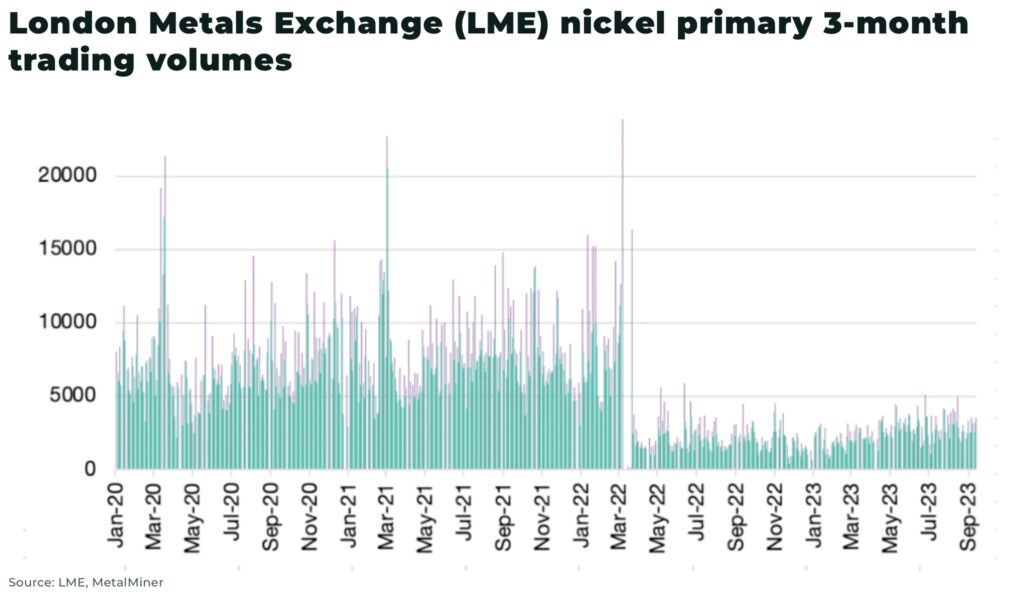

Trading volumes for the London Metals Exchange (LME) nickel contract remain significantly below averages since the suspension of the LME’s nickel contract 18 months ago.

The latest volumes highlight the LME’s challenge in regaining trust and confidence after they suspended in nickel for the first time since 1988, when prices surged 250% in March 2022, to over US$100,000/tonne, within hours.

And competitors are reportedly starting to plot ways to replace the oldest and largest metals market — a cornerstone of the global nickel market estimated to be worth US$38.44 billion in 2023.

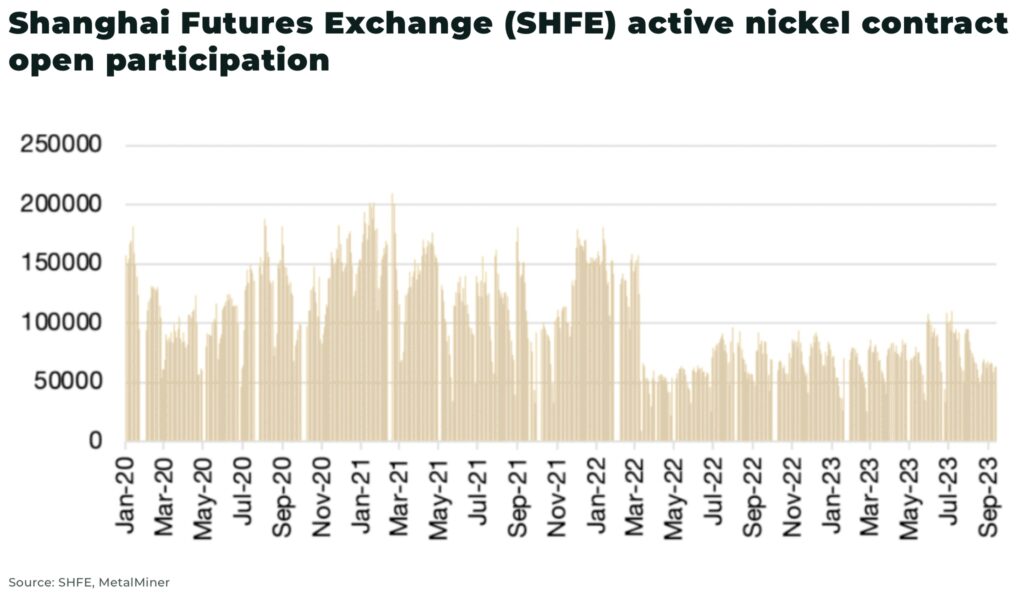

According to a Reuters report, the Shanghai Futures Exchange (ShFE) is looking into the potential launch of nickel futures for international use, including providing international firms access to the nickel contracts on its International Energy Exchange (INE), where commodities such as copper, crude oil and rubber are traded in yuan.

Another potential competitor, CME Group, is reportedly looking to launch a nickel contract that would settle against prices gathered from a platform to be launched by British-based Global Commodities Holdings (GCH). However, they have also told the Financial Times that they are not planning to launch a nickel contract to rival the LME.

In Singapore, a new commodities exchange, Abaxx, plans to launch a nickel sulphate contract, the world’s first for a type of nickel used to make the lithium-ion rechargeable batteries that power electric vehicles. The move comes as markets expect a significant tightening of nickel Class I.

In response, the LME is moving ahead with changes to how it sets its end-of-day prices, in an attempt to boost transparency and trust.

Our analysis on whether the London Metal Exchange nickel contract can survive: