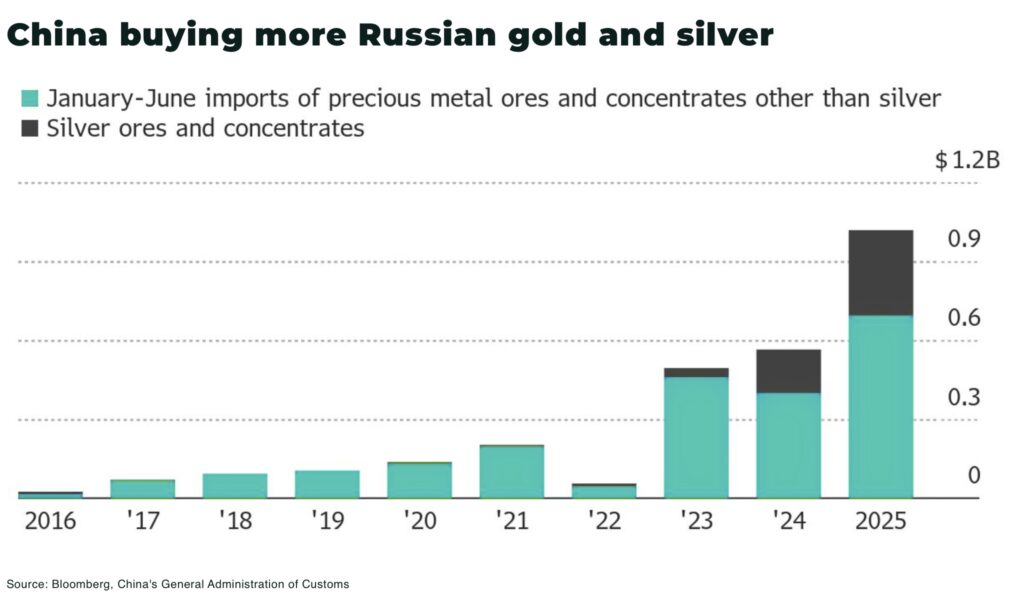

China is importing more silver for it’s booming solar industry, but also as a hedge against eroding confidence in local‑currency savings.

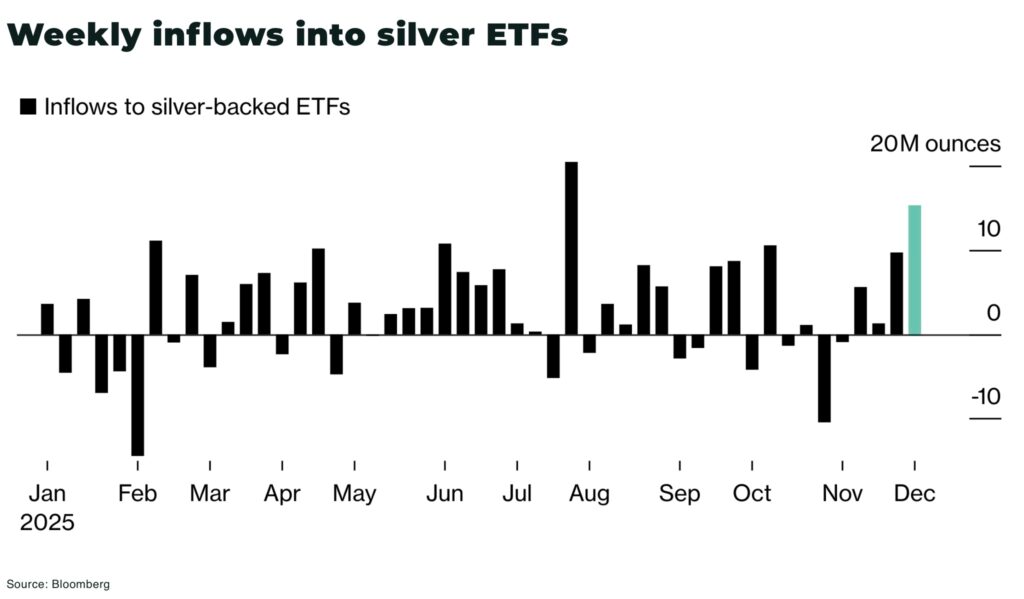

Inflows into silver-backed ETFs investors increased 40% in 2025.

Physical buying of silver has also surged, with reports of US and European mints struggling to keep up with demand of coin and bar demand:

- in the US, between 2010-2024, purchases reached a “staggering” combined total of 1.5bn oz (46,160t) was purchased by retail investors

- in India, cumulative Indian bar and coin demand stood at 840Moz (26,100t)

- German physical silver investment averaged an “eye-watering” 48.5Moz (1,510t) during 2020-22

- by 2022, Australia’s physical retail demand had surged to a record high of 20.7Moz (644t)

Silver squeeze on inventories

Physical inventories of silver are dwindling at major trading hubs. By 2025, in Shanghai, exchange stocks fell to their lowest levels since 2015. London’s vaults (a key vaulting center for ETFs and industrial users) also saw notable drawdowns as metal flowed to India and Asia.

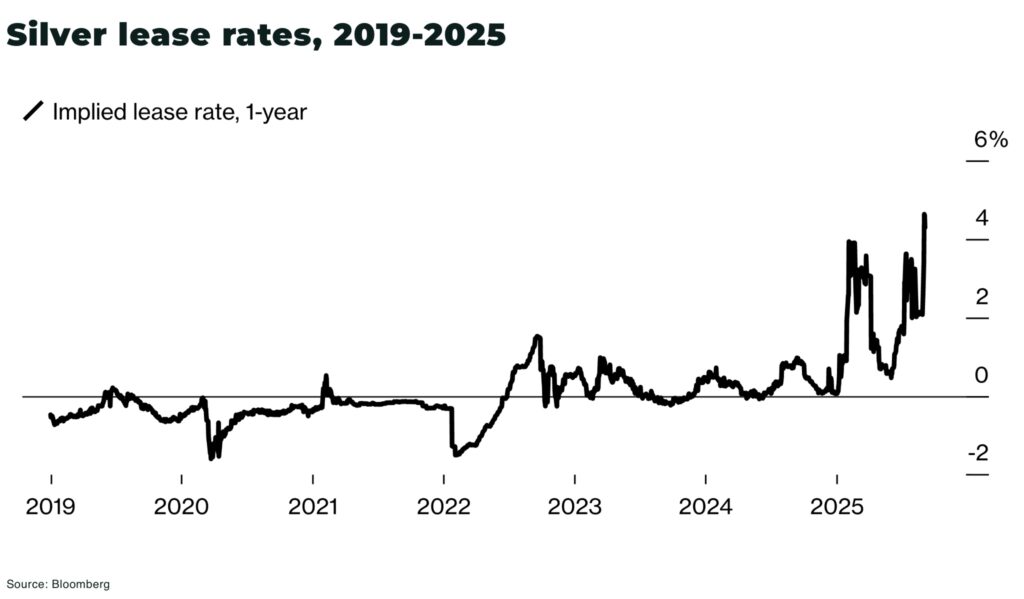

These inventory drops have real consequences: lease rates for silver spiked above 5% in September, for the fifth time this year, well above historical levels of near-zero — signs that holders of physical bullion are demanding a premium. Such tightness in supply-chain pipelines underscores that this rally isn’t just paper speculation; it reflects genuine scarcity in available metal.

Can silver reach $150

With silver now in uncharted territory price-wise, the natural question for investors is: how much higher can this go?

Many mainstream forecasters see further significant upside in 2026, though typically in the $60–$80 range. For example:

- Citigroup predicts silver will “continue to outperform gold” and could reach the high-$70s in 2026

- Bank of America recently raised its 12-month silver target to US$65

- Metals Focus forecasts silver to average US$57 next year, and even take a run at the US$60 level laer in 2026

Breaking US$100 in the next few yearts — a level once dismissed as fantastical — is now openly discussed. To take a few examples:

“I think that silver will be over US$100” — Frank Holmes, of US Global Investors, told INN.

And he’s not alone, with Philippe Gijsels, chief strategy officer at BNP Paribas Fortis, told CNBC, that he “would not be surprised to see silver well north of US$100 in the not-too-distant-future”; veteran technical analyst Michael Oliver has suggested a scenario of US$100-US$200 silver by early 2026.

And, of course, there are plenty of other even high views expressed if you search (!)

These bullish forecasts are rooted in the idea that the forces at play (supply tightness, industrial need, monetary turmoil) are not only persisting but potentially intensifying. And, in previous precious metal bull markets (eg 2008-2011, when the silver price increased 431%), silver demonstrated the ability to significantly overshoot.

Today’s backdrop of structural deficit and monetary risk arguably rivals that period, giving silver bulls confidence that triple-digit prices are attainable if long-term currency debasement and equity market weakness spark an even larger rotation into hard assets.

Conclusion

“Run it hot” has become the market meme of 2025.

Hard assets, but especially silver that sits between industrial and precious metal demand, are the pressure release valve — but getting to US$100 or even US$200 would require more than incremental demand growth.

Solar, data centres and electrification are not the trigger. They are the new floor. These forces underpin silver structurally; they are unlikely to create price shocks.

A true break to triple-digit prices of silver would require a major event. This could come from a sudden supply shock (for example, production or export disruption in a top silver producer such as Mexico), or from a macro financial event, such as a currency crisis or a sharp shift in global interest-rate expectations.

Note: the risk cuts both ways. Silver’s leverage amplifies upside, but it also magnifies reversals. A sudden hawkish turn by the Fed, a tightening of financial conditions, or a collapse in speculative positioning would hit silver hard and fast. And the current rally suggests retail and leverage are pushing the market harder and faster than fundamentals suggest.

Silver’s setup is structurally bullish and, if 2025 is the trend, then silver is in for a wild ride over the next few years.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.