- global market for ammonia forecast to increase x3, driven by low-carbon ammonia demand

- ammonia market value expected to be worth US$103.8 billion by 2028

- will ammonia be able to break through as an energy carrier for hydrogen

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

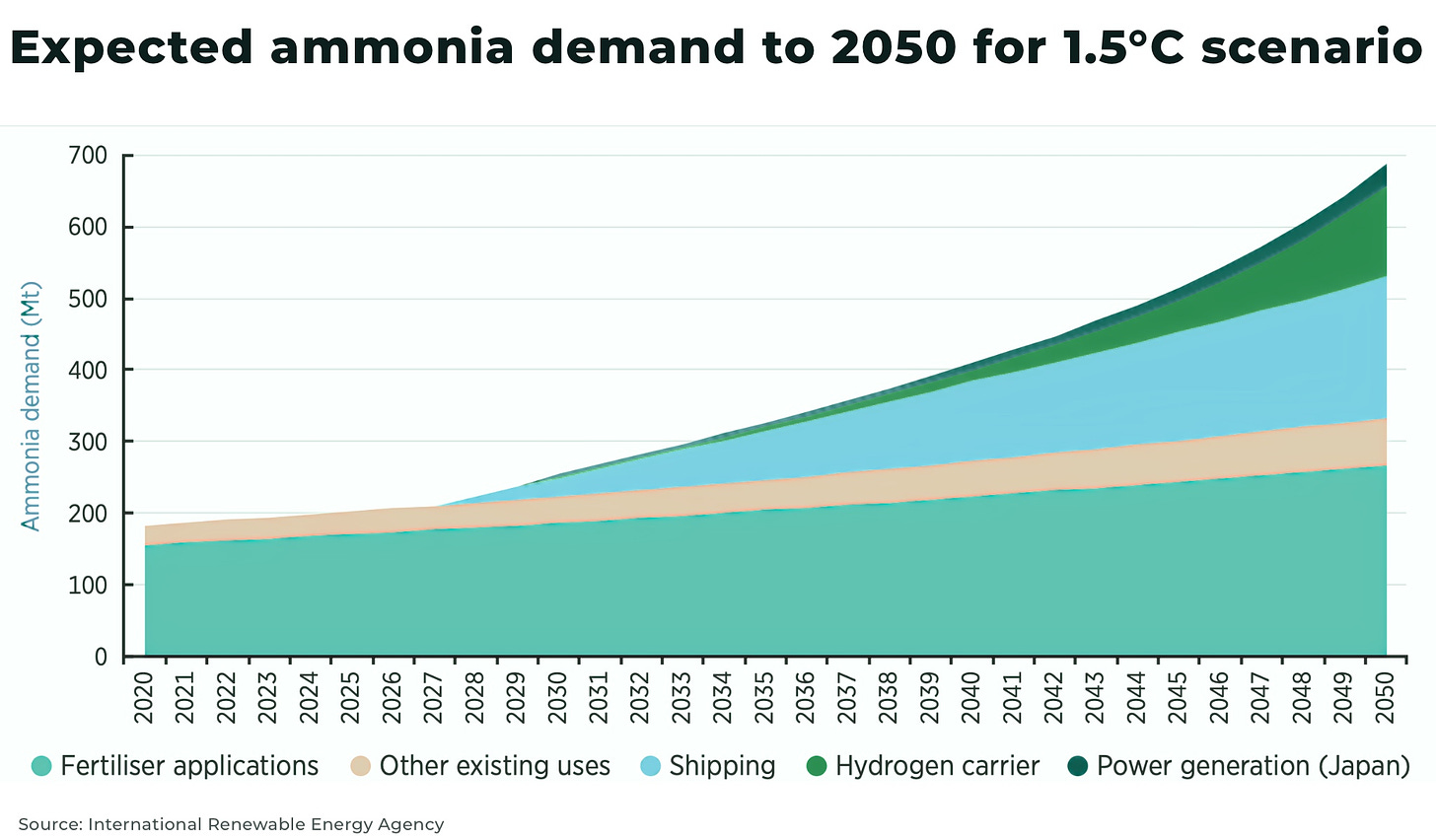

The global market for ammonia is forecast to increase x3 — from 200MT in 2020, to 600-700MT by 2050 — and 66% of this growth will be driven by low-carbon ammonia: from 0.02MT in 2021 to 420MT by 2050.

This massive new demand is expected as ammonia enters a new sector: green energy, including use directly as a low-carbon fuel in gas power plants, fuel cells, ships, or as a long-range hydrogen energy carrier.

Ammonia is already an established commodity, around 80% of it is used to make fertilizer, with a global market value of US$75.7 billion, that is expected to increase to US$103.8 billion by 2028.

But can ammonia make the transition from feedstock to fuel?

What is ammonia

Ammonia (NH3) is a colorless gas, with a characteristically pungent odor, created on an industrial scale through the Haber-Bosch process, by synthesizing nitrogen and hydrogen.

It is essential for modern society, especially as a key ingredient in fertilizers to sustain the global population, but also explosives, plastics, pesticides, and other chemicals.

Ammonia production is also responsible for approximately 2% of global energy consumption and 1.3% of CO2 emissions from the energy system.

There are five main color types of ammonia, taken from the hydrogen production process::

- Grey: uses hydrogen produced from natural gas

- Brown: uses hydrogen produced from coal

- Blue: uses either grey or brown methods of production, but integrated with carbon capture technology

- Turquoise: converts methane into pure carbon and hydrogen, which is reacted with nitrogen to make ammonia

- Pink/yellow ammonia –uses hydrogen produced form nuclear power

- Green: uses hydrogen produced from renewable elecricity for electrolysis

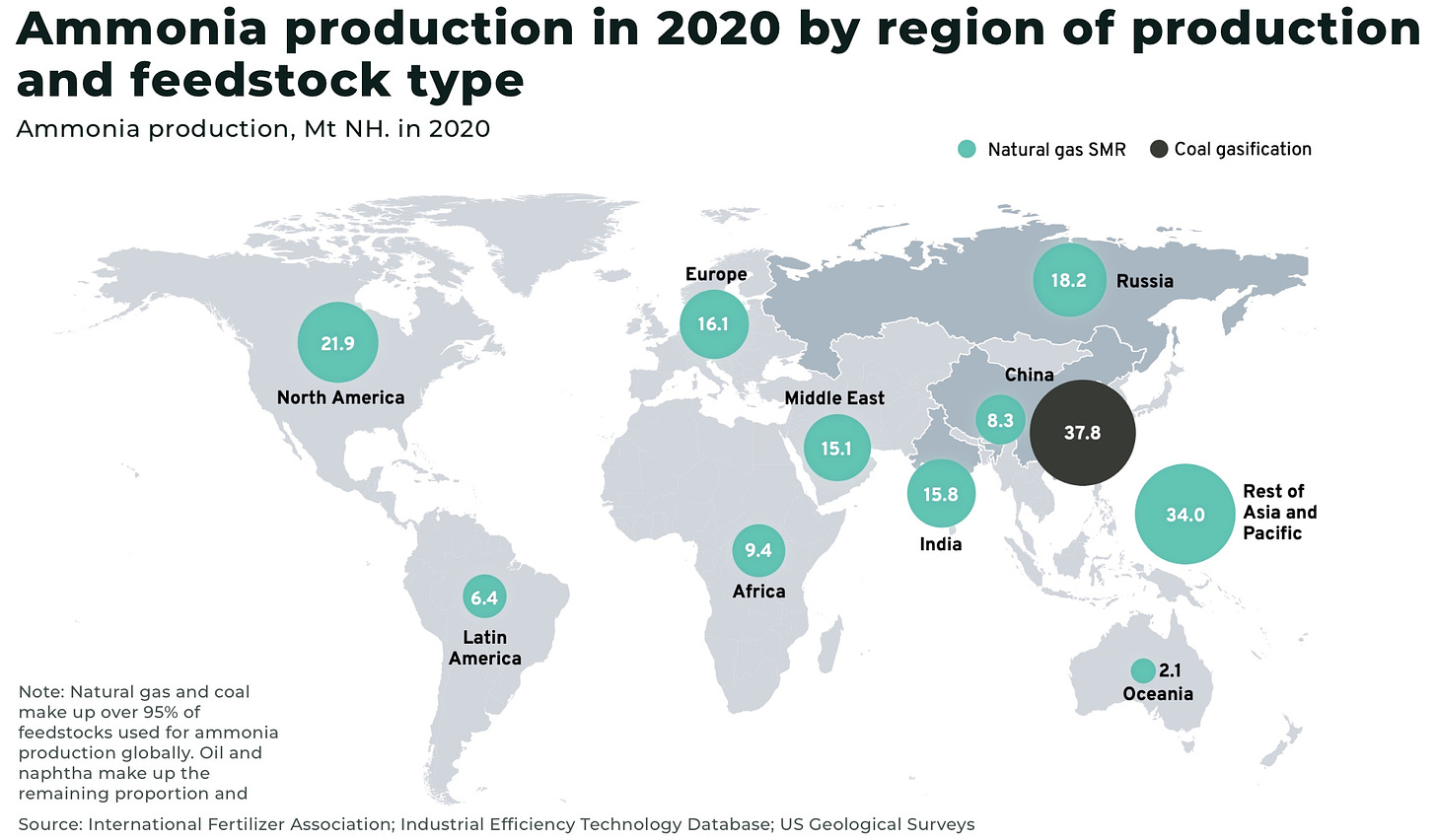

China is the largest producer of ammonia with approx 30% of market share, and Russia, US, India each accounting for approx 8-10% each.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Ammonia demand

The biggest demand for ammonia to 2050 will continue to be in fertilizer production, forecast to increase from 156MT in 2020 to to 267MT by 2050 in a 1.5°C scenario, as global population and food consumption rises.

But, the fastest and largest growth in ammonia demand will come from:

- transport fuel, especially shipping

- as a hydrogen energy carrier

- power and heat generation

Growth in new ammonia markets is expected to be more than double the size of the entire fertilizer market.

The reasons for ammonia’s huge potential as a low-carbon fuel is driven by five main factors:

- when ammonia combusts, the only by-products are hydrogen and nitrogen, free from carbon dioxide; for example, to generate electricity in gas turbines

- ammonia can be “cracked” to be used to produce hydrogen for use in fuel cells

- the energy density of ammonia is higher than both a lithium-ion battery and hydrogen

- ammonia is easily stored as a liquid, in modestly low temperatures (10-15 bar), by compression, hydrogen must be stored 350-700 times bar

- due to it’s use in the fertilizer industry, ammonia already has an extensive infrastructure network, including 550 ammonia plants and 120 ports with ammonia terminals, set up and ready for use; for example, the largest refrigerated ammonia storage facilities are often located at ports where ammonia is produced and shipped. This geographical diversity of supply also helps secure supply chains, unlike many critical minerals

Investment

There are an estimated 269MT of ammonia projects under development across the world, with 133MT for clean ammonia (excluding China).

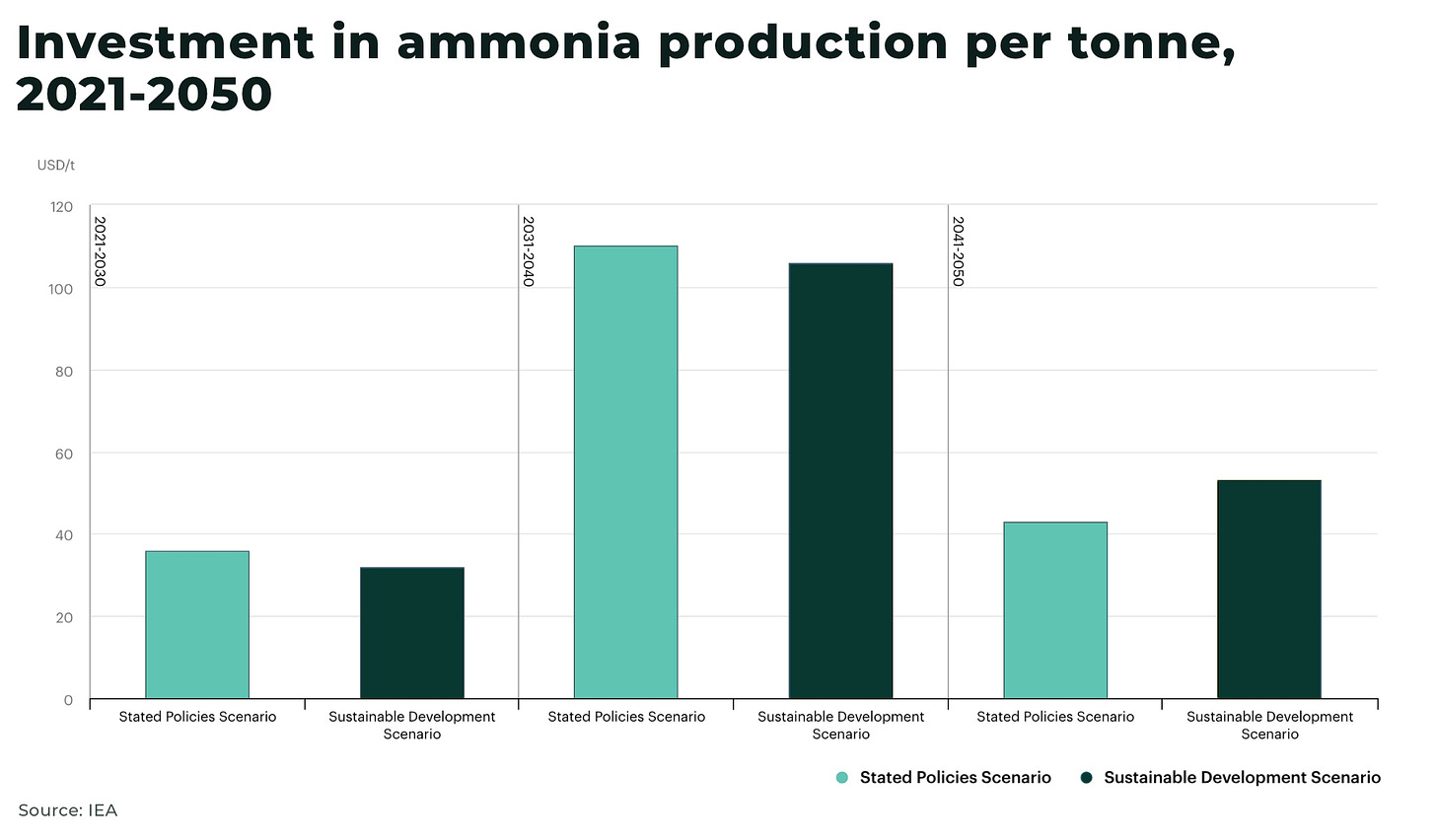

Investment to meet anticipated demand is estimated to be US$15 billion a year by 2050, with at least 80% in low-carbon production facilities.

And significant sums are already being invested, for example:

In ammonia production:

- US$7.5 billion investment in the US Ascension Clean Energy plant to produce 7.1 million tons of ammonia a year by 2027

- a US$2.9 billion investment, by Yara and Endbridge, in a blue ammonia production plant in Texas to produce up to 1.4 million tons a year

- CWP Global is the largest operator in Australia, with nearly 20MT of low-carbon ammonia in the pipeline, followed by BP with more than 10MT

- a green ammonia investment in the Southern India state of Tamil Nadu worth US$6.61 billion

- Morocco’s state-owned OCP, one of the world’s biggest importers of ammonia, plans to invest US$7 billion in a green ammonia plant to produce 200,000 ton of ammonia/year by 2026, increasing to 3 million tons by 2032

- the Qatar Fertiliser Company Mesaieed Ammonia Plant 7, with an estimated capex of US$1.06 billion with a capacity of 1.2 million tons a year

- Australian company CWP Global is the largest operator in Australia with close to 20 million mt of low-carbon ammonia in the pipeline followed by British multinational oil and gas company BP with more than 10 million mt

In shipping:

- Maersk Tankers, one of the world’s largest tanker operators, has ordered up to ten very large ammonia carriers (VLACs) — with the hope they will also run on green ammonia

- North Sea Container Line (NCL), in partnership with Norway-based fertilizer producer Yara, plan to build the Yara Eyde, the world’s first containership that will operate on ammonia by 2026

- Hyundai’s HD Korea Shipbuilding & Offshore Engineering reported two orders for a total of four very large ammonia-fueled carriers (VLACS) valued at a total of US$463 million

- last year, the world’s first commercial shipment of “clean ammonia” was transported 14,000km over 20 days from Saudi Arabia to South Korea, with plans for another this year

- South Korea is building an ammonia receiving terminal, that can handle 4 million tons a year, to be operational by 2030

Hydrogen:

- the world’s largest demonstration project to date, to “crack” ammonia to hydrogen has started supplying 400kg of hydrogen a day in the UK

- NEOM Green Hydrogen Company is building the world’s largest green hydrogen plant to produce green ammonia at scale in 2026, with an investment of US$8.4billion

- Odisha state in eastern India has approved investment proposals worth US$5.5bn for four green hydrogen production projects to produce ammonia

And in energy production:

- GE Gas Power and IHI Corporation, a leading heavy industry manufacturer based in Japan, have signed an MOU to develop gas turbines that can operate on 100% ammonia

- Europe’s first ammonia-fired power generation facility is planned in Ireland

- it’s estimated nearly half of the contracted hydrogen volume is planned to be delivered in the form of ammonia by 2030. South Korea and Europe are the largest export destinations

- in 2022, green ammonia made up the largest proportion of global hydrogen project announcements at 27%

And there are many more such projects.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Challenges

Green Ammonia

The problem in using ammonia in green energy: less than 0.02MT of ammonia was produced from renewable energy in 2021, and none is traded globally.

As of 2023, 99% of ammonia traded globally is derived from fossil fuels (more than 70% of ammonia is produced using natural gas, 25% from coal, and most of the remainder by oil and electricity.

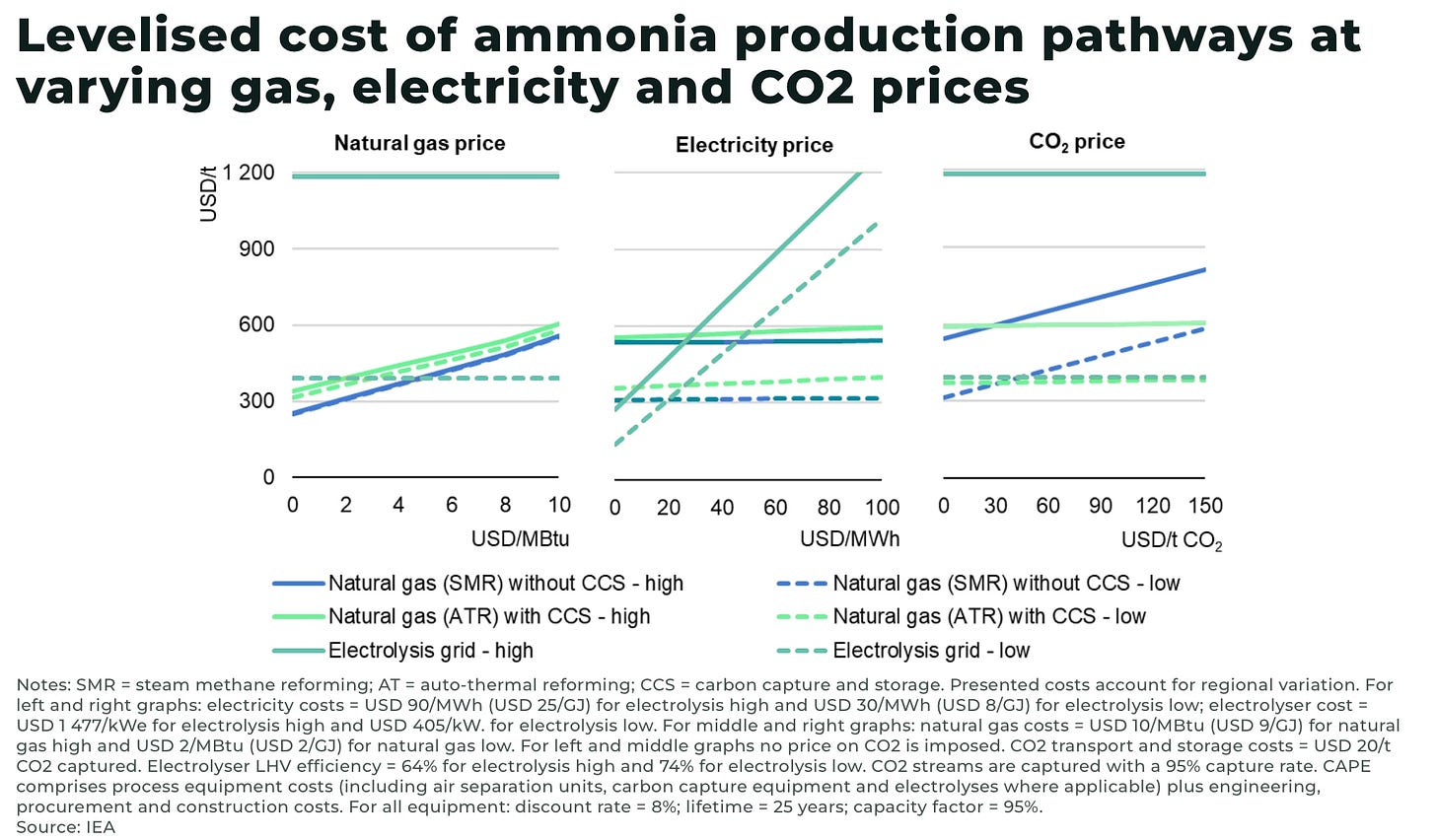

Low-carbon ammonia production is approximately 10-115% more expensive than the cost of fossil fuel ammonia.

To be price competitive, ammonia made through renewable energy electroylsis, needs low electricity prices, low electrolyzer costs, and high natural gas prices.

“Electricity prices of about USD 40/MWh or lower are required for electrolysis to be cost competitive with natural gas-based ammonia production with or without CCS. Application of CCS to natural gas-based production becomes competitive at CO2 prices of USD 30/t CO2”

— IEA, Ammonia Technology, Towards more sustainable nitrogen fertiliser production

There are few direct government tax credits or incentives to support a green ammonia infrastructure build out. However, indirectly, governments are leveraging other tools, for example:

- the US Inflation Reduction Act does not mention ammonia and instead focuses on hydrogen — but there is nothing in the law that says a company cannot build out a hydrogen plant with the tax credits and then sell/export that hydrogen as ammonia

- in the EU, companies importing hydrogen and ammonia must now report their greenhouse gas emissions with the introduction of the EU’s Carbon Border Adjustment Mechanism (CBAM)

There are now at least 8MT of announced ammonia project production in the pipeline for 2030.

But rising capital costs due to interest rate hikes have meant, for example, the 1.2MT a year low-carbon ammonia project at Nutrien’s existing facility in Geismar, Louisiana (to be the largest clean ammonia plant in the world) has now been suspended.

Shipping

Decarbonizing shipping is a vast subject (for another upcoming analysis), so we will focus on the main challenges and opportunities for ammonia today.

A recent report found green ammonia could meet the fuel demands of 60% of global shipping by 2050, costing an estimated US$2 trillion by 2050 to finance the supply infrastructure.

If only 20% of the world’s shipping used ammonia as a fuel, the potential demand for ammonia would be approximately 150MT, roughly 75% of the current size of global fertilizer market.

Challenges include:

- ammonia as a fuel has competition from methanol, biofuels, hydrogen, nuclear and a variety of other technologies being tested

- the technology for ammonia-powered engines are being developed but are currently not commercially available

- the container shipping industry had it’s most profitable two years in shipping history in 2021-22. This meant that more ships have been ordered than ever before. And container ships have an estimated lifespan of 20-30 years. This means that new orders for ships with new technology could take at least a decade.

A new study suggests it the barriers to retrofitting old ships with new ammonia-powered engines are not “showstoppers”. However, with a conversion cost of more than 50% of the vessel’s fair market value, many companies will be reluctant the to invest until there is clarity over the regulations - ammonia is toxic and so difficult to use as a fuel, with safety protocols still being developed. The International Maritime Organisation (IMO) says it has made “significant progress” on interim guidelines, but currently ammonia ships are not allowed to operate.

For example, Fortescue, the world’s first ocean-going ammonia-fueled ship, arrived in the UN Climate Conference COP28 after nearly 4 weeks at sea, powered by diesel to raise attention to the problem.

And developers planning to build European terminals for the import of green ammonia have delayed investments due to an ambiguous clause in the EU’s upcoming hydrogen and decarbonized gas markets package.

Conclusion

The global ammonia market is set to undergo a period of significant transformation in the next two decades, driven by government net-zero targets.

The most attainable goal will be the decarbonization of ammonia production in the fertilizer market.

Regardless the price of natural gas, we expect new investments to be focused on low-carbon ammonia production as investors remain wary of international carbon tariffs, in the EU and elsewhere. This will drive the increase of supply of green ammonia.

The big bet on ammonia lies in the answer to the question: will ammonia be able to break through as a green fuel, as an energy carrier for hydrogen, a fuel to power shipping, as well as power gas turbines?

Currently there is almost no commercially-viable green ammonia industry but ammonia has numerous main advantages that give it an advantage over many other green fuel options, including:

- existing infrastructure

- potential to decarbonize sectors such as shipping and industry

- easier to transport than hydrogen

(see our analysis on Lessons on hydrogen energy’s ambition vs reality from South Korea on the challenges facing the hydrogen market)

Technological breakthroughs, for example, in blending for power, nitrous oxide scrubbing, and ammonia cracking, would also accelerate ammonia’s adoption.

Because of these advantages, we believe ammonia will not only be forced to decarbonize, but also break into the energy markets — but on a limited scale. This limited scale, however, will be of a significantly large size.

The reason: the viable options for companies and governments to decarbonize sectors that are hard-to-abate, such as shipping and heavy industry — especially as costs rise with interest rates — are limited. Ammonia offers a proven technology with a head start.

This head start also means that we don’t expect prices to rise on supply tightening anytime soon (depending on natural gas fluctuations). It will take years for the new sectors, such as shipping, to come online at scale.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.