- Russia supplies approx 20% of the world’s Class I nickel, the world’s largest producer

- supply of nickel Class I is expected to face a shortage for the next 3-5 years

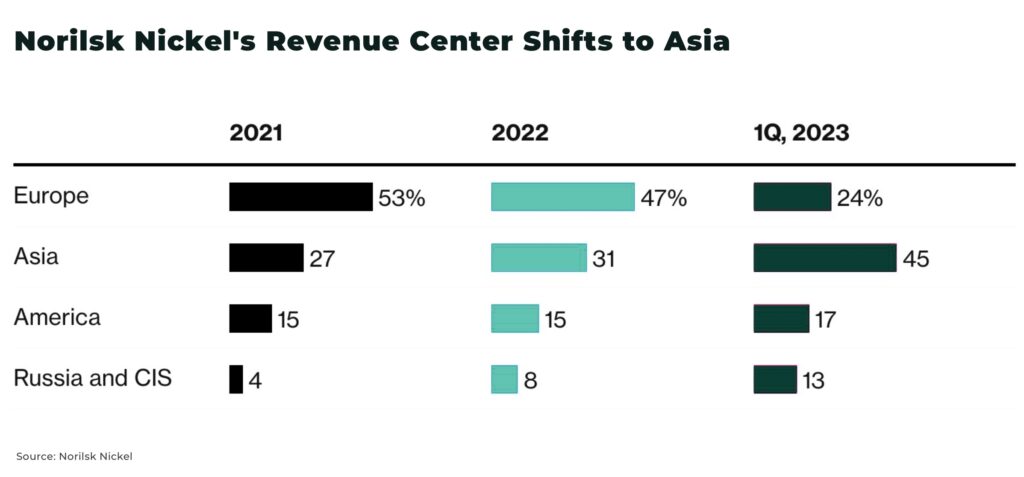

- market shifting to Asia, accounting for 45% of revenue for Russia’s largest nickel miner, so far in 2023

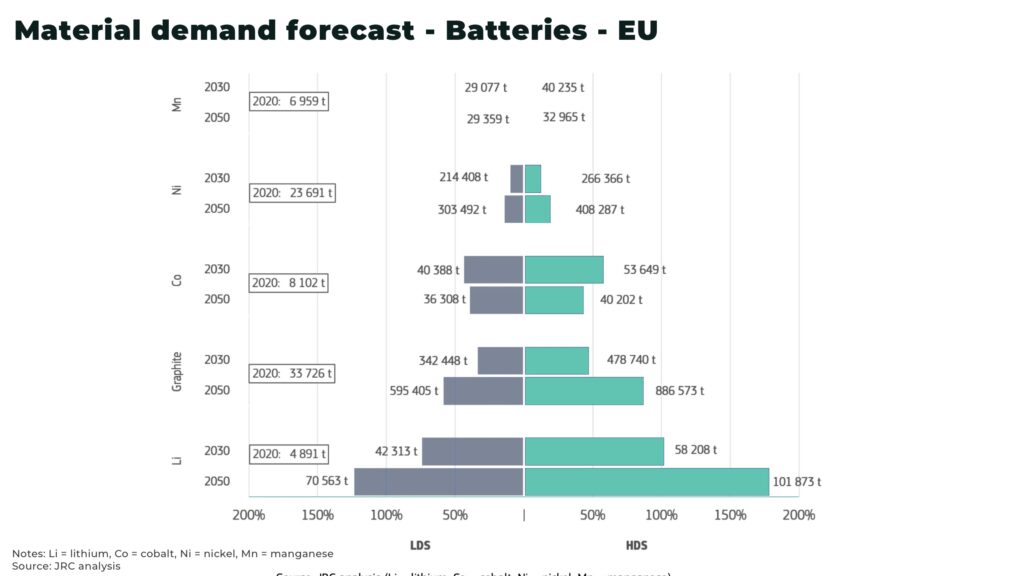

- EU nickel demand projected to rise to 266,36 MT in 2030 and 408,28 MT in 2050

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

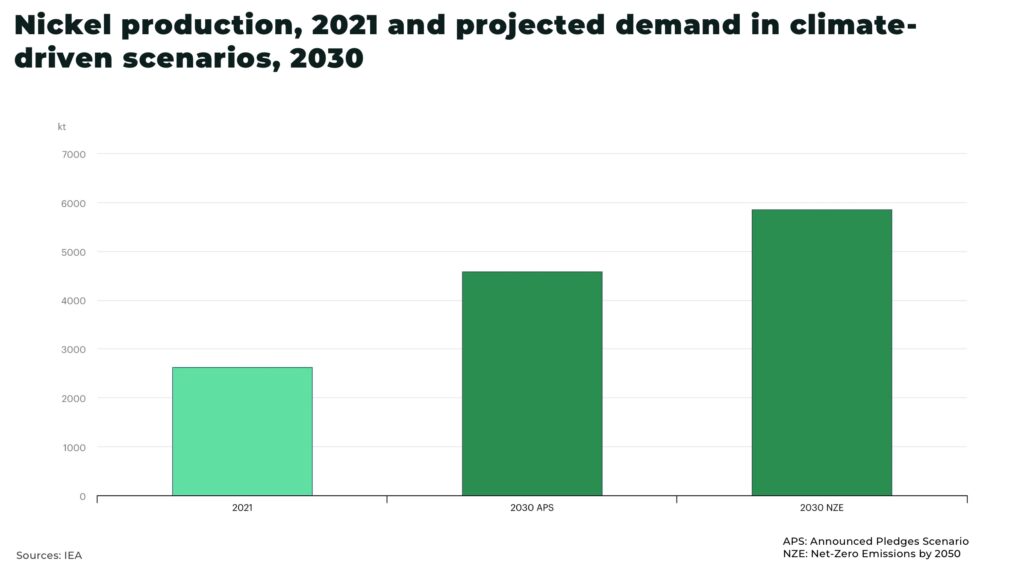

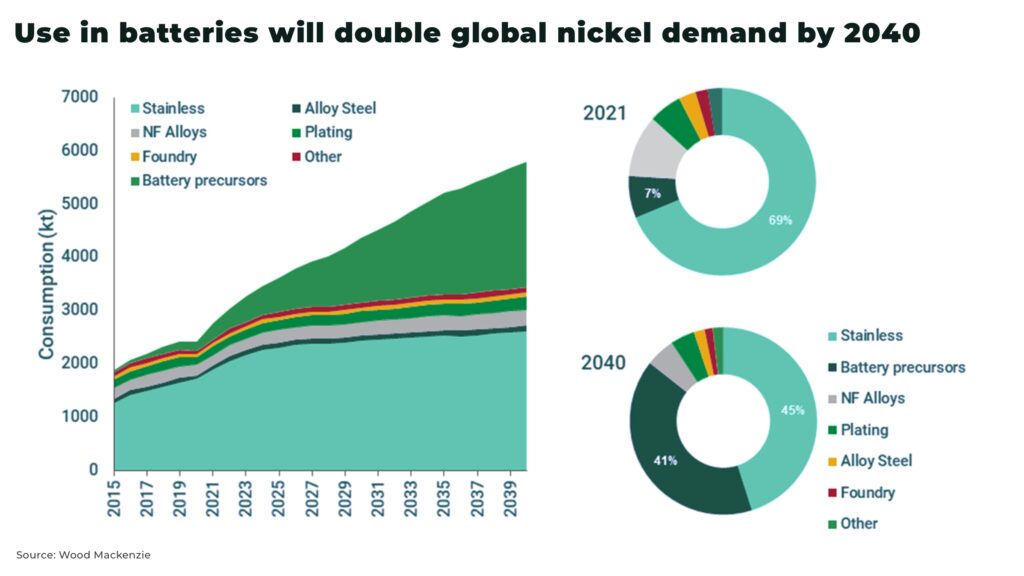

Nickel demand is expected to increase x3 current production by 2030, but volatility over supply from Russia could significantly impact Class I supply and pricing.

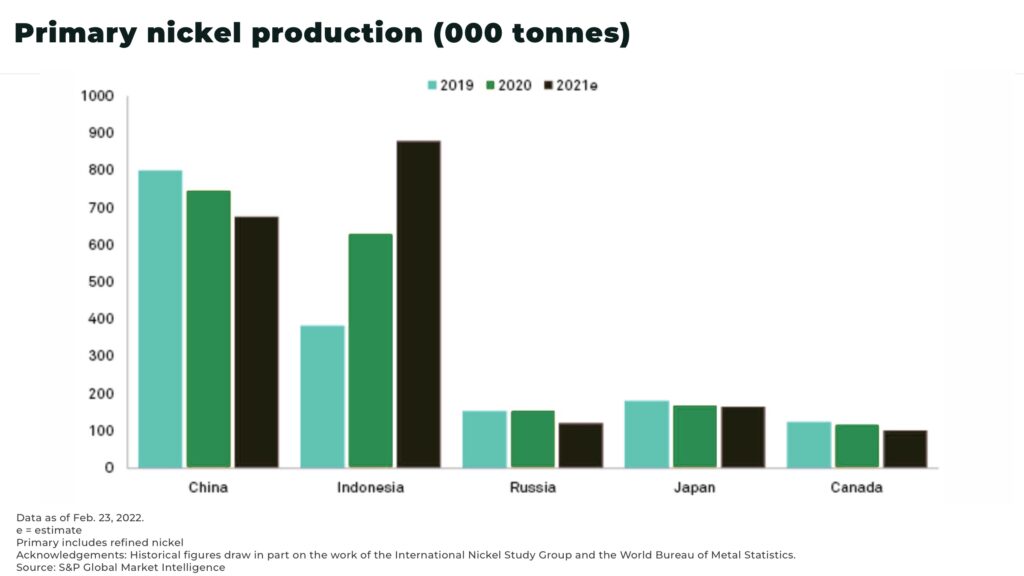

Russia is the third largest nickel producer in the world, with 220,000MT, compared to Indonesia, the world’s largest producer, with 1.6 million MT.

Yet it can have an outsized impact — especially so with volatile geopolitics.

Sanctions vs Russia

Since the start of Russia’s invasion of Ukraine in February, 2022, the West has moved to prohibit the export of nickel (and other commodities) from the country:

- the UK banned imports of nickel from Russia in May, 2023 as part of a new sanctions package following the invasion of Ukraine — and in hopes others will follow

- US raised import duty tariffs on Russian nickel by 35% in March 2023, as part of a larger package covering 100 other metals

- the LME suspended the warranting of Russian-origin nickel from LME warehouses in the US and UK, but decided against a full ban

- the EU has expanded the prohibition of new investments in Russia’s mining and energy sector (with the exception of mining and quarrying activities involving certain critical raw materials)

- the US and UK have imposed sanctions on Norilsk Nickel’ top shareholder and president, Vladimir Potanin (although no penalties have yet been placed on the company or its exports)

- the US sanctioned Sergey Gennadevich Malyshev (Malyshev), Chief Financial Officer and Senior Vice President of Norilsk Nickel (although no penalties have yet been placed on the company or its exports)

- the LME is aware that a number of nations, including the US, EU, UK and other G7 countries, have taken measures to revoke Russia’s most-favoured-nation (“MFN”) trade status

And Russia’s nickel exports must also pass through the disrupted logistics and shipping, insurance concerns, as well as banking issues.

For example, Finland’s state railway firm has said it will end freight traffic from Russia to the Harjavalta refinery in 2023, forcing, major Russian exporter Nornickel to find other ways to get it’s supplies out.

For many investors and companies, the direction of travel is clear.

The challenge is how to make up the looming supply deficit.

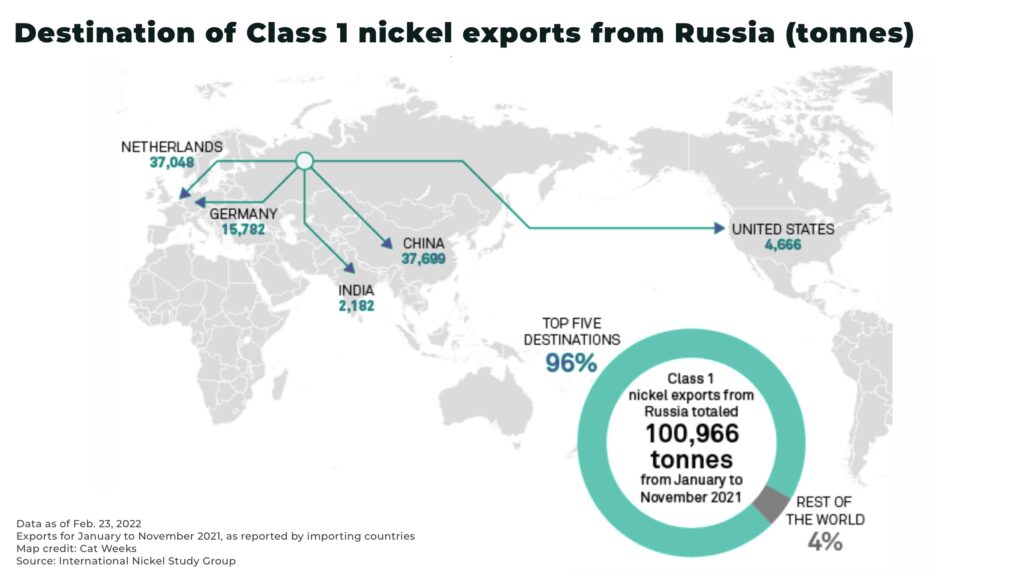

Russia’s class I nickel exports

After Russia invaded Ukraine, the three-month nickel price on the London Metal Exchange reached an 11-year high of US$25,575 per tonne in trading on February 24.

The third largest nickel exporter in the world was exerting a disproportionate influence on the market.

The reason: Russia supplies approximately 20% of the world’s Class I nickel, the world’s largest producer, which has a 99.8% purity.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

There are two main types of nickel:

- Class I: higher purity of 99.8%, essential for electric batteries and LME deliverable

- Class II: often with less than 99% purity, non LME deliverable, used in stainless steel

Nickel Class II is expected to face a significant surplus of supply this year as production continues to increase, particularly in Indonesia.

But, supply of nickel Class I is tightening, just as electric vehicle and electric battery demand is rising dramatically.

As highlighted in our latest nickel report — The Green Economy and Nickel’s Generational Supply Crunch — the supply of nickel Class I is expected to face a shortage for the next 3-5 years.

“The implicit market balances are therefore a deficit of 169kt in 2021, and surpluses of 105kt in 2022 and 239kt in 2023. Historically, market surpluses have been linked to LME deliverable/class I nickel, but in 2023 the surplus will be mainly due to class II and nickel chemicals (principally nickel sulphate)”

— International Nickel Study Group, Nickel Market Observations for 2023

According to the latest figures, supply of nickel Class I has declined 28% so far this year to 40,032 tonnes, the lowest level since 2007.

Russia’s nickel moves east

In 2020, the European Union imported 23,691 MT of nickel for electric batteries. In a high demand scenario, this is projected to rise to 266,36 MT in 2030 and 408,28 MT in 2050.

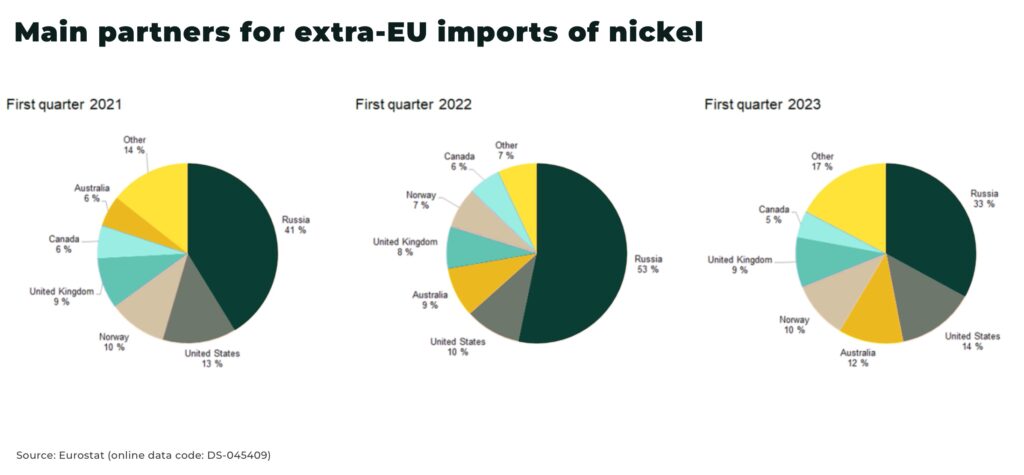

Yet, Russia’s share of EU nickel imports has fallen 20% between Q1 2022 and Q1 2023. Compared with January 2021, the volume index of nickel imported from Russia stood at 115 in October 2022 but fell to 73 in March 2023.

Before the war with Ukraine, Nornickel planned to expand capacity from the Harjavalta refinery to 75,000 MT/year and 100,000 MT/year by 2026. Instead, the company is now considering cutting its output of nickel by 10% this year as European buyers shun the market.

BASF, the German chemical giant, is also considering stalling construction of a planned precursor cathode active material (PCAM) plant in Harjavalta, Finland as part of it’s electric battery investment across Europe. Ostensibly this is because of permits, and not linked to it’s supply agreement with Nornickel.

From January-March 2023, Asia accounted for 45% of revenue for Russia’s largest miner, Norilsk Nickel. Revenue from Europe fell to 24%, from 53% in 2021.

Even with no official sanctions, the market has shifted.

None of this is good news for Russia’s nickel exports.

As Europe restricts imports, so the potential for the growth of nickel exports to Asia is challenged by:

- a shift in electric battery manufacturing in China to nickel intermediates, including mixed hydroxide precipitate and nickel matte, from Indonesia due to high nickel prices

- concerns over China’s economic forecasts impacting short and medium-term industrial demand

“I do not think that there is any mine that could match the pure nickel production of Russia, but laterite ores are abundant both in the Philippines and Indonesia that can support the ferronickel production, which is a pure nickel substitute, used for stainless steel, nickel concentrates and other nickel products that can be used for battery production”

— Philippine Nickel Industry Association and Global Ferronickel Holdings Inc. President Dante Bravo said

However, as with Russia’s sanctioned crude oil through Saudia Arabia, we don’t think these challenges will stop Russian nickel from finding it’s way into the market — and the extra logistical challenges may well elevate the price.

The changing Class I global nickel market

So, where should investors look for exposure to this market?

Indonesia and Philippines:

- Indonesia, the world’s largest nickel exporter, plans to develop downstream to produce electric batteries and EVs. Western companies such as Ford and Volkswagen are investing billions. Challenges includes the environmental, social and governance impact of the nickel (see our analysis: Nickel’s environmental challenge offers opportunity for the West)

The West:

- the share of nickel imports into the EU from the US increased 4%, Australia and Norway, both 3%, between Q1 2022 and Q1 2023

- the US and Europe who are rolling out trillion-dollar investment plans for the energy transition that will need substantial amounts of ESG-clean nickel, opportunities are in Australia, Canada and domestic supply

- in the US, EV companies like Tesla are signing agreements with domestic producers to source supply

- Australia accounts for 6% of global nickel production, with exports increasing by 5% in 2022 over 2021, and expected to grow at a CAGR of 9% between 2022 and 2026. For example, BHP Group have built a new nickel refinery at Kwinana to produce 100,000 tonnes per year of nickel sulphate, enough to make 700,000 electric vehicle batteries each year

- Canada is also working to access US funding for new mines and Canadian companies, such as Vale and General Motors, signing agreements for long-term nickel supply

There are, of course, a variety of factors impacting price, including ESG (see our analysis: Nickel’s environmental challenge offers opportunity for the West) and the loss of confidence in the LME.

But, the restrictions on Russia’s nickel exports mean markets such as Europe will increasingly have to compete on the global market for more Class I nickel.

Russia will play a key role in the expected volatility in the price as the already tight supply of nickel Class I tightens further.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.