Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

US tariffs are disrupting global uranium supply chains — just as demand is expected to accelerate with the rollout of new fleet of nuclear power stations worldwide.

A word of warning, the tariff regime is extremely volatile and subject to change at any moment, but this in itself is adding to the disruption. So far, the tariffs and sanctions include:

- Russia: ban on unirradiated, low-enriched uranium (LEU) imports, with waiver options and quotas, and threat of 500% tariff on countries that import Russian uranium

- Canada: 10% tariff on uranium imports

- Mexico: 25% tariff on all imports, including uranium

- China: 145% tariff on imports, potentially including uranium; as well as a probe to stop China circumventing the Russian ban

- Kazakhstan: representing 43% of global uranium production, is at risk of secondary sanctions via China or Russia

And, in April, Trump has signed an Executive Order to investigate foreign-controlled critical mineral imports, including uranium.

The disruption has sent shockwaves through the market, with both short-term risks and long-term opportunities.

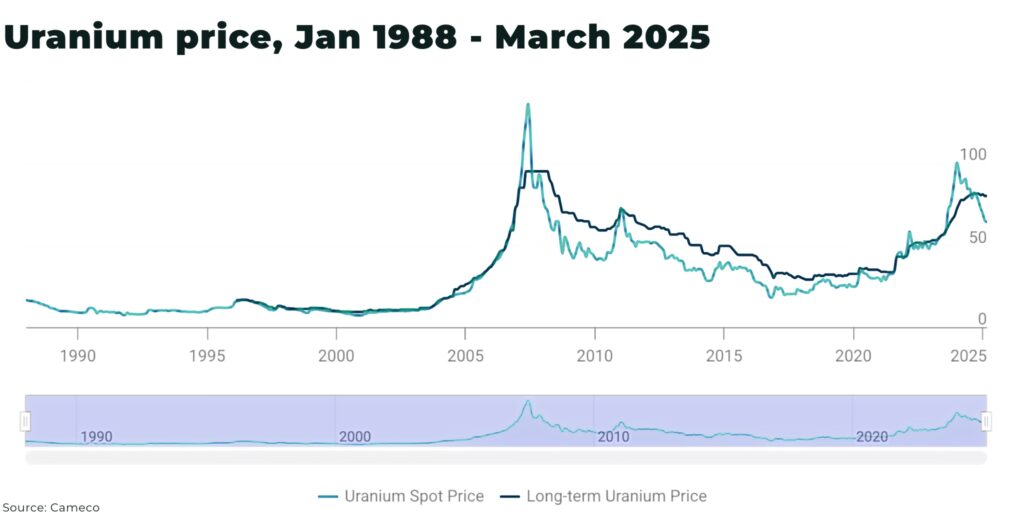

US utility purchases of uranium dropped 50%, with uranium futures falling 40% from highs in 2024, after Trump announced a 10% tariff on imports from Canada, which supplies approx 27% of America’s nuclear fuel.

But, so far, prices have fallen (only) to levels seen in 2023.

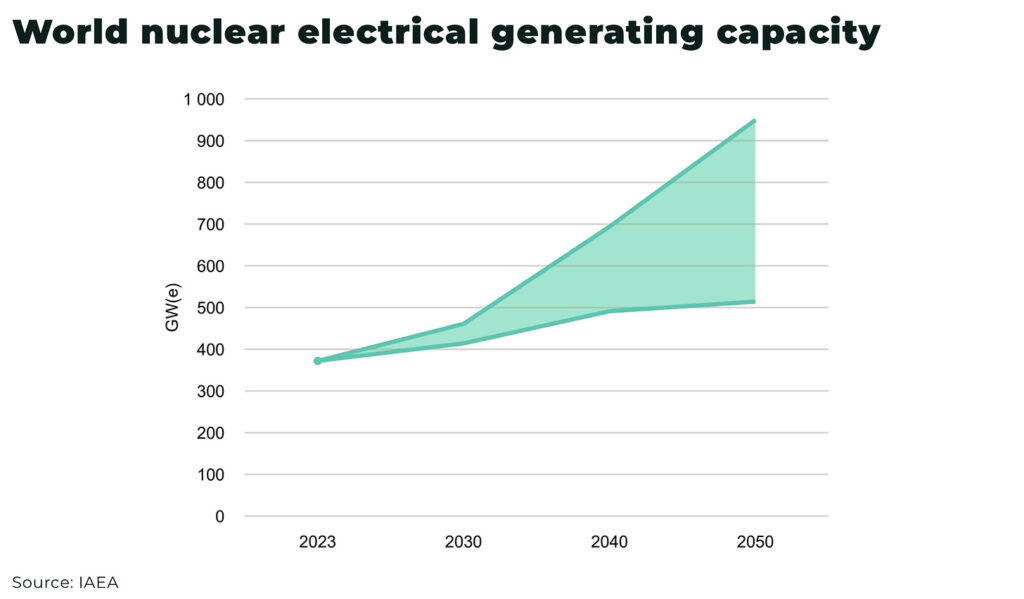

The development timelines for both nuclear power plants and uranium mines typically span many years, often decades, meaning the ramp-up in uranium demand is a long-term, structural narrative rather than a short-term cycle. Despite recent volatility in uranium prices, the macro case for sustained and growing uranium demand remains robust.

Global nuclear capacity is forecast to rise significantly, with the World Nuclear Association projecting a 28% increase in uranium demand between 2023 and 2030, and a 51% increase for the following decade as new reactors come online and existing ones are extended

And the current low uranium prices threaten to slow investment in new mine development.

The utilities are in no immediate danger of running out of nuclear fuel in the short-term, but the ongoing volatility is setting the stage for a significant snap-back in prices.

As the old saying goes, the cure for low prices is low prices.

Demand

We are at a pivotal moment for nuclear energy.

Approximately 60 reactors are currently under construction worldwide, with plans for at least 110 more. For context, there are around 440 nuclear reactors operating globally today. And, global nuclear generation is on track to hit an all-time high in 2025, with output expected to grow by 3% or more annually.

This demand is driven by:

- nuclear power station restarts and extensions (especially in the US, Japan)

- China, in particular, is already building out a record number of reactors

- tech companies, financial institutions and governments pledging billions in investment to power data centers for Artificial Intelligence (AI)

- projects for Small Modular Reactors are being signed off and developed across the world

- and, in global decarbonization efforts, nuclear energy (finally) acknowledged as clean power

Supply

China and Russia have, so far, been the target of Trump’s most significant tariff threats:

- “China now faces up to a 245% tariff on imports to the United States as a result of its retaliatory actions” — Fact Sheet: President Donald J. Trump Ensures National Security and Economic Resilience Through Section 232 Actions on Processed Critical Minerals and Derivative Products

- and, the proposed Graham-Blumenthal legislation also represents a possible 500% tariff penalty on nations importing Russian uranium, oil, or gas, which would significantly impact shipments of uranium from Kazakhstan to Russia

There is also the risk that export restrictions on uranium may be tightened — and not just by the US, similar to China’s recent export ban on numerous rare earths and antimony.

Australia is the world’s fourth largest uranium producer, with 28% of global reserves, however the country’s uranium mining sector faces its own challenges with bans in some regions and the closure of the Ranger mine in 2021 left only two operating uranium mines.

In the meantime, yes, Canada currently faces a 10% tariff on its uranium exports to the US, but that’s modest compared to tariffs on other major suppliers.

The tariffs aim to bolster domestic uranium production in America, which currently accounts for 5% of US reactor fuel needs, but, despite the levy, Canada remains the top foreign supplier of uranium to the US, providing 27% of imports in 2022, and that position isn’t likely to change.

While utilities have paused buying, likely waiting to see whether Trump reverses any of the tariffs, Canada’s status as a secure, reliable source isn’t in question. The utilities will be back.

And, look beyond the rhetoric: the Canadian government is, in fact, working to accelerate plans to develop the country as an energy and mining hub to power America’s battery belt, “Fortress North America“. In particular, this includes streamlining the approval process for major mining and infrastructure projects in the country.

At the centre of Canada’s uranium production potential is the Athabasca Basin, boasting the highest-grade uranium deposits in the world, and strategically positioned to benefit from the US desire to secure supply.

“As the world faces unprecedented trade and tariff challenges, the importance of secure, high-grade uranium supply from the Athabasca Basin has never been clearer. F3 Uranium is at the forefront of exploration in this globally significant district, advancing new discoveries that highlight the Basin’s potential to support North American and global energy security.

Our technical team’s track record of multiple major uranium discoveries in the Athabasca Basin demonstrates our commitment to innovation and excellence in exploration. As demand for clean energy grows, F3 remains dedicated to unlocking the next generation of high-grade uranium deposits in the world’s premier uranium district”

Conclusion: the tariff paradox

Recent tariffs, intended to boost domestic production, have paradoxically depressed prices and increased volatility, reducing incentives for the revival of US uranium mining, which requires long-term stability.

More importantly, the uranium market’s current turmoil masks structural deficits that make the long-term fundamentals of the uranium market compelling. Even in the short-term, utilities will need to secure 2027-2028 supply within the next 18 months.

Tariffs are creating volatility in the short-term, but Canada’s geography, geopolitics, as well as uranium production and reserves, mean the country’s position to offset the risk for America will only increase over for decades to come.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.