Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

It was the best of times, it was the worst of times. It was the age of gold, it was the age of bitcoin, it was the epoch of more than $3,000 gold.

We’re paraphrasing Charles Dickens introduction to a Tale of Two Cities, a story about the French Revolution, to highlight gold’s historical and future importance as a store of value in volatile times — and why that means there’s more volatility ahead.

Writing a piece on gold after we’ve seen a fall of nearly -5% may seem bold, let alone suggesting the price may be headed higher, but the recent drop is barely a scratch on the glittering run of more than +140% the metal has made from 2018-2025.

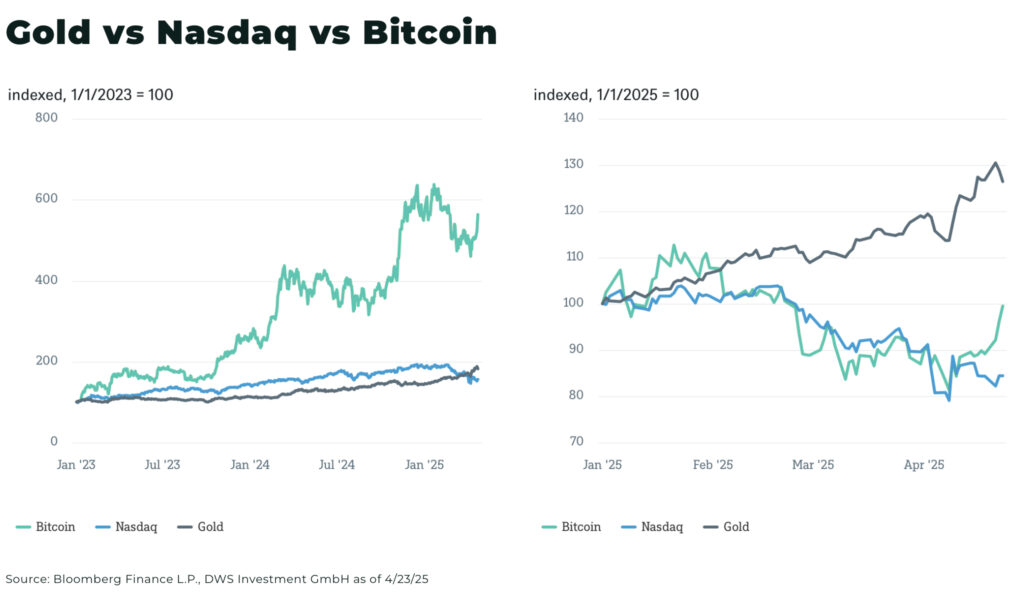

Bitcoin, by comparison, has fallen approximately -22.9% from its year-high of US$109,114.88 to its current price of $84,086 as of April 4, 2025.

We’re not here to rehash the bitcoin vs gold debate. Bitcoin has had — and will likely have — a tremendous run. In seven of the past 10 years, Bitcoin has been the best-performing asset class in the world.

But, while Bitcoin was heralded as the new digital store of value, it has been gold that served as the warning of incoming volatility — only reinforcing gold’s position as the traditional hedge of last resort (except, of course, guns).

And, when it comes to gold, Canada is the safe haven’s safe haven.

Flight to safety

The rise in the price of gold is being driven by geopolitical and economic uncertainty, as investors search for a safety, including:

- geopolitical tensions, from the invasion of Ukraine to the tariff war between the US-China

- economic uncertainty, from soaring US debt (more than US$36 trillion, and Republicans planning to extend tax breaks in 2025), sliding consumer sentiment, inflation concerns, as well as interest rates cuts with US President Trump urging the Fed to lower interest rates (“This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates” are Trump’s exact words)

And, to throw it back at you, our readers, do you see volatility reducing over the next three years? You’re not alone:

Goldman Sachs raised their forecast for gold prices end-of-2025 to US$3,300 per ounce from US$3,100; JP Morgan sees gold hitting US$4,000 per ounce by Q2 2025; Bank of America has raised their estimate up to US$3,350/oz in 2026, from US$2,625/oz.

For gold, whatever the outcome of Trump’s economic policies or tensions with China, we have volatility incoming, with gold is set to benefit significantly.

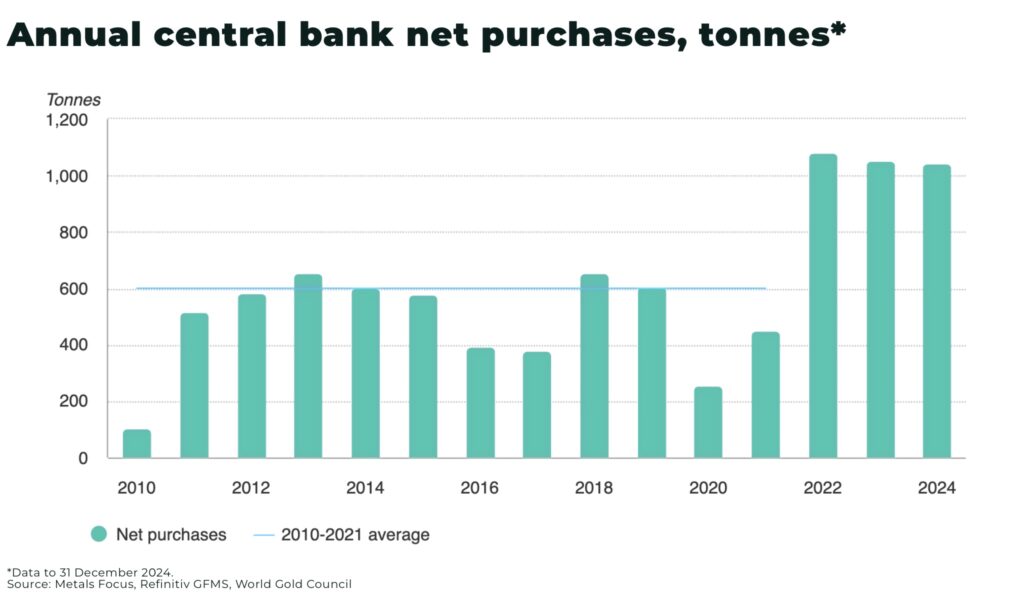

The biggest signal is central banks around the world, who have been buying gold in record quantities, speaking to the global nature of the crisis.

Over 1,000 tons of gold bought by central banks since Russia’s invasion of Ukraine in 2022. The Gold Council sees more evidence that “supports the idea that central banks can repeat again their 1,000t-plus net buying in 2025” — and, in February 2025, this rose again further 24 tonnes in net purchases.

And then there’s the dollar.

Historically, gold’s appeal diminishes when the reserve currency, the US dollar, is strong and acts as its own financial safe haven.

We do not believe we’re in a period of de-dollarization, however, we do think the Trump administration wants a weak dollar (despite their rhetoric suggesting the opposite) to boost manufacturing and reduce the trade deficit.

Again, this will help to boost the price of gold.

So, with central banks (governments) buying up record quantities of gold, and the US working to secure supply chains of trade and critical minerals — where is the safest place to secure gold?

The opportunity: gold mining stocks

Gold is safest, not as an ETF, but a physical bar of gold. And it’s the same for junior mining companies. If the gold company is in an insecure region, it can be threatened by export restrictions or seized by military juntas in Mali.

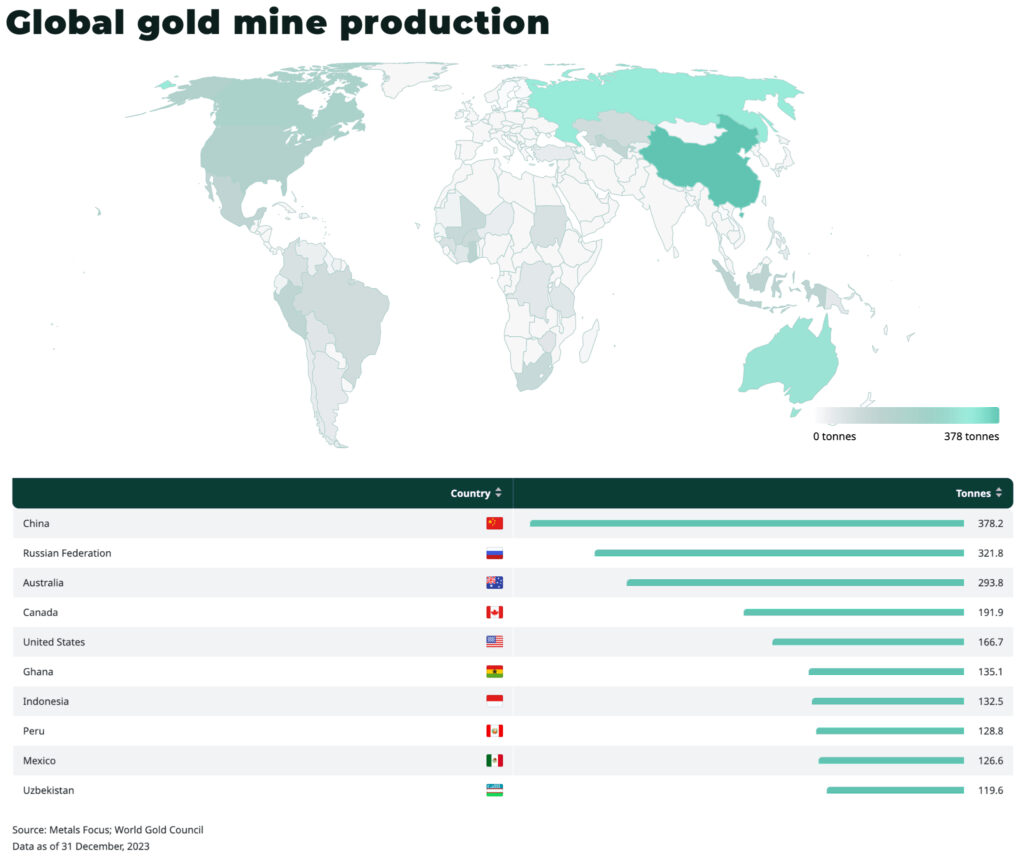

The world’s two largest gold producers are China and Russia, posing a number of challenges, including geopolitical and trade risks, lack of environmental scrutiny, governance and transparency issues.

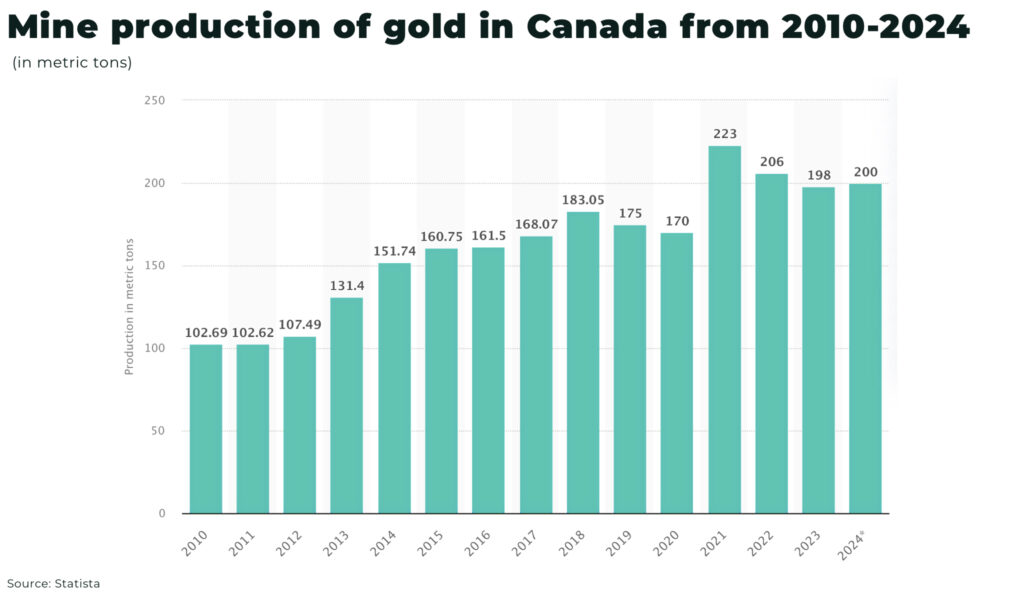

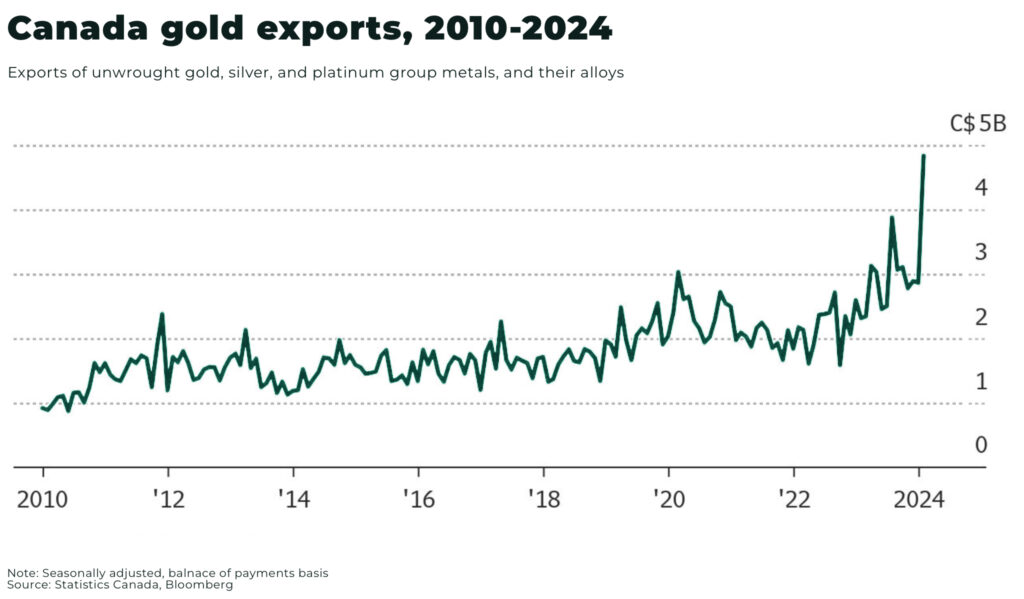

As we highlighted in our recent analysis on Canada’s Gold Rush 2.0, it’s Canada that is working to position itself as a leader in new mine development, including:

- gold is Canada’s most valuable mined commodity, with a production value of CA$15.1 billion in 2023

- new discoveries in the country’s “Ring of Fire” region

- provinces and territories in Canada will no longer require separate federal government approval for new mines

- creation of a “Major Federal Project Office” with a “one project, one review” mandate, under the new Prime Minister Mark Carney

- investment in hydroelectric power can mean both sustainably sourced power and lower energy costs

Canada’s geographical location, so close to the US and fundamentally under its security umbrella, mean the supply chains are significantly less impacted by tariffs and trade tensions.

Junior mining companies

So, for investors who want to invest in the “safe haven’s safe haven”, junior mining stocks offer a compelling opportunity as the market’s valuation of gold equities currently fails to reflect gold’s price strength. And, as many major gold producers face depleting reserves after years of limited exploration, they will increasingly look to acquire juniors with defined resources rather than conducting exploration themselves. This creates substantial upside potential for well-positioned junior miners with quality assets in safe jurisdictions.

Companies like Amex Exploration (TSXV: AMX) exemplify the opportunity.

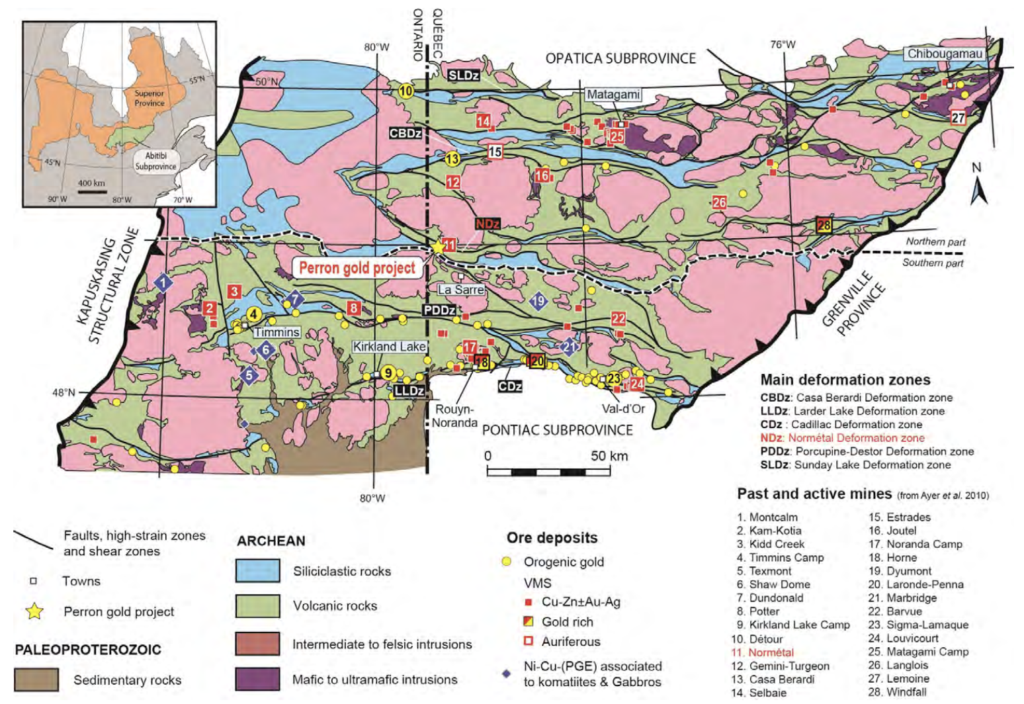

Amex Exploration (TSXV: AMX), a Canadian developer in Quebec’s low-risk mining belt, is focused on its 100% owned Perron Gold Project within the prolific Abitibi Greenstone Belt. Amex has made multiple high-grade gold discoveries over a 4 km strike. Situated near existing infrastructure and a skilled workforce, the project has potential for both open pit and underground mining.

Eric Sprott, a renowned gold investor, has recently purchased US$1,478,978 worth of shares in Amex adding to his position in the company.

The company has been undertaking extensive drilling, exceeding 350,000 meters and aiming for 100,000 meters in 2024 alone. Recent drilling results, such as 18.66 g/t Au over 3.00 m in the Gratien Gold Zone, and the discovery of new zones like the Team Zone, highlight the ongoing potential to define substantial resources.

The company completed a Preliminary Economic Assessment (PEA) in Q4 2024, highlighting a compelling low-capex, high-margin operation with a rapid payback.

With hundreds of thousands of meters of drilling completed, Amex continues to make new discoveries and expand known mineralisation, including the recently discovered Team and JT Zones.

Backed by a strong management team and significant institutional investment, including Eldorado Gold, Amex offers substantial exploration upside and is poised to deliver significant value through further resource definition and project advancement.

Conclusion: the greatest gold rush

We are an historical turning-point, where no one knows the outcome — and that’s the point.

The potential impact of sustained tariffs, inflation concerns, geopolitical risk, a volatile dollar — all create a powerful argument for gold, and gold equities, suggesting we are on the cusp of a new gold rush, maybe the greatest gold rush.

While gold offers protection globally, North American gold equities — particularly well-funded juniors in Canada — offer the safest bet.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.