Dr. Nathan Chutas, Senior VP Operations and Director, is a professional geologist with over 20 years exploration and mining experience across North America, South Africa, Mexico, and most recently seven years in Papua New Guinea. Nathan holds PhD in Geological Sciences from the University of Washington and is a Certified Professional Geologist with the American Institute of Professional Geologists.

Papua New Guinea: the world’s next major source of copper

- Papua New Guinea (PNG) holds some of largest undeveloped copper resources in the world, eg Wafi-Golpu (Morobe Province) with ~2.3 million tonnes of copper reserves

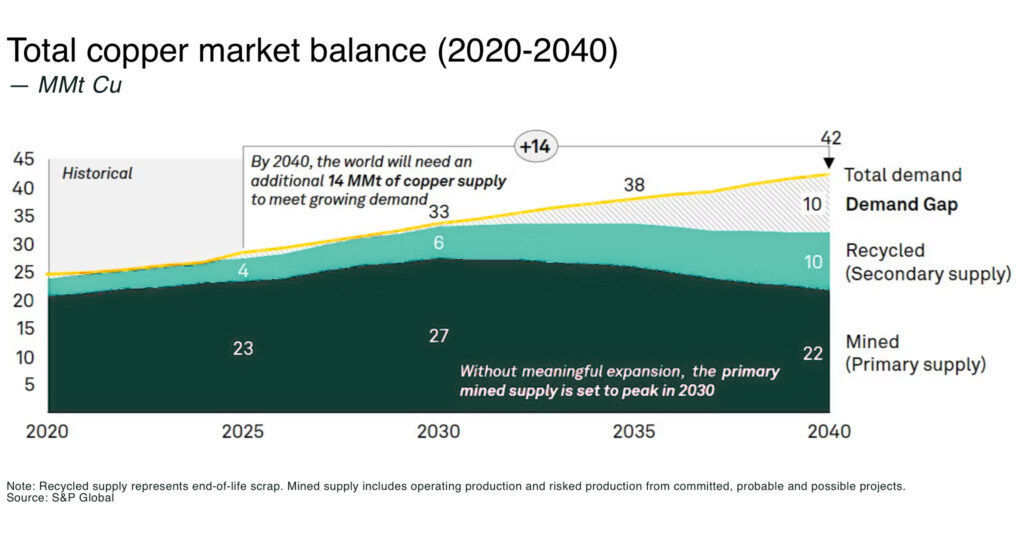

- S&P Global projects copper demand will rise 50% by 2040 (to 42 Mt) while supply falls short by 10 Mt

- copper prices are at record highs (hitting $13,000/t in January 2026) on tight inventories and disruptions, as top producers Chile and Peru are rocked by strikes and protests

Why is copper demand surging?

Copper is critical to electrification. No copper, no data centres, no EV charging, no energy transition — and no modern power grid. The problem, as with so many critical minerals, is that demand is accelerating just as supply tightens.

The latest S&P Global report finds annual copper demand will jump 28 Mt in 2025 to 42 Mt by 2040, a 50% increase. The study projects a potential 10Mt copper shortfall by 2040 without significant supply expansion.

Demand is being driven by four main factors:

- AI and data centers

- “core economic demand”, from appliances to construction

- the energy transition

- defense

- (and potentially robots will add a fifth demand driver)

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

For example, by 2030, data centers alone could rise from today’s 5% to 14% of US electricity demand; electric vehicles (EVs) require x2.9 more copper than a conventional car; the developing world is projected to add as many as two billion new air conditioners by 2040.

Why are major copper producers under strain?

Just as global copper demand increases, so supply is increasingly vulnerable.

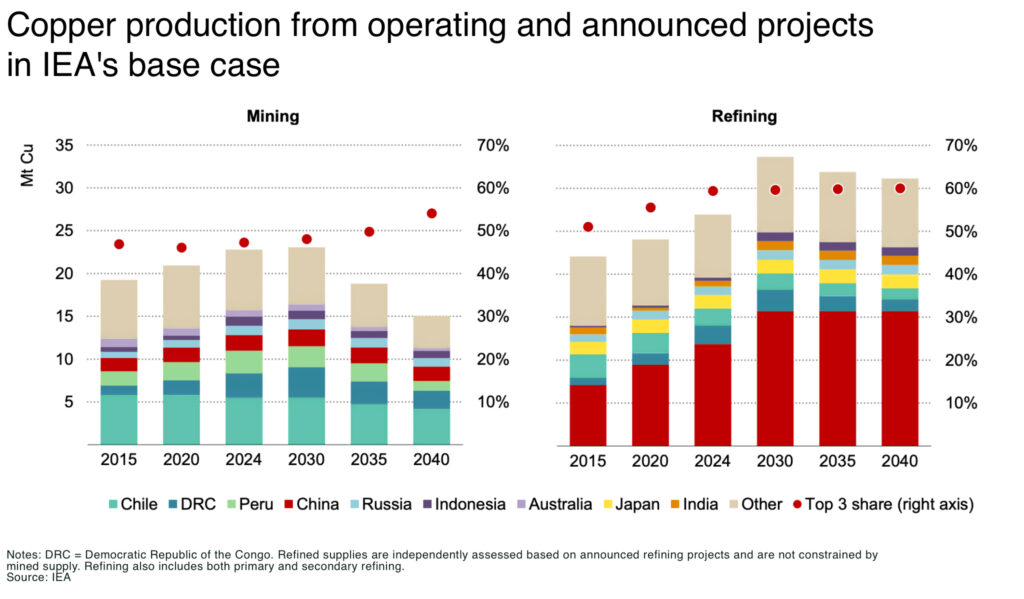

Global mined copper supply reached 22.8 Mt in 2024, with Chile (the world’s largest producer), supplying a quarter of global output; Chile and Peru together account for roughly one-third of the world’s mined copper. The Democratic Republic of Congo extended its lead in mined production over Peru in 2024 to remain the second-largest producer.

However, long-term structural supply problems include:

- declining ore grades

- asset retirements

- reserve depletions

- rising costs

- increasingly complex extraction conditions

According to IEA estimates global mined copper supply peaks in the late 2020s (at approx 24Mt), after which output declines noticeably to less than 19 Mt by 2035.

And then there’s the short-term disruptions that are playing havoc and accelerating the trend. For example:

- in January 2026, contract-workers in Chile blockaded access roads to Escondida and Zaldivar (the world’s largest and a top-10 mine) delaying shifts and transport

- in January 2026, production at Capstone Copper’s Mantoverde copper and gold mine in northern Chile largely halted after the mine’s desalination plant was shut down amid a nearly three-week labor strike

- in September 2025, Freeport-McMoRan (TSXV:FRI) declared “force majeure” after 800,000 tons of wet mud flooded multiple levels of its Grasberg Block Cave mine (the world’s second-largest copper mine)

- in July 2025, artisanal miners blocked a key route for MMG’s Las Bambas, Hudbay’s Constancia and Glencore’s Antapaccay, in Peru

Such immediate-term disruptions compound the longer-term issues; for example, Chile’s Codelco, the world’s largest copper producer, has cut its forecast for 2025 output, despite higher production in the year’s first nine months through September.

Meanwhile, many key global projects are delayed: Russia’s Norilsk Nickel faces setbacks on a planned China-backed smelter; in 2023, First Quantum’s Cobre mine in Panama was shut down after the country’s Supreme Court declared its contract unconstitutional, and has not been reopened; regulatory delays have pushed potential production in Rio Tinto and BHP’s Resolution copper mine into the 2030s (one of the largest undeveloped copper deposits in the world, with potential to supply 25% of current US copper demand).

What about Papua New Guinea: a wealth of copper in the Highlands

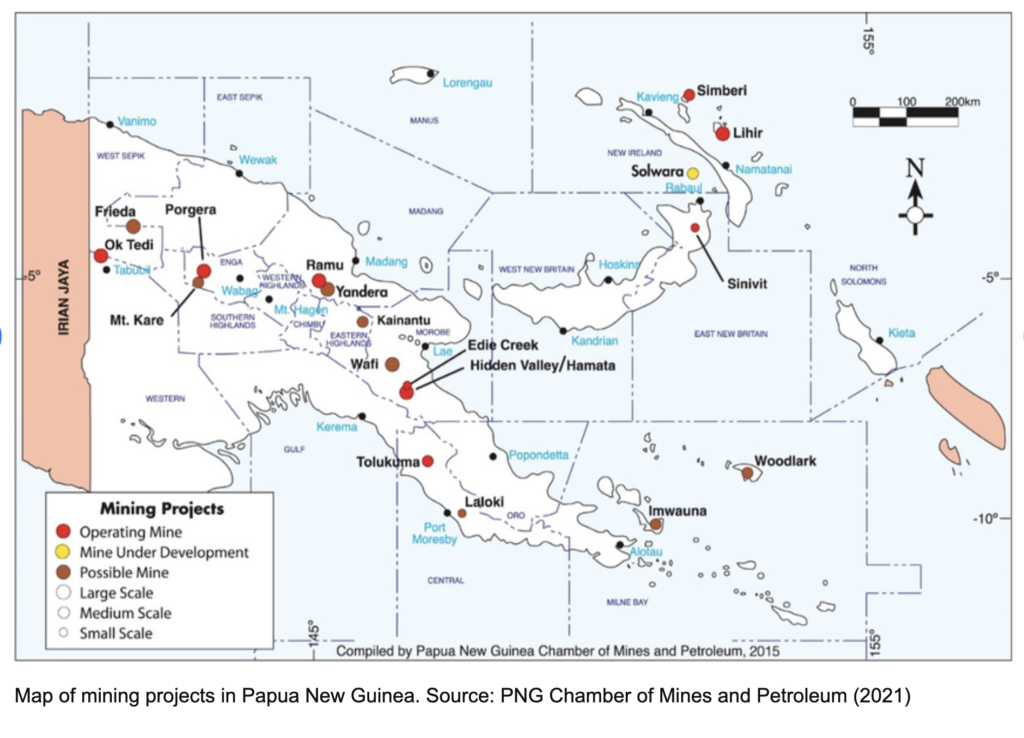

In 2023, Papua New Guinea exported US$904million of copper ore, making it the 16th largest exporter of copper (out of 111) in the world, with production projected to rise by a CAGR of 8% between 2023-2027.

Production currently comes mainly from two (aging) mines, one of which produces copper as by-product of gold: Ok Tedi (Western province, where copper is the primary product) and Kainantu mine (Morobe province, where copper is produced as a by-product of gold).

However, PNG has some of largest undeveloped copper-rich deposits in the world that have never been mined. Wafi-Golpu, Frieda River and Yandera alone host billions of tonnes of ore.

In total, PNG has at least three large copper projects at feasibility stage (plus a controversial seafloor deposit): Wafi-Golpu, Frieda River, and Yandera (plus the older Solwara-1 project).

In feasibility studies: Wafi-Golpu (~161 ktpa Cu plus 266 Koz pa Au), Frieda River (initial plans ~100 ktpa Cu & 160 Koz Au) , Yandera (~3.1 Mt Cu resource), among others.

Wafi-Golpu (Morobe Province): PNG’s crown jewel. This Newcrest/Harmony Gold project has one of the world’s largest undeveloped copper-gold deposits, arguably the biggest undeveloped mining resource in the Pacific region. The Wafi-Golpu joint venture’s copper Mineral Reserves total an estimated 2.3 Mt and total copper reserves with mineral resources (inclusive) at 4.3 Mt.

As of late 2024, negotiations continue between the mining companies and the Papua New Guinea government to secure the mining development contract and the special mining lease

Frieda River (West Sepik): majority-owned by China’s Guangdong Rising, based on the extraction of the Horse-Ivaal-Trukai- Ekwai-Koki (HITEK) porphyry copper-gold deposit which contains an estimated 12Mt of copper. A feasibility study estimates average annual production of 670,000 tonnes of concentrate containing 175,000t of copper and 230,000 ounces of gold.

Yandera (Madang): a large porphyry deposit held by Freeport Resources (TSXV:FRI). Yandera’s inferred resource is on the order of over 3 Mt of contained copper, making it one of PNG’s largest undeveloped copper prospects — Freeport describes Yandera as “one of the largest undeveloped copper deposits in the world.” The Pre-feasibiliity Study estimates the project’s potential annual production of 100,000 tonnes of copper over a 20-year LOM.

In December 2025, PNG regulators granted a suite of environmental permits for Frieda’s mine, power grid, hydro project, road and port. And, in January 2026, Freeport signed a Memorandum of Understanding with Kumul Minerals, Papua New Guinea’s state-owned mining investment company, to collaboratively advance the 100%-owned Yandera Copper Project.

There are, of course, enormous challenges for each of these projects. Not only the delays in getting permitting with government and community agreement, but also multi-billion dollar infrastructure costs, from ports to energy projects, for example, Frieda’s model involves a 600 MW dam and 260 km of transmission lines , a colossal engineering challenge in dense jungle.

The current price of copper, however, changes the investment-risk dynamic.

Papua New Guinea’s investment outlook: risks vs rewards

PNG’s promise as a copper hotspot is clear: Asia-near big volumes at a time of global shortage. Its west Pacific location offers shorter trade routes to China, Japan and South Korea than South America.

And, amid the US-China rivalry, Western allies are keen to secure critical minerals from regions outside of Chinese supply lines. As China backs Frieda (through state-owned investors), so the West looks to counter any further strategic foothold.

And, the PNG government, eager to diversify beyond LNG and gold, pitches these projects as nation-building ventures.

In summary, PNG’s risk-reward profile is extreme. On one hand, few places on Earth match its copper potential at a time when new supply is desperately needed. On the other, turning that potential into cash requires surmounting technical, political and financial obstacles.

Conclusion

The world will need an estimated 80 new, large copper mines to meet demand by 2040. Many of these mines will come at the extremes of copper’s frontiers.

With copper’s price rising, the risk-reward is shifting in PNG’s favour.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.