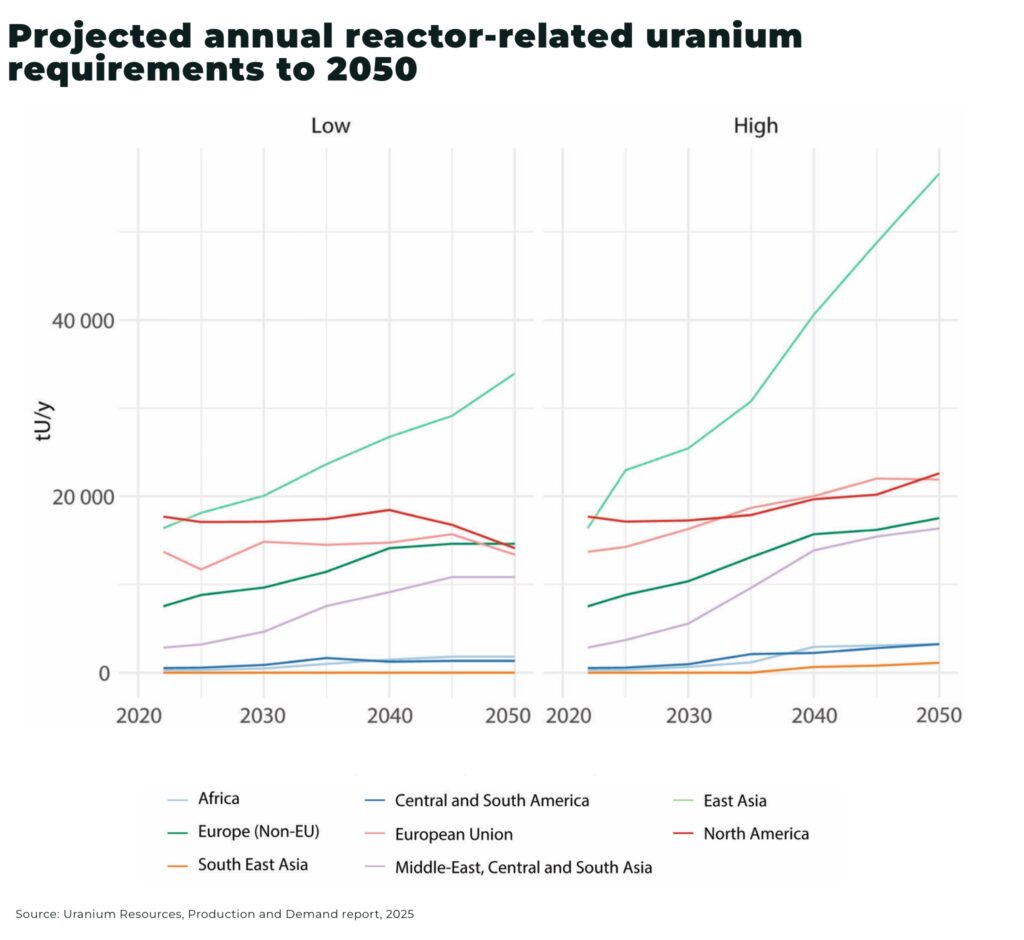

- demand is compounding: Uranium demand forecast to rise 28% by 2030 and more than double by 2040 as nuclear capacity expands and lifetimes extend, led by China and a Western policy pivot

- supply is concentrated and slow to respond: 63 reactors (71 GW) were under construction at end-2024, one of the highest levels since 1990

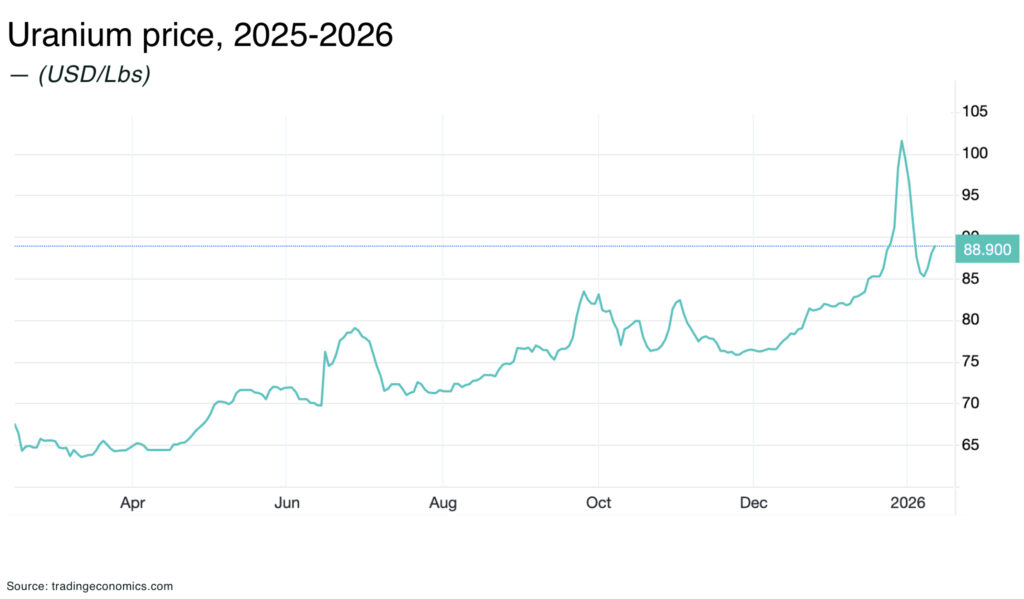

- 2025 was the tell: Spot uranium was broadly rangebound while term prices drifted higher and equities outperformed, setting up a utility-led phase change if contracting accelerates in 2026

Uranium is now strategic infrastructure: With explicit US policy support and funding, the market has shifted from commodity pricing dynamics toward policy-anchored strategic asset behavior

There were 63 nuclear reactors under construction at end-2024, more than 70 GW of capacity, one of the strongest build pipelines since 1990 — and uranium demand is rising with it. But the incoming 2026 story sits in the plumbing:

- utilities are running out of cheap procurement options

- conversion and enrichment are tightening

- and governments are now writing checks and rules that reshape physical flows

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

What changed in 2025, and why it matters for 2026

The key insight from 2025 is structural: spot didn’t need to explode for the market to reprice.

Spot U₃O₈ spent much of 2025 in a relatively tight band while the long-term contracting market quietly moved up. Nasdaq summarized it bluntly: spot was “locked between US$63 and US$83/lb” for much of 2025 while long-term contracting prices inched higher, with equities showing a V-shaped recovery into the second half of the year.

This disconnect is not a contradiction. It’s the typical setup before utilities force the issue: term supply tightens first, then spot reacts when uncovered requirements collide with thin availability.

How tight is the demand outlook really?

The World Nuclear Association’s base-case calls for uranium demand to rise 28% by 2030 and more than double by 2040 to 150,000+ tonnes a year, versus about 67,000 tonnes in 2024, as nuclear power gains momentum.

New nuclear powerstations impact the long-term, but it’s the decisions to extend operating lifetimes of 60+ reactors worldwide, covering almost 15% of the global fleet, that impacts the short-term uranium demand cycle.

These lifetime extensions matter disproportionately because utility procurement is not a real-time market. Reactors operate on fixed reload cycles with contracted fuel windows. Fuel must be secured years in advance of consumption. When demand expectations shift upward, utilities do not average in gradually. They sign contracts in bursts, often competitively.

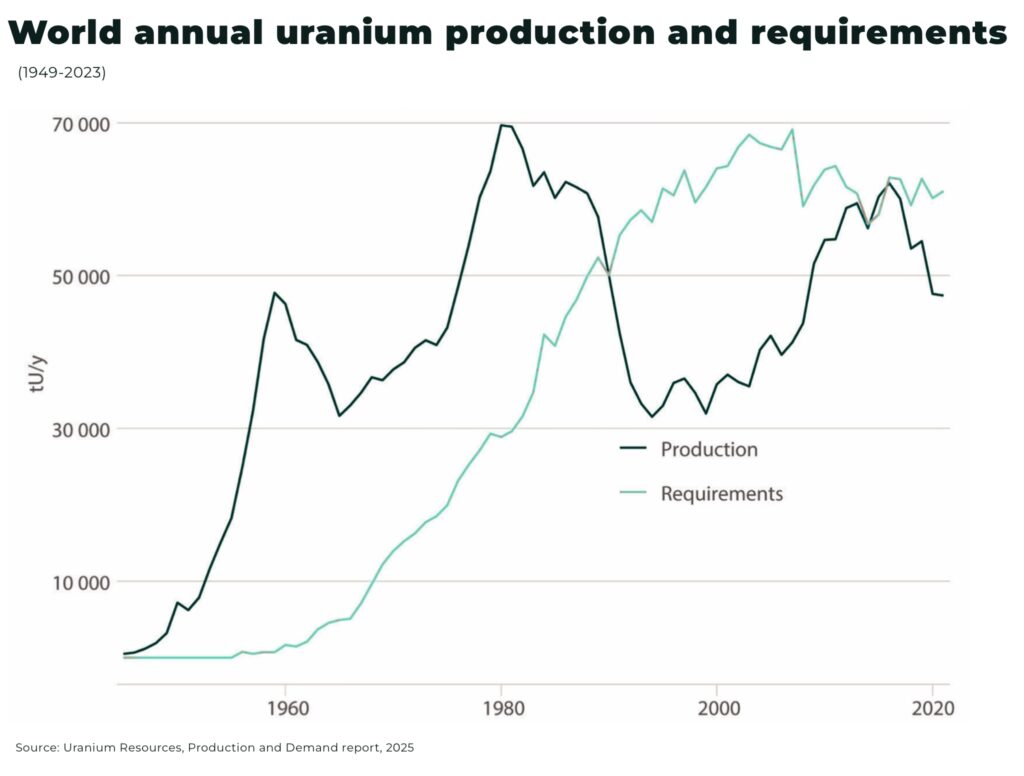

Supply is improving, but 2026 is still a thin market

The supply response is happening — but the geography and timeline are problematic.

Production is geographically concentrated, and the system relies on a handful of suppliers meeting targets. That’s why ongoing concerns over supply from Kazakhstan (the world’s largest uranium supplier) and Cameco (the world’s largest uranium mine) carry outsized price impact.

The other constraint is pipeline timing. New mines that actually move global balances are multi-year projects with permitting, financing, and construction risk. Mine restarts help, but the market is already looking past restarts and toward uncovered requirements in the late 2020s and 2030s.

If you want one chart-ready metric: Cameco cites UxC estimates that cumulative uncovered uranium requirements are approx 2.1 billion pounds to 2040, an enormous forward short that can only be filled by long-term contracting and new supply.

Why conversion and enrichment are now front-page issues

The vulnerability to sudden supply tightening exists because procurement options run out, especially as utilities compete for the same midstream capacity.

Long-term uranium contract prices already hit approx $79/lb in mid-2024, the highest since 2008, driven by utilities scrambling to secure fuel amid supply uncertainty and rising electricity demand narratives.

And, in January 2026, the US doubled down on enrichment capacity: the DOE awarded $2.7 billion in contracts aimed at boosting domestic uranium enrichment over the next decade, explicitly to reduce reliance on Russia, in particular for HALEU, which at scale has been commercially dominated by Russia.

Reuters reports Urenco received US approval to enrich to higher levels, with first deliveries of commercial quantities planned for 2026, underscoring that 2026 is when midstream constraints start translating into physical delivery schedules — not just policy statements.

US policy in 2026: supply security over price

It’s been in the pipeline for sometime but, in 2025, the US started treating uranium and fuel services like strategic infrastructure.

In practical terms, that means:

- public money into enrichment and domestic capacity

- restrictions on Russian uranium and fuel supply, with a clear policy trajectory to reduce dependence

- a procurement signal to utilities: don’t assume a frictionless global market

Government involvement adds a second buyer class to the market: state procurement and quasi-state incentives that can pull pounds forward and tighten availability for commercial buyers.

“The uranium market is entering a phase where utilities are no longer debating if they need to contract, but how quickly they can secure supply that actually delivers.

President Trump commented at the World Economic Forum in Davos, calling on the need for a doubling of energy capacity to support AI growth. With supply already constrained, uranium is following a trajectory similar to silver, where tightening fundamentals are driving spot prices up dramatically.

After years of underinvestment, the system has very little slack. As we move into 2026, the focus is shifting from spot price optics to long-term security of supply — and that’s where high-grade discoveries in Tier-1 jurisdictions start to matter, like F3 Uranium’s Patterson Lake North (PLN) discovery in Canada’s Athabasca Basin.”

— says Dev Randhawa, F3 Uranium (TSXV: FUU, OTCQB: FUUFF), CEO and Chairman

China policy: quiet stockpiling, long contracts, less price sensitivity

China’s approach is the opposite of Western “just-in-time” procurement: secure first, optimize later.

While exact inventory numbers are opaque, the directional pattern is consistent: China’s nuclear reactor buildout (with 28 reactors currently under construction and a target to triple capacity by 2050) is paired with state-backed, long-dated contracting and strategic stockpiling when liquidity exists. The strategic effect is economically significant: China becomes a less price-sensitive buyer, and the rest of the market inherits the volatility.

The debasement trade: uranium isn’t gold, but it rhymes

Uranium is not a monetary asset. But in a world where investors are hunting for scarce, strategic, policy-supported commodities as the dollar and yuan depreciate, uranium’s profile improves.

If the macro regime remains characterized by higher fiscal deficits, expanded industrial policy, and elevated geopolitical tension — conditions that seem structural — then uranium is one of the few commodities where demand is structurally anchored by policy and supply response is slow. This combination explains why capital continues to return after corrections.

Pullback or broadening rally?

The setup for 2026 looks more like a broadening, utility-led market, rather than a significant pullback.

The primary reason is the procurement clock. Utilities have laregly defered, but cannot do so indefinitely. When uncovered requirements become operational risk, contracting accelerates and term pricing can gap higher. This would mean prices in the $100-$150/lb become plausible when available supply is exhausted.

That doesn’t mean a straight line. Prices are still likely to see volatility, especially around on marco risk, fund flows, and headline noise. But the underlying bullish fundamentals are shifting the uranium market toward pricing higher. And the longer it takes, the higher it will go.

Conclusion

The uranium market’s 2026 story is not “will nuclear grow?” That’s already happening. The story is whether utilities accelerate contracting into tightening conversion and enrichment capacity while governments harden policy and reshape supply chains. 2025 showed the path: spot can look calm while the real market — term contracting — tightens underneath. If utilities move together, 2026 can flip from orderly to crowded fast.

The procurement clock is ticking. When it strikes, the market will move.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.