Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Amidst global titanium supply volatility, Australia has the potential to be a key strategic supplier for Western nations seeking supply chain security, with some of the world’s largest reserves and production:

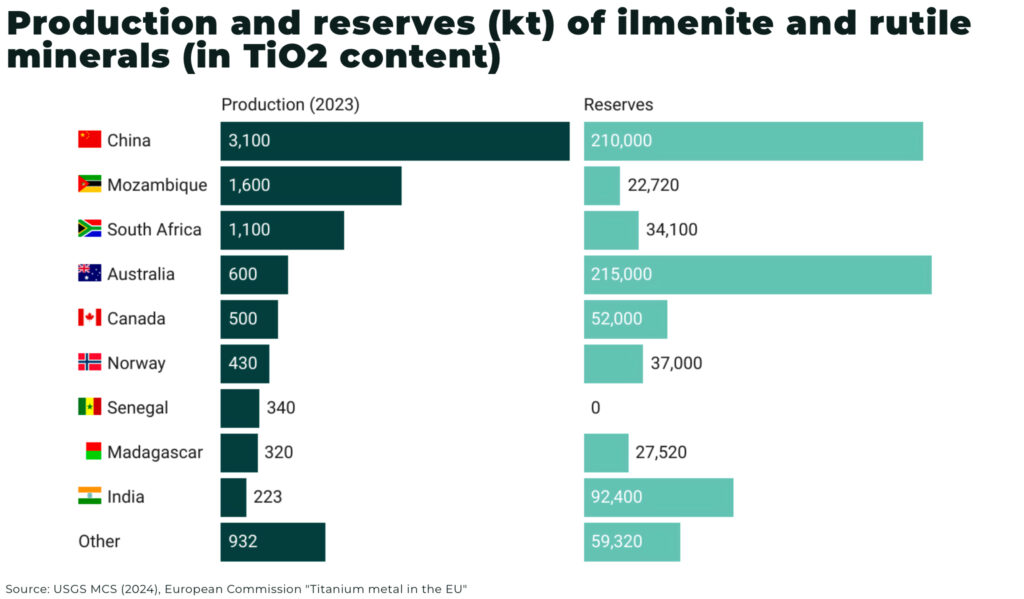

Australia holds the world’s largest titanium mineral reserves. As of 2024, the nation possesses approximately 180 million metric tons of ilmenite and 35 million metric tons of rutile, measured in titanium dioxide (TiO₂) content

Australia is the fourth largest ilmenite and rutile producer, after China, Mozambique and South Africa. Production expanded to 9.2K tons in 2024, up 1.5% from the previous year — and recent discoveries, by companies like Empire Metals, rank among the largest known deposits in the world.

Why titanium matters

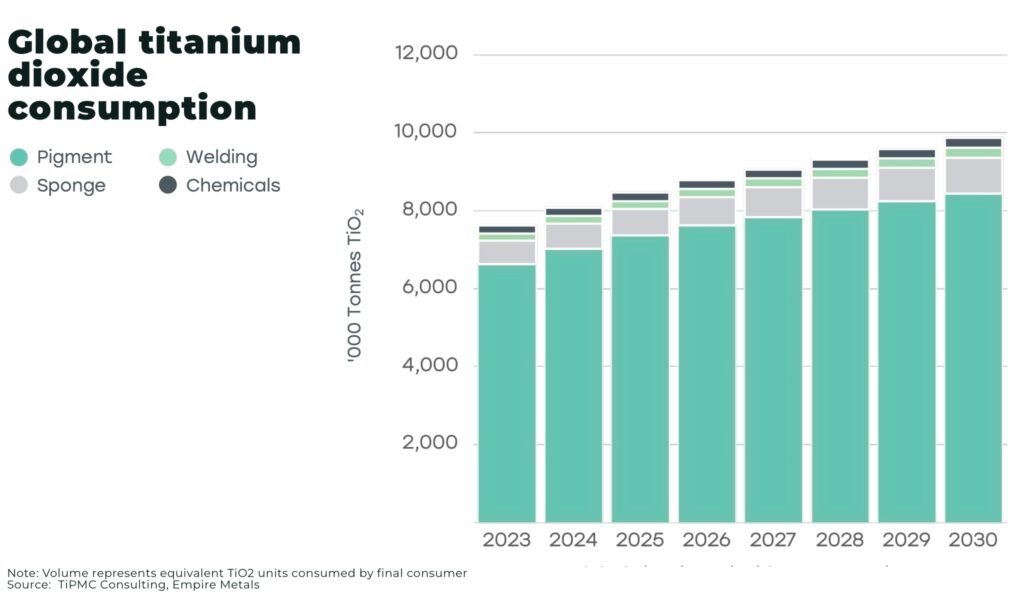

Titanium dioxide (TiO₂) is best known for its role as a pigment—providing opacity and brightness to paints, plastics, and paper — which accounts for 91% of the market. But titanium’s importance extends far beyond the pigment that whitens your walls or brightens your plastics.

Its strategic importance is underscored by its classification as a critical mineral by numerous governments, including the US, EU, Australia, India, and Japan.

Prized for its exceptional strength-to-weight ratio, high melting point, and resistance to corrosion, titanium is indispensable across a range of advanced sectors:

- aerospace: aircraft frames, engines, and landing gear require lightweight strength and heat resistance

- defence: military equipment, armor, and missile components rely on titanium for durability and performance

- medical: implants and surgical instruments use titanium for its biocompatibility

- emerging technologies: hydrogen fuel, green energy, and lightweight materials for electric vehicles and advanced transportation

Titanium’s role in these high-value sectors, many vital to national security, means supply disruptions have outsized impacts—especially as geopolitical tensions accelerate defense and aerospace investments.

Deficits, geopolitical turbulence and supply chain vulnerabilities

The overall TiO₂ market is substantial, valued at $24 billion in 2024, with a projected CAGR of 3.7% from 2023-2030, driven by GDP expansion and industrialisation.

Yet the market already faces significant supply risks and regional deficits, including:

- more than 30% of titanium supply comes from China, more than 60% from the top 3 producers (each in high risk jurisdictions) creating potentially significant vulnerability to disruptions

- China’s dominance in global pigment and sponge markets has driven supply deficits of high-value titanium minerals like rutile

- defense and aerospace demands are expected to increase as military spending and air traffic rises

Ilmenite and rutile, currently the principal titanium-bearing ore minerals, are processed to remove impurities and separate the titanium dioxide (TiO₂). TiO2 is predominantly used in pigments (91% of global demand) used to provide opacity in paints, plastics, paper, etc; or converted into titanium tetrachloride (TiCl₄), which is then reduced via the energy-intensive Kroll process to produce titanium sponge.

In particular, China dominates the global titanium sponge industry with a remarkable expansion of its production capacity since 2018, increasing x3 between 2018-2023, from a 37% share of global output in 2018 to 69% in 2024. And, China is increasingly dominant as a TiO₂ pigment producer, putting pressure on global TiO₂ supply chains.

As supply chains are increasing concentrated and demand for titanium metal surges, so too has the US and EU’s exposure to supply vulnerabilities, for example:

- the US has net import reliance of over 95% for US titanium sponge metal and 86% import reliance of titanium mineral concentrates, in 2024

- while the US has some domestic production of ilmenite and rutile concentrates, it has a high net import reliance, ranging from 81% to 90% of apparent consumption from 2021 to 2024e

- the US produces titanium sponge metal at only one operation in Utah, a facility with an estimated capacity of 500 tons per year and produces titanium for electronics, while two other larger capacity facilities in Nevada and Utah have been idle since 2020 and 2016, respectively

- the EU is a net importer of titanium metal and is 100% reliant on imports for titanium sponge

Any viable alternative to titanium would involve major trade-offs in cost and performance.

Australia’s titanium opportunity

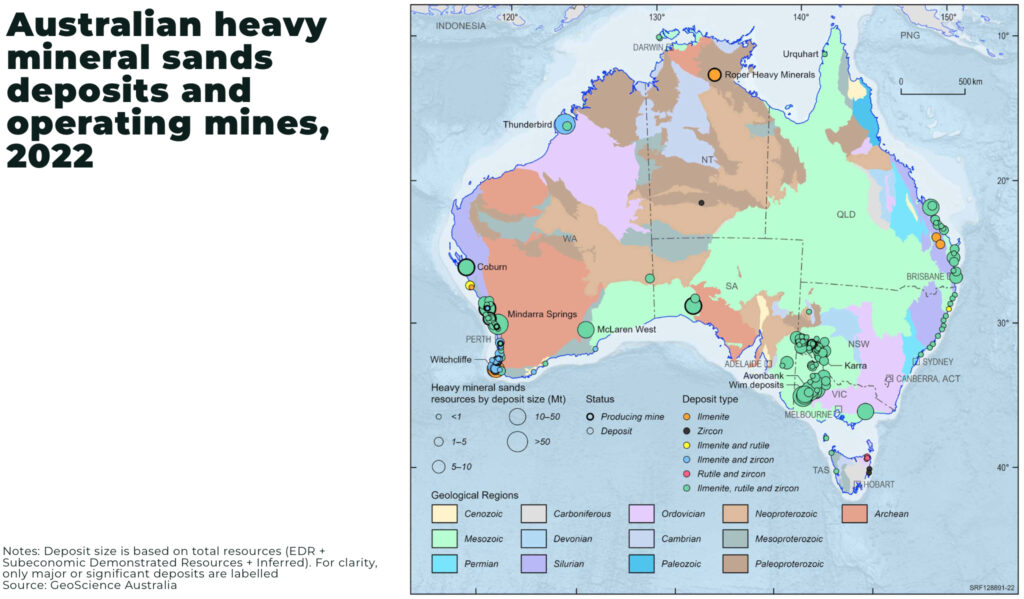

Australia holds 62% of the world’s rutile resources and 32% of the world’s ilmenite resources.

These critical titanium minerals are primarily found in heavy mineral sand deposits across Western Australia, Victoria (notably the Murray and Gippsland basins), New South Wales, and Queensland.

And now Australia is moving beyond raw extraction to downstream processing, signalling a clear intent to move down the value chain and capture more opportunities downstream of mining, including:

Empire Metals (LON: EEE OTCQB: EPMLF) is accelerating the economic development of its flagship Pitfield project, a world-class, district-scale titanium mineral system in Western Australia, which extends over 40km x 8km x 5km deep making it the largest known titanium discovery in the world.

The company’s initial focus is on two key prospects, Cosgrove and Thomas, which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

A JORC Exploration Target* for Pitfield was declared in 2024, covering the two initial prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Preliminary testwork has delivered a high-purity TiO2 product, which assayed at 99.25% TiO2 and was clean of deleterious impurities, providing strong potential for its use in high-quality titanium sponge metal or high-grade titanium dioxide pigment production.

The project is located in Australia’s mid-West, a Tier One mining jurisdiction with direct access to critical infrastructure:

- existing road/rail network

- proximity to Geraldton Port (150km)

- low-energy processing advantages from weathered cap mineralization (30–40m depth)

Metallurgical bulk sampling has been completed and up-scaled metallurgical testing is underway ahead of the design of a larger metallurgical test facility, expected in 2026. Empire is focused on accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit

- Tronox NYSE: TROX, is a leading integrated manufacturer of titanium dioxide pigment, Tronox offers a vertically integrated platform spanning from mine to pigment. Their global operations and focus on sustainability position them as a reliable supplier in the TiO2 market

- Iluka Resources ASX:ILU with a strong presence in mineral sands and rare earths, Iluka is a key player in the titanium feedstock industry. Their recent strategic shifts and investments in high-grade deposits underscore their commitment to meeting growing titanium demand.

- Rio Tinto NYSE:RIO | ASX:RIO is a major producer of ilmenite in Australia, primarily through its 80% stake in the Weipa mine in Queensland. As part of its broader mineral sands portfolio, Rio Tinto’s Australian operations support its global titanium supply chain and reinforce its position as a reliable source of critical mineral feedstock.

Australia is intensifying its strategic initiatives to address global supply challenges, leveraging vast reserves and a stable political environment to position itself as a reliable and attractive alternative within international supply chains.

Government strategy and financial support:

- Australia’s Critical Minerals Strategy 2023–2030 aims to accelerate development of the country’s mining sector, expand downstream processing, and position Australia as a secure supplier of raw and processed critical minerals — with titanium is listed as a strategic priority

- tax incentives, specifically a 10% tax break on processing and refining costs for 31 critical minerals — including titanium — are planned from 2028 to 2040

- in 2025, the government announced an AUD 1.2 billion Critical Minerals Strategic Reserve, and a AUD 1 billion increase to the Critical Minerals Facility, raising its total to AUD 5 billion

Political environment and robust infrastructure:

Australia was the world’s top mining nation with a record number of listings in 2024, offering a stable political environment, robust infrastructure (skilled workforce, road, rail, ports, electricity networks), and deep capital markets; for example, Australian pension funds hold a significant proportion of their money in Australian-listed stocks, supporting long-term mine development.

China is Australia’s largest two-way trading partner, accounting for 26% of our goods and services trade in 2023-24, but the relationship has been hit by a series of crises over the last few years (from Huawei bans to restrictions on coal exports).

Australia has instead started to pivot and deepen relationship with the US, for example, agreeing a “Statement of Intent: Climate, Critical Minerals, and the Clean Energy Transformation” in 2023 to deepen bilateral collaboration on critical minerals.

Commitment to ESG practices:

Australia is positioning itself as a world leader in Environmental, Social, and Governance (ESG) performance, embedding strong practices into mining operations, including mandatory, internationally aligned ESG reporting for miners; JORC Code reforms embedding ESG at every project stage; financial incentives tied to ESG performance; and growing access to ESG-driven capital.

Conclusion

In the current volatile landscape, Australia emerges not merely as “just another” source of titanium, but as a strategic pivot and secure hub for Western nations seeking to secure their titanium supply chains and reduce reliance on concentrated, potentially unstable sources. Discoveries like the massive Pitfield project underscore the potential for multi-generational supply.

While challenges in processing complexity, capital intensity for downstream development, and infrastructure remain, Australia is actively working to address these hurdles through a comprehensive national strategy and targeted investments.

The West has limited options, but Australia represents a long-term opportunity to an emerging crisis.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.