Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

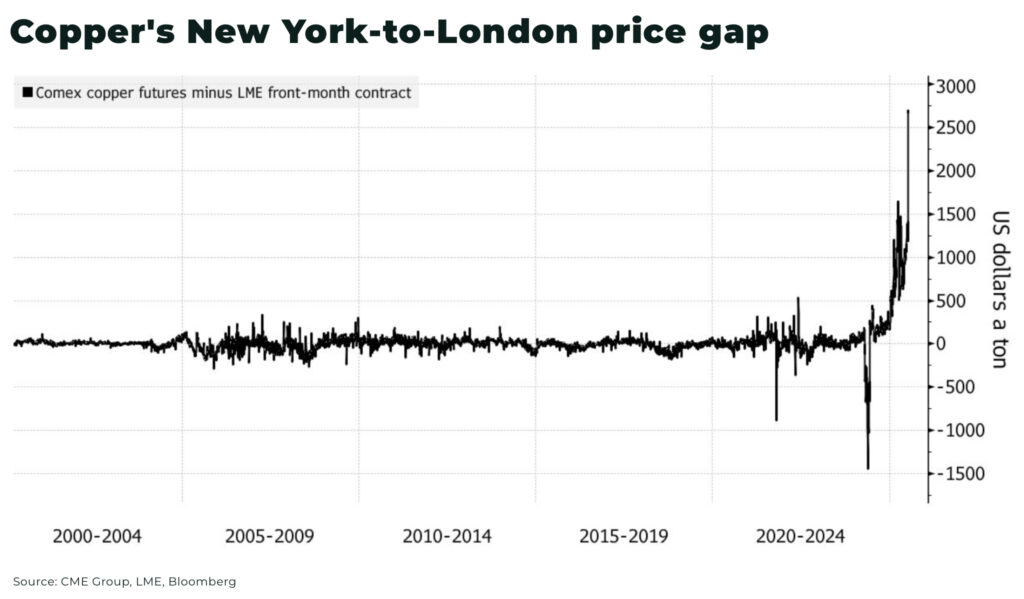

Following Trump’s surprise announcement calling for 50 % import tariff on copper under Section 232, copper prices climbed as much as 17% in New York on Tuesday — a record one-day spike to an all-time high, since records began in 1968 — before falling more than 4% in early trading on Wednesday.

Trump’s tariff declaration, made during a campaign stop in Pennsylvania, was not backed by formal policy action, but markets treated it as a credible signal of future trade friction.

“I believe the tariff on copper, we’re going to make it 50%,” Trump said at a cabinet meeting.

The move would disproportionately affect US importers, particularly manufacturers and clean energy developers reliant on refined copper from Chile, Peru, and Canada.

The US imports over 40% of its copper needs, according to the US Geological Survey, with minimal domestic smelting capacity. The proposed tariff, if enacted, would deepen pressure on US supply chains already strained by energy transition-related demand.

According to our report, copper is facing a supply gap of nearly 10 million mt within the next ten years.

Copper is a key input for electric vehicles, transmission lines, solar inverters, and data centers. A sudden spike in its price threatens to ripple through the industrial economy. Benchmark three-month LME copper prices also rose sharply, though not to the extent of U.S. futures, highlighting fears of domestic supply dislocation more than global shortage.

Analysts said Trump’s use of national security provisions under Section 232 to justify tariffs on an energy-critical mineral would be an exceptional step, reminiscent of Trump’s 2018 use of the same statute to impose steel and aluminum tariffs.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.