- China has started to dismantle its national zero-Covid policy

- expectations for economic growth and commodity demand to rise in 2023

- there will be volatility, for investors timing will be everything

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

China has announced significant measures loosening its zero-Covid policy, with major repercussions for the global economy and commodity prices.

First, a caution, we are providing no timelines for when or how China will reopen their economy. There will be volatility and it may well take longer than anticipated.

But China’s National Health Commission has announced it is loosening Covid-19 restrictions, including more limited lockdown and testing requirements, as well as deactivating the national Covid tracking app that has been operational for three years.

As China reopens its economy, we expect the government to rollout a significant economic stimulus package to encourage investment.

We expect this stimulus early in 2023, but there will be a variety of factors that will influence the decision, for example, the spread of Covid among the population and the response of consumer spending.

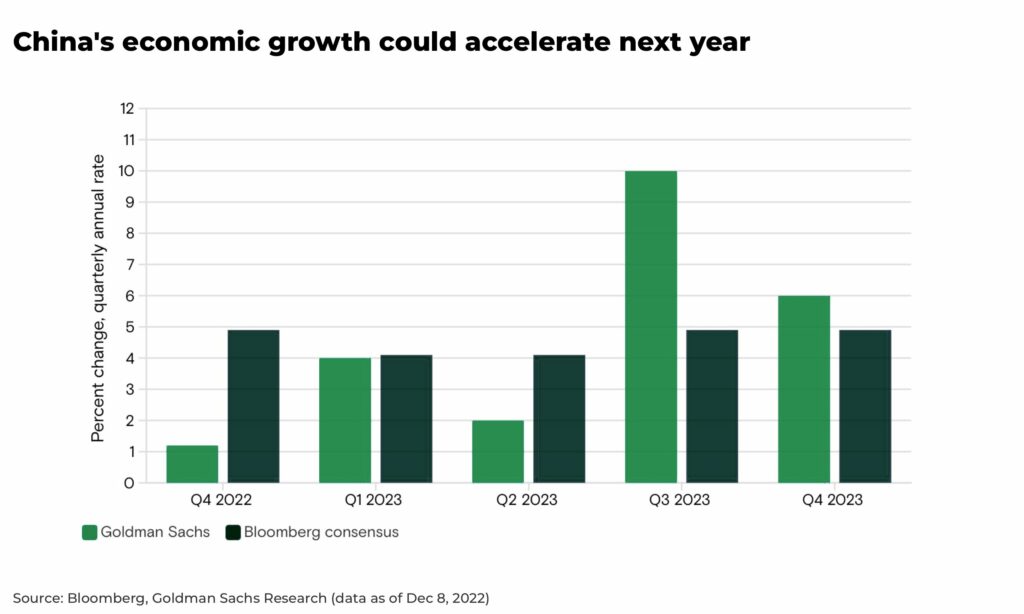

But investors should be prepared: the second largest economy in the world is starting to reopen, and it’s now just a question of timing. Bloomberg is reporting officials are considering a target of 5% growth of GDP.

Why China matters so much for commodities and the global economy

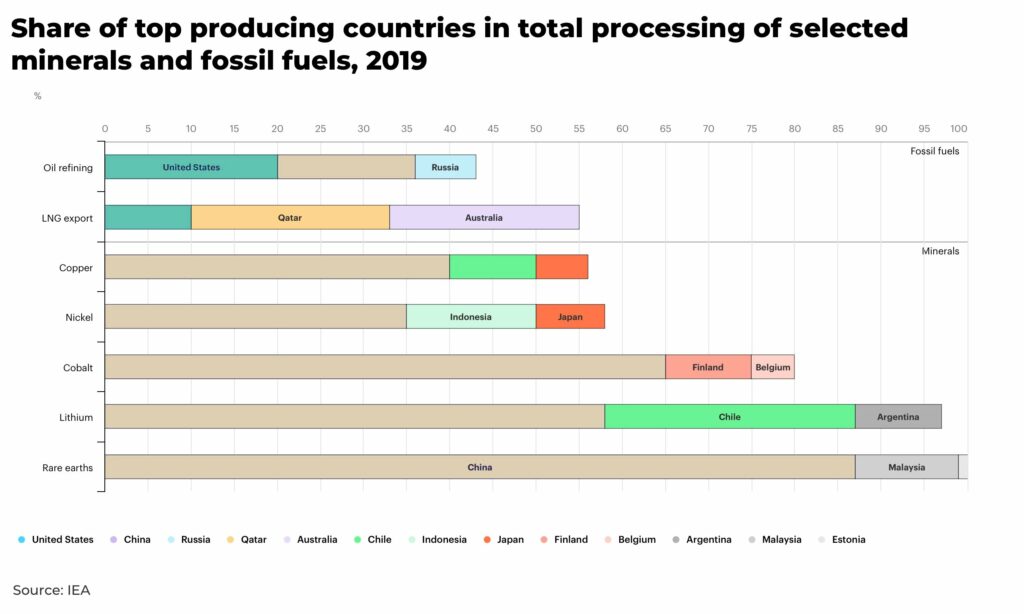

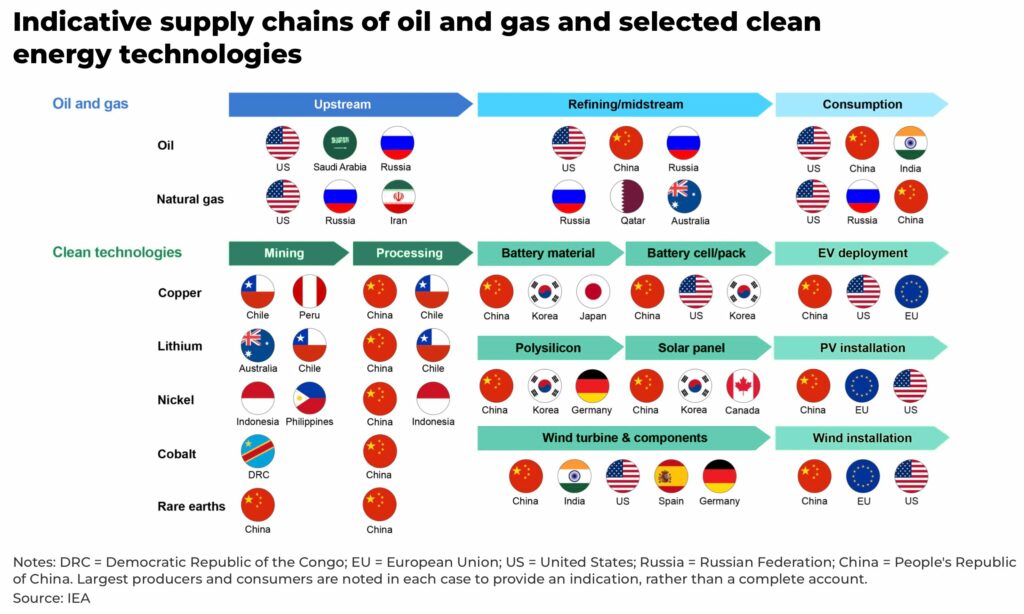

Before Covid, China dominated production, processing and consumption for many of the world’s major commodities.

The Covid pandemic and subsequent economic lockdowns across China have meant economic growth has slowed as consumers have cut back on spending, businesses closed, and industrial smelters closed due to supply chain delays.

In particular, investment in real estate fell 8.8% in the first 10 months of 2022, year-on-year, according to National Bureau of Statistics. This has a big impact on commodities with, for example, China’s property sector accounting for almost 40% of its steel consumption.

Imports in November fell 10.6%, year-on-year, which is the biggest drop since May 2020.

Chinese demand for commodities can have a big impact on global prices.

“When China sneezes, commodity prices catch a cold”

— ancient mining proverb

What’s happening in China’s economy

Now, there are signs China is beginning to increase imports again, restocking ahead of potential stimulus measures, for example:

- crude oil imports in November hit a 10-month high of 11.37 million barrels per day, up 12% from October-November last year

- iron ore imports rose 4.1% in November, month-on-month

- copper imports rose 5.8% in November, compared to the same month last year, totaling 539,901 tonnes

And markets are starting to take notice:

There are other economics moves happening as well:

- three of China’s biggest commercial banks have agreed to provide fundraising support to property developers

- China’s State Council announced more stimulus measures, including an additional US$44 billion in quotas for infrastructure spending and investment

- the People’s Bank of China Governor, Yi Gang, has stated the central bank’s attention is now focused on growth

What does the end of zero-Covid mean for China’s economy

Our expectation is that these agreements are just the start.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Goldman Sachs has suggested China’s economic growth will likely accelerate next year.

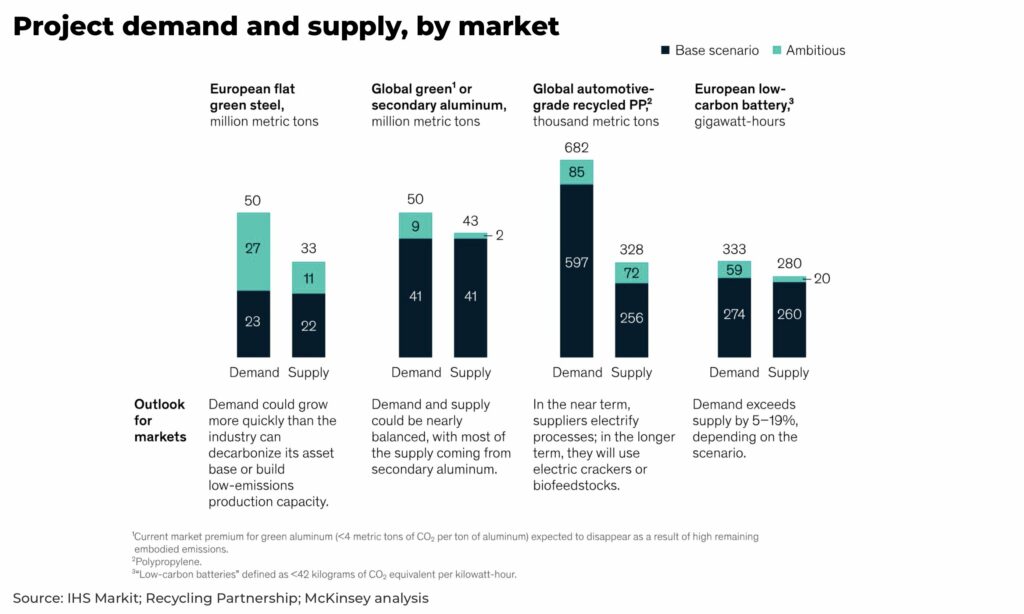

Commodity prices now face two possible major demand shifts on an already tight supply chain: the reopening of China and the green energy transition.

You can read about the impact of the green energy transition on commodity prices in our rolling analysis.

The green revolution will need more commodities and China is positioning itself as key to the transition.

“We should increase the dependence of international supply chains on China and establish powerful retaliatory and menacing capabilities against foreign powers that would try to cut supplies”

— Xi Jinping, President of the People’s Republic of China, 19th CPC Central Committee strategy.

If we take copper as an example, Goldman Sachs suggests the copper market will rise next year in a “unique setup” with near depleted stocks, China reopening and demand for raw materials from the energy transition.

“If China were to return its copper stock to consumption ratio to pre-2020 levels, that would imply as much as a 500kt boost to physical demand”

— Goldman Sachs, Copper, The end of surplus

As we said at the top, there will be volatility.

China is not the only player in the market with, for example, steel demand expected to contract by 3.5% in 2022 according to the World Steel Association. And interest rate hikes in the US to curb inflation will impact prices as costs rise to match the reality of operating expenses.

Timing will be everything, but the end of zero-Covid in China is good news for commodities.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.