Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Apple and MP Materials have announced a “first-of-its-kind” deal, investing $500 million to establish a fully domestic supply chain for rare earth magnets. The deal comes shortly after the announcement that US Department of Defense is investing US $400 million to become the largest shareholder in MP Materials.

“We are proud to partner with Apple to launch MP’s recycling platform and scale up our magnetics business. This collaboration deepens our vertical integration, strengthens supply chain resilience, and reinforces America’s industrial capacity at a pivotal moment”

— said James Litinsky, Founder, Chairman and CEO of MP Materials

The investment finances the construction of a new manufacturing facility in Fort Worth, Texas, where MP Materials with a series of neodymium magnet manufacturing lines to produce advanced magnets specifically designed for Apple products, from 100% recycled rare earths from end-of-life devices supplied by Apple.

Magnet shipments are expected to begin in 2027 and ramp up to support hundreds of millions of Apple devices.

The multi-year agreement marks one of the largest US investments to date in rare earth magnet production and positions Apple as the first major electronics manufacturer to secure a domestic supply of these critical components.

“Rare earth materials are essential for making advanced technology, and this partnership will help strengthen the supply of these vital materials here in the United States. We couldn’t be more excited about the future of American manufacturing, and we will continue to invest in the ingenuity, creativity, and innovative spirit of the American people”

— said Tim Cook, Apple’s CEO

The rare earth elements involved — primarily neodymium, praseodymium, and dysprosium — are key inputs for the small, high-strength magnets used in iPhones, MacBooks, and other Apple devices. Although rare earth minerals are mined at MP’s Mountain Pass site in California, the final manufacturing of magnets has historically occurred almost entirely in China.

Apple’s funding will be delivered through a mix of direct investment and long-term procurement commitments. MP will operate the facility and retain ownership of the processing infrastructure.

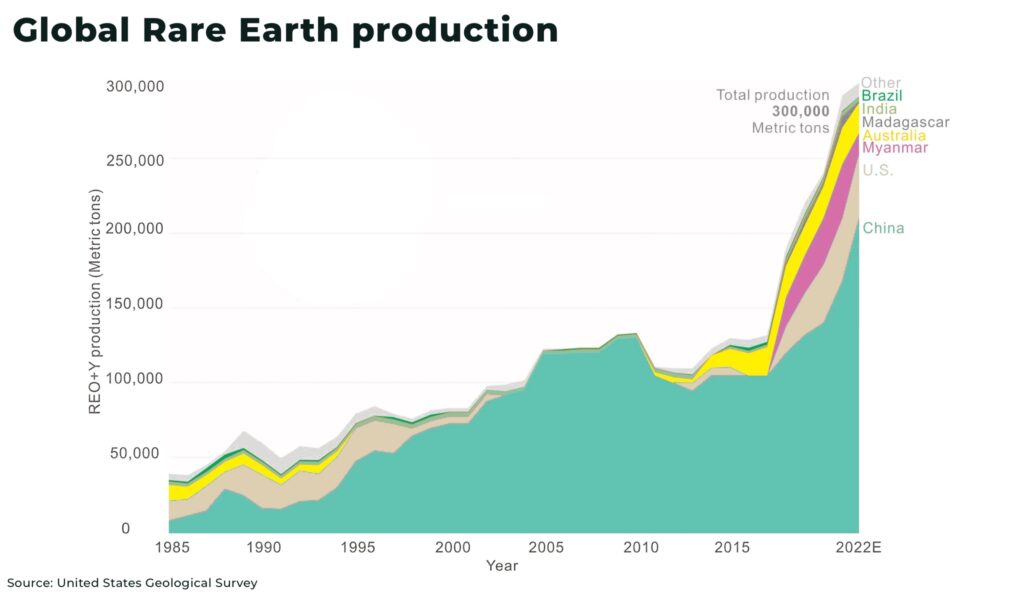

Over 90% of the world’s rare earth magnets are currently produced in China, creating a single point of failure for industries ranging from consumer electronics to electric vehicles and defense systems. The new Apple-MP partnership directly addresses this exposure by creating a US-based closed-loop system, from material recovery to final manufacturing.

The deal comes amid continued geopolitical uncertainty around access to critical minerals. In recent years — particularly at the start of 2025 — China has imposed export controls on a series of critical minerals and rare earth-related technologies. By investing in domestic processing, the Pentagon and Apple hope to reduce America’s reliance on foreign suppliers and buffers its production against future disruptions.

The $500 million Apple-MP Materials agreement establishes a U.S.-based supply chain for rare earth magnets using recycled materials. It represents a material step toward reshoring critical components, reducing exposure to geopolitical supply risks, and building commercial-scale processing capacity within the U.S. electronics sector.

(Photo credit: MP Materials)

Further reading:

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.