- Australia in top 3 global reserves of in-demand critical minerals, including zinc, lithium, nickel and cobalt

- plans A$500 million (US$336.7 million) government investment for critical mineral projects

- cumulative investment between US and Australia worth more than US$960 billion

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

It’s no exaggeration to describe Australia as one of the most important mining countries in the world, as well as arguably the most attractive destination for mining investment.

Australia’s resource and energy exports climbed 9% to a record A$460 billion (US$309.7 billion) in 2022.

Now, Australia’s mineral industry is trying to pivot towards the US and downstream critical mineral development, with significant impact on investors.

Australia’s mining and commodity exports

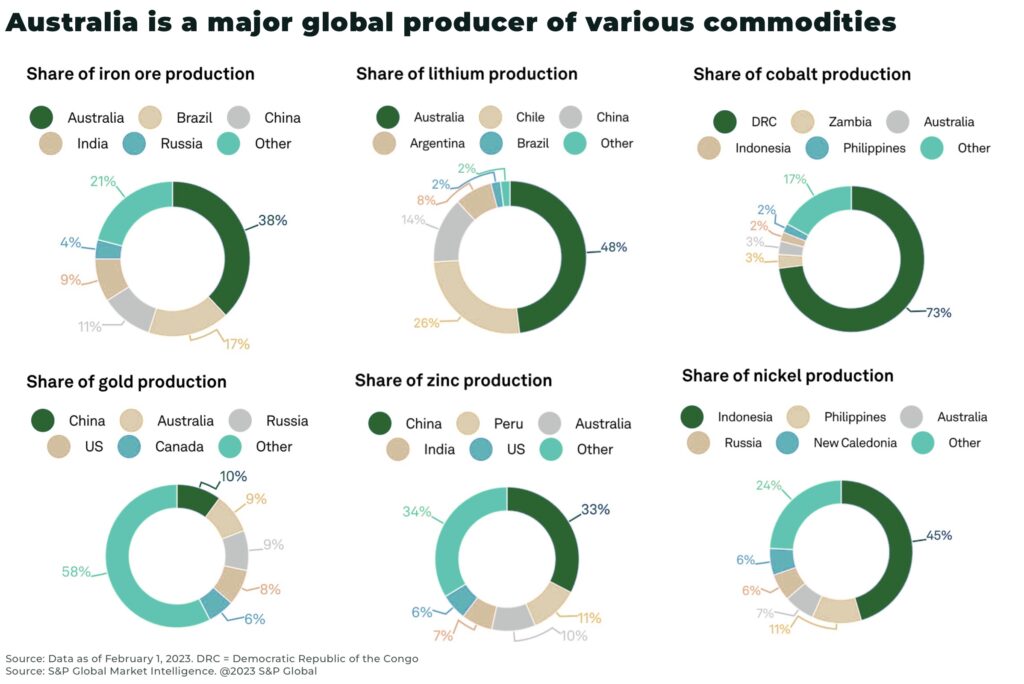

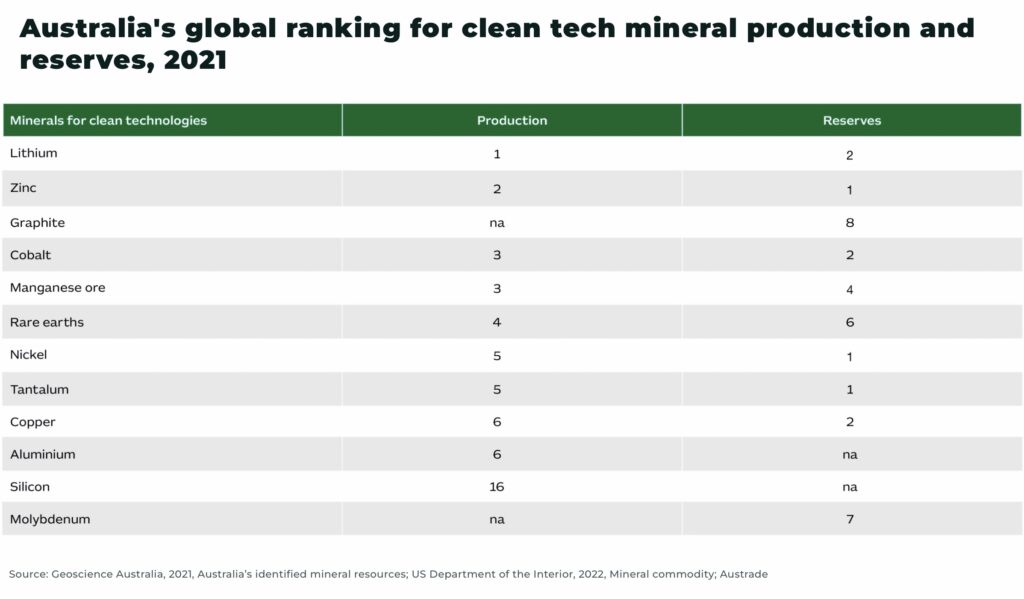

Mining is Australia’s largest export industry, contributing A$2.4 trillion (US$1.6 trillion) in resources export revenue over the past 10 years. The country has the largest reserves of zinc, nickel and tantalum and second largest reserves of lithium, copper and cobalt. In 2021-22, Australia’s exports of minerals, metals and energy commodities were worth A$413 billion (US$278 billion).

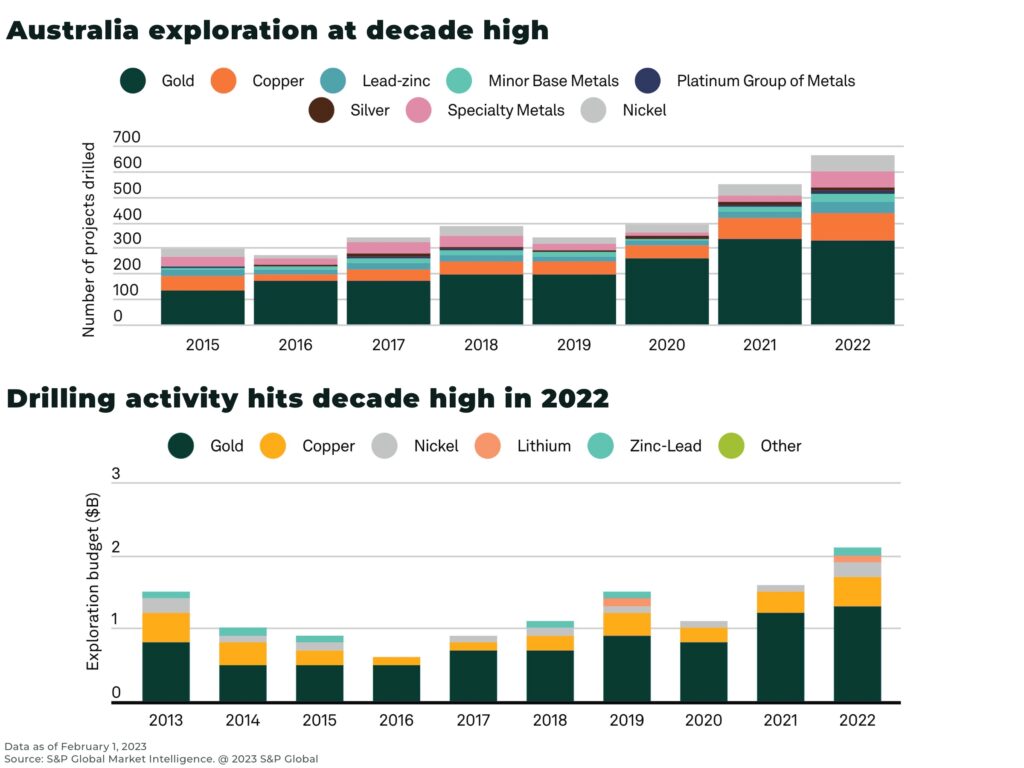

And 80% of the country’s territory remains under-explored, with the potential for big new exploration opportunities.

China was Australia’s largest export market during 2022, accounting for 25% of total exports, and it is the destination for 97% of Australia’s lithium.

The next biggest market is Japan, accounting for 12.2% of all exports in 2022.

As the global energy transition gains momentum, so demand for the minerals used in electric vehicles (EVs) and other low emissions technologies is expected to rise dramatically.

Production of lithium in Australia is predicted to double and the industry’s revenue to triple by 2027-28, compared with the last financial year.

Exports of metals used in low emissions technology (namely copper, nickel and lithium) are expected to generate A$33 billion (US$22.2 billion) in export earnings in 2022–23, over double what they earned in 2020–21. Annual exports of copper, alumina, lithium and nickel are projected to reach A$49 billion (US$32.9 billion) in real terms by 2027-28.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Changing relations with China

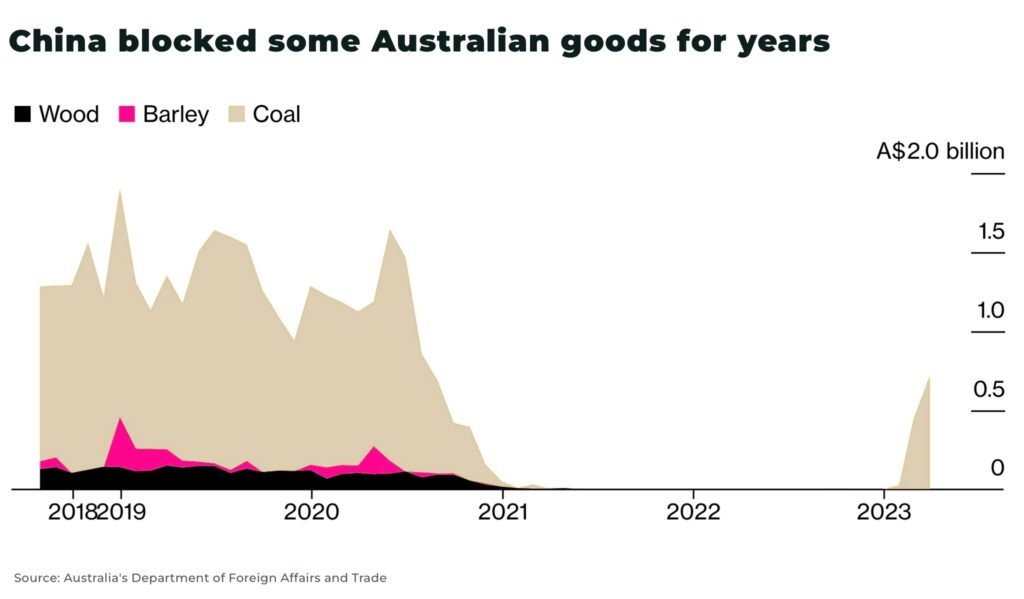

China is Australia’s largest two-way trading partner, accounting for nearly one third (32.3%) of good and services, but the relationship has been hit by a series of crises, including:

- in 2018, Australia banned Huawei Technologies from its 5G broadband network

- in early 2020, Covid 19 exacerbated tensions between the two countries when the Australian Prime Minister at the time, Scott Morrison, called for an independent investigation into the origin of the virus. This led to a two-year freeze in trade relations, with China imposing restrictions on coal, exports of barley, beef, cotton, wine, lobsters and grapes from Australia

- in early 2023, China reviewed its trade restrictions as trade tensions eased

In March 2023, exports from Australia to China hit a record high as China bought commodities such as coal and iron ore.

But, we expect the relationship between the two countries is likely to have peaked. While we expect trade between China and Australia to continue to be robust, Australia has signaled to investors that it is intent on establishing new international investment partnerships.

Closer ties with the US

Australia is deepening its ties with the US, with cooperation between the two countries focusing on the climate, critical minerals and security. The past 12 months have seen significant developments:

- October 2022, news emerges that the US is preparing to deploy up to six nuclear-capable B-52 bombers to northern Australia

- March 2023, Australia, the US and UK sign the Trilateral Australia-UK-US Partnership on Nuclear-Powered Submarines, a significant naval deal that will provide Australia with its first nuclear-powered submarines

- May 2023, Australia and the US sign ‘Statement of Intent: Climate, Critical Minerals, and the Clean Energy Transformation’. Australia and the US sign an agreement to deepen bilateral collaboration on critical minerals

- the US, Japan, India and Australia are also close to an agreement on setting up a public-private body to discuss joint investment in strategic goods, such as semiconductors and critical minerals

Perhaps most importantly for investors, recent agreements mean Australia’s critical mineral mining industry is set to be registered as a domestic jurisdiction for US investment.

This means Australia will be able to access billions of dollars of investment from the US Inflation Reduction Act — which will also stop potential investment from Australia relocating to the US.

For example, half of the US$7,500 clean vehicle credit for critical minerals sourced in the US or from a country with a free trade agreement with the US will include Australia.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Australia’s critical minerals strategy

The challenge — and opportunity — is that almost all of Australia’s critical mineral exports are shipped first to China for processing. For example, 94% of Australia’s lithium was exported to China in 2022, 80% of iron ore, 40% of its copper.

Now, Australia is moving to access global supply chains by re-shoring critical mineral processing and manufacturing.

The government’s Critical Mineral Strategy 2023-2030 (published in June 2023) will target A$500 million (US$336.7 million) of new investment into critical minerals projects.

Importantly, the strategy commits the A$40 million Critical Minerals International Partnerships program (US$26.9 million) to support co-investment between Australia and like-minded international partners to help develop end-to-end critical minerals supply chains — in particular, the US and Japan.

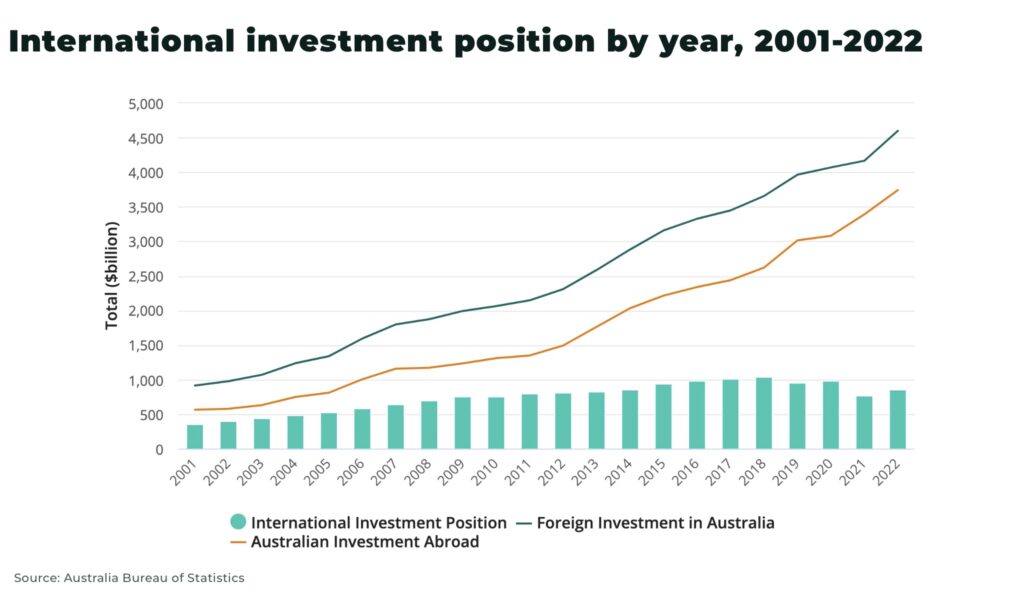

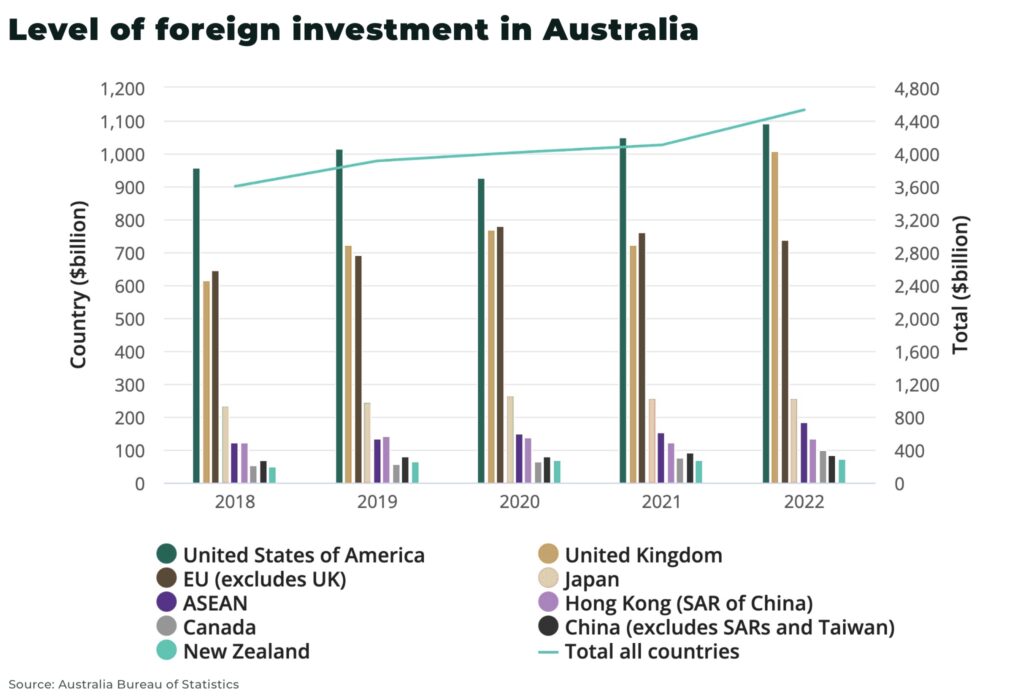

In 2022, A$118.4 billion (US$79.7 billion) foreign direct investment (FDI) was invested into Australia’s manufacturing sector – up 2.9% from 2021, with earnings growing 17.8% in 2021-22.

While FDI from China remained low from A$69.6 (US$46.87) in 2018 to A$85.1 (US$57.3) in 2022, investment from the US rose from A$957.9 (US$644.9) in 2018 to A$1092.2 (US$73.5) in 2022.

Tesla, General Motors and Stellantis have all secured Australian supply in the past few years as global competition for battery minerals heats up.

As part of its Critical Mineral Strategy, the Australian government has earmarked A$500 million (US$336.7 million) to support resources projects via the Northern Australia Infrastructure Facility. This is in addition to the A$1 billion (US$673.3 million) earmarked for ‘Value-add in resources’ and A$3 billion (US$2 billion) for ‘Renewables and low emission technologies’ priority areas.

There are already at least 30 investment-ready projects across lithium, nickel, cobalt, graphite, copper, vanadium and rare earths that have all completed pre-feasibility studies at a minimum, according to PwC Australia.

Building out electric battery industry could help contribute A$16.9 billion (US$11.4 billion) in gross value added (GVA) to the Australian economy by 2030.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

It is not, however, without it’s challenges.

For example, lithium production at Tianqi plant, Australia’s first lithium hydroxide refinery, has announced production is down due to “setbacks” to 142 tons of battery-grade chemical in Q2 2023, down 85% from March, and a far-cry from it’s goal of 24,000 tons a year.

The other two major companies, US lithium producer Albemarle Corp and Australian conglomerate Wesfarmers, attempting to onshore lithium refining have also struggled to meet production targets.

BHP mining giant also warns, in it’s submission to Australia’s critical minerals strategy discussion paper, that “Australia is currently at high risk of falling behind the curve and ceding this advantage to other competitor nations, due to a decline in relative competitiveness.”

This includes taxes, restrictive industrial relations and uncertain approval times.

Conclusion and exposure to risk

Australia successfully positioned itself for the last great commodity investment opportunity: the rise of China.

But this opportunity is no longer immune to the global headwinds in the global economy.

We expect volatility in a market facing sluggish growth and inflationary pressures, with tighter fiscal and monetary conditions, and this could lead to a scaling back of investment in key projects.

However, Australia’s economy sits at the enormous, long-term opportunity presented by the West’s energy transition goals.

As we have highlighted in many of our other articles, there are very significant challenges facing the critical minerals industry — with demand forecast to rise dramatically, driven by the global energy transition, but with significant supply challenges including mine permitting, investment, supply chain security and low grade ores.

The world, and especially the US and Europe, urgently need Australia to meet their net-zero goals. There will be challenges, but this expected demand will help steady Australia’s mining industry’s pivot from falling off-balance.

For investors interested in pivoting their own portfolios to this “critical minerals strategy 2.0”, there are a wide variety of opportunities:

- major Australian mining companies, such as Pilbara Minerals with their Pilagangoora Operation and Project (the world’s largest independent hard-rock lithium operation); or BHP, with the Olympic Dam mine (Australia’s largest mine and the site of the world’s largest known uranium ore deposit), and GEMCO’s Groote Eylandt (the world’s largest manganese mine)

- micro cap mining stocks also offer direct exposure to the opportunity of new exploration and development projects. As always, we highly recommend thorough due diligence in any micro cap company – the rewards can be bigger, but so are the risks

- or, start-ups looking to take advantage of the new downstream opportunities in building out mineral processing and electric battery plants.

Stay Subscribed.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.