Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

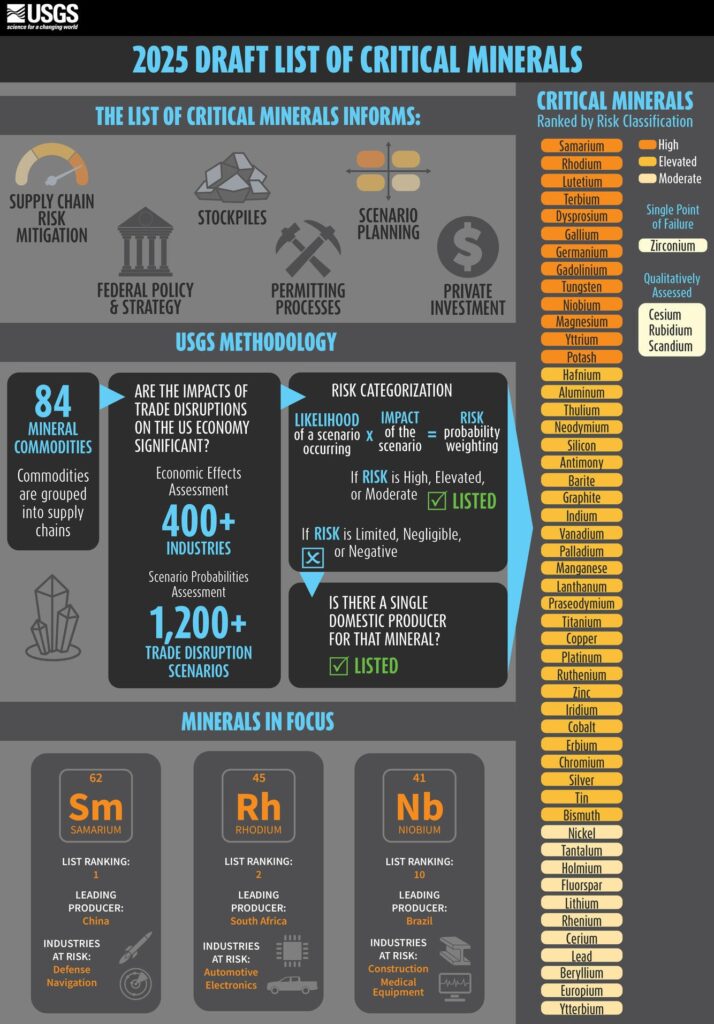

The US Department of the Interior has released the draft 2025 List of Critical Minerals adding six new minerals while phasing out others. To be included:

- potash

- silicon

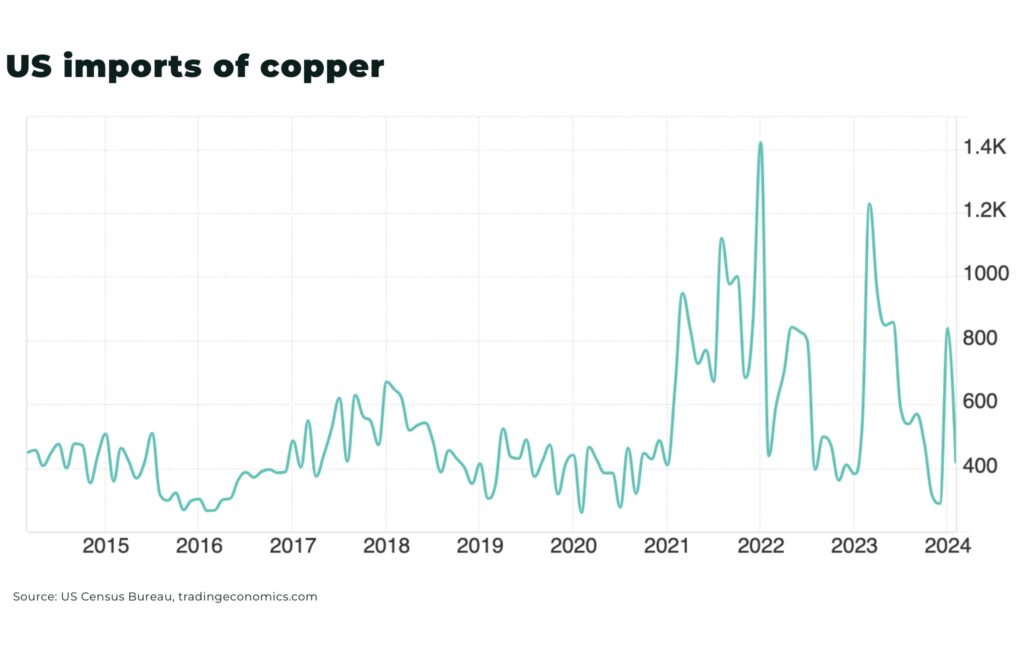

- copper

- silver

- rhenium

- lead

And recommended for removal are:

- arsenic

- and tellurium

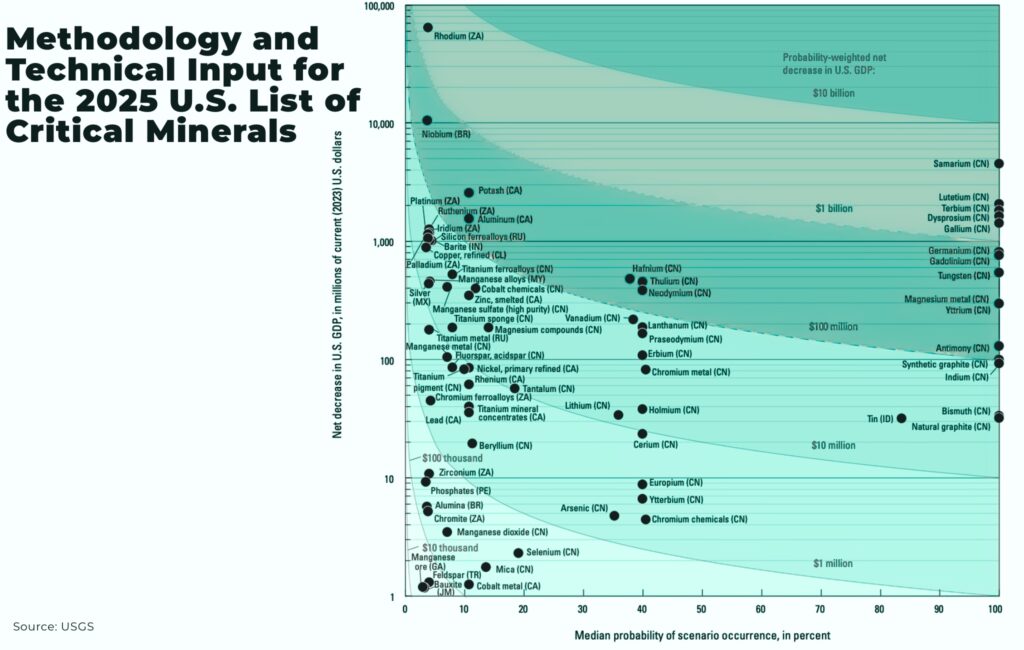

The top 10 mineral commodities, in descending order by the estimated probability-weighted impact of supply disruptions on the U.S. economy, are samarium, rhodium, lutetium, terbium, dysprosium, gallium, germanium, gadolinium, tungsten and niobium.

The report highlights how the impacts in the billions of dollars may appear small against the US$29 trillion U.S. economy, but those figures are probability weighted. As with the example of rhodium, the consequences of an actual disruption would be far greater.

“On America’s Balance Sheet, the loss of even one critical mineral can ripple through entire industries, from semiconductors to defense systems, undermining production capacity, technology leadership, and American jobs” — Department of the Interior releases draft 2025 List of Critical Minerals

This is the second update to the list since its inception under the 2017 Executive Order and the Energy Act of 2020 requirement for triennial revisions.

The updated minerals were flagged based on advanced economic modeling by the US Geological Survey that forecasts the impact of trade disruptions on the US economy, including simulations of over 1,200 trade disruption scenarios quantify GDP impact across industries, with a probabilistic view of economic fallout triggers inclusion at moderate or higher risk.

“Copper fits that description perfectly: it underpins electrification, defense, and clean energy, while its supply chains are increasingly under pressure. Recognizing copper as critical is good for America because it secures the foundation of its competitiveness and energy transition” — Juan Ignacio Diaz, head of the International Copper Association, told Bloomberg.

Why these changes matter

Silver, lead, rhenium, silicon: each of these minerals plays specialized roles — from finance and electronics to industrial processes. Their inclusion reflects new supply‑risk thresholds identified in the methodology.

Copper: added for its critical role in transportation, defense, and electricity — especially amid surging demand from AI and data centers.

Potash: vital to agriculture as a fertilizer component, with high U.S. import reliance — particularly from Canada — raising supply disruption concerns.

Next steps

The draft is now open for public comment for 30 days, allowing stakeholders to weigh in before the final list is published in roughly a month. The initiative reflects a more dynamic posture toward strategic mineral polic, aligning resource security with geopolitical and technological imperatives.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.