As the price of copper soars over global supply-demand concerns, more than US$5 billion dollars worth of investment have been announced in Canadian copper projects in 2025 — with more expected in the coming year:

- in December 2025, Vale and Glencore announced plans for a US$2 billion joint venture in Canada’s Sudbury basin to produce 880,000 tonnes of copper over 21 years

- just months earlier, in July 2025, Canadian miner Teck Resources approved a life-extension of its Highland Valley Copper mine to 2046, securing roughly 132,000 tonnes of annual output into the 2040s

- and in December 2025, Teck and Anglo American merged with the commitment to spend at least CAD$4.5 billion in Canada within 5 years, including in connection with the Highland Valley Copper mine life extension

- Eldorado Gold will acquire Canada’s Foran Mining in a US$2.79 billion deal, giving them the McIlvenna Bay copper project in Saskatchewan( with probable Mineral Reserves of 29.7 Mt containing 793 million pounds of copper), hoping to be in production by mid-2026

- Newmont is expected to make a decision on advancing its US$2.4 billion Red Chris Mine in British Columbia this year (a project on Prime Minister Mark Carney’s list of potentially nation-building developments)

These moves underscore Canada’s growing importance in global copper supply chains at a time when copper prices have hit record highs amid a global scramble for secure supply.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Why copper is in demand

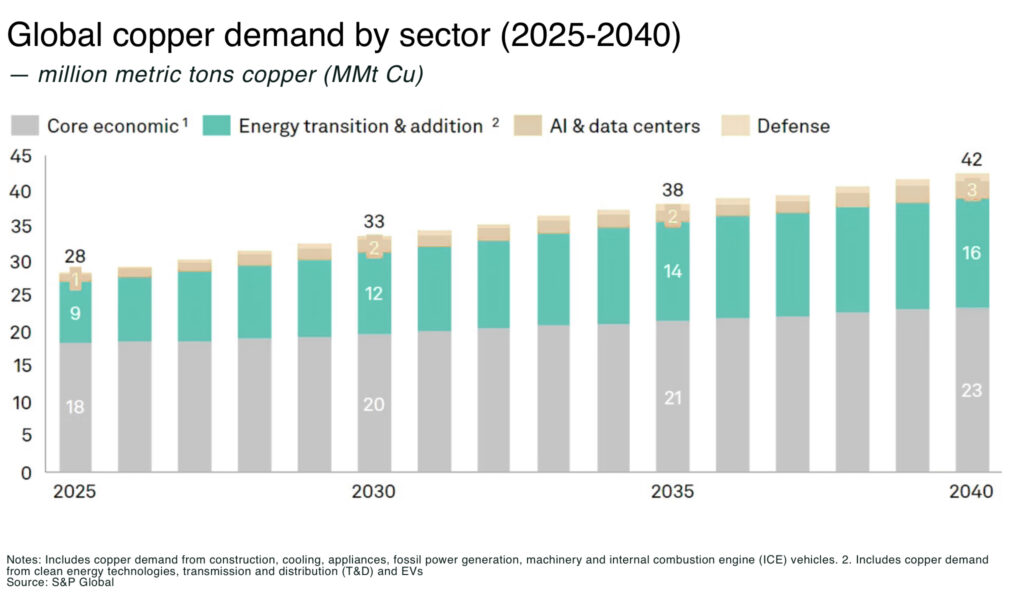

The International Copper Study Group (ICSG) projects a 150,000-ton refined copper deficit for 2026, while JP Morgan estimates a deficit of 330,000 tons, as global copper consumption is projected to increase by 8.2 million metric tons annually by 2035.

The main drivers are:

- elecrtic vehicles and the energy transition

- AI-driven data centers

- defense spending

- (re-)industrialization

- and potentially robots

(See our analysis on: Can copper can hit US$15,000 in 2026?)

The challenge for supply

As demand rises, so supply is struggling to keep pace:

- major producers, for example, Chile and Peru face declining ore grades, as well as permit delays

- recurring short-term incidents, such as the Grasberg accident in Indonesia, labour strikes in Chile, impact supply

- and, new copper mines can take, on average, 16.8 years to build

Critical stat: meeting projected copper demand may require building 80 new copper mines by 2030, alongside US$250 billion in investment

Resource nationalism and protectionism are also complicating supply routes with, for example, Trump imposed 50% Section 232 tariffs in July 2025 on imports of certain semi-finished copper products; in May 2025, China imposed an additional 10% import tariff on copper products and scrap sourced directly from the US

Canada’s role in global copper supply

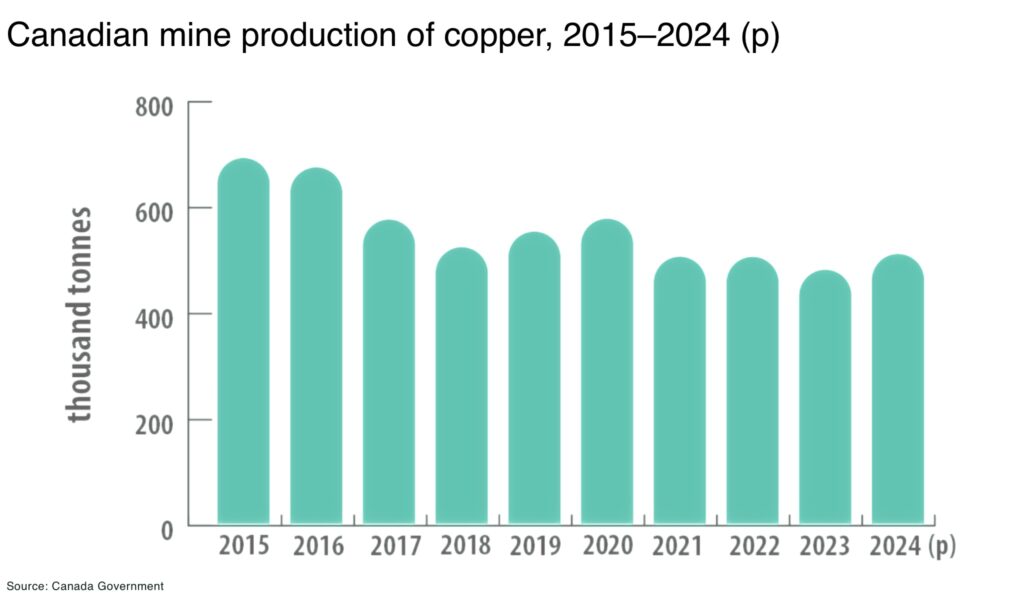

Canada is not a top-volume producer on the scale of Chile (5.3 Mt) or Peru (2.5 Mt), and production has actually decreased in the last decade, but it punches above its weight in reliability and security of supply to America.

In 2024, Canada mined 514,582 tonnes of copper, ranking around 12th globally, with 2% of world output.

However, between 2020-2023, Canada accounted for 95-99% of America’s copper content of ore and concentrate imports (and 17% of refined copper) — when geopolitics and security of supply is such a priority for America, this makes Canadian copper exports almost indispensible to America.

This is why successive US administrations’ push to reshore critical mineral supply chains is translating into billions of dollars flowing into Canadian mining, processing, and infrastructure.

Canada’s critical mineral plan

Canada has responded with a CA$6.4 billion critical minerals plan funding 26 projects to strengthen supply chains and reduce reliance on unstable sources. Notably, Canada has rich copper reserves and untapped deposits, estimated at 8.3 million tonnes, making up about 1% of the global total.

And, not just reserves or geopolitically secure location, Canada offers a top-tier mining jurisdiction, political stability and infrastructure (eg Saskatchewan and Newfoundland & Labrador, made the top ten most attractive jurisdictions for mining investment in 2024).

The government is also implementing sweeping reforms to reduce mine permitting delays, with provinces and territories no longer requiring separate federal government reviews to approve major mining and infrastructure projects.

For example, in 2022 Canada introduced a 30% Critical Mineral Exploration Tax Credit to spur investment in copper, nickel, lithium and cobalt projects.

The USMCA trade framework and decades of cooperation also means US manufacturers import Canadian minerals tariff-free and with minimal political risk (but not semi-refined copper products after Trump’s 50% tariffs). US Vice-President JD Vance proposed a critical minerals trading bloc in February 2025, including price floors, that would have involved Canada.

US automakers are also making deals directly with Canadian mines for minerals, for example, with with Vale Base Metals to supply GM and Tesla with nickel. These deals may not directly involved copper — yet — but they set a precendent.

Canada’s aging copper mines

The challenge: Canada’s existing copper operations are not insignficant but aging.

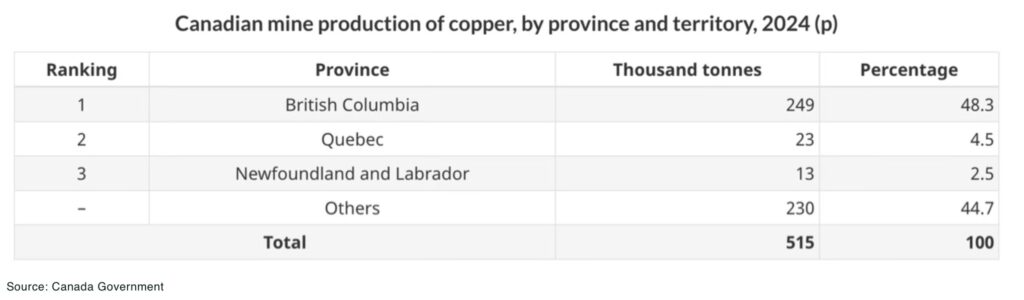

The country’s largest mine, Teck’s Highland Valley in BC, typically produces +120,000 t annually, more than 20% of national output. Other contributors include Glencore’s Kidd operations in Ontario, Hudbay’s mines, and a number of smaller-scale producers.

British Columbia led Canada’s copper production, accounting for about 48% of the nation’s total output. The province is home to Canada’s largest copper mine, Highland Valley, near Logan Lake.

Much of Canada’s mined copper is exported as concentrate to foreign smelters (especially in China) as Canada currently lacks large-scale copper refining capacity domestically, and refining facilities like Glencore’s CCR refinery in Montreal (which handles imported copper anodes) are under threat.

Canada’s copper is becoming more strategic, but aging mines and limited refining capacity require major investment — creating a clear growth opportunity.

Where Troilus Mining fits in Canada’s copper opportunity

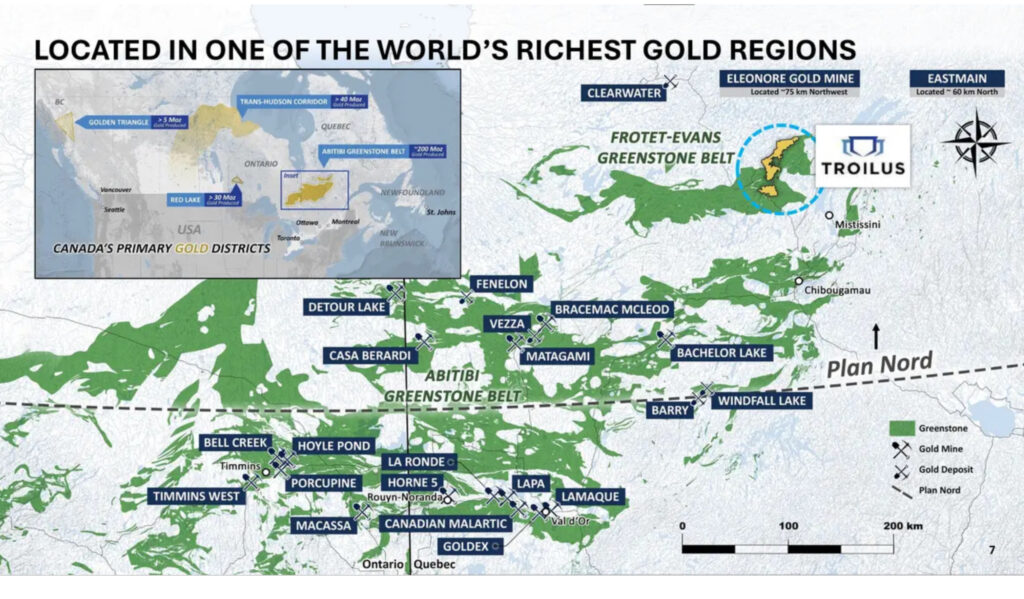

Troilus Mining Corporation (TSX: TLG; OTC: CHXMF) is one of the more leveraged ways to gain exposure to Canada’s copper upside.

The company’s flagship copper-gold Troilus Project in Quebec, Canada, is one of the largest undeveloped gold-copper systems in North America, with 13.0Moz AuEq of resources and 7.3Moz AuEq of reserves, underpinned by a 22-year mine life and expected average production of >300koz AuEq per year.

And the project is in Quebec, a jurisdiction at the core of North America’s critical-minerals push, offering additional strategic advantages, such as low-carbon hydroelectric power, established mining infrastructure, and direct access to US and Atlantic supply chains.

Troilus is not a greenfield story. The former mine operated for more fourteen years under Inmet Mining Corp., producing copper and gold at scale, and is now being repositioned as a large, long-life copper-gold asset.

For investors, Troilus sits at the intersection of three themes now driving capital back into Canadian mining:

- Copper supply security in friendly jurisdictions

- Scale and optionality as long-life assets become more valuable in a structurally tight market

- M&A or strategic interest as majors and downstream players look to lock in future supply

As Canada’s role in global copper supply chains grows, projects like Troilus illustrate where the next layer of value creation is likely to emerge, not from marginal tonnes, but from large, restart-ready assets positioned to benefit from reinvestment, re-rating, and strategic scarcity.

Can Canada deliver on its copper potential?

Scaling Canadian copper supply remains constrained by long permitting timelines, rigorous environmental reviews, and extensive community consultation — meaning new mine development has historically stretched across decades.

But, that dynamic is starting to shift. Political consensus across federal and provincial governments has aligned behind critical minerals development, reducing regulatory uncertainty and accelerating policy support for strategic projects.

Canada’s high regulatory standards, often seen as a bottleneck, may ultimately prove to be a competitive advantage. Projects that successfully navigate the approval process tend to benefit from strong stakeholder alignment, lower political risk, and long operating lives, increasingly valuable attributes in a fragmented geopolitical environment.

Policy incentives are also reshaping the landscape. Exploration tax credits, infrastructure funding, and streamlined permitting frameworks are being deployed alongside broader geopolitical tailwinds as Western governments seek secure, allied sources of copper.

From a market perspective, sustained high copper prices, reinforced by structural supply tightness and emerging policy tools such as potential price floors, are improving project economics. Elevated prices help offset Canada’s higher operating costs and bring previously marginal deposits into the development pipeline.

At the same time, few jurisdictions are meaningfully expanding production capacity. If Canada maintains its current trajectory, its combination of stability, scale, and policy alignment positions it to capture a disproportionate share of new investment.

In an era defined by supply security rather than pure volume growth, Canada’s competitive edge may not be speed, but consistency — steady, responsible expansion that delivers reliable copper into increasingly strategic supply chains.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.