Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Cameco has announced a significant cut to its 2025 uranium production forecast at the McArthur River/Key Lake operation — to 14–15 Mlb U₃O₈ from 18 Mlb — reducing output by approx 22% compared to prior guidance.

Tight supply in the world’s largest, high-grade uranium mine has sent shockwaves throughout the sector, and is reshaping expectations for other developers and explorers in the region.

The update in context

Only a month ago, Cameco was still guiding to 18 Mlb at both McArthur River/Key Lake and Cigar Lake for 2025, and nudged its expected average realized uranium price to ~$87/lb on stronger market pricing.

The primary reasons for the revision are development delays in transition to new mining areas and slower than expected ground freezing at the McArthur River/Key Lake operation.

However, the revision comes as contracting and investment momentum shifts to meet demand from AI data centers, address national security concerns over supply, and geopolitical tensions.

Even Cameco, it appears, is preparing to buy up to 9-10 Mlb by year end to meet deliveries:

“As much as our inventory is a little lower this quarter, it’s just a matter of kind of the timing of when production falls, and also when our supply other purchase commitments fall. In terms of the cost overall, I would point a little bit to our purchase pound. In our outlook, we’re guiding to about 11 or 12 million pounds to be purchased this year, and year-to-date, we’ve only purchased about two million pounds; a lot of purchasing yet to come” — Heidi Shockey, Cameco, Senior Vice-President and Deputy Chief Financial Officer, Q2 2025 Results conference call

(heads up to Paulo Macro, investor, on the quote)

Local shortfall in a global deficit

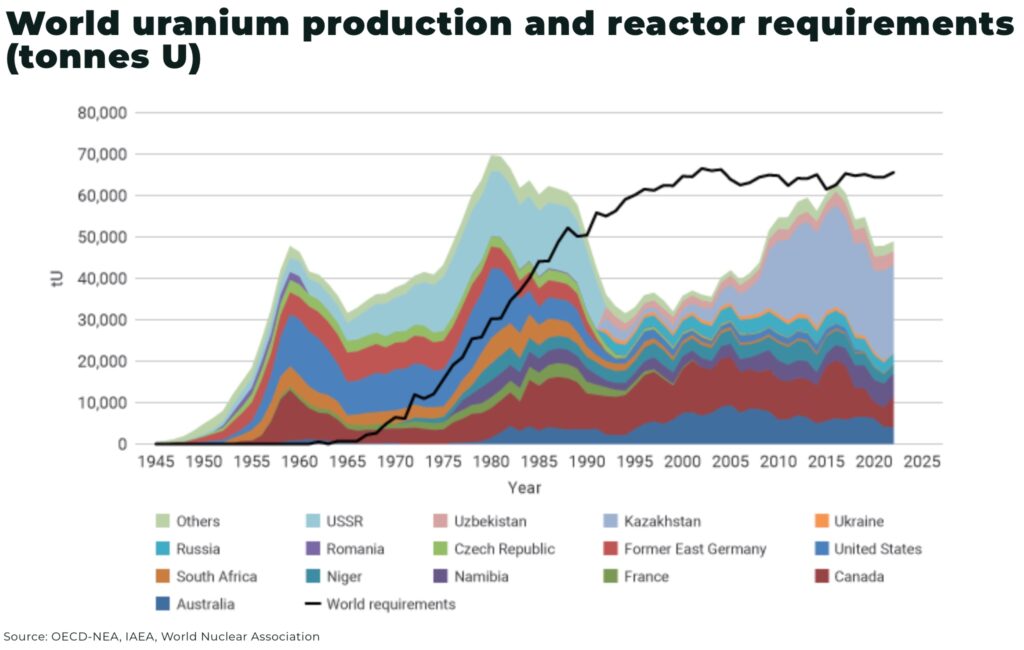

Global uranium supply is already running 10-20% below reactor demand driven by a structural supply deficit and growing global policy support — and utlities have not fully entered the market yet.

As we’ve outlined in previous reports, demand is only set to increase, for example:

- China currently has at least 30 reactors under construction, with another 194 planned or proposed

- the US, EU and Japan are in process of restarting and extending the legal lifespan of nuclear reactors, from the Palisades Nuclear Plant in America, to Japan’s Kashiwazaki-Kariwa nuclear plant (the largest in the world by net electrical power rating)

- then, in May 2025, US President Trump signed four executive orders overhauling the US nuclear energy sector by expediting reactor approvals, bolstering domestic uranium production, and integrate nuclear power into national security and rapidly expanding AI infrastructure

Meanwhile, supply is contracting, including:

- Kazatomprom (the world’s largest uranium producer) has cut its own uranium production guidance for 2025 by 5000 tU, citing uncertainties in sulphuric acid supply

- geopolitical tensions, especially with increasing demand for uranium from China and Russia, threatening to spillover into Kazatomprom’s joint venture partnerships with Kazakhstan, which make up 43% of global supply

- in Niger, a military junta seized control of Orano’s mine, representing 24% of the EU’s imports

- and, now, Cameco’s production shortfall warnings

Spotlight on the Athabasca Basin

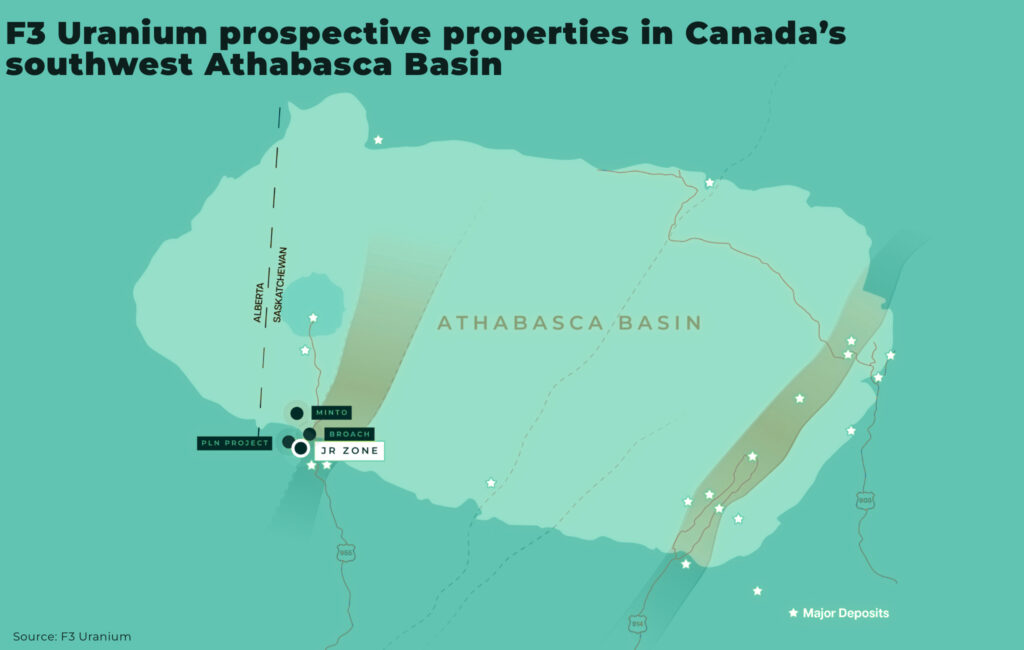

Ironically, Cameco’s production challenges underscore the strategic value of the Athabasca Basin’s uranium assets — in particular, for US national security as there is almost no viable replacement than Canada as America works to secure uranium supply chains to meet soaring demand.

The basin’s unique geological characteristics, hosting some of the world’s highest-grade uranium deposits with grades up to x100 the global average in one of the world’s top-ranking mining jurisdictions, make the region perfectly positioned to take advantage of the opportunity.

There are currently, at least, 67 junior uranium companies in the Athabasca Basin all of which can expect more attention from utilities and investors seeking exposure to upside potential, as well as the risks inherent, in early-stage exploration.

- Denison Mines (TSX:DML | NYSEAmerican:DNN) — Wheeler River; McClean Lake JV — is progressing with permitting after receiving provincial EA approval for Wheeler River with federal CNSC hearings scheduled for this autumn, plus first SABRE-mined ore at McClean North now being processed at the McClean Lake mill

- NexGen Energy Ltd (TSX: NXE | NYSE: NXE) — Rook I / Arrow — doubled contracted sales with a new 5-Mlb offtake to a major US utility in early August, adding commercial heft ahead of final federal approvals and future FID. However, NexGen Energy’s flagship Rook I project must wait for a Commission Hearing now scheduled for February 2026 for approcals, delaying its development

- Paladin Energy (ASX: PDN) — Patterson Lake South / Triple R; via Fission acquisition — now controls the PLS/Triple R development after completing the Fission Uranium acquisition late last year; recent updates keep development targets on track into the next decade

- F3 Uranium (TSXV: FUU, OTCQB: FUUFF) — Patterson Lake North (PLN) — continues to advance PLN (JR Zone) and the new Tetra Zone, with fresh high-grade intercepts and geophysics underway, including the latest discovery with drillhole PLN25-205 which intersected radioactivity over a total of 33.0m including 0.56m of high radioactivity (>10,000 cps) with a peak of 37,700 cps at 398.34m. And the company has also just closed a private placement worth more than US$5 million (CA$7 million)

- IsoEnergy (NYSE:ISOU | TSX:ISO) — Larocque East, Daneros, Tony M — is running an expanded 2025 drill program around Hurricane (Larocque East), reported assay grades of up to 5.4% U₃O₈ from initial drill holes at the Nova Discovery on the Dorado Joint Venture, and in May 2025 the company began trading on the NYSE American

Operational lessons from Cameco’s update

- geology still calls the tune: even with world-class teams, ground freezing, labour availability, and custom equipment commissioning can slip schedules

- processing is the chokepoint: with Cigar Lake ore processed at McClean Lake, and that mill’s capacity central to regional flows, proximity and access agreements

Conclusion

Cameco’s revised guidance is modest in absolute pounds but meaningful at the margin — exactly where pricing and term books are set.

And, more importantly, the announcement confirms expectations that uranium’s global deficit has no short or long-term solution.

This environment fundamentally changes the risk-reward profile for smaller Athabasca Basin producers in three ways:

- price support: austained higher uranium prices improve project economics across the basin

- operational flexibility: smaller operations can often adapt more quickly to changing market conditions

- strategic premium: limited new supply sources command higher valuations

The market dynamics are shifting in favor of smaller producers who will be needed to position the sector to meet the coming wave of uranium demand.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Image courtesy of Cameco