Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

PT Gunbuster Nickel Industry, a US$3 billion China-backed nickel smelter in Indonesia, has reportedly cut production and is at risk of shutting down.

The facility, one of the largest smelters in Indonesia, has capacity to produce 1.8 million tons of nickel pig iron a year, but already shut all most of its 20 production lines since the start of the year, according to Bloomberg.

The smelter is backed by China’s Jiangsu Delong Nickel Industry Co., whose financial collapse has left Gunbuster unable to pay its energy bills or buy nickel ore.

Indonesia supplied 54% of global nickel supply in 2023, which is expected to increase to 60% by 2028, driven mostly by demand from stainless steel and electric vehicles.

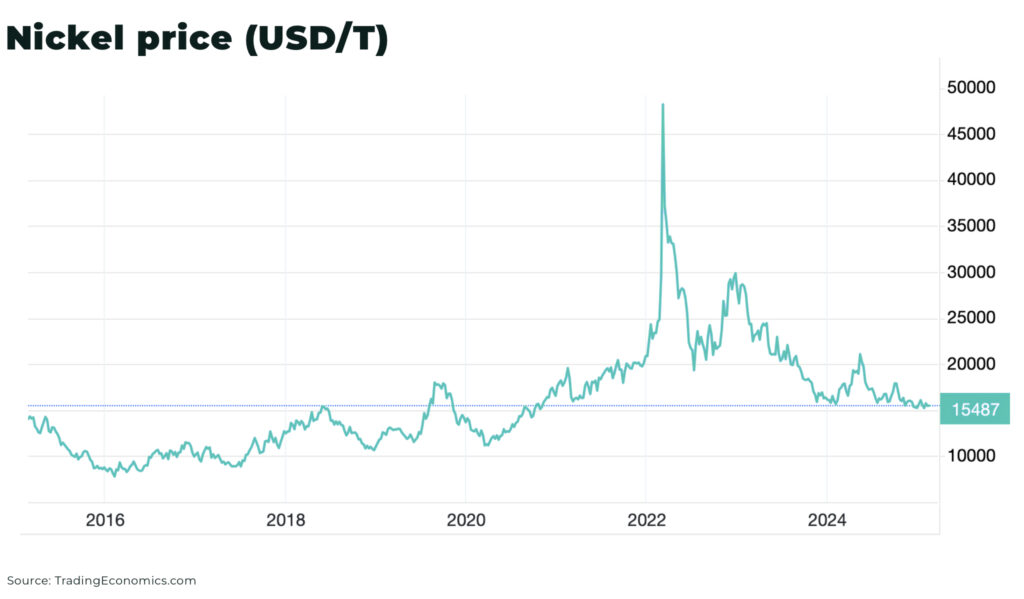

However, nickel prices have been stuck below US$16,000 per ton on the London Metal Exchange since mid-2024, pressured by Indonesia’s record exports.

Our estimates suggest, Gunbuster’s closure puts 10% of Indonesia’s refined nickel exports at risk (which stood at 1.8 million tons in 2024)

The global nickel market is under pressure from increased exports from Indonesia as the country fights to protect and expand its global market share. Read our full analysis: The great nickel trade war.

The risk of closure of Gunbuster suggests the low prices are now impacting the domestic industry. And, as the saying goes, there’s no cure for low prices like low prices.

In our recent interview with Mark Selby, CEO of Canada Nickel, we explore why the nickel market isn’t as weak as headlines suggest, how Indonesia’s dominance may be peaking, and why large-scale nickel projects outside of China are critical for long-term supply security.

“Pay attention to Indonesian ore prices. When they squeezed supply last summer, the price of Indonesian ore increased significantly. Indonesia had eased off on supply restrictions in late 2024, but this was likely due to pressure from China to maintain ore supplies. We expect them to start managing supply more intentionally in the near future, which will likely drive up ore prices and the floor price for nickel”

— Mark Selby, CEO of Canada Nickel

Full interview: