Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

- US Department of Energy awards $2.7 billion to restart domestic uranium enrichment after decades of decline

- the move targets HALEU fuel, now critical for next-generation nuclear reactors and defense applications

- US currently relies heavily on Russia-linked enrichment services

- enrichment capacity, not uranium mining, is now the tightest bottleneck in the US nuclear fuel cycle

The US US Department of Energy has awarded US$2.7 billion to restore American uranium enrichment capacity, largely abandoned three decades ago, aiming to reduce reliance on foreign — and increasingly adversarial — suppliers.

The funding will support commercial-scale enrichment, early deployment of advanced centrifuge technology, and the production of high-assay low-enriched uranium (HALEU) — fuel enriched between 5% and 20% U-235. HALEU is essential for most advanced reactor designs now backed by US policy and capital.

Why enrichment is the weak link in the uranium supply chain

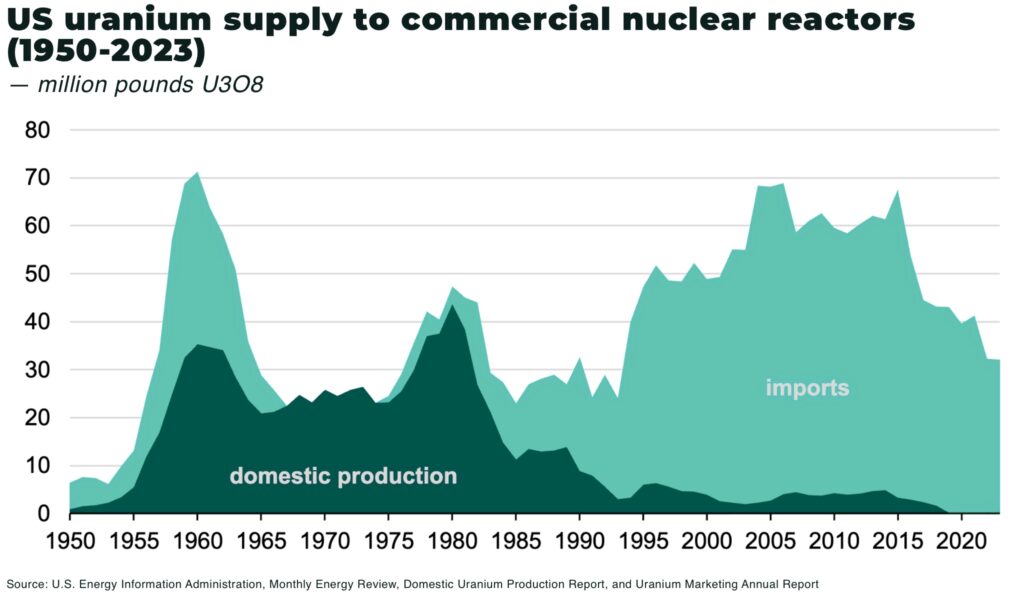

The US once dominated uranium enrichment. That system collapsed in the 1990s as cheap Russian supply flooded global markets under the “Megatons to Megawatts” program. Today, the US has no commercial HALEU enrichment capacity and only limited conventional enrichment, according to the DOE.

Globally, enrichment is concentrated. Russia’s state-owned Rosatom controls an estimated 40% of global enrichment capacity. The United States imports 20-25% of its enriched uranium from Russia. Even after sanctions following the invasion of Ukraine, Russian material continues to flow into Western fuel cycles under waivers and exemptions.

For the US, that dependence has become untenable. Advanced reactors backed by federal loan guarantees, Pentagon contracts, and Big Tech power purchase agreements cannot proceed without assured domestic fuel supply.

“President Trump is catalyzing a resurgence in the nation’s nuclear energy sector to strengthen American security and prosperity,” said US Secretary of Energy, Chris Wright. “Today’s awards show that this Administration is committed to restoring a secure domestic nuclear fuel supply chain capable of producing the nuclear fuels needed to power the reactors of today and the advanced reactors of tomorrow.”

What Is HALEU — and why it matters now

HALEU is not a niche product. The majority of next-generation reactors — including small modular reactors (SMRs), microreactors, and fast reactors — require it. The DOE estimates initial US demand for HALEU could reach tens of tonnes per year by the early 2030s, scaling sharply thereafter.

Projects from companies like TerraPower and X-energy are already delayed by fuel availability. Without domestic enrichment, the US would be forced to source HALEU from Russia — the only commercial supplier today — or delay reactor deployment indefinitely.

Inside the DOE plan — rebuilding the fuel cycle

The US$2.7 billion award is part of a broader effort to rebuild the entire US nuclear fuel supply chain — from conversion and enrichment to fabrication. The DOE’s HALEU programs support:

- commercial-scale centrifuge enrichment

- demonstration of advanced enrichment technologies

- long-term contracts to anchor private investment

The following companies were awarded task orders totaling $2.7 billion to provide enrichment services for LEU and HALEU:

- American Centrifuge Operating ($900 million) to create domestic HALEU enrichment capacity

- General Matter ($900 million) to create domestic HALEU enrichment capacity

- Orano Federal Services ($900 million) to expand U.S. domestic LEU enrichment capacity

The strategy mirrors earlier US interventions in semiconductors and rare earths: public capital to de-risk infrastructure the market cannot rebuild alone.

Crucially, this funding is structured to catalyze private capital, not replace it. Enrichment is capital-intensive, regulated, and politically sensitive. Without government support, the economics simply do not clear.

Why this fits the bigger nuclear reset

The enrichment push sits within a wider nuclear revival. Global nuclear capacity is set to expand as governments chase firm, low-carbon power. The US alone has committed billions in loan guarantees, tax credits, and direct support for reactors, fuel, and supply chains.

As previously outlined in our Nuclear Energy Is Back analysis the bottleneck is no longer demand. It is execution — and fuel availability is at the center of that challenge.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.