Critical Minerals and Energy Intelligence

Gold and Silver

The price of precious metals, gold and silver, are pushing historic highs.

Demand is driven by their traditional use as a hedge against geopolitical and economic risk, tightening supply as exploration budgets stagnate, opening up of jewelry markets in Asia, and increasingly used as a critical metals in the energy transition.

But risks remain, especially as price rises and falls in both gold and silver are strongly correlated to interest rates and the price of the dollar.

Gold and Silver Insights

Latest News

What are gold and silver?

Gold and silver are the world’s most recognized precious metals, valued for their rarity, durability, and unique physical properties. Gold (atomic number 79) is a dense, malleable, and corrosion-resistant metal with a distinct yellow luster, prized for millennia as a store of value, currency, and adornment. Silver (atomic number 47) is a brilliant white metal, renowned for its exceptional electrical and thermal conductivity, making it indispensable in both monetary and industrial contexts.

Both metals are extracted through open-pit and underground mining, followed by refining processes that achieve high purity levels. Their finite supply, combined with diverse demand sources, underpins their enduring strategic and economic significance.

Why gold and silver matter: strategic applications

Gold: safe-haven and industrial uses

-

safe-haven asset: gold is the premier hedge against inflation, currency devaluation, and geopolitical uncertainty, held by central banks and investors worldwide

-

jewelry and reserves: yhe majority of gold demand comes from jewelry and official reserves, with central banks purchasing a record 1,037 metric tons in 2024

-

technology: gold’s conductivity and biocompatibility support its use in electronics, dentistry, and space technology

Silver: dual role as precious and industrial metal

-

monetary and investment asset: silver’s historic role as currency and store of value continues, often tracking gold’s price movements

-

industrial demand: over 50% of silver demand is industrial, with major uses in solar panels (20% of global supply), electronics, electric vehicles, 5G infrastructure, and medical devices

-

green technologies: silver’s role in renewable energy and advanced electronics is expanding, positioning it as a key metal for the clean energy transition

Supply and demand dynamics

Gold

-

supply: gold supply is constrained by the complexity and cost of mining, with new discoveries rare and mine development requiring significant capital and time

-

demand: demand surges during periods of economic uncertainty, inflation, or geopolitical instability, driving prices to new highs—reaching $3,247.33/oz in April 2025

-

central bank buying: central banks have become major buyers, supporting long-term price stability and reinforcing gold’s strategic role

Silver

-

supply: silver supply remains tight, with only 313 million ounces above ground and a projected annual deficit of 100 million ounces by 2026

-

demand: Industrial demand is accelerating, especially from solar and EV sectors, outpacing new supply and contributing to price pressures

-

gold-to-silver ratio: the current ratio of 80:1 (historical average 60:1) signals that silver is undervalued relative to gold, suggesting potential for outperformance as industrial demand grows

Market trends shaping gold and silver’s future

-

geopolitical and economic drivers: gold continues to set new records amid global volatility, inflation, and shifting monetary policy, with central bank activity and US dollar strength as key factors

-

green transition: silver’s industrial role, especially in solar and electronics, is driving a structural shift in demand, making it a critical material for the energy transition

-

investment trends: both metals remain core components of diversified portfolios, with gold favored for wealth preservation and silver offering growth potential through its dual monetary-industrial profile

-

supply constraints: tight supplies, especially for silver, and long mine development timelines support bullish long-term outlooks for both metals

Gold and silver are foundational to both financial markets and emerging technologies. Gold’s role as a safe-haven asset and central bank reserve is more critical than ever, while silver’s unique blend of monetary and industrial utility positions it for potential outperformance as the world pivots to a sustainable, technology-driven future.

Mining investment tightens as geopolitics and oversupply shape 2026 — Wood Mackenzie

Global mining investment will be dominated by three main drivers in 2026: geopolitics, the energy transition, cautious capital investment, according to the latest report by

Can silver hit $150 in 2026

A record rally fueled by supply squeeze and safe-haven demand The price of silver broke all records in 2025, and by December surged above US$65

Golden Cross: on track to define Victoria’s next high-grade gold project

A gold legacy that built a bank When Louis Ah Mouy put down his carpenter’s tools and walked into the valleys of Australia’s Victoria goldfields

Calling Canada’s next gold company take-outs

“Blue Horseshoe likes AMEX” This bull run has us thinking. It’s time for mid tier and big tier to gold companies to start buying stuff!!!!

Exploring the Perron Gold project: how AMEX Exploration is unveiling Quebec’s next major mining district

Sponsored Post: exploring the Perron Gold project: how AMEX Exploration is unveiling Quebec’s next major mining district Canada’s Abitibi greenstone belt is one of the

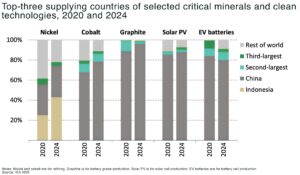

The next energy shock won’t be oil — it’ll be critical minerals, warns IEA

Key takeaways The International Energy Agency’s World Energy Outlook 2025 redefines energy security for the electric age: not oil or gas, but critical minerals are