- US adds copper and silver to its 2025 critical minerals list, joining uranium among top national-security priorities

- the list now covers 60 minerals, up from 50 in 2022, signalling a broader definition of “strategic” materials

- policy support for copper, silver and uranium is likely to accelerate permitting, investment incentives, and new midstream infrastructure

- move aligns resource policy with industrial re-shoring, electrification, and nuclear revival goals

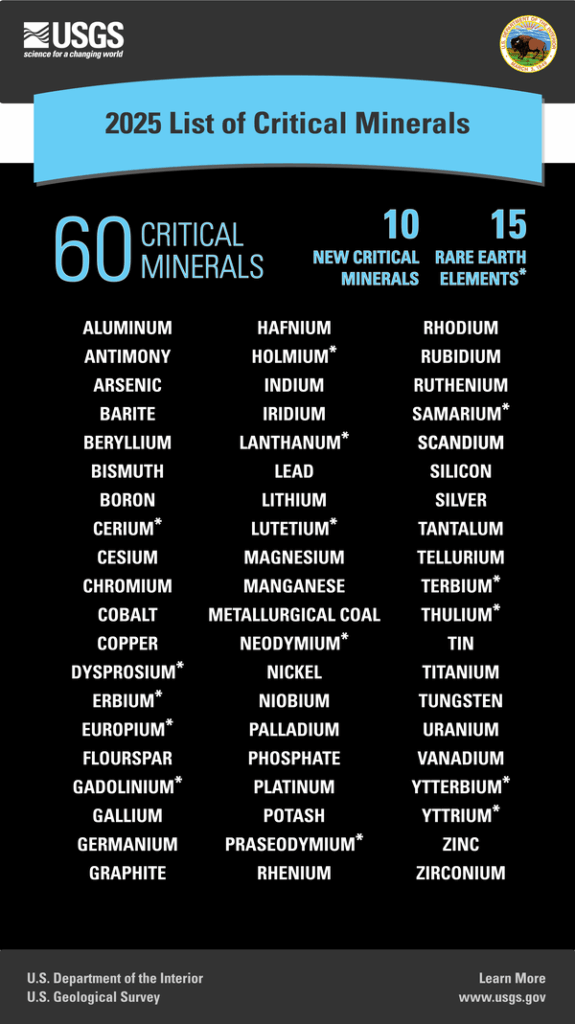

The US government has expanded its 2025 list of critical minerals, officially adding copper and silver and long-standing strategic elements such as uranium — a move that redraws the map for mining investment and supply-chain security.

The updated list, published this week by the US Geological Survey (USGS), raises the total number of designated critical minerals to 60, up from 50 in 2022.

The Trump administration framed the update as a “supply-chain sovereignty” push: extending national-security status beyond EV metals to the backbone materials of the energy system — copper for electrification, silver for solar, and uranium for baseload power.

Copper: from base metal to strategic backbone

Copper’s inclusion marks a turning point. The world’s most versatile conductor is now officially recognised as critical to US economic and national security.

Demand is surging: global copper consumption is expected to rise 35% by 2035, driven by EVs, grid expansion, data centres and renewable infrastructure. Yet new mine supply is tightening. Wood Mackenzie estimates the global copper shortfall could hit 6 million tonnes annually by 2030, even before factoring in US re-shoring targets.

By designating copper as critical, the US opens access to Defense Production Act funding, tax incentives, and faster permitting — effectively elevating the metal into the same strategic tier as lithium and rare earths.

Silver: from precious metal to industry workhorse

Silver’s addition reflects its growing role in solar panels, EV electronics, and semiconductors. Photovoltaic demand alone accounts for nearly 30% of global silver consumption and is rising fast.

The Silver Institute expects a fourth consecutive annual market deficit in 2025, driven by record solar installations in China, India and the US. US domestic output is modest — under 1,000 tonnes a year, concentrated in Nevada and Alaska — leaving over 70% of supply dependent on imports.

Policy recognition could stimulate domestic exploration and refining capacity, particularly for polymetallic mines where silver is a by-product of gold or base-metal operations.

Uranium: reinforced as strategic power fuel

While copper and silver are the newcomers, uranium remains the cornerstone of US energy security. Its continued inclusion underscores the administration’s commitment to nuclear expansion.

The Department of Energy (DOE) has called for tripling domestic uranium production by 2030 to feed new small modular reactors (SMRs) and replenish national reserves. Spot prices have surged above $90/lb, the highest since 2007, as US utilities rush to lock in contracts.

Washington has already launched a Strategic Uranium Reserve, backed by a $1.4 billion budget, and secured domestic supply deals with companies like Energy Fuels, Cameco, and Uranium Energy Corp.

A broader industrial strategy

The new list signals that Washington is redefining “criticality”, from a narrow focus on green tech to a wider industrial-security framework.

USGS says the updated list “reflects both economic vulnerability and the expanding scope of essential technologies.”

For investors, it’s a clear policy signal: the next wave of US resource investment will not just be about batteries, but about the entire energy ecosystem.

Conclusion

Copper, silver, and uranium now sit at the heart of US critical-minerals policy. The 2025 list cements their status as cornerstones of a secure, electrified, and nuclear-powered economy.

For miners and investors, the opportunity is structural: Washington has tied industrial strategy to resource policy. Projects producing these three metals are now riding the same wave — national security meets the energy transition.