Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

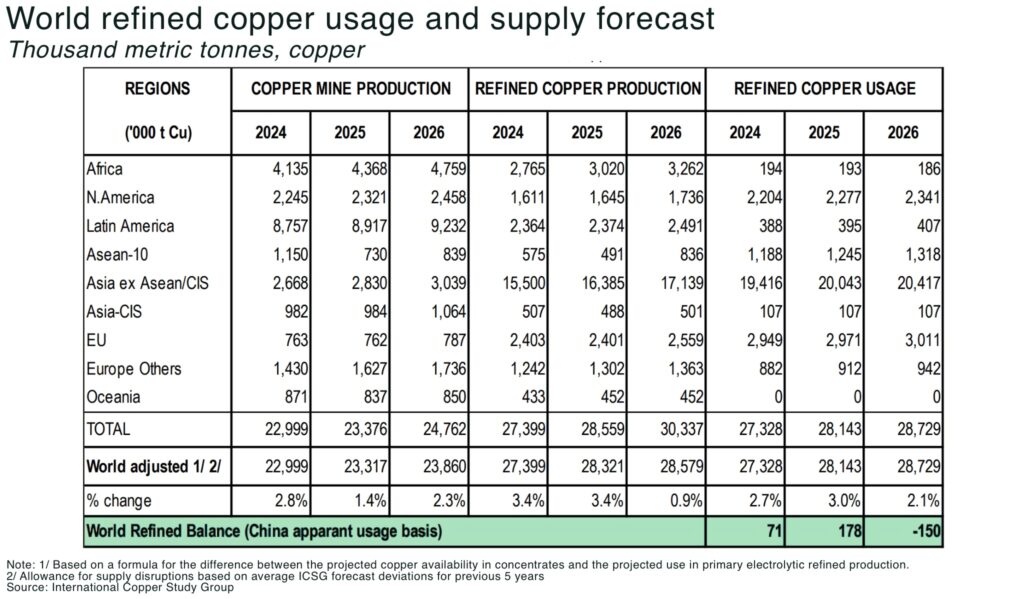

- ICSG forecasts mine-supply growth of just 1.4 % in 2025, down from 2.3 % earlier

- the surplus expected for 2025 has been trimmed to ~178,000 t, and the market is projected to swing into a 150,000 t deficit in 2026

The latest forecast from the International Copper Study Group expects global mine production growth of just 1.4 % in 2025 — a sharp downshift from its earlier 2.3 % forecast. The modest rate comes alongside a refined-production growth forecast of 3.4 % for 2025, which then collapses to 0.9 % in 2026 as concentrate availability becomes a bottleneck.

The market is shifting from surplus to shortage with a surplus of 178,000 t for 2025 is expected to flip to a 150,000 t deficit in 2026.

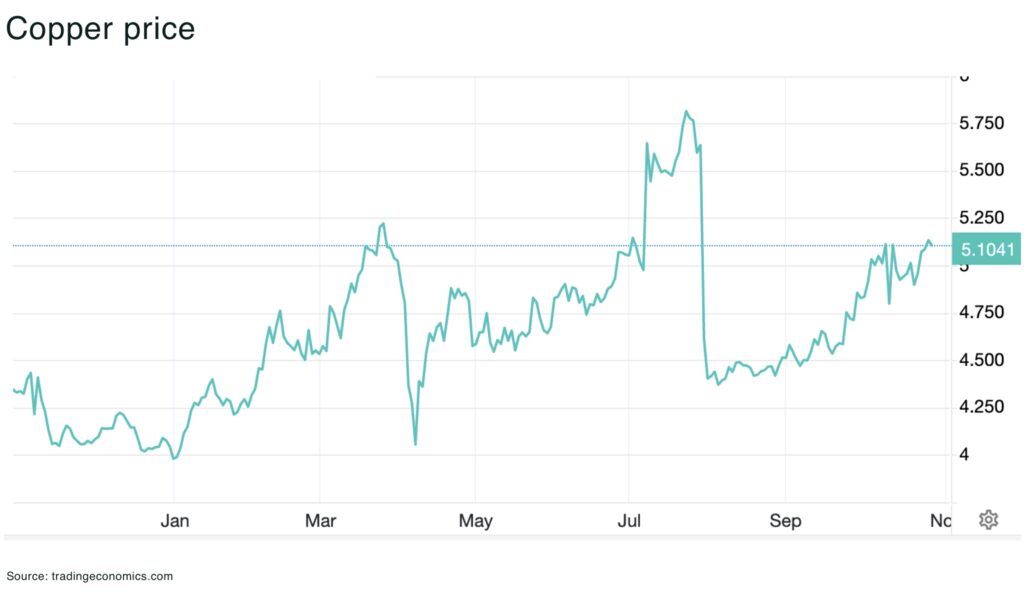

At the same time, copper prices are nearing record highs. LME contracts recently hit US$11,094/t as supply concerns collided with hopes of a US–China trade deal unlocking demand. For investors, this signals the old “plenty of copper” narrative is giving way to one of structural constraint.

Why growth is stumbling

Several factors are conspiring to slow supply growth:

• Mine disruptions: A series of accidents at tier-1 copper mines — including the mud-inflow at Indonesia’s Grasberg Mine — have knocked concentrate feed and pushed the ICSG to cut its growth forecast

• Concentrate vs smelter imbalance: Even when mine output rises, refined production is constrained because smelters lack concentrates. The ICSG notes this gap as the key brake

• Demand-side softness masking structural tightness: Although usage growth is modest (2.1 % in 2026) and demand from regions outside Asia remains weak, the lack of new supply projects means that a small bump in demand or additional disruption could trigger tightness quickly

Demand: steady, but not spectacular

Global refined-usage growth is forecast at 2.1 % in 2026, down from faster growth in prior years. China, which accounts for approx 58 % of global copper usage, is forecast to see demand growth decelerate markedly. On the surface this demand number appears modest, but the key implication is that supply must now carry the burden of tightness rather than demand spikes driving the story.

In short: demand remains supportive but unexceptional. The upside for copper now resides in supply constraints, not a demand explosion.

Conclusion

The ICSG’s latest outlook highlights the pivot for copper: from surplus to structural tightness. With mine-growth trimmed and concentrate bottlenecks looming, the industry faces a 150,000-ton deficit in 2026. That tightness is already pricing in, as reflected in near-record prices. For investors in critical minerals and mining, the signal is clear: supply reliability matters more than ever. Companies that navigate the bottlenecks, not just dig more rock, will capture the value in the immediate-term.

Our report on the expected demand for copper from Artificial Intelligence and data centers:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.