Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Sponsored Post: F3 Uranium’s Tetra Zone discovery: expansion potential in the Athabasca Basin

- F3 Uranium confirms drillhole PLN25-205 intersected radioactivity over a total of 33.0m

- early drilling cut intervals up to 67 m thick, the widest ever recorded on Patterson Lake trend (PLN), home to NexGen’s Arrow and Paladin’s Triple R

- with uranium demand set to more than double by 2040, timing for new Athabasca discoveries is strong

- US$14.3 million (CAD$20M) financing gives F3 the capital to expand Tetra and test new pods

A new discovery in the Athabasca

The Athabasca Basin in northern Saskatchewan remains the world’s most prolific uranium district. Its deposits average grades of around 2% U₃O₈ — up to x100 higher than the global average. Within this district, the Patterson Lake corridor has yielded a string of world-class finds over the past decade.

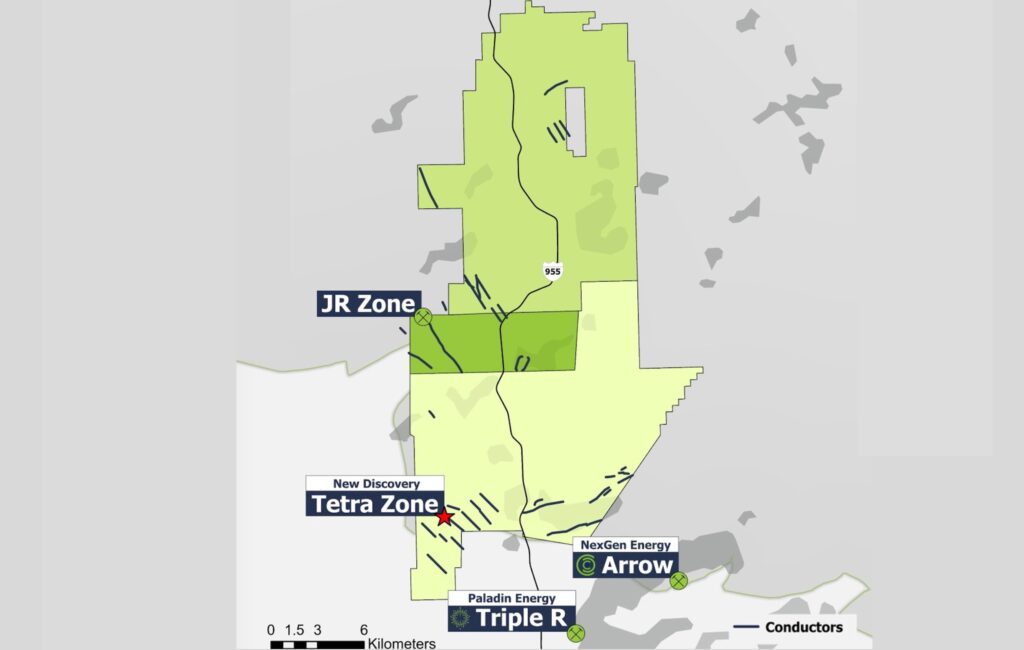

F3 Uranium (TSXV: FUU, OTCQB: FUUFF)‘s Tetra Zone, discovered in 2025, sits within this same corridor. Just 13 km south of the company’s JR Zone, it expands the mineralized footprint of the Patterson Lake North project and strengthens the case for PLN as a multi-pod uranium system, comparable to Shea Creek, where four pods were outlined along strike.

Early drilling results

F3 Uranium’s Tetra Zone discovery in Saskatchewan’s Athabasca Basin delivers wide uranium intercepts and exploration upside as demand surges.

The first hole into Tetra in April 2025, PLN25-205, cut 22.5 m averaging 0.26% U₃O₈, including 1.0 m at 2.50%. Subsequent drilling has expanded the scale including 0.56m of high radioactivity (>10,000 cps) with a peak of 37,700 cps at 398.34m with visible pitchblende.

- PLN25-217: intersected a total of 67.0m composite radioactivity between 299.5m and 414.5m, including 49.0m of continuous radioactivity

- PLN25-212: approx 23m up-dip of PLN25-217 and 31m along strike from discovery hole PLN25-205 intersected the second widest interval to date with 39.5m composite radioactivity from 330.0m to 409.5m, including 27.5m of continuous radioactivity

The higher-grade cores mirror the structure of Athabasca’s biggest deposits. Geologically, Tetra is hosted in basement rocks, similar to NexGen’s Arrow, indicating the potential for sizeable pods of mineralization controlled by fault structures.

Major trends and regional context

The Tetra Zone’s location enhances its strategic value:

- Arrow (NexGen Energy): 239 Mlbs U₃O₈ at approx 2% grade

- Triple R (Paladin Energy): 135 Mlbs U₃O₈ at approx 1.3% grade, acquired for $1.1B in 2025

- Shea Creek (UEC/Orano): four pods totalling 96 Mlbs U₃O₈ along 3 km of conductor

Tetra and JR are the first two discoveries on PLN, made within three years. Their proximity to these Tier-1 projects underscores the fertility of the Patterson corridor. Historic mineralization 1.2 km from Tetra suggests more pods may be waiting to be defined.

Uranium market backdrop

The broader uranium market adds weight to Tetra’s timing:

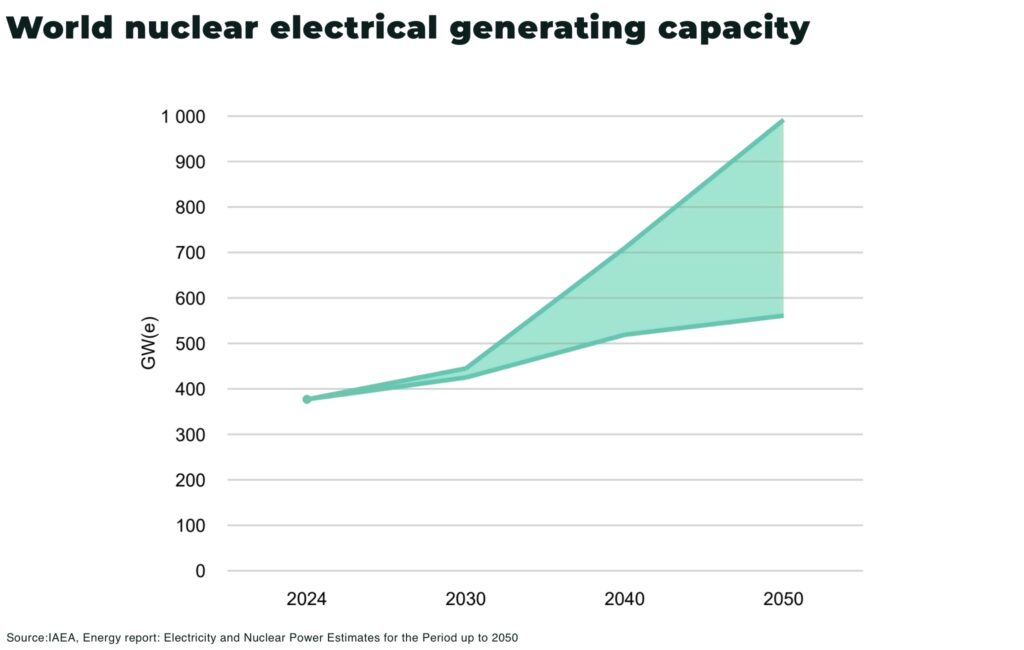

- demand growth: the World Nuclear Association projects global uranium needs to rise 28% by 2030 and more than double by 2040

- reactor buildout: 70 reactors are under construction, with 110 more planned; SMRs are advancing in multiple countries

- supply gap: the uranium supply gap is expected by the EIA to widen over the next decade to a combined 184 million pounds, equivalent to more than three years of consumption.

- prices: Spot uranium hit more than $83/lb in September 2025, with long-term contracts near $90/lb

This context makes high-grade Athabasca discoveries especially strategic. F3’s timing allows it to position PLN as future supply while majors search for the next development-ready deposit.

Financing and strategy

In September 2025, F3 raised US$14.3 million (CAD$20 million) in an upsized financing led by Red Cloud Securities. The proceeds will fund step-outs at Tetra, additional geophysics, and testing of new conductors within PLN. The raise, increased from an initial US$10 million (C$15 million), reflected strong institutional interest in the project.

This funding gives F3 the ability to accelerate drilling and chase multiple targets without financial constraint, a critical factor in early-stage discoveries.

Strategic implications

Two discoveries in three years underscore PLN’s strong mineral system, suggesting continued expansion at the Tetra Zone could confirm a multi-pod uranium zone. Each intercept carries added weight amid high uranium prices and tightening global supply forecasts. Athabasca discoveries rarely stay independent; a defined resource at PLN could position F3 as a likely takeover target for larger producers.

Outlook

The Tetra Zone adds a second discovery to F3’s Patterson Lake North project, reinforcing its status within the Athabasca Basin’s newest uranium camp. Backed by fresh financing and drilling momentum, F3 is positioned to test the size of Tetra and search for more pods.

With uranium demand rising, supply constrained, and prices strong, discoveries like Tetra take on strategic weight. The question for investors now is how large the zone will grow and whether PLN proves to be a multi-deposit system.