- markets no longer feel like they are in control, no longer able to manage crises

- global economy means any volatility could become systemic

- governments have less and less capacity to manage risks

- for the prepared investor, there will also always be opportunities

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

If investing is all about so-called animal spirits then, in today’s market, the animals have all been let loose.

Black Swans, Grey Rhinos, Bears, Elephants, Bunnies, Dead Cats, Dragon Kings.

For the last 30 years, growth in the global economy has been underpinned by the idea that, whatever the risk, governments and markets were in control. Whatever the crisis, it could be managed. Events would respond to market reaction and self-correct. The end of history, the victory of liberal democracy.

The financial crisis of 2007-8, was arguably both the zenith and end of this presumption. Such was the threat to the global financial system that governments united in an historic co-ordinated response to shore up the system. From the US to China, Brazil to Europe, it worked in the short-term. But, since then, markets no longer feel like they are in control, no longer able to contain and manage crises.

“We’ve got the most complex, disparate, and cross-cutting set of challenges that I think I can remember in the 40 years I’ve been following this stuff”

— Lawrence Summers, former US Treasury Secretary

From Brexit to Trump, Covid to Russia’s invasion of Ukraine. Politics, not economics, is in the driving seat. And it’s about to get a lot more serious for the global economy.

So, how should investors position themselves?

Meet the animals

- Black Swans are events that are extremely rare, cannot be forecast, and the fallout involves severe economic and political consequences (there are also grey, white and green swans)

- Grey Rhinos are events that are highly likely, with dangerous impact, but largely ignored

- an Elephant in the Room is a major, obvious problem which is ignored by significant number of investors

- a Bear Market is when the stock markets have significant price declines, when stock prices decline 20%

- a Bull Market has prices rising or expected to rise, for significant amount of time

- a Bunny Market is a stock market that jumps up and down, but does not move in any significant direction

- Dead Cat bounce is a temporary increase in asset prices after a long decline, that then falls back to a continued decline

- the Dragon King theory is used to predict events that are both unique and severe in its impact

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

Why markets are no longer in control

“When troubles come, they come not single spies, but in battalions”

— Claudius, Hamlet Act IV, Scene V, Shakespeare

The world has gone through an historic period of globalization since the fall of the Soviet Union. Economies are more interconnected than ever before, creating enormous opportunities with a global economy set to hit US$1 trillion by the end of the year, but also the risk that any volatility could become systemic.

Some of the major reasons for volatility includes:

- deglobalization (see our analysis on deglobalization)

- debt and banking crisis, rising interest rates

- the strong dollar

- record inflation

- the ongoing pandemic (especially in China)

- rising populism, nationalist trade policies

- demographics, falling regional populations

- rising food, energy costs

- climate change

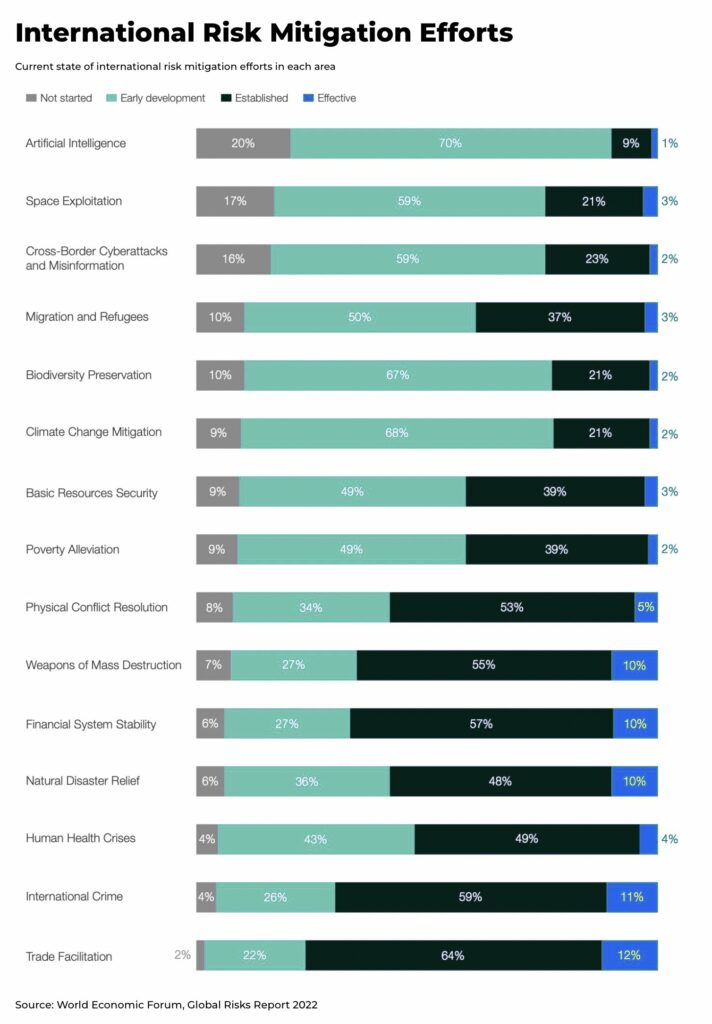

Each of these problems limits the capacity of both governments and markets to respond. For example, rising interest rates make borrowing more difficult; pandemics increase debt and divert resources from other economic priorities; falling populations means less people of working age; etc.

This list is by no means exhaustive, but the outcome remains the same: governments across the world have fewer levers to pull to address any new crisis. And each crisis often reinforces the next.

And, as risks and volatility rise and governments try to manage them, they seem only to spiral further out of control.

For example, as the West increases its support for Ukraine against Russia, so it increases the possibility of Russia taking more serious steps in retaliation, from mobilization to sabotaging Western infrastructure, pushing up inflation and the possibility of a nuclear attack. Or, as the Federal Reserve raises interest rates and follows through with quantitative tightening, so bond and gilt prices rise in Europe and the rest of the world, threatening political stability.

One term used (originally by former EU Commission President Jean-Claude Juncker) to describe the problem(s): polycrisis.

This dynamic, of course, could work instead as a risk-off dynamic: a technological breakthrough in nuclear fusion technology or electric battery technology could significantly change the challenge of creating cheap, green energy. But technology itself is extremely disruptive and, the example of nuclear fusion alone, would cause an earthquake across the global energy markets.

There is the possibility that there will be no more shocks to the international economic and political order over the next ten years. But it would be unprecedented.

Instead, in the face of a new financial crisis, few imagine a coordinated global response similar to 2007-8 would be possible today. In fact, quite the opposite, it would more likely be leveraged for geopolitical advantage.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.

The potential risks

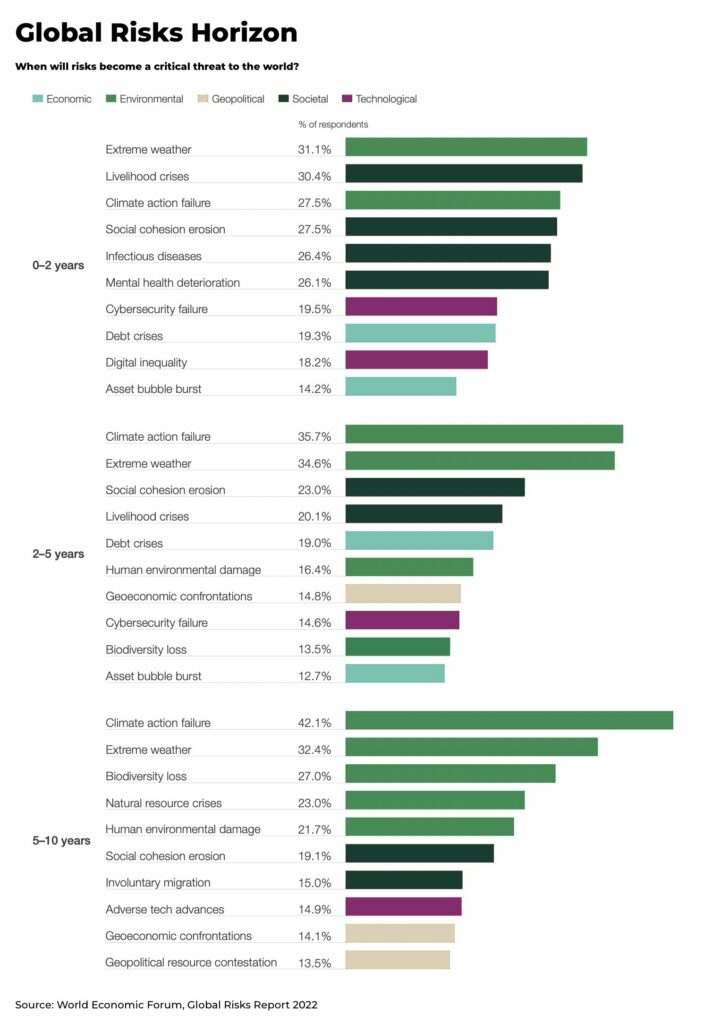

Some of the most severe risks facing the world over the next decade include:

- a nuclear attack

- climate change, extreme weather

- geopolitical and geo economic confrontation

- debt and bank crisis

- cyber security and internet disruptions

- another pandemic

- social cohesion, mass migration

The most feared Black Swan

The challenge, obviously, when writing about Black Swan events and others, is that they — by their very nature — are extremely difficult to forecast and therefore for investors to account for and react to in their portfolio.

But, just like with black holes (which can only be “seen” by observing how they affect matter nearby), we can infer the impact of possible Black Swans and other economic tremors by whether the global economic and political system would be able to manage them. The answer is, for the first time in decades, in doubt.

The question that we can try to find an answer for is how much capacity do governments have to manage such risks. This is perhaps the most feared Black Swan of all. And the answer is: less and less.

Where should investors position themselves?

So-called Black Swan investing claims to provide insurance against unexpected, sharp stock market price drops. But, due to the unknown nature of black swan events, this is an inherently risky strategy that doesn’t always pay off. But advocates say the investment, in a diversified portfolio, are worth the cost.

Artificial intelligence and risk management software allows Hedge Funds to hedge against some of the most volatile positions, called a tail-risk hedge (in reference to the long, thin tail at the end of a bell curve of outcomes distribution where the most dangerous outcomes are positioned). Retail investors can gain exposure from ETFs such as the Cambria Tail Risk ETF, which reportedly saw inflows of US$168 million so far this year.

There are indicators of risk, including Treasury Yields or the Cboe Volatility Index (VIX), which is designed to measure volatility in the US stock market.

However, we would not recommend creating your portfolio based solely on the expectation that disaster may strike at any moment. Only that you should be prepared for the unexpected.

Don’t take on more risk than you have the capacity to manage.

Diversity is security, so do not have all your investments in one basket.

Stay alert to the risks, however unlikely, even if others don’t seem to be doing so. And not just for the immediate impact but what may come after. For example, US sanctions on superconductors in China will impact not just the superconductor industry, but the electronics industry and even the future of China-US trade relations.

Be aware of safe havens in times of significant volatility, such as US treasuries and gold, even cash.

And never forget, in a time of volatility as everyone else flees the market, if timed right, it can also be a time of opportunity to take advantage of cheap assets.

But, to take advantage of all of these risks in time of trouble, perhaps the most important thing investors need is liquidity. Read our analysis on how to stay liquid during a time of crisis.

Potential black swans, rhinos and other animal spirits are always a risk when making investments. For the prepared investor, there will also always be opportunities.

We continue our analysis of some of the major macro themes, both risks and opportunities, here at The Oregon Group, from energy costs to inflation, semiconductors to commodities.

Subscribe for Investment Insights. Stay Ahead.

Investment market and industry insights delivered to you in real-time.