Since copper’s move above $4/lb in March 2024, the giant copper producer Freeport-McMoran’s (NYSE: FCX) stock jumped 20+%. That’s a material increase for a $60+ billion company. However, the percentage move pales in comparison with its tiny namesake’s (Freeport Resources Inc. TSX:FRI, OTCQB: FEERF, FRA:4XH) share price increase of 200+% since early March 2024. A rising tide lifts all boats, especially the small ones.

Following on our extensive coverage the past year of the looming copper supply deficit — a nearly 10million mt supply gap in the next ten years, according to our latest industry report — we expect copper prices to continue to rise. For those intrepid investors seeking asymmetric risk/reward returns, the best opportunities are in the small cap copper developers and explorers. For illustration purposes, we highlight one such company below.

Freeport Resources Inc.

TSX:FRI | OTCQB:FEERF | FRA:4XH

Sponsored Spotlight: Compelling Risk/Reward Play on the Copper Price

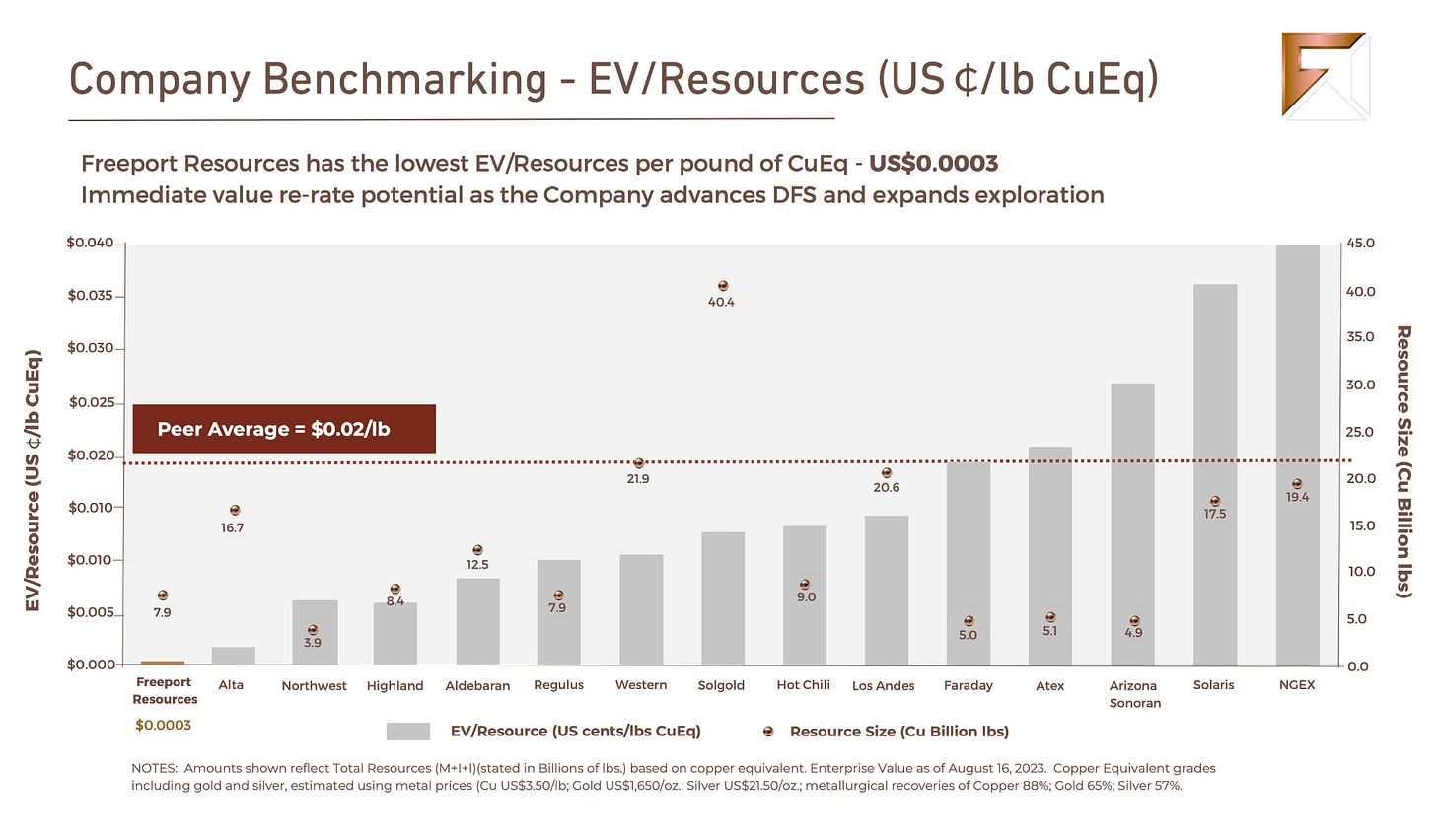

Freeport Resources owns one of the largest, undeveloped copper projects in the world and already has the engineering and feasibility studies in place. It ranks as the largest undeveloped copper project in Asia, the world’s largest copper refiner and consumer. At today’s share price of $0.06, its market cap is just US$11 million, making it arguably the market’s most undervalued copper asset, which is of course why it came to our attention.

Why so undervalued? It’s simple: the company was stuck on its license renewal application. However, its license was renewed by Papua New Guinea (“PNG”) Mining Ministry in March of this year and investors are now taking notice. Furthermore, it recently announced that it has engaged in discussions with strategic investors for completion of final engineering studies and mine development. Freeport is a perfect example of what we search for in this sort of market: an asymmetric risk/reward where the downside from $0.06 per share is negligible compared with the upside of such a large copper resource.

Freeport’s principal asset is its 100% owned, Yandera copper project located in PNG. The project was acquired several years ago from the Sentient Private Equity Fund, a US$2.7 billion specialist mining Private Equity (PE) fund. Sentient, and the project’s prior owner, spent well in excess of USD $200+ million in engineering and feasibility studies but was forced to sell when the Fund had to be liquidated.

Yandera is a major, world class copper deposit. A pre-feasibility study completed by Worley Parsons in 2017 showed total resources of 959 million tonnes of copper equivalent grading 0.37%, including measured and indicated resources of 728 million tonnes, grading 0.39% copper equivalent. According to the conclusions of the Worley Parsons 2017 Pre-Feasibility Study, the Project has an IRR of 23.5% with an expected payback of 5 years and 8 months based on a copper price of $3.35 per pound. With copper already trading above $4.00 and with analyst estimates forecasting much higher prices in the coming years, the project economics will become increasingly more attractive.

Recent advances in new copper catalyst technologies have also opened an entirely new, low-cost processing route for Yandera and other large yet lower grade sulphide copper deposits. These technologies, which allow for the treatment of lower grade sulphide ores as oxides via a standard SX/EW circuit, are currently employed and being tested at various copper projects by Jetti Resources and Rio Tinto. The Company is currently evaluating these technologies to determine if they are applicable to the Yandera project. If they prove to be viable, this could greatly enhance the feasibility of Yandera by significantly reducing the CAPEX and OPEX required to transition the project to production.

View a video of the project below or visit www.freeportresources.com

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.